How Klarna Grows: Building The Shopping Destination of the Future

A primer on the $260B Buy Now Pay Later market, and a deep dive into how Klarna grew from 0 to 150M customers and is disrupting the $8 trillion credit industry.

👋 Welcome to How They Grow, my newsletter’s main series. Bringing you in-depth analyses on the growth of popular companies, including their early strategies, current tactics, and actionable business-building lessons we can learn from them.

[I’m really sorry this post is a day late. I had a technical issue publishing]

…

Hi friends 👋

Welcome to our first soiree into the world of FinTech, banking, and…

I’ve had several people ask me over the past few months to do a deep dive into a company in the Buy Now Pay Later (BNPL) market. But, I’ve delayed doing it because I’m not really a shopper, and when I do buy things online, I prefer to just cough up and pay in full at the time of purchase — I’m credit averse.

So, since I don’t use BNPL products like Affirm, Klarna, or Afterpay, I felt I’d be missing the hands-on experience of using a product I love to bring to these analyses.

Well, since we’re here talking about Klarna, clearly something changed.

Like I said, I’m not a big shopper. I have a fairly simple summer wardrobe mostly of blacks/whites/greys that have served me well over the years, and that I’ve always felt were stylish. But, as we head into summer here in the US, my fiance persuaded me (through teasing/light bullying) to add a few new things to my summer wardrobe.

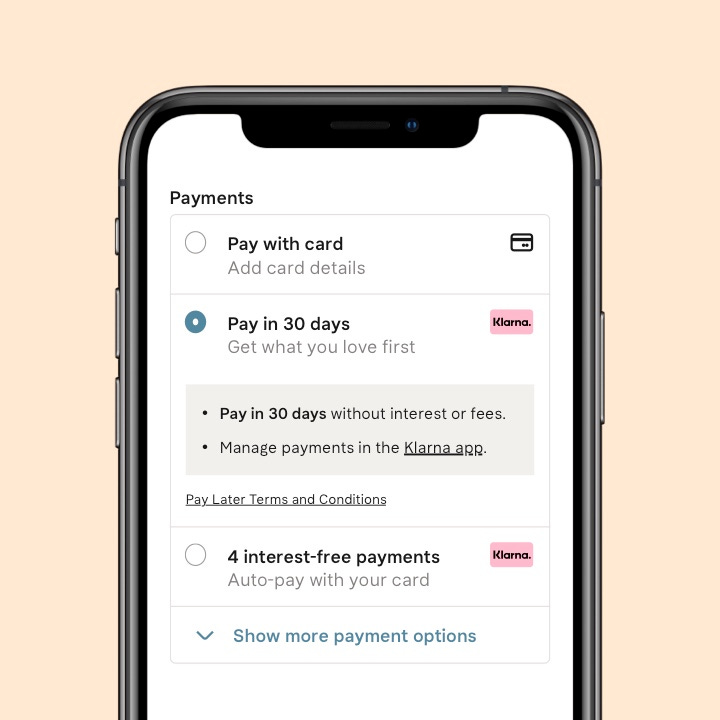

So, I went online, got to the checkout, and then I saw this:

For some reason (maybe because we have a wedding coming up), I decided to pay using Klarna, the leader in the BNPL space. It just looked… so easy. And why not break up my purchase over, say, 4 payments without any fees or interest? 🤷♂️

A no-brainer. I get what I want, and my wallet doesn’t get knocked as hard.

So I tapped to pay with Klarna, and I was absolutely delighted by the product experience not just of signing up and buying with them, but the Klarna universe post-transaction.

This brings us to today’s analysis into the $6.7B company disrupting the $8 trillion credit industry.

To simply dub Klarna as a BNPL product though would be a huge undersell. While the Swedish-born FinTech company has their roots in this lending model—and while it’s still core to their business—Klarna has evolved into what’s now a full-fledged retail platform. One that controls demand through their consumer network, and has changed how people (especially Gen Z and millennials) shop and pay for products online by becoming a shopping destination that has vertically integrated the shopping experience into one convenient app.

A true one-stop-shop, if you will.

With this, they’ve unlocked tremendous network effects, flywheels, moats, and data advantages that have made Klarna the #1 contender for what may well be a winner-take-most market.

To help dissect Klarna and the $260B Buy Now Pay Later Market, I teamed up with none other than Aakash Gupta . Aakash has worked at Google, Epic Games, and most recently, was a product leader at Affirm. He’s also the #1 product voice on LinkedIn and writes one of my favorite newsletters, Product Growth , for 46K+ readers.

To say Aakash is an expert on product, growth, and the world of BNPL is an understatement, and I was delighted that he was down to collaborate on this piece.

So, grab a coffee, and let’s get to it.

Here’s what we’ll be covering in our Klarna analysis:

Klarna, and a primer on the $260B Buy Now Pay Later (BNPL) market

Disrupting traditional credit systems, and winning Gen Z

Meet Klarna: The OG credit card unbundled

How Klarna Grows: From 0 to 150M customers

Act I: Buy Now, Pay Later (Using lending as a wedge to bootstrap consumer demand)

Act II: Becoming a shopping destination and Super App

Adding value beyond the transaction: A lesson on vertical integration and compound startups

The Klarna marketplace: Dual flywheels, growth hacking, and data moats

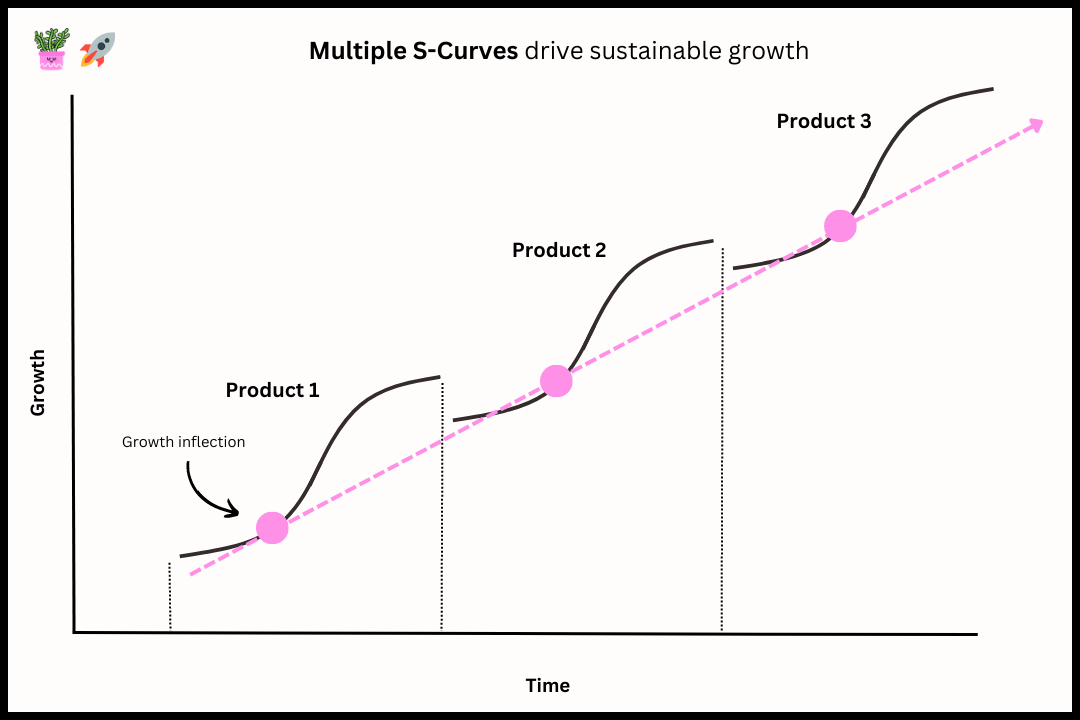

Beyond Payments: A lesson on growth inflections, S-Curves, and bundling value

Act III: The AI Retail Revolution

Klarna x OpenAI: A lesson on integrating your product with AI

Small ask: If you enjoy today’s post and learn something new, I’d be incredibly grateful if you helped others discover my writing. Hitting ❤️ in the header, or sharing/restacking, are all a huge help. Thank you!

To truly understand how Klarna grows, we need to understand the context that they operate in. So let’s kick things off with a quick market overview.

Klarna, and a primer on the $260B Buy Now Pay Later (BNPL) market

Since the 19th century when Singer sewing machines were sold for a “dollar down, dollar a week”, the idea of postponed payment has been a compelling concept: Breaking down a large purchase into smaller installments is just as valuable for the buyer who’s short on cash, as it is for the seller who’s eager to sell to customers short on cash.

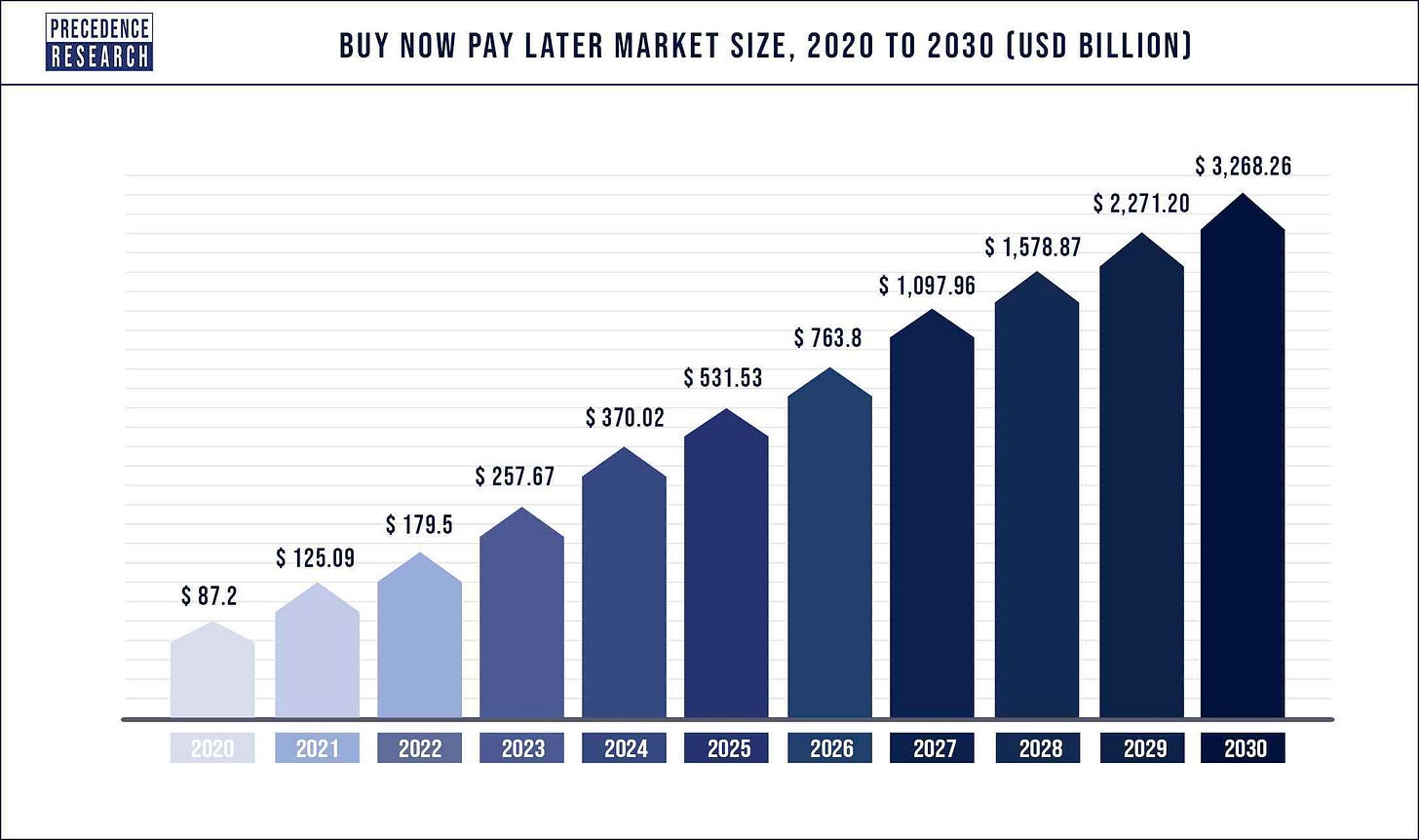

BNPL as we’re familiar with it likely started with department stores like Nordstrom handing out their own in-store credit cards back in the 80s and 90s. But, since about 2010, this consumer debt instrument has changed online consumer behavior so much that BNPL has become its own $260B market.

The way it works is simple. Instead of paying everything at once up front, buyers can choose to stretch payment over extended periods of time. The full amount is usually paid over 8 weeks, with zero interest, in equal and predictable installments. This removes friction from the purchasing decision and makes large sums appear smaller and more affordable.

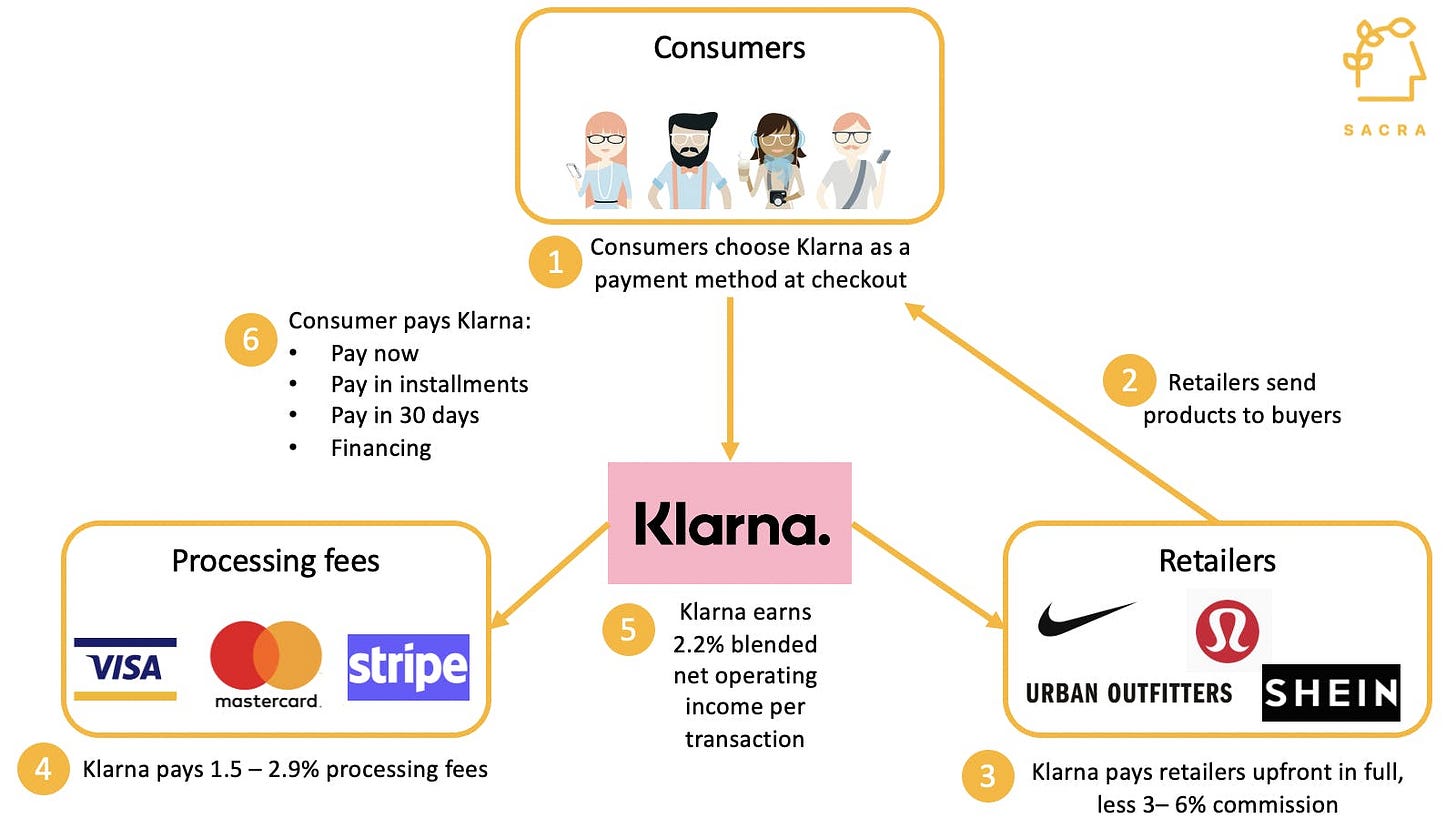

In pursuit of a smooth purchasing experience, many BNPL providers don’t charge consumers. Instead, they take a cut from sellers for unlocking latent demand and converting window shoppers. Essentially, making BNPL companies mega affiliates, marketers, and credit lenders in one.

At a high level, it looks something like this: 👇

And to figure out which window shoppers are eligible for short-term loan facilities, and to what degree, providers do soft credit checks that don’t affect credit scores. They also then collect data and create rich profiles about the financial credibility of their customers as they make payments, which dynamically adjusts users’ purchasing power over time.

The beauty of this process is that BNPL it’s seamlessly integrated into the on-site buyer journey. Applications for credit cards and loans generally live outside of the commerce experience, with only about 40% of them getting approved and ~6% of them never being paid back.

But, by targeting inefficiencies in this traditional financial value chain and baking underwriting into the payment journey, BNPL companies can merge traditional and non-traditional data to build new data-driven underwriting models. This has led to 70% of BNPL applications getting accepted with much better loan settlement rates.

In part, that’s driven by the fact that BNPL purchases are focused on consumer goods, paid back over short periods. The average order value is $150, making it a little bit of a considered purchase, that’s just made easier to pull the trigger on. Simply, because the bigger the loan and the further out you need to worry about it, the more out of sight, out of mind it becomes, which increases the odds of a loan default.

As you can imagine, this has become specifically appealing to younger buyers with lower credit scores who (1) face higher costs to access credit products, and (2) who are just over having to deal with the process of getting traditional credit. 👇

Disrupting traditional credit systems, and winning Gen Z

As Rex Woodbury wrote: “For the better part of a decade, pundits have been predicting the fall of the mighty credit card. Back in 2013, an article titled The Slow Death of Credit Cards announced:”

Great news: Americans are giving up on one of the most ruthless destroyers of wealth the numerically challenged have ever known: credit cards. We’re more interested in debit cards these days. Old style American consumerism, one built on debt, may be coming to an end. Good riddance, credit cards.

BNPL is the first real threat to credit cards. According to the Marqeta State of Credit Report, 2021, 70% BNPL users prefer BNPL to credit cards; 59% say they would happily replace their credit cards with BNPL; and 57% say they find it easier to manage multiple BNPL plans than to manage credit card statements.

To illustrate why, let’s turn to the Blue Ocean Strategy. Specifically, the Strategic Value Canvas framework, comparing how Klarna fairs on certain key features customers care about vs a credit card like American Express

As you can see, from a consumer-stand point, BNPL wins on access, flexibility, and convenience.

But it’s also a huge value add on the other side of the transaction: Offering BNPL at checkout (1) boosts retail conversion rates 20% to 30%, and (2) bumps average purchase sizes by 30% to 50%, according to RBC Capital Markets estimates.

Just take a look at these stats (provided by Klarna, so take them with a pinch of salt).

From a merchant perspective, they’re looking for new ways to attract a younger audience and a different audience, but also a higher basket size from a demographic that they may not have attracted in the past.

— Zahir Khoja, GM of North America at Afterpay

And this threat to traditional credit has been accelerating since about 2017:

The ongoing shift away from traditional credit cards and toward debit has been accelerated and further amplified by the pandemic. Credit card applications have dropped 50 percent while over $100 billion worth of credit card debt has been paid off. Consumers are recognizing that traditional credit cards are not a great business model.

— Sebastian Siemiatkowski, Founder and CEO at Klarna

But, it’s not an evenly distributed threat from a demographic perspective. While trending up across all ages, BNPL is having a field day with Gen Z and millennials. (Which makes sense given the tiny % of total wealth they hold in the US)

As Zahir Khoja describes, “The younger shopper in particular is showing an aversion towards what I would call expensive credit, interest, and excessive fees. So, from a consumer perspective, it fits very nicely into the lifestyle of the younger generation. And it’s in a digital format that makes sense to them.”

What’s more, this business model is working capital intensive given that it pays retailers upfront, and only collects from the consumers over 6 to 8 weeks. This short-duration nature of BNPL provides a significant advantage to traditional credit providers because higher capital velocity means higher asset turnover, therefore, higher return on capital.The average duration of Klarna’s credit portfolio is just ~40 days. This means they can recycle their capital 9 times per year.

This disruptive force of BNPL points to a broader trend that is well underway: the unbundling of credit cards.

Large financial institutions generate an incredible amount of revenue on credit cards, and a new generation of companies will also succeed by unbundling their offerings with better, consumer-friendly products that better serve the younger generation and the dynamic world we live in.

The opportunity is massive: $8T in consumer credit, $121B in credit card interest charges, $11B in overdraft fees, $3B in late fees; overall bank non-interest income was ~$250B in 2019.

These amounts are staggering, and while BNPL has small market share today, growth rates suggest market share will increasingly shift to BNPL over the next decade

Okay, now that we know a bit more about this important market, let’s turn out attention to one of the most important players in it.

Meet Klarna: The OG credit card unbundled

In 2005, during an incubator at the Stockholm School of Economics, three entrepreneurs pitched a payments platform that promised to increase an online retailer’s conversions at checkout by an eye-raising 30%.

At the time (circa the early 2000s), online shopping was in its infancy, and it was rife with fraud and scams, leaving people to generally see it as unsafe. This left many consumers hesitant to share their credit card or banking details online.

This major problem in a rapidly growing market led to the kernel of the idea for Klarna: What if you could make online payments easy, flexible, and safe by avoiding the need to give credit card details?

So, founder and CEO, Sebastian Siemiatkowski, had the simple and brilliant idea of (1) enabling customers to make payments in installments and to even “try before you buy”, but (2) still paying retailers the full order value immediately. In turn, they’d fuse two previously separate financial pillars— payments and lending— which would allow them to deliver a whole new level of trust, flexibility, and security to the online experience. This would unlock consumer demand and bring more sales to merchants, thus becoming a catalyst for e-commerce growth.

In the immortalized words of the legend…”I want it all….and I want it now!”

So, along with Niklas Adalberth and Victor Jacobsson, Sebastian founded Klarna (Swedish for clarity). With it, the first BNPL company was born.

As an aside: While learning about the early days of Klarna, one unique thing stood out was how Sebastian and his co-founders approached choosing the startup path. Essentially, they sat down and agreed that this new venture was not a life-changing decision. Instead of mentally justifying this risky new path, they just committed 6 months to it. For 180 days they’d put all their time and energy into the idea and nothing else. Then, they’d evaluate if they’d continue, or go back to cushy well-paid jobs.

He recalls how this time-boxing approach made the decision much easier for them. A handy way to think about taking a big leap.

Surprisingly (or maybe not), their first BNPL had very little technology behind it. The real innovation was a business one. With three non-technical founders, their MVP really took an old idea and reconfigured it for online. Simply, online shoppers were mailed an invoice 30 days after they made a purchase.

Not nearly as sexy, or as Klarna likes to say, “Smoooth”, as it is today. They were even nicknamed “The invoicing company”, but who cares, it worked really well to validate demand for BNPL on both sides of the market before ramping up the technical product.

By 2014, Klarna had become one of Europe's fastest-growing companies and its largest FinTech startup. To continue their growth trajectory (and to ensure they didn’t lose ground to the recently launched Affirm), in 2015 they began expanding to the United States. While the culture and competitive set is fundamentally different in the US from Europe, 330M Americans create enough room to find a big enough niche.

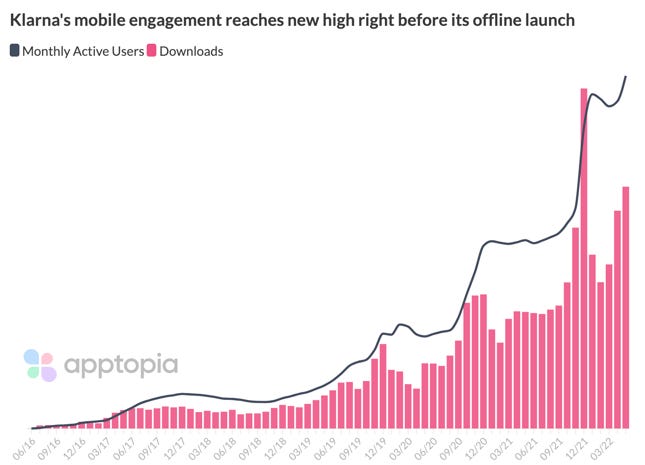

Since then, the US has become Klarna’s principal focus for future growth, and they’ve seen continued adoption and increases in MAUs.

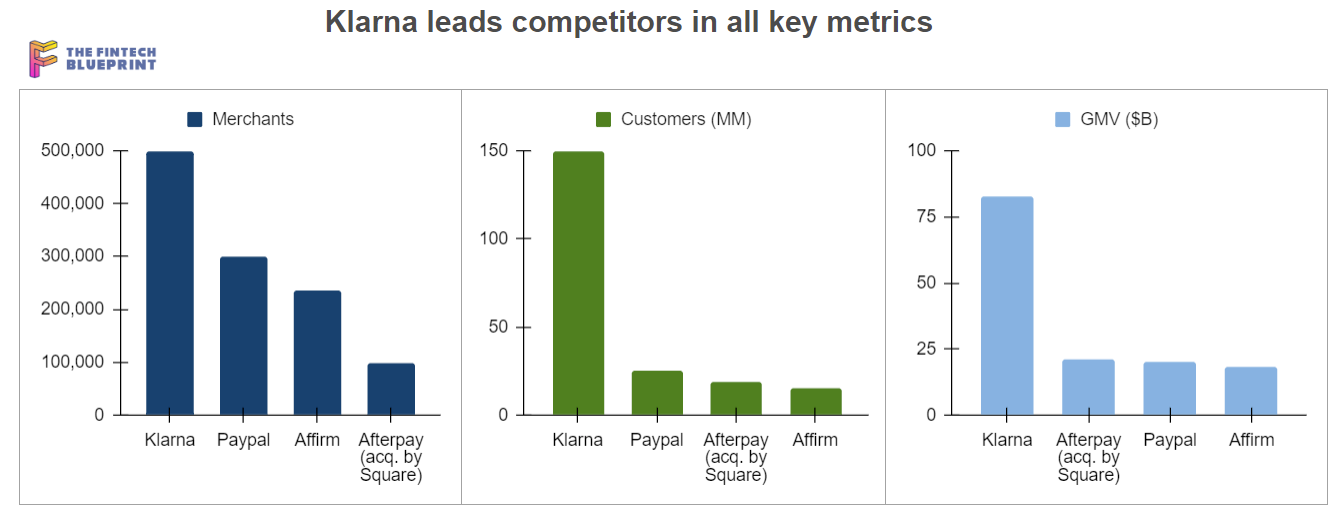

Today, Klarna boasts 150M active consumers, 500K retail partners, and facilitates 2M purchases every day across 45 countries.

However, a big component of that growth is how Klarna has evolved from a BNPL product into a full ecosystem for shopping through their in-app marketplace, with broader ambitions of becoming a “Super App”.

For journalistic integrity (although, I am by no means one), it’s worth mentioning that Klarna in 2021 had a peak valuation of $46B — valuing them at 38X their FY20 revenues. This was high compared to publicly listed comparables, but so were the times. When the going started to get tough and interest rates went up (driving down tech valuations), needless to say, their valuation took a ~85% knock when they raised in 2022. However, the market corrected all BNPL companies and is more symbolic of crazy valuations than a declining business.

Our point: Klarna is still a high-growth company worth studying in a market on track to hit $680B by 2025 (28% CAGR).

And so far, Klarna is winning in it.

Ok, so let’s dive into how they’re doing it. 🔬

How Klarna Grows: From 0 to 150M customers

Klarna’s growth can be broken up into three broad acts.

Act 1️⃣ : Buy Now, Pay Later (Using lending as a wedge to bootstrap consumer demand)

Act 2️⃣ : Becoming a shopping destination and Super App

Act 3️⃣ : The AI Retail Revolution

While the majority of Klarna's timeline has been Act I (2005-2021), we actually won’t be analyzing this phase. In short, Klarna’s go-to-market strategy was to create the BNPL market, and ultimately seed the way for this new way of buying online.

Shortly after releasing their MVP in ‘05, they evolved their invoices-in-the-mail product to something more in the wheelhouse of a savvy tech startup.

At this point, their model was to work exclusively with retail partners. The more providers they were integrated with at checkout, the more consumers they touched, and the more money they made. In that sense, Klarna’s BNPL go-to-market was focused on B2B, and their early growth curve is largely a story of sales-led growth to new stores across new countries.

Also—since they were the first people doing this—a huge part of this initial phase was educating—and proving—the value and trustworthiness of not just Klarna, but this new way of buying/selling things.

While a seemingly straightforward GTM, as they pushed through innovators and early adopters into the mainstream market, Klarna was actually using BNPL as a wedge to start building a network of loyal and creditworthy consumers — along with a lot of consumer data. 👀 And with this consumer network, they were able to level up from a FinTech tool to a Financing+Banking+Shopping platform.

And it’s here in Act II where we start seeing interesting things like moats, flywheels, the power of vertical integration, S-Curves, and the path to reclaiming a $46B and beyond valuation.

Shall we? 🫖

Act II: Becoming a Shopping Destination and Super App

Act I gained Klarna 20M customers in the US in 6 years. But, their shift from unsecured consumer lender to retail conglomerate doubled that in a third of the time. And this evolution was driven by changing from B2B to B2C, leveraging their network of buyers, and starting to deliver a direct to consumers experience (D2C).

Clearly, this was a game-changing move.

To see why, consider this growth loop that emerged:

Simply, this is Klarna’s engine to accelerate commerce. Here’s how:

Driving awareness with a great brand. Starting with payments allowed Klarna to generate trust and build a network of consumers. And, the more people that know about and use Klarna, the more control over consumer demand they hold. Thus, more merchants join the Klarna network, pushing the Klarna brand even further.

Superior payment services available across a global network. Expanding their payment plans and improving their integration with merchants provides more flexibility to shoppers and retailers at checkout. This drives more global retail partners to join, thus (1) giving existing consumers more options, and (2) improving Klarna’s distribution to new consumers.

Creating more value through transaction-related services. When Klarna launched their app and went B2C, their value no longer ended at purchase. They began thinking about the value chain of buying stuff online and integrated themselves into things like budgeting, delivery tracking, etc. This increased stickiness with consumers and made Klarna a product to not just be considered at checkout.

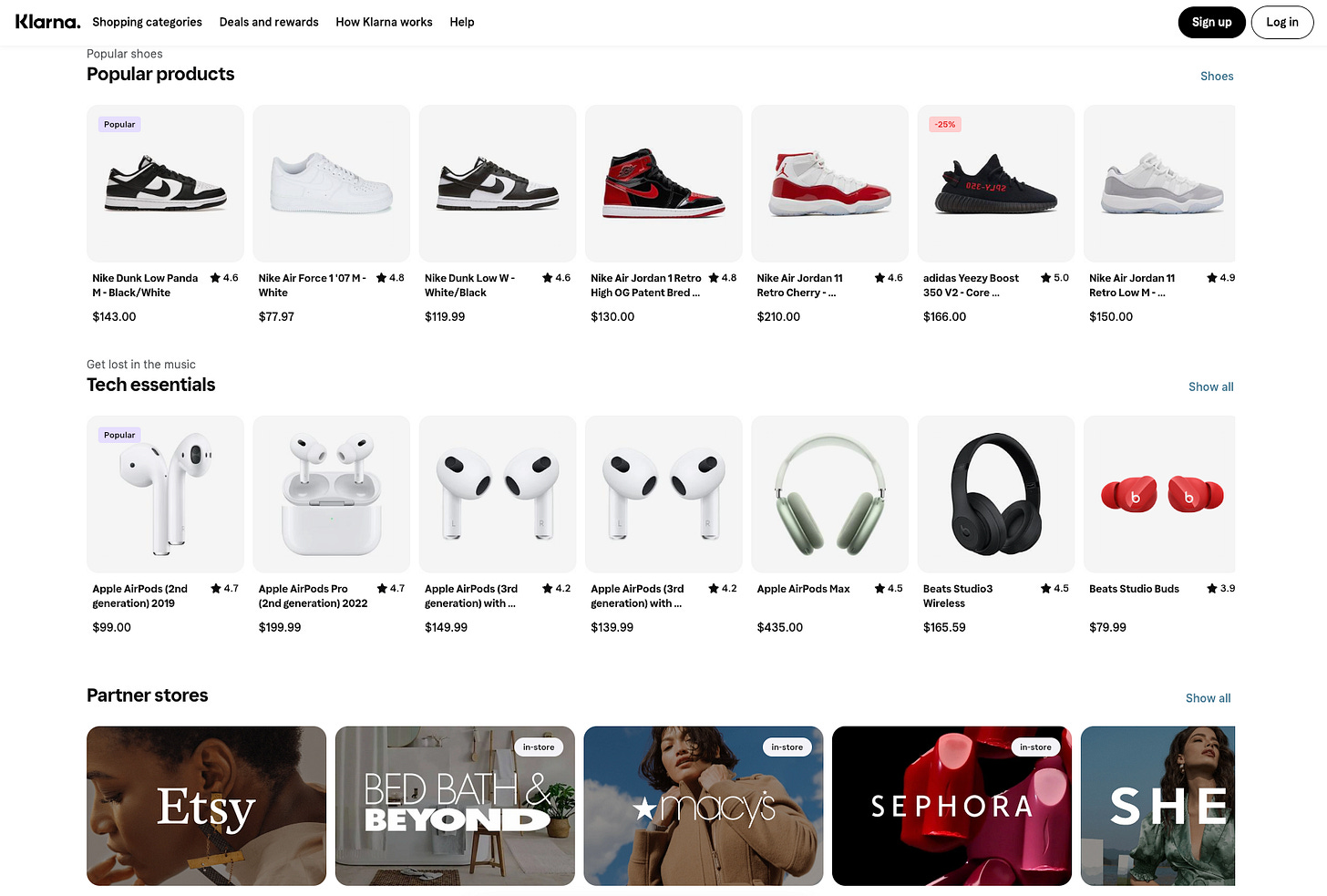

Delivering a true shopping destination. Through their app and site, Klarna delivered an e-commerce marketplace for intent-driven shoppers. By consolidating their official partners, and by ingesting the internet for any other site (more on this growth hack soon), Klarna consumers can enjoy BNPL for anything. This drives a ton of traffic to retailers, increases the total number of consumers buying things and the frequency of their purchases, leads to more channel partners, and in turn continues to drive brand awareness. This creates a stronger/bigger consumer network using Klarna as a shopping Super App.

All in, this model expands the total addressable market because it brings in on-the-cusp shoppers who either (1) just can’t afford those new kicks, or (2) are averted to interest-based credit. AKA — Klarna gets more online and offline window shoppers to the checkout.

This unlocking of latent demand is perfectly illustrated by Chan Kim and Renée Mauborgne’s “Three Tiers of Noncustomers” framework.

Companies that make the pie bigger for everyone are the ones who win. As I wrote recently:

Extensibility is the key driver behind durable revenue growth. Investors like to look for founders, at the earliest stages, who have a strategy for how the company will expand the initial market size. TAM runs out, and like we’ve seen in many cases so far with this newsletter (like Stripe and Shopify) — companies that expand the market are the ones that win.

And this often comes in the form of launching new products and thinking like a platform.

So, now that we know how Klarna is expanding the market by bringing new people into it, let’s go deeper into what they’re doing to actually take over the end-to-end shopping experience.

And using our neat 4-part flywheel from above as a springboard, we’ll begin with the first part of Act II: Creating more value through transaction-related services. 🛝

Adding value beyond the transaction: A lesson on vertical integration and compound startups

Instead of just being a neat embedded product at the point of checkout, Klarna has delivered user-facing products at various other points in someone’s overall shopping journey.

How they’ve approached this is across a two-axis principle:

First, integrating the customer purchasing journey. They’ve done this with tools like personalized shopping carts, planners, and comparison platforms to ease the pre-purchase step, accompanied by software for fraud prevention, direct or installment-based payments for convenience during the purchase journey, and finally wrapping the blanket of easy-returns, price guarantees, and refunds post-purchase.

Second, integrating the two-way relationship between the buyers and sellers. Klarna’s app works as a favorable bridge between both sides of a transaction. And, wherever they’ve simplified the selling of products for merchants and retailers (e.g. logistical efficiencies through APIs that help track deliveries) it directly or indirectly benefits the overall shopping experience for consumers as well.

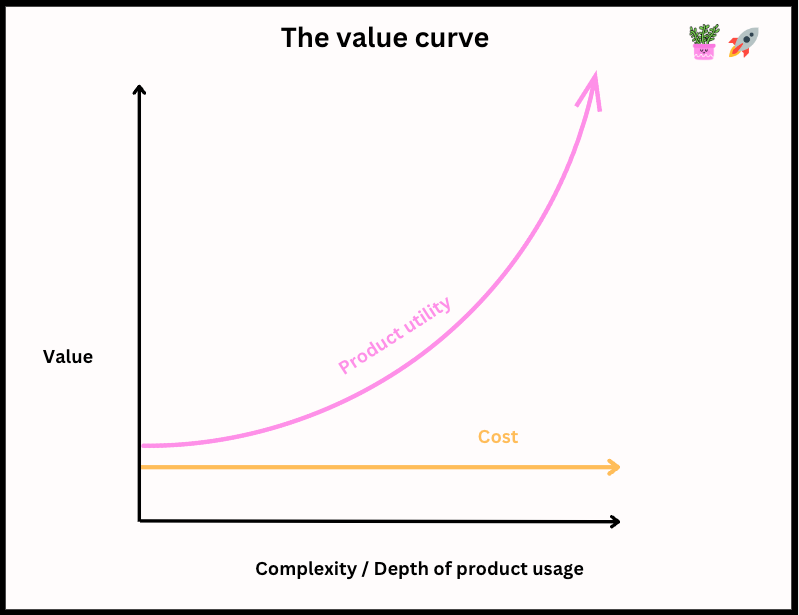

This two-axis approach is vertical and horizontal integration, and a huge benefit of it is that Klarna gets to add a lot more value across a much bigger piece of the user experience.

And, the more problems you solve and the bigger your surface area of value is, the more of a compound startup you’ll be.

A compound startup? 🤔

Originally coined in the context of SaaS by Parker Conrad, but still super relevant for B2C, this is a company that instead of just doing one very narrow thing, tries to build a whole set of different point solution systems in one coherent product and tackles them all at once to solve a much larger problem for someone.

Conventional wisdom bucks that going niche and deep on one problem is a winning strategy (at least, to start).

So, why would you do this?

Simply, because the companies that tend to be bigger and more ambitious are solving the whole problem as opposed to just building a tool.

As Parker Conrad, founder of Zenefits and Rippling, describes:

When you think about the problems your clients have, they often span a lot of different business systems or point solutions.

In fact, I think some of the biggest problems, and therefore the problems that potentially could give rise to the most valuable companies tend to be things that span a lot of different point solution products within a business. And therefore, only building one point solution product can't really address them.

Once upon a time, a small company could dominate a super niche space. But now there are actually a lot of different companies operating in all of these different narrow-point solution verticals. So there is actually now a lot more opportunity if you can go bigger and combine a bunch of these different point solutions into one product.

In other words…think in ecosystems. It will help you with moat digging. 🏰

Just take these examples of ecosystem plays:

Stripe: All things payment infrastructure

Atlassian: All things DevOps

Alchemy: All things Web3 development

HubSpot: All things CRM

So, to differentiate themselves from a commodity market of BNPL providers and stay ahead of the competition, Klarna is gunning to be a compound startup/ecosystem for all things shopping and consumer payments.

They started by hooking people in with BNPL, and then retaining them and increasing their lifetime value (LTV) with everything else inside their Super App. However, over time as they’ve rapidly ramped up their different use cases, they’ve actually come to treat each feature as a beachhead for a certain type of customer.

For instance, some types of people come in for BNPL, some come in for their price comparison tool. Once Klarna hooks them with that value proposition, through an automation cycle they reintroduce that value proposition as well as graduallyintroduce customers to all the other related ones. By identifying the different sticky points per audience type, they don’t need to sell the entire app/ecosystem at once. Instead of overwhelming people, they slowly move people up the product learning/discovery curve until they reach maximum value.

A classic example of Come for the fries, stay for the Happy Meal.

However, they’re not tackling the challenge of becoming an ecosystem alone. 👇

Accelerating time to Super App through M&A: A lesson on building vs buying

Klarna’s acquisitions and investments are a huge contributor to their success. Examining their game plan, we can see how Klarna has been gathering blocks toward their current vision of a one-stop-shopping destination through consistent efforts of inserting themselves across the value chain by both building and buying.

Just take a look at this acquisition map put together by WhiteSight.

Klarna’s core expertise was with BNPL. If they chose to build each of those unique elements out themselves from scratch, they’d face hiring challenges to build out new teams, organizational complexities, and all the other headaches it takes to learn and excel at a new sport.

However, by adopting a buy approach, Klarna identifies the teams that are already crushing their respective “sports” and brings them into the fold.

This also has a massive advantage: time to market.

If I was a fly on the wall in the Klarna office, I imagine hearing the tradeoff to build vs buy go something like this:

How much will it cost us to build this ourselves? Both capital investment-wise and opportunity cost-wise?

Okay, now roughly double that for everything we don’t know we don’t know, and the usual execution risks….

So when will we get this to market?

And what’s the cost/forgone opportunity of us not having this product in the market until then?

Who else is doing this really well? How much can we acquire them for?

Okay, and how much post-close will it cost us to integrate them into the ecosystem?

So, roughly double that for everything we don’t know we don’t know, and the usual execution risks….

And what value do we gain getting this to market X much quicker, plus all the other stuff our teams can do instead of building from scratch?

Clearly based on all of Klarna’s acquisitions, #2 had a better ROI a lot of the time.

Let’s move onto the final part of Klarna’s big-picture, market-expanding, model: Delivering a true shopping destination.

The Klarna marketplace: Dual flywheels, growth hacking, and data moats

As a reminder, merchants benefit from Klarna because:

Klarna helps brands to increase their average order size and conversion rates

Klarna is becoming a huge distribution channel for merchants. By aggregating and curating brands/products for consumers in the app, they drive a ton of traffic and customer acquisition for merchants.

Klarna provides a flexible finance solution but it takes on the credit risk for the retailers — bringing brands more on-the-fence consumers.

Because of this three-prong value, Klarna does much more than just bring tech to merchants (like a credit card), they also bring consumers. This had led to the size of Klarna’s partner network growing exponentially, which already includes over 500,000 official brands worldwide.

Today, the Klarna marketplace spans a ton of categories, each with a deep supply.

You might be comparing this to Amazon, but, Amazon lacks:

Quicker gratification through BNPL

The full catalog of some of these vendors (i.e Sephora)

Aggregation tools across suppliers, like their Price Comparer (see below)

To be clear, Amazon is not worried about Klarna. The point is, their marketplace has a unique enough selling point that gives it legs as its own shopping destination. Especially when you consider all the other layers of bundled value they’ve added to the shopping experience (which we’ll cover in a second when we talk about S-Curves 🐘).

First, you might be noticing a common marketplace flywheel emerge here. In fact, there are two that work together. So, let’s take a look.

Supply → Demand → Supply 🔂

For each new brand that integrates Klarna at checkout (i.e. adding the Klarna logo on their sites) and joins their merchantnetwork, Klarna gains distribution and awareness to that brand’s pool of customers.

This flows into and grows Klarna’s total consumer network, in turn, making Klarna a more valuable channel partner for the entire ecosystem of other stores, thus creating an even bigger incentive for more brands to join the party.

This is their 2-sided indirect network effect. And joined to it at the point of “NEW USER”, is their consumer engagement flywheel: 👇

Essentially, this dual growth loop is a sustainable model that attracts new customers with a low CAC and keeps bringing them back continuously.

Now, strategic partners like Nike, Nordstrom, and GameStop are essential because they help market Klarna and increase brand awareness. But as you can imagine, there are nearly infinite consumer tastes and preferences, and that means even with an extensive coverage of merchants there are going to be folks who can’t buy what they want.

The Klarna team realized this momentous challenge, and in pursuit of becoming the ultimate BNPL shopping destination for everyone, they in fact found a huge opportunity in this predicament.

And it just so happened to end up as their greatest growth hack.

Ingesting the Internet: Shop anywhere with Klarna

One of the most brilliant things they did with their mobile app was to create an in-app web browser.

Here’s how it works:

On the Klarna app, you search for whatever you want. Say, flights with United Airlines.

Klarna checks if that vendor is a partner. If not, they give you a link to their site.

You’re then directed to the site within the app. A smooth experience that still feels like you’rerefdw using Klarna.

Now, since that vendor doesn’t have Klarna offered at checkout, what are you to do?

A genius move: Klarna creates a one-time virtual card for you to use on that site, giving you the same BNPL convenience and flexibility attached to the card instead of the merchant.

At checkout, just drop in your new ghost card details, and you’re off to the airport without such a dent in your wallet.

This unlocked every merchant there is, partner or not, meaning anyone can buy anything anywhere, and pay later.

This blew up Klarna’s serviceable market to every American. 📈

And, with more people in the consumer network browsing anywhere and buying anything…Klarna’s D2C approach brings them a ton of consumer data.

Data advantages: A lesson on data network effects

Klarna does over 2M sales every day, and each purchase comes with lots of transaction data about exactly what people are buying. This builds two huge advantages:

Their in-house credit risk assessment models can improve as their transaction and repayment history deepens

The retailer and shopper data they collect offers insight into consumer purchasing decisions, creating the foundation for other adjacent services and a more valuable user experience

Let’s compare that to credit cards.

Because Klarna partners directly with merchants, they gather much more data than banks can with a credit or debit card purchase. For instance, AMEX knows you spent $500 at Adidas. But, Klarna knows that you bought a size medium sweatshirt, Ultraboost sneakers, and a Gatorade.

This information—combined with in-app browsing and feature engagement— is used to build a richer profile of you and your purchasing behavior as an individual and as part of a demographic group. From here, Klarna can build more equitable and reliable credit assessment models powered by AI trained on mass amounts of data. As their CEO describes: “We already have tons of data to suggest that real-time information is much more powerful to predict people’s spending habits and their propensity for potentially getting into debt”. And, with this data, he plans to transcend Klarna’s role as a retail lender into an everyday financial partner for consumers.

We do budgeting tools, and I genuinely believe, as we advance our investments in that area, that we are going to come to a place where we’re telling customers ‘You know what? Don’t buy that.’

In a perfect market, the only thing you have to care about is, ‘What’s the value I’m creating for my customers?’

I think in the long-term, that’s what’s going to drive competitiveness. You may have to be willing to do things that may feel like bad business, like saying ‘Don’t spend on that product right now.’

— Sebastian Siemiatkowski, CEO

At the end of the day, people with healthy budgets are more likely to be able to continue spending in the long term. Plus, that sort of customer-first behavior would add a ton of trust and brand affinity — especially with the Gen Z audience who are super averse to greedy corporates.

Then for the second advantage.

This same data is used to personalize emails, creative, advertising, and product suggestions — a huge data advantage of owning the end-to-end shopping experience.

Here’s what Sebastian has to say about it:

Thanks to granular data, Klarna has a great understanding of consumer habits and spending patterns. However, I think there has been a lot of industry learnings about when data sharing can go wrong. At Klarna, data must be approached from a customer-centric perspective first, which then benefits our retail partners.

When we process a transaction today, Klarna sees the SKU (stock keeping unit) data and full digital receipts, which allow us to create a much richer experience for consumers post-purchase. We can provide customers with additional value, such as target offers relevant to past purchases, or additional items that could match their interests. It can [translate] into an increase in sales for our partners, while bringing something compelling and relevant to the shopper

One further data aspect is our Wish List functionality on the Klarna app, where we allow customers to save their favourite items from across the internet. We have seen over 7 million items Wish Listed in the last six months. If a shopper has saved a pair of shoes, they will be linked to offers on the item or an indication on where to purchase if it has gone out of stock. The customers feel like their data is working on their behalf and that is valuable to our retailers.

With these two advantages, another virtuous flywheel emerges for Klarna: A data network effect.

Data network effects occur when your product, generally powered by machine learning, becomes smarter as it gets more data from your users. In other words: the more users use your product, the more data they contribute; the more data they contribute, the smarter your product becomes (which can mean anything from core performance improvements to predictions, recommendations, personalization, etc. ); the smarter your product is, the better it serves your users and the more likely they are to come back often and contribute more data – and so on and so forth. Over time, your business becomes deeply and increasingly entrenched, as nobody can serve users as well.

The more automation you build into the loop, the more likely you are to get a flywheel effect going.

— Matt Turck (VC at FirstMark), The Power of Data Network Effects

Beyond Payments: A lesson on growth inflections, S-Curves, and bundling value

A growth inflection point is an event that results in a significant change in the growth trajectory of a company. Something happens, and a snowball effect follows (except in reverse up a growth curve).

In an earlier-stage startup context, this might look like watching your top-line revenue and wondering where growth will start to take off. For later-state companies, this could be specific to a certain product or business line.

If you’re lucky, you find a growth inflection point and you end up with this curve: the typical trajectory of a successful product.

So, where do you find growth inflections?

According to extensive research by Lenny Rachitsky into the growth inflections of a bunch of highly successful companies, the majority of growth inflections sprang from a product improvement. Good news for us product managers!

Now you might be thinking, “But what’s so successful about that curve? It flatlines at the top!”.

Well, you’ve no doubt heard the adage, “Nothing goes up forever”. And that couldn’t be more true for products. To achieve long-term sustainable growth, it’s never as simple as just one thing.

Think of growth inflections like logs for a fire. Throw one on and you’ll kickstart growth, but eventually, the flame will dwindle.

But why the slowdown in growth? 🤔 One (or many) of a few reasons:

Market Saturation: The most common reason for growth slowdown is market saturation. This means that the product or feature has reached nearly all potential customers in its target market. When this happens, the rate of new adoptions decreases, and growth slows down.

Competition: If other companies or products enter the market offering similar features or benefits, growth can slow down. This competition can lead to a division of the market share, making it harder to maintain the same growth pace.

Maturity: As a product matures, companies often find it more difficult to innovate and add new features that attract new users. If a product can't evolve to meet changing consumer needs, growth may slow.

Change in User Needs: Over time, user needs and preferences can change. If the product or feature does not adapt to meet these new needs, growth can slow. This can be due to technological advances, changes in societal trends, or other factors.

Economic Factors: Factors such as economic downturns or changes in purchasing power can also impact growth. In difficult economic times, consumers may be less likely to adopt new products or features, leading to a slowdown in growth.

Product Lifecycles: Every product goes through a lifecycle: introduction, growth, maturity, and decline. The growth slowdown is a natural part of this cycle. Once a product reaches maturity, it's common for growth to slow.

Decreased Effectiveness of Marketing Efforts: Over time, the same marketing strategies may not yield the same results, distribution channels get saturated, leading to decreased user acquisition and slower growth.

Regulatory Changes: Sometimes changes in laws and regulations can impact a product's growth. For example, new data privacy laws can affect tech products' ability to reach or retain customers.

Technology Lifecycle: Technological advancements can cause a product to become obsolete, causing a slowdown in growth. For example, the growth of DVD players slowed and eventually declined with the advent of streaming technology.

So, the best way to keep growing: keep throwing new logs on the fire. 🔥

As Lenny describes:

Although a single moment can (and often does) ignite growth, to build a durable business you’ll eventually need to get all three [of these] pieces right:

Ongoing product improvements, to build something people want/need

Ongoing events that get the word out

A well-oiled growth engine

This tells us that to keep the growth bonfire burning and getting bigger, companies need to understand that sought-after quadratic growth (not impossible exponential growth) is a series of S-Curves (i.e 🪵), where the start of each curve (i.e the inflection point) is generally rooted in a better product experience.

Now, armed with our theoretical understanding of S-curves, let’s return to the field.

Klarna consistently rolls out new features across their web and mobile apps that (1) attract new users, and (2) retain existing ones. Each new improvement parlays on the existing features, creating an integrated, feature-rich, shopping experience.

Let’s take a look at some of their most significant growth inflections from a product standpoint. 👇

Immersive shoppable content: A lesson on leaning into changing behavior

Leaning into the massive trend of Short-form Video and the infinite scroll experience, Klarna rolled out “Watch and Shop” in their app.

Like we saw with TikTok, the more someone engages with the feed (combined with all the other data Klarna already has on them), the more personalized the feed becomes.

Consumers get to see real people sporting spring fashion looks, gadget reviews, home decor inspiration from pros, etc. This inspires purchases, and of course, all items are just a tap away to buy or add to a Wish List.

It’s unclear how used this feature is, but it certainly leans into the way young consumers [47% of US consumers who made livestream purchases last year were members of Gen Z] consume content and tend to be discovery-based users vs intent-based. It’s also a marketing money-maker with their B2B customers.

Creator platform: A lesson on building whole products

A product nicely coupled with their immersive shoppable content feed — Klarna figured they’d make the brand experience even smoother and more complete by building an integrated Creator Platform.

Simply, this helps merchants find the right influencer partners, collaborate with them, and then track and optimize these relationships with insights into performance metrics, all without leaving Klarna.

This is a great move to embed Klarna even deeper within their partner network, again, going far beyond just providing lending services to brands.

Search & Compare: A lesson on using free tools as a land-and-expand play

Klarna is a massive aggregator of products — many of which are identical from different merchants. So, leaning into this advantage, they launched an unbiased search tool that compares thousands of retailer websites in real-time to help consumers find what they love for the best price.

This further establishes Klarna as a destination for shopping, because who doesn’t want the best price? What’s more, while Klarna finds you the best prices, it also scrapes the internet for any available deals/coupons — driving home the best deal for you even more.

And as touched on earlier, free tools like this have become a land-and-expand play for Klarna. Some folks come in to find the best deal, discover they can pay with flexibility, become BNPL customers, and then end up as regular MAUs.

Virtual shopping: A lesson on closing the gap between desired, and actual, user behavior

Klarna rolled out a feature that lets consumers go inside their favorite stores and speak with an expert. Virtually.

This allows people to see products up-close, get detailed styling advice, and more through in-app video and messaging. Clearly having identified the benefits of the in-store experience (e.g the luxury of concierge), but also the resistance to leaving home and mission to a store, Klarna is cleverly delivering a way for the two worlds to meet.

Obviously, this is slower to scale, and for now Klarna is only rolling this out with mid to higher-end clothing brands. But, this is a really interesting hook for folks who don’t feel like schlepping to a mall and dealing with that stress.

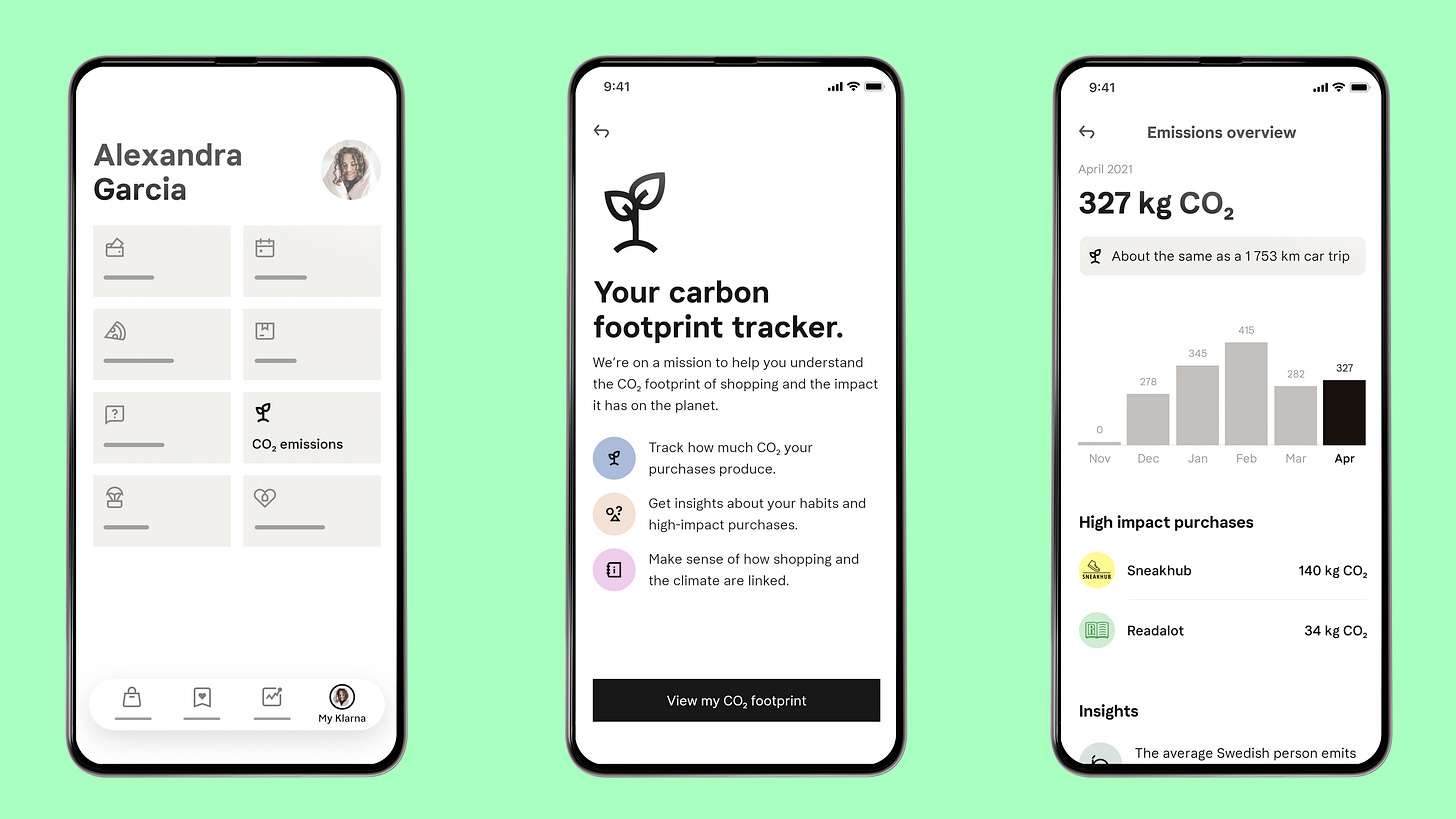

CO₂e Emissions Tracker: A lesson on leaning into cultural shifts and values

Another brilliant feature Klarna rolled out leans heavily into a seismic shift in Gen Z behavior: Sustainability.

Especially for the environmentally conscious younger generations, climate tech is booming and people care more and more about the footprint of their purchases. According to McKinsey/Nielsen, 78% of people want to shop sustainably.

Leaning into what their core audience wants and values, Klarna has two “green” tools.

First, they launched a CO₂ emissions tracker, allowing consumers to see how their purchases impact the planet.

Then earlier this year, they launched “conscious badges” in collaboration with sustainability platform Clarity AI. The feature allows customers to view metrics about a brand’s GHG emissions and the amount of energy it derives from renewable sources, among other climate-related stats.

The unbiased, AI-driven environmental assessment follows the launch of Klarna’s Conscious Collections in 2022 – an initiative that increases transparency around sustainable practices in the apparel and footwear industry.

Long-tail, this is good for the planet as brands realize this level of transparency is being demanded by younger shoppers and influences their buying decision. Short-term, it builds brand loyalty with Klarna as Gen Z feels good about who their hitching their shopping identity to.

And identity is an extremely powerful force, not to be underestimated. That’s why Apple has die-hard evangelists willing to keep paying out the wazoo. Apple connects with people’s identity on a fundamental level — arguably the best retention tool on the planet.

Online + Brick-n-Mortar: A lesson on meeting your customers where they are

Klarna is moving beyond their core online products. One big way they’re doing this is through the launch of the Klarna VISA card — putting BNPL power in users’ physical wallets (or Apple Pay, of course).

This expands their serviceable market and use case coverage as they’re solving the payments problem wherever their customers might encounter it.

Plus, most retailers lack a complete picture of the behavior of their customers between online and offline. This could change that, since Klarna would be able to provide insights into this over time as their in-store adoption improves. That would be a huge selling point, driving growth of their partner network even further.

Creating a smooth resell experience: A lesson on partnering with other services

The trend of buying and selling secondhand is growing as consumers seek eco-friendly options and budget-friendly solutions. According to a recent Klarna survey, over one-third of consumers are more likely to resell an item now compared to one year ago.

The new resell feature in the Klarna app speeds up the process of creating listings on secondhand marketplaces by pre-filling product details and images. To resell a past Klarna purchase, consumers can simply tap on the ‘Resell’ button next to an item from their order history to be automatically taken to a participating re-commerce platform. This reduces the time and energy needed to list items for sale, so consumers do good by their wallets and the environment.

Today the feature is available in Sweden, together with Tradera, the largest resell platform in the Nordic region, and is set to go live with more partners across the world soon.

And that’s Act II.

Let’s wrap up our analysis today by briefly looking at how Klarna is betting on AI.

Act III: The AI Retail Revolution

The first bet on AI they’re taking— and their most recent S-Curve—is by bringing AI to Klarna. 👇

The product recommendation engine: A lesson on personalization

Thanks to that data advantage we saw earlier, Klarna is in a great position to deliver algorithmically-powered product discovery feeds. AKA — the TikTokification of shopping.

Built under their immersive shopping experience noted above — instead of searching for what you want, Klarna takes everything they know about your preferences and curates a feed For You.

Our new AI-powered discovery shopping feed is the next evolution of the Klarna app becoming the starting point for every purchase. This builds on a ton of initiatives we’re working on in the AI space, to provide a greater level of personalization to consumers that was once thought impossible.

— Sebastian Siemiatkowski

The feed updates in real-time with a range of products and deals and becomes increasingly tailored as it learns more about your preferences. This compliments Klarna’s recently launched Search & Compare tool really nicely, as while you scroll you get details about what’s on sale, best prices, shipping options, and stock.

This further evolves the app to become a starting point for every purchase, and through personalization, each user's experience is more relevant and valuable — driving better retention and more sales.

The second bet they’re making here is taking Klarna to AI. 👇

Klarna x ChatGPT: A lesson on integrating your product with AI

Omnichannel (i.e. a seamless and consistent shopping experience across all possible channels or platforms) is the future of retail.

So is AI.

Klarna knows it, and they’re fusing the two together with their latest integration with ChatGPT and partnership with OpenAI.

You don’t need any evidence to know how many products (and stores selling them) exist. Because of this insane volume, consumers face the task of researching things like quality, price, and customer reviews before buying. Wading through the mountain of consumer goods and decision-making info is a mission.

That’s why Klarna was one of the first brands to work with OpenAI (1 of just 11 so far), using their protocol to build an integrated Plugin for ChatGPT. This integration delivers a highly personalized and intuitive shopping experience by providing curated product recommendations to users who ask ChatGPT for shopping advice and inspiration. Of course, along with links to buy those products on Klarna.

This partnership taps Klarna into a pool of 100 million monthly active users on the fastest-growing application in history —an omnichannel move that unlocks a tremendous distribution hose for Klarna.

Plus, through this collaboration, Klarna is at the forefront of defining the online shopping experience of the future in an AI-native world.

As Sebastian says:

I’m super excited about our plugin with ChatGPT because it passes my ‘north star’ criteria that I call my ‘mom test’, i.e. would my mom understand and benefit from this? And it does because it’s easy to use and genuinely solves a ton of problems - it drives tremendous value for everyone. Klarna is in a unique position to leverage the best technology and data to help people discover new products and solve problems for consumers at every stage of the shopping journey, and we’ll continue innovating to bring these services to our 150 million consumers.

We can also easily see Klarna adding an AI shopping assistant in their own app — bringing text (or audio) concierges that polish the online shopping experience for consumers.

Bottom line: Klarna has their ears to the ground, is closely watching technological and behavioral shifts, and is making sure they’re at the forefront of so much more than just BNPL.

AI could very well be the biggest seismic technological wave we’ll see in our lifetimes. If you’re thinking about your own product right now and wondering how to get it a seat on the AI train, here’s some insight on how to integrate AI into your product strategy.

Key considerations and steps in adding AI to your product: 🤖

Problem identification: Before anything else, you need to very clearly define the problem you're trying to solve. AI can be a powerful tool, but it's not a cure-all. In fact, if it’s just added without a clear purpose, it can worsen your product. AI works best when applied to specific, well-defined problems. This could be things like predicting customer churn, automating customer support, personalizing product recommendations, streamlining SaaS workflows, etc.

Evaluate AI appropriateness: Once you've defined your problem space, consider whether AI is an appropriate solution. And no, just because it’s the cool new thing does not make it appropriate. AI is particularly well-suited to tasks that involve pattern recognition, prediction, classification, and automation. However, for tasks that require human judgment, creativity, or complex/nuanced decision-making, AI might not be the best solution.

Data availability: AI algorithms need data to learn from. Consider whether you have access to sufficient, high-quality, and relevant data to train your AI. If not, you might need to invest in data acquisition or augmentation. Remember, the quality of your AI's output will be directly related to the quality and quantity of the data you feed it.This is why data network effects (assuming good data governance) are so powerful.

Feasibility and costs: Implementing AI can be costly and time-consuming. It requires specialized skills and resources, including data scientists, AI experts, and potentially expensive computational resources. Be sure to conduct a thorough cost-benefit analysis before jumping in and proposing an AI play.

Ethics and bias: AI can inadvertently perpetuate existing biases in data or create new ones. It's important to consider the ethical implications of your AI system and take steps to minimize bias.

Integration with existing systems: Consider how the AI solution will fit into your existing product ecosystem. You'll need to think about things like API integration, user interface design, and how to handle potential errors or failures in the AI system. Prepare for a world of known and unknown unknowns.

Then, only once you've considered these points and got alignment on proceeding, here's a framework for implementing AI in your products:

Define the AI project: Clearly define what you hope to achieve with AI. Set measurable objectives and key results (OKRs).

Rally for resources and assemble a team: Depending on the scope of the project, this could include data scientists, AI engineers, product managers, and UX designers. Remember the opportunity costs of their time working on this vs something else when framing your ROI.

Data collection and preparation: Collect and clean the data you'll use to train your AI. This could involve data cleaning, transformation, augmentation, and splitting into training and validation sets.

Model development: Choose an appropriate AI model for your problem and train it on your data. This could involve techniques like machine learning, deep learning, or reinforcement learning.

Evaluation and optimization: Evaluate your model's performance using appropriate metrics. Optimize your model by tuning hyperparameters, adding more data, or trying different architectures.

Deployment and monitoring: Deploy your AI model and integrate it with your product. Monitor its performance over time and be prepared to retrain it as necessary.

Iterative improvement: AI development is an iterative process. Be prepared to continually improve your AI system based on user feedback and changing circumstances.

Remember, AI is a tool, and like any tool, it's only as good as the person (or team) using it. A successful AI implementation requires a deep understanding of the problem, a well-planned strategy, and a commitment to continuous learning and improvement.

And that, friends, is a wrap on our Klarna deep dive. 🫡

If you enjoyed today’s post, please consider hitting the like button, sharing, or telling some friends/co-workers about How They Grow. This is a reader-supported newsletter, and your support means a lot and helps others discover my writing. 🙏

And once again, a huge thank you to Aakash Gupta for collaborating with me on this. This was a lot of fun! Folks, if you haven’t yet, be sure to subscribe to Product Growth. Aakash is a goldmine of insights, and if you’re a PM, you’ll get a ton of value from his work.

Also, if this was your first time reading How They Grow, drop your email below to get more in-depth analyses like this.

Until next time.

— Jaryd ✌️

Wow, what is the average time for writing this article? It is so clear and broad. Thanks, appreciate it a lot. Love from Amsterdam.

This was a really helpful article. As a product designer, I gained alot of insight into the business side of things. Definitely learnt so much.