How Stripe Grows

What we can learn about solving hard problems, wizards, going deep on problems and moving fast, building products at the right time, and becoming masters at moat building from Stripe.

Hi, I’m Jaryd. 👋 Every other week, I pick one company/startup you probably know, and go deep on their go-to-market strategy, how they acquired early customers, and what their current growth engine looks like.

+ every Friday — I bring you 5 short-form insights from the startup/tech universe.

If you haven’t subscribed yet, join the other folks interested in growing a company by subscribing here:

❤ If you enjoy this post, throw it a like by clicking the heart up top to help more people find it.

Hi friends 👋

In our last deep dive, we spoke about how Shopify is the platform and ecosystem for e-commerce entrepreneurs. And it got me thinking about probably one of the most important platforms out there — Stripe.

You’ve no doubt heard of this juggernaut of a private company that is powering payments for businesses all over the world — and whether you know them or not — I can say with certainty that you’ve used Stripe multiple times (90% of US adults have).

Going deep on their story and unpacking the growth drivers of this $95 billion startup, founded by two brothers in Dromineer — a tiny village in Ireland with a population 102 — has been so flippin’ interesting. These guys have created the most incredible product and have grown spectacularly into one of the golden geese of Silicon Valley, with Wall Street licking their chops for their IPO.

While that’s spoken like someone who’s being paid to market a company, as usual, I have no affiliation with Stripe or any of the companies I write about, and nothing here is ever investment advice. I pick the companies that really excite me as a product manager, and the ones that I personally really want to learn from — and the only advice you’ll find here is on how to build and grow a product.

So, why does Stripe excite me?

Stripe is a mission-critical product that is laying the railroads for global money movement. People will always need to pay for things, and businesses will always need to get paid. As the worlds GMV grows (which it will), so will Stripe’s business.

But, just because you’re solving a mission-critical problem doesn’t mean you will be an essential solution. Plenty of products solving a vital problem have fizzled out.

So, today, we’re going to look at how Stripe has grown to become one of the most significant companies out there today. We’ll get into how they started with a very specific who (developers), who had a real and very painful problem (accepting payments), and how they solved that one problem extremely well and created a culture of obsession with the customer experience.

I think it’s safe to say nobody particularly likes toll booths — but Stripe has managed to position itself as a deeply loved toll booth of the internet, collecting a small commission fee from a large share of the internet economy.

Also, most people know that Stripe is an incredible company, but very few know why Stripe is an incredible company.

Today, we’re unpacking the why. There are a ton of product and growth lessons in here for anyone starting a business, and building or marketing a product.

So, grab a coffee, and let’s get into it. ☕

How Stripe Grows

(Click that link ☝️ to read the full thing in your browser/app — sadly, it gets cropped in email )

How They Started

How They Grow

Takeaways

As we go, I’ll be calling out key learnings and takeaways that can help all of us build and grow better businesses, and also sound smarter in our next meeting. 😎

I do have just one ask of you though — if you learn at least one new thing, please consider subscribing, sharing with someone, and/or just giving it a like! Thank you 🙏

Stripe — the financial infrastructure for the internet

Stripe was founded in San Fransisco in 2010, but the story really starts in a tiny Irish village back in ‘05 — with a 16-year-old Patrick Collison.

I can’t remember exactly what I was doing at 16 — but I can assure you it wasn’t winning Young Scientist of the Year for creating my own programming language, or leaving early to attend MIT based on an SAT I took at 13.

Patrick is a very smart guy. But equally so is his younger brother, John.

And in ‘07, the two Collison brothers launched their first startup together, Auctomatic, a SaaS platform for eBay power sellers to track inventory and traffic. That year they joined Y Combinator (YC), and within just 10 months of incorporating — they were acquired for a nice $5m.

At 19 years old, Patrick went on to become the Director of Product Engineering at Live Current Media (the company that bought them), and John went to Harvard.

You’d think Patrick would have his hands-full at this point, trying to figure out how to be a director and all. But no, he actually had a bunch of small side projects he was toying around with.

Now, at this point in time— online payments were supposed to have been solved.

Elon Musk, Peter Thiel and Max Levchin founded PayPal in 1998, which was bought by eBay in 2002 for $1.5 billion. The fintech ‘revolution’ that followed, however, wasn’t much of an uprising but more of a spot of portfolio diversifying by some banks that laid down the payment rails any eager startup had to ride on. The banks still verified identity and owned the account for cards and payments drew from.

For years, the growth in e-commerce outpaced the underlying payments technology: companies wanting to set up shop had to go to a bank, which processes payments, and setup a gateway to connect the two. This takes weeks, lots of people, and fee after fee. Much of the software in place was decades old and written by banks, credit-card companies and financial middlemen.

PayPal – designed to simplify payments – actually made this worse. The company infuriated startups with its restrictions – once turnover hit a certain level, PayPal automatically put the business on a 21 to 60 day rolling reserve, meaning that up to 30 per cent of a company’s revenue could be locked up for up to two months. Developers had to choose between this and complex legacy systems built by banks.

— Stephen Armstrong via Wired

But, while Patrick was working on his various ideas — he noticed this problem, and began to wonder why it was so difficult to accept payments on the web. John agreed💡

For us it was quite visceral: these [payment] products are not serving the needs of the customers, so let’s build something better.

In old-fashioned legacy companies it’s the CFO choosing the payments system. They think all systems are alike, so they just sort the bids from suppliers. But if you’re a developer building the next Kickstarter, or the next Lyft, and you have a two-person team, both of you writing relatively complex code and solving complex infrastructural problem, you need a simple payments API that – once installed – doesn’t keep changing.

— John Collison, co-Founder and CEO

So, they began tinkering with the idea of solving online payments, seeing if it was possible to make it simple — really simple. And in 2010, they came up with seven elegant lines of code that anyone could insert into any app or website in just a day to connect to a payments company. It included a huge promise that no other changes were needed. Once the Stripe API was integrated, it wouldn’t have to be touched for years.

A process that used to take weeks was now a simple cut-and-paste job. And significantly, they focused just on the people doing the cutting and pasting — the developers — the people actually building the sites and apps and integrating payments.

💡 Takeaway: Focus on a very specific audience. Stripe is very clear about putting developers first, and that reflects across the board. [Learn more about finding a super-specific who for a consumer business here]Solving a hard problem everyone else was ignoring

But payments wasn’t a new problem — it was actually in these developer’s faces constantly. So, why was nobody else solving it? Paul Graham has a great essay, Schlep Blindness, that tells us why:

There are great startup ideas lying around unexploited right under our noses. One reason we don't see them is a phenomenon I call schlep blindness. Schlep was originally a Yiddish word but has passed into general use in the US. It means a tedious, unpleasant task.

The most dangerous thing about our dislike of schleps is that much of it is unconscious. Your unconscious won't even let you see ideas that involve painful schleps. That's schlep blindness.

The most striking example I know of schlep blindness is Stripe, or rather Stripe’s idea.

For over a decade, every hacker who’d ever had to process payments online knew how painful the experience was. Thousands of people must have known about this problem. And yet when they started startups, they decided to build recipe sites, or aggregators for local events. Why? Why work on problems few care much about and no one will pay for, when you could fix one of the most important components of the world’s infrastructure?

Because schlep blindness prevented people from even considering the idea of fixing payments. Probably no one who applied to Y Combinator to work on a recipe site began by asking “should we fix payments, or build a recipe site?” and chose the recipe site. Though the idea of fixing payments was right there in plain sight, they never saw it, because their unconscious mind shrank from the complications involved.

– Paul Graham, Schlep Blindness

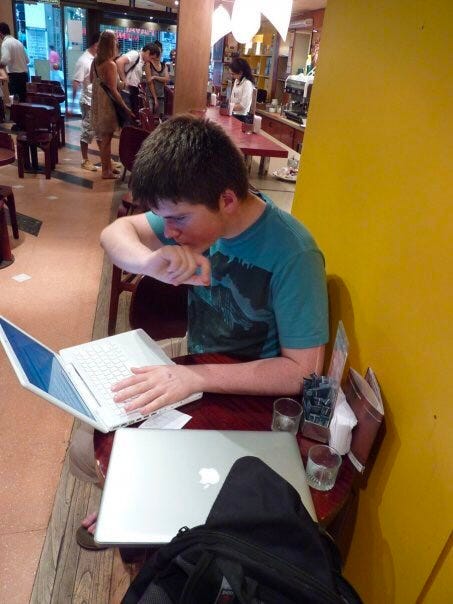

But Patrick and John set out to solve this hard problem at a time when there was a great tailwind — the acceleration in the number of online businesses — and within 2 weeks of building the prototype they had their first transactions with a YC company, 280 North. Below is a snapshot of John doing their first production deploy of the Stripe API — shortly before their first transaction.

In the beginning they weren’t sure how big the market was or if they could provide the user experience that they wanted. They also weren’t sure if they could fully address issues like fraud, non-US payments, and solving similar problems that PayPal does but in user-friendly way.

And this ignorance, according to Paul Graham from that same essay, is probably why they picked payments to work on:

Frankly, the most valuable antidote to schlep blindness is probably ignorance. Most successful founders would probably say that if they'd known when they were starting their company about the obstacles they'd have to overcome, they might never have started it. Maybe that's one reason the most successful startups of all so often have young founders, and the reason younger founders have an advantage is that they make two mistakes that cancel each other out.

They don't know how much they can grow, but they also don't know how much they'll need to.

💡 Takeaway: To find a schlep problem to work — try to take yourself out of the picture. Instead of asking "what problem should I solve?" ask "what problem do I wish someone else would solve for me?" If someone who had to process payments before Stripe had asked that, Stripe could well have been of the first things they wished for.But, over the next 6 months, they showed their API to friends, watched people interact with it, and iterated as fast as they could. They soon realized they were onto something big, seeing a massive opportunity to change the architecture and landscape of the financial industry and dramatically improve the stale payments ecosystem.

So, they started working on Stripe full-time in the fall of 2010, and they shaped their huge vision for the company — “To increase the GDP of the internet.”

Now let’s look at how they turned seven lines of code into a $95 billion startup. 🚀

How They Grow

Acquiring early customers and Stripe’s MVP

In those first few months, while they were iterating on that prototype and trying to figure out if they would even be able to build the ideal experience they wanted — Stripe was very much running a minimum-viable-product (MVP).

So much so in fact, that on the backend, when someone signed up to Stripe, Patrick would call up his friend who would then actually manually set up a merchant account for that user.

Basically to start, Stripe just made an easier and faster to implement API. They were not really a company — they were just trying to figure out if this approach resonated with their target customers.

This is called a Wizard of Oz experiment. 🧙♂️

What do wizards have to do with anything?

There are many different ways get quick feedback and figure out what the demand is for your product without having to invest a bunch of time in building the whole thing.

You can spin up a landing page with a waitlist, create a single-feature app, create a concierge — or, like the Collison brothers, you can create a prototype that gives the illusion of the real thing.

If you haven’t seen the Wizard of Oz (1939)— I’m not too worried about spoiling anything for you at this point. The big reveal is that the true identity of the Wizard of Oz is actually an ordinary human with no magical powers, who hiding behind a screen and through his inventions, manages to convince the people of Emerald City that he was a wizard.

The analogy should hopefully be pretty clear here.

And in startup-land, generally speaking, "Fake it 'til you make it" is a completely acceptable way to build your MVP….not you, Ms. Holmes 🤔

In short, with a WoZ test, you do the work manually in the background while giving the impression of a fully-developed product in the foreground.

Uber famously had people email one of the founders to gain access to the service. The MVP they created allowed people to text their address to Uber and in turn, someone in their office would find the nearest available car, send the driver to the address provided, and text the customer back with an update on who’s picking them up. 🪄🚕

So, playing Wizard, the Collison brothers got Stripe their first 20 customers from people they knew at Y Combinator and gathered essential feedback before building out their first real, no illusions, Payments product.

And not only did Stripe lean into their network….they were also very forward about it. As Paul Graham outlined in another one of his famous essays, Do Things that Don’t Scale:

At YC we use the term "Collison installation" for the technique they invented.

More diffident founders ask "Will you try our beta?" and if the answer is yes, they say "Great, we'll send you a link."

But the Collison brothers weren't going to wait. When anyone agreed to try Stripe they'd say "Right then, give me your laptop" and set them up on the spot.

As they got new customers using Stripe and demonstrated the simplicity of their API , these developers in turn told their friends.

Initially it very much spread through a word of mouth process. That was surprising to us because it’s a payment system not a social network so it’s not something you’d think would have any virality whatsoever. But it became clear that everything else was so bad and so painful to work with that people actually were selling this to their friends.

— Patrick Collison, via Techzing Podcast

💡 Takeaway: Make something your customers need to do easy, and don’t be too concerned early on with building the whole thing — find the easiest and fastest way to test your idea and go from there.Not all product feedback is equal — using pricing as a forcing function

Feedback is essential at all stages of a company, but particularly when running an MVP around a complex problem. The right feedback can make your business, and the wrong feedback can derail you completely.

But, getting honest feedback is tricky when all your first customers are friends from your direct network.

Ali Abouelatta (author of First1000) has a great insight here on how Stripe used pricing as a forcing function to get the candid feedback they needed:

Patrick and John decided to price Stripe during Beta at the most expensive end of the spectrum. [They charged] 5% +$0.5 when all their competitors were charging 2.9%-3.2% + $0.3. This expensive pricing structure ensured 2 things:

1. People who signed up to Stripe and were willing to bear the expensive cost were not incentivized by money. Money creates all sorts of conflicts and may very well attract the wrong customers. You don't want to be building for the wrong audience ever...but especially not in the early days and not in an industry where product decisions are almost irreversible.

2. It also forced the team to build a great product. The more you charge for your product, the higher the customers' expectations are. Having that pressure from customers asking every day if their offering was truly worth almost X2 what the competitors charge, ensured that the only way to keep their customers around was to build a product that was at least twice as good as anything out there.

So, as they were gathering feedback from the right people and making their product better— more and more people spoke about Stripe because they made something customers needed to do really easy. Developers typically have high standards, and they talk to one another. And Stripe exceeding those standards led to continued word of mouth growth.

Then, on September 29th, 2011….Stripe launched to the public.

Following this launch, they put a lot more energy into acquisition and started creating a community of devs around the product. Here are a few key things they did that bolstered their word of mouth engine.

They hosted monthly Capture The Flag hackathons at their offices. This eventually became so popular they took it online.

They started hosting general meet-ups for developers and hackers across the country — basically wherever Patrick and John travelled to.

They started running ads on Stack Overflow . For the first year, that was the only channel they used for paid marketing.

They spent a lot of time building dev tools like clear and detailed documentation. For developer-focused products, well written documentation is one of the most important assets that creates a great experience, saves devs' time, and earns appreciation — which all further fuel word of mouth growth.

At this point in the game, for their core Payments product, they had already locked on their key customer, persona, problem, and solution for solving traditional e-commerce payments (i.e buying on Pelaton). To continue building out the financial infrastructure for the internet, they needed to support businesses running more complex payment flows.

So in late 2011, they launched Stripe Connect, their second core payments product that opened them up to two massive use cases.

Enjoying this deep dive? Consider subscribing for more like this every other Wednesday.

Becoming an ecosystem with Stripe Connect

Stripe’s first set of APIs created the easiest way for e-commerce merchants to accept payments and move money around globally.

With Stripe Connect, they aimed to bring that same elegance to businesses who are doing more than simple one-way transactions, like onboarding their own sellers, simplify compliance, and managing global payouts.

The started building for platforms (like Shopify) and marketplaces (like Etsy).

Like Stripe’s first product, Payments, the Connect product was quick to establish product market fit. That is because Stripe did not just go to market haphazardly. It spent six months in production testing the product. It iterated from learnings, for example allowing customers to add optional fees, as well as adding donations in SubReddits.

Fast forward to today, and Connect is estimated to be one of Stripe’s biggest revenue drivers. Take Shopify, which has done about $80B in payment volume over the last twelve months. At a 2.5% take rate, and 38% gross margin for that segment, we can estimate Stripe received $1.2B in revenue from Shopify.

— Aakash Gupta, via Product Growth

As Aakash Gupta lays out for us there — the powerful part of Stripe Connect is that by building out payments for an e-commerce platform like Shopify, they are able to piggyback on Shopify’s incredible growth.

They inserted themselves as the tollbooth for every single cent moved through all of Shopify’s network of merchants.

The reason that building infrastructure for platforms and marketplaces was such a strategic move is best captured by Paul Graham:

Platforms help people make money. Stripe helps platforms. Shopify is not Stripe’s only big platform or marketplace customer. Stripe also has names like Lyft and WordPress on the list. Stripe grows as these customers grow. This is how Stripe accomplishes its mission of building out the infrastructural rails for the internet. If Lyft and WordPress are building out the roads, Stripe is supplying the cement.

— Aakash Gupta, via Product Growth

💡 Takeaway: A startup that helps people make money will make money itself.Going deep to solve problems super well (why and how to do it)

People often think that growth means expanding your product offerings in some way — like building features to help you get new types of customers, etc.

But sometimes, as in the case of Stripe, focusing on the products that you already have and making those excellent for your customers is one of the best ways to grow.

In 2014, Stripe became a billion dollar company 🦄. At this growth milestone, lots of companies would prioritize expanding their product.

Not Stripe. With their two core products, Payments and Connect, they were covering most types of internet businesses’ core payment needs. Their product for subscription businesses (Billing) would only come much later in 2018.

So, for years they focused on making their foundational services the best product experience possible. Documentation became better, integration became faster, and ultimately developers came to love these APIs even more.

Instead of solving additional problems and risking being spread too thin, stripe went deep on their customers’ core, mission-critical, JTDB. They didn’t get distracted by new products, and today, choosing Stripe is a complete no-brainer because the core problem is basically perfectly solved.

Stripe works. Not only that, but it does so with an elegance that can only come from obsessive devotion and exacting standards. From design to functionality, every aspect of Stripe’s suite seems to have been worried over, honed, polished. Indeed, one of Stripe’s values is to “really, really care.”

— The Generalist

So, how do you go deep on a problem? Stripe had four main techniques that we can learn from:

1. Go deep on your customers

At any given time, especially when we were smaller, [Patrick] could ask about a particular deal you were working on, and he knew about that company and how they should be using Stripe…He took the time to actually be plugged into the technology and the products and the business.

From the beginning the Collison brothers were very hands on with each and every customer. This culture of being customer obsessed trickled down from the CEO level to the entire organization. People on their product team have described user research as part of the job of “every team across Stripe,” because it is “a part of literally every part of product development.”

When you’re laser-focused on a persona (developers), it becomes easier to establish deep empathy for them, develop a true understanding of who they are, and go deep on their pain points and motivations.

2. Take on complexity

Stripe also went deep by taking on complexity. They continued to add on complexity in the back end of these products, like Machine Learning, more country support, and currencies.

And the art here was that as they solved complexities, they continued to keep it dead simple for developers. All their APIs, as an example, are backwards compatible. This mean that as Stripe’s customers ship new work to their own customers, nothing should stop working.

3. Add scale

Another technique Stripe used to go deep is adding scale.

For a rapidly growing payments company that massive companies rely on, this one’s basically a pre-requisite. Slowness and downtime during payments could cost billions.

While a simple problem to define, performance is a complicated one to solve. But Stripe went deep on this front and now has a ~99.999% uptime over Black Friday and Cyber Monday. For a company that handles ~200 billion API requests in a year, that’s phenomenal.

4. Move fast

Finally, Stripe went deep by moving fast. Being deep does not mean moving slowly. Actually, Stripe is explicitly focused on speed. As John Collison explains, “speed is of the essence, and a defensible trait in companies.”

Stripe publishes updates to its core API 16 times per day.

There’s a lot we have in common with tech broadly, but one thing that distinguishes Stripe is that it’s an incredibly deep-thinking culture. It’s a written culture really focused on getting to the right answer. Going really deep and getting all the way down into the details around things, then distilling it down to a form that makes the complexity broadly consumable and actionable.

Another thing is a sense of urgency. The company is especially dedicated to moving very, very fast. That urgency comes from [Co-founder and CEO] Patrick [Collison] who even has a page on his website dedicated to fast projects in history, ones that were unreal and unreasonably quick.2 That has really permeated the Stripe culture.

That deep thinking and speed are combined with a substantial amount of user focus and user empathy. That’s something that you see talked about everywhere as being important, but I haven’t ever quite felt it as I have here. And finally, Stripe is a humble and low-entitlement culture. There’s a high degree of kindness between people, and I don’t think you can ever take it for granted.

— Michael Siliski, Business Lead PM for Payment Experiences & Platforms, via Bring the Donuts

💡 Takeaway: Focus on expanding the market, not taking the market. To do that, you need to go deep on the problems you’re solving, and move fast.While Stripe was heads down on solving their core problems extremely well, another strategy was in play.

Moving from Startups ⇒ Enterprise ⇒ Everyone

Stripe went to market by focusing on startups for a very simple reason — they are too busy with other stuff to be building their own payments infrastructure.

If you’re a time crunched team trying to get your MVP out the door in 2 months, nobody has time to get payments right. 7 simple lines of code becomes super appealing.

From those first few months tapping into their network at YC, to the word of mouth growth that followed — Stripe got into startups early and has grown along with them. And as these young companies became more successful, stories and praise for Stripe spread. This opened the door for them to start actively selling to bigger companies (who are usually not the early adopters). As Aakash Gupta says:

Stripe found that old world businesses like Harris Teeter and LVMH (the luxury brand worth $400B) “increasingly see they need the same technology that helps startups move so quickly.” Overall, Stripe made the normal disruption jaunt from startups to enterprises.

But it did not end at the typical jaunt for Stripe. Patrick Collison calls the normal cycle upmarket “the software cycle of life.” It has a big problem. As the products move upmarket to the enterprise, they become long in the tooth. Eventually, they become the ones that are disrupted. So, to avoid this fate, Stripe’s solution is to have high standards that its single product serves the bottom and top of the market well:

Stripe’s Persona started with startups. As it moved up market, it built for the whole continuum.

So, they started out by serving an over-served audience (engineers at startups) with a product that prioritized simplicity and speed over features. Significantly though, like Slack, Stripe took advantage of the compounding effects of young customers.

At an increasing rate, startups become big companies, and young people become decision makers. While incumbents and other competitors focus upmarket, on the most lucrative opportunity in the present, Stripe focuses on compounding over time.

— Pack McCormick, via Not Boring

To reenforce that point, here’s what Patrick Collison had to say about that in a Stripe Keynote:

Our strategy is very deliberately to serve both ends of the continuum (startups and enterprises), and every point in between. This ensures we can provide the most powerful functionality to the youngest companies in the world, and that we can provide the most forward thinking technology to the largest and most established.

— Patrick Collison, via Stripe Sessions Keynote (’19)

And here’s a snapshot from his slideshow:

As Stripe moved upmarket (deliberately and via existing customers getting bigger), they had to build out more products and features to support the needs of enterprise.

This has allowed them to capture more revenue from each end of the market, and has had a double compounding advantage — Stripe’s revenue grows both as its customers’ revenue grows and as they buy more Stripe products.

To support the acquisition of bigger fish, Stipe shifted from focusing solely on engineers via a self-serve product (product-led growth) to building out a sales-assisted function. This is simply because larger companies have more complex needs and purchasing decisions.

And one more quote here from Packy McCormick which will take us nicely into our next topic:

In many ways, working with large companies today is a way to improve the product for countless companies yet to be built. It’s also a defensive play against competitors and a way to accumulate the data Stripe needs to continue to build products that benefit all of its customers.

💡 Takeaway: Start with startups, move upmarket, then build for everyone.Let’s unpack “building out more products and features” in more details.

Building products (at the right time)

Stripe went deep on their two core products for a relatively long time. It was almost 4 years from when Connect came out until they launched another product.

Just take a look at this release timeline:

It’s clear that from 2016-ish onwards, Stripe really accelerated innovation on their platform. They have taken their product beyond payments (a commodity business) to a full set of tools that make it easy to start and run an online business.

They’ve done this by leaning into their customer relationships and the massive amount of data they get, and have built out an ecosystem of higher-margin products that they upsell to both ends of the market, such as:

Radar — fraud and risk management. Because Stripe has so much data, they are better able to prevent fraud and prevent legit customers from being flagged as bad actors. This is huge for all types of customers, but is table-stakes for enterprise.

Atlas — company incorporation. Atlas makes it easy for companies anywhere in the world to establish a Delaware (US) corp, open a bank account, and get setup with Stripe’s infrastructure. This locks in global startups and operates as an advance guard for geographical expansion — i.e even if Stripe can’t offer payments to entrepreneurs in South Africa, it can still establish a relationship via Atlas, promising a degree of inbuilt demand when the country goes live. This shows Stripe heading even further down the market to build for startups at the point of inception.

Sigma — customer reporting. This lets users pull rich insights directly from their own Stripe data instead of having to purchase Looker or another data analytics tool.

Corporate Card — issuing company credit cards. Stripe automatically provides limit increases to virtual and physical cards based on growth and offers rewards aimed at startups and engineers.

Capital — loans for growing businesses. Stripe is able to see their customers’ revenue from the Payments side and costs from the Corporate Card side, and gives them access to capital based on what their delta look likes between them.

Treasury — banking-as-a-service. With one integration, Stripe’s customers can enable their own users to hold funds, pay bills, earn yield, and manage their own cash flow.

Adding adjacent products like Atlas or Radar is a powerful strategy. Fast forward to today, and 94% of enterprise customers use multiple Stripe products. One can imagine a customer starting with Atlas, going to payments, then adding Radar as they grow. This is an arc of using Stripe to grow.

It allows Stripe to double the compounding: growth of the client with growth of the share of wallet.

— Aakash Gupta, via Product Growth

💡 Takeaway: The key to adding new products and services is timing. Too soon, and you risk not having done deep enough on your core JTDB, as well as confusing people with what your offering is. Too late, and you risk retaining customers and expose yourself to competitors.There are three key (fairly obvious) points to highlight here around how Stripe’s expanded their product:

Higher margin products ⇒ more money ⇒ growth

New products ⇒ new personas + solving new problems ⇒ growth

An ecosystem ⇒ moats ⇒ customer lock-in ⇒ retention + growth

Let’s look at point 3 — creating an ecosystem.

Building moats — Stripe’s 7 powers

We’ve touched on compounding a few times above, but to reiterate — Stripe’s strategy is built to compound the impact of a growing internet economy over a long time horizon.

But things that take a long time are risky. The further out something is, the higher the chances competition can eat away at you. So, a huge part of this strategy relies on creating moats so that customers don’t switch to a competitor before becoming more profitable.

This has consequently made Stripe excellent at building moats. In last weeks 5-Bit Friday’s, we looked at “The Taxonomy of Moats” by Jerry Neumann.

Another framework for thinking about moats comes from “7 Powers: The Foundations of Business Strategy”, by Hamilton Helmer. The book argues that there are seven moats that a business can leverage to make itself “enduringly valuable.”

The book has a bunch of case studies that show us companies that use 1/2 of these moats to sustain their advantages.

Netflix takes advantage of (1) scale economies and (2) counter positioning.

Facebook and LinkedIn build (3) network effects.

Oracle has high (4) switching costs.

Tiffany’s has a powerful (5) brand.

Pixar’s “Brain Trust” is a (6) cornered resource.

Toyota’s Toyota Production System demonstrates (7) process power.

Stripe has all 7 of them 👀

Let’s get into each of their moats in a bit more detail.

Scale Economies 📉

Simply put, this means as your business gets bigger unit costs go down.

This really is a scale business, and you can just go arbitrarily deep in improving the product in all sorts of incredibly detailed ways that would never be worthwhile for any individual business.

— John Collison

Patrick Collison tweeted back in Feb 2020 that they had built a machine learning engine “to automatically optimize the bitfields of card network requests” that will generate an incremental $2.5 billion in revenue for Stripe customers.

No idea what that means.

But, they clearly have enough customers that they’re able to make small optimizations like this that bring in tremendous value faster and more affordably than their competitors could.

That’s scale economies.

Network effects 🕸️

The more people that are using Whatsapp, the more valuable Whatsapp is for everyone.

That’s a network effect. Value goes up as total users go up.

Stripe’s network effect comes from data, and like Geoffre Moore (author of Crossing the Chasm) says: Without big data, you are blind and deaf and in the middle of a freeway.

Just one example of Stripe’s network effect comes from more users giving Stripe more data to use to detect fraud and improve acceptance rates. If Joe Schmo commits fraud on one website that uses Stripe and tries to use another website that has Stripe on it — he’ll be blocked. 🙅♂️

i.e All the other companies that use Stripe benefit from all the information across the network. Multiply that across billions of transactions, and Stripe has a massive amount of data that any startup would have a nearly impossible time replicating.

Switching costs 😓

The harder and more costly it is to leave a product, the higher the switching costs are.

Stripe’s customers are usually integrated across several products and have a ton of historical information living inside Stripe. Leaving the Stripe ecosystem would not only make developers very sad, but it would mean putting resources behind switching vendors as well as taking on risk.

What happens if any data is lost about paying customers? For big businesses, tiny downtimes can mean millions of dollars.

And the more products a company uses, the higher the switching cost.

Cornered resource 💎

According to Hamilton Helmer, this is “preferential access at attractive terms to a coveted asset that can independently enhance value.”

That’s a mouthful.

Simply, that means if you have rights (or first dibs) to certain types of resources or assets — you have a cornered resource. Most of the time this is a form of legal IP like a patent or copyright.

But with Stripe, their cornered resource is that the best talent in the world want to work for Stripe — especially engineers.

Stripe has a tremendously strong brand (more on this in a moment), a great pedigree in the startup world, and people love the Collison brothers and the culture they’ve made at Stripe (more on this soon, too).

Since the beginning, the consequence of hiring the best people (slowly and methodically) and letting them work on huge, meaningful, problems together compounds and strengthens Stripe’s moat here.

A new startup will struggle to steal talent from Stripe.

And the more excellent people they have on their team, the stronger their next moat becomes.

Process power ⚡

Process power as a moat means that a company has some type of internal organization or activity that makes it extremely efficient.

Stripe’s process power comes from the way that they work. Like their well documented communication, excellent talent, powerful internal tools, and how fast teams operate.

This internal scale with their value of moving quickly make it a hard and lengthy process for a newcomer to copy.

Counter-positioning 🛡️

This is when you do something in your business model that incumbent competitors can’t copy. If they did, they’d risk cannibalizing their existing business.

For instance — Instagram can’t copy BeReal, because they made their model of how content is consumed is the complete opposite of Instagram. i.e If your business is designed around maximizing time spend scrolling, how can you copy a business aimed at minimizing it?

This is deeply related to the compounding effects of young users. Banks provided most of the payments infrastructure for the early internet economy, and selling into finance teams at large companies was in their DNA. While competitors targeted finance teams at large companies in a long, complex sales cycle that ended in long, complex integrations, Stripe let thousands and then millions of developers integrate their product quickly, no meetings required. While others focused on sales and marketing, they focused on product. Competitors couldn’t react, both because they couldn’t risk alienating existing clients, and because they couldn’t build excellent products.

— Pack McCormick, via Not Boring

And here’s what Patrick Collison said to Tim Ferriss back in 2018 about this:

If startups can create a product that is so much better than the status quo that they start to get organic traction, once you attach a real sales and marketing engine to that, it’s going to be really frickin hard for a big company to effectively compete because this organizational transformation to being good at software is just profoundly hard.

It’s much easier for a product-led company like Stripe to add a sales and marketing function, than for a sales-led company to build a product culture.

Counter-positioning gave Stripe a huge head start on product and written communication.

And, while it was building product, Stripe built brand.

Brand 😍

I’m not a marketer, but I think I’m qualified enough to say that Stripe has built a tremendously powerful (and dare I say, gorgeous) brand.

They’re developer-first, but their brand appeals to everyone. Devs, designers, founders, marketers, PMs…most people I know who see Stripe’s product are impressed. In fact, one of the reasons I got to thinking about Stripe was because a marketer on my team said something along the lines of Stripe having the best landing pages.

Payments are not intrinsically sexy but Stripe does a great job at making it look that way. And they have built a brand that influences buying decisions and has created a huge moat for them.

So, how have they built brand so well?

We can break this down into five reasons.

Having great taste that appeals to a broad range of people. Stripe just has great taste in terms of how they design their site and present their brand. It’s professional, but approachable and fun. Their website has always been clean and presented beautifully and this great taste is why so many people use their site as a reference and know of Stripe. As — Michael Siliski, Business Lead PM at Stripe, says, “ There’s a surprising amount of tastefulness and just caring about every angle of everything. Whether it’s the user experience, support experience, or how the brand presents itself. There is just the feeling that it should all be exceptional. We should push for an extreme quality bar on all of the fronts”.

Building an excellent (whole) product experience. If your product sucks, you can’t really have a long term brand people love. Stripe has always focused on elegance and simplicity of their APIs and the keep adding delightful features over time. And critically, documentation is also part of their product, and Stripe has prioritized making it excellent.

Helping companies get started. Their Atlas product makes a long, frustrating, and expensive process of getting incorporated in the US easy. And for global founders, it makes the impossible possible. Stripe also acquired Indie Hackers — a community for early stage product builders to help young companies become successful. Together, Atlas and Indie Hackers expand Stripe’s Total Addressable Market by creating more potential customers and building early loyalty with them.

Employees who love Stripe. Again, the people who work at Stripe love working at Stripe. They have attracted brilliant talent, and Stripe sets people up to publish their own thoughts and ideas — which signals to potential employees and customers that these are knowledgeable people you want to work with.

Publishing helpful, authoritative, content. Besides their documentation being loved by engineers, Stripe has another unique way of getting great content published. They literally started their own book publishing company, Stripe Press. A seemingly odd move for a payments business, but when you think about how it fits into their strategy — brilliant.

Stripe's long-term play is based on new companies getting started, growing with Stripe, and having compounding value on a long-term horizon. Their books are long-tail bets that can inspire and help aspiring entrepreneurs — seeding growth in the startup ecosystem.

Press is a brand builder, a recruiting tool, a revenue driver (from book sales), and most importantly, a way to increase the number of people interested in tech companies over the long term. Patrick described this strategy on Hacker News:The vast majority of Stripe employees work on our core functionality today. But we see our core business as building tools and infrastructure that help grow the online economy.

When we think about that problem, we see that one of the main limits on Stripe’s growth is the number of successful startups in the world. If we can cheaply help increase that number, it makes a lot of business sense for us to do so. (And, hopefully, doing so will create a ton of spillover value for others as well.)

Bringing this all together — Stripe’s 7 moats work together to lock in customers and fend of competition while Stripe execute on their long-term compounding strategy.

For instance, by creating an excellent brand, Stipe gets more of a cornered resource, which gives them more process power — which in turn helps them grow their business and create more scale economies. So the cycle goes.

And while a newcomer could match Stripe on certain features and undercut Stripe on pricing, Stripe has built these advantages over time and that is really hard for a startup to break through with any meaningful threat to Stripe.

Just look at these flywheels! 😵💫

And that’s a wrap on Stripe!

Before getting to a recap of the key takeaways...I hope this outlined why Stripe has become so successful, and how they’ve grown from just 7 lines of code to a global financial infrastructure giant.

As a last note, I’ll say I am extremely confident that Stripe will continue to grow. There are lots of macro tailwinds that point to future growth for them, such as:

The internet is massive (and their the tollbooth)

There are still a lot of people who are not online.

Those that are online still buy most stuff offline.

When people buy stuff online, Stripe already powers a lot of it.

As more people come online, Stripe will power more transactions.

As people buy a bigger proportion of things online, Stripe will power even more transactions.

And as more businesses start, Stripe will grow it’s customer base

And as Stripe play the long-game, their 7 Powers (moats) will keep compounding on each, making it near impossible for newcomers to break in.

I know these pieces are on the longer side, and that’s by design. I spend a lot of time researching the companies I pick, as well as going on research tangents to clarify themes, frameworks, and other insights that come up. All in, they each take me about 20-30 hours.

My goal here is to bring you the most comprehensive picture into how these companies grow — so we can all build and grow better products.

If you’re new, consider subscribing for more deep dives sent right to you. And if you know anyone else who you think will find value in these pieces — you can share How They Grow with them below.

or

And to sign out, below are the high-level lessons we can take to build better products.

See you next time! ✌️

— Jaryd

🍕 Takeaways for builders

Keep an eye out for hard problems, be aware of schlep blindness. Instead of asking "what problem should I solve?" ask "what problem do I wish someone else would solve for me?"

Don’t found a startup. Find a problem.

Hire slowly and pragmatically.

Focus on a very specific audience.

Make something your customers need to do easy.

Find a macro tailwind that gives you a strong why now. Stripe’s was the acceleration in online businesses and e-commerce.

Get very hands on with your users.

Tap into your personal network for B2B customers and do what it takes to get an activated customer.

“Fake it ‘til you make it” is a great approach to an MVP. Use a Wizard of Oz experiment to give the illusion of the product experience without the investment to built it out.

Not all product feedback is equal.

Use pricing as a forcing-function.

A startup that helps people make money will make money itself.

Go deep and move fast, by going (1) deep on your customers, (2) adding complexity, (3) moving faster, and (4)adding scale.

Focus on expanding the market, not taking the market. Find a long-term compounding strategy to grow as your customers, and the market, grow.

Start with startups, move upmarket, then build for everyone. Focus on product-led growth, and then add sales. It’s much harder to go the other way around.

The key to adding new products and services is timing.

Find out which of the 7 Powers (moats) you have for your business to leverage so you can make yourself “enduringly valuable.

Prioritize clear, well documented, written communication.

Publish helpful, authoritative, content to build your brand.

Think about the whole product experience.

Any other takeaways — drop them in the comments below!

I know I'm late but just got around to reading this one. Fantastic coverage Jaryd!

Quite late to read this post but this is a "Fantastic read". So much information and so much to learn from a single post. Thanks Jaryd.