How Cash App Grows: Becoming King For Block’s $24B Commerce Stack

The innovation stack, obsessing over distribution, leveraging cultural cachet as an advantage and moat, and breaking away in a crowded FinTech market through product velocity

👋 Welcome to How They Grow, my newsletter’s main series. Bringing you in-depth analyses on the growth of world-class companies, including their early strategies, current tactics, and actionable product-building lessons we can learn from them.

Hi, friends 👋

Last week I launched Chat—the corner of this newsletter where subscribers can ask me anything.

posed a great question:In answering it, I realized I haven’t written about any consumer finance apps. I said Venmo, PayPal, Chime, and Revolut where good examples.

And they are, but I did some more digging after and realized I’d left out a blaring omission…Cash App.

If you live outside of the US, you likely haven’t heard of them. Simply, they’re a mobile payment service, and their bread and butter is peer-to-peer payment transfers.

Yes, same idea as PayPal, Venmo, Zelle, etc.

But Cash App has extended far beyond that since their incubation within Jack Dorsey’s Block (formerly Square), and despite being late-ish to the payments party, they have done a tremendous job at breaking away in the market of digital wallets and payment apps by becoming a diversified platform and payments Super App platform. One that’s cheaper and more accessible that traditional banks, and one that allowed Cash App to wedge themselves into the market by targeting “the unbankables”.

Given Cash App was built as a startup within a startup, an exact valuation is hard to pinpoint. But for perspective, Block—the horizontal payments company offering a full suite of commerce products, including POS hardware and software—currently has a market cap is $24B.

And today, 63% of Block's revenue comes from Cash App. In the second quarter of 2023, Block's revenue grew 26% year over year to $5.5 billion. Cash App's revenue increased 36% to $3.6 billion during that same period.

A project with an outsized ROI for the growth behind the payment category queen. And even more important when you consider the consumer market opportunity Cash App unlocks for Block. As per Ark Research:

In 2024, we expect more than 220 million digital wallet users in the US which, if valued like bank customers at maturity today, could represent an $800 billion opportunity in the US equity market.

Just for clarity—digital wallets are smartphone-enabled financial ecosystems that give folks access to a variety of services, like wealth management, insurance, instant payments, investing, banking, and crypto assets.

Here’s a snapshot of Cash App’s resume:

And outside of the finance category, in 2022, it was the 3rd most downloaded app in the US across all categories.

What should standout to you in that chart is the company Cash App is keeping near the top—social apps.

At first, that feels surprising for a payments app. Until you realize, they’re not just a banking app—they are also a social network. And that’s been a key part of their customer acquisition and defensibility.

Arnav, thanks so much for peaking my interest in this space. Learning about Cash App and the market has been super fun and insightful. There are so many lessons in here for folks, regardless of what you’re building. And Arnav, I hope this answers you’re original question in more detail. 😄

In short, Cash App is a fascinating case study in product, distribution, growth, and building a culturally mainstream brand.

On that note, let’s get into it. 🤑

Here’s what to expect in today’s analysis:

How They Started: Squaring away consumer payments

Building a startup within a startup: Don’t smother the baby!

Finding “Ka-ching!” in a crowded payments market

How They Grow: From P2P powerhouse to a full-suite commerce Super App

Cash App’s innovation stack

Cash App’s three-prong, product-led, acquisition channels

Cultural cachet as a viral and low-cost distribution advantage

Product velocity as fuel for the growth engine: The Cash Is King Ecosystem Strategy

Actionable insights 🧠 🛠️

If you only have a few minutes to spare, here are just a few of the tactical takeaways from Cash App — from a building perspective.

If you ain’t first…that’s totally okay. Cash App was a late entrant, and shows us that by finding an underserved community that is overlooked, creating a strong hook, and going deep into their culture/community, they can find a foothold.

Velocity is how startups win. Being the first product isn’t as important as building and learning quicker than the next guy. It’s more about who creates an all-encompassing Swiss Army Knife first.

For consumer products—obsessive over CAC and payback period. Cash App bring acquisition costs to the forefront of all their decision. For B2C and D2C, every marginal dollar can deeply impact your growth curve.

Create a distribution-centric culture, and think from first principles about how to reach people. By and large, Cash App has such a low CAC thanks to product-led, viral, acquisition. They show us various ways to intergate virality into our products.

If building within a company, or being integrated via M&A, consider this operating mantra: Long-term synergy, short-term independence. Cash App is successful because they’ve been given autonomy and their own culture.

Innovation doesn’t need to be one big revolutionary thing—it can be a stack of smaller “obvious” things. And those small innovations don’t need to be novel, it’s okay to copy from other verticals and repurpose them for your product. The bigger the “stack”, the hard it is for others to decipher and replicate.

To break into mainstream culture, don’t be lame and try so hard. Cash App show us that it’s about learning from your users, about how they perceive you and what they want from you. Watch organic behavior, then bet big and lean into it.

Cultural-cachet comes from putting your audiences culture first, and proving your respect. Cultural relevance is a huge advantage for Cash App, and two lessons they bring us to pull that off ourselves is to (1) operate in your customers shoes, and (2) build respect with opinion leaders from the community.

To drive word of mouth, systemize and operationalize NPS. WOM is a game of building a remarkable product, and you do that by generalizing NPS feedback, creating 2/3 key pillars of development from it, and incrementally moving more people to promoters.

More on those, and many more nuggets inside.

Before we hop in, a very short word from this week's awesome sponsor…Storylane. (p.s even just clicking on one of these link helps keep 85% of this newsletter free)

If you’ve ever tried building a product demo for your product before, then you know that doing it natively is not only time-consuming to build, but a real pain in the ass to maintain.

If you haven’t explored demos yet and you operate a SaaS app, they are an excellent onboarding tool to help your users get from 0 to all the value within your product.

That’s where Storylane comes in. They help you build killer product demos in <10 minutes.

With Storylane, you can leverage the power of interactive and personalized demos to shorten your sales cycles, increase prospect interactions, and convert more visitors. Storylane also gives you actionable data on demo engagement and gives you an AI assistant to help you figure out which demos are driving qualified leads.

To start boosting product-led growth and getting more customers, join other GTM teams at companies like Gong, Clari, and Twilio by checking out Storylane.

Alrighty, shall we?

How They Started: Squaring away consumer payments

Cash App is our first story about a wildly successful startup incubated within a larger company.

In 2013, the app (initially coined Square Cash) was seeded out of a Square hackathon, yet most people have no idea of the affiliation given how much of a cultural phenomenon Cash App has become in it’s own right.

The idea from the hackathon was simple: create a simple way for folks to make online payments to friends. Bill splitting, divvying up the costs of an Airbnb, coughing up for a lost bet, etc.

Nothing novel there considering Venmo and PayPal were doing that. But the impetus was clear—Square was focused on B2B and wanted to expand into the consumer cash cow that is P2P payments and digital wallets.

Given Cash App is winning and has unseated Venmo as the category leader, Square has clearly incubated the project and allowed it grow in the right way. This stems from clear internal operating principles that have allowed the Cash App team to navigate a complex and competitive new market and break away as a leading player in the P2P payment space.

The principles? Glad you asked.

Building a startup within a startup: Don’t smother the baby!

At the highest-level: Long-term synergy, short-term independence.

To unpack that quick:

Long-term: Cash App has been aligned around Block’s larger ambitions. Block is in a unique position because they manage two payments ecosystems: millions of merchants on their POS hardware and software combo, and tens of millions of consumers on the Cash App. Big picture, Block could be shooting for the holy grail of payments: a closed-loop payments system that cuts out intermediaries, giving it a larger share of the economics and the ability to cross-sell services between and among consumers and merchants without the friction associated with more traditional payments ecosystems.

Short-term: On the day to day, they haven’t been smothered by bureaucracy and the velocity killers that come about within bigger companies. Startups win and have a shot at unseating incumbents because they have the power of velocity. And the short-term independence from the beginning has allowed the Cash App team to achieve it’s own greatness over the long term.

And looking at the short and long term together, tactically speaking, this has manifested itself within the Square pod for Cash App in three ways:

Allow them to have a distinct culture

Create a separate operating model with centralized decision making

Leverage expertise from Square but not infrastructure

This has allowed Cash App to truly feel like it’s own thing—it’s own startup—and not just a product in what’s now Block’s stack.

Ali Abouelatta wrote the following, and I completely agree:

Culture is particularly important. Culture dictates the heuristics employees use to make quick, informed decisions in a new and challenging environment. When operating in a new arena, as Square was doing in the consumer market, the heuristics they needed to embed in every employee looked different from those at the parent company.

At its core this is why the Cash App team succeeded. They were able to

Selectively take with them the best practices, playbooks, and heuristics that worked from Square

Leave behind others that were not a good fit for the new P2P market

Develop some best practices the hard way; by making & learning from their own mistakes unencumbered by the mothership.

If you’re ever in a situation where you’re building as an intrapreneur (e.g Cash App within Square, or Gmail within Google), or working on an integration with an acquired company, this notion of “long-term synergy, short-term independence” is super important to remember.

If you want an example of what it looks like when you don’t do that, just read Why Vine Died to see how Twitter botched up the integration of what could have been TikTok.

Finding “Ka-ching!” in a crowded payments market

As mentioned, Cash App wasn’t a new concept back in 2013. Venmo was well established, and having launched 4 years earlier already had a strong foothold in major markets like New York and LA. Plus, Google had just rolled out P2P payments functionality as well.

And the thing about peer-to-peer payments is that they have hyper-local network effects: if all your friends are on Venmo, chances are you’re on Venmo too. Most people (myself included until researching this piece) don’t have both Venmo and Cash App.

What’s more, the first version of Cash App was very basic. V1 of Cash App wasn’t even an app, it was an email product.

Looking at that, you wouldn’t think Venmo were worried about having their lunch money stolen.

And the challenges they faced when going to market were well reported. Mike Isaac said it well when he wrote a short piece on the product’s launch for AllThingsD.

While the site’s landing page is slick and the concept is cool enough, Square isn’t exactly re-inventing the wheel here. You can still send folks money using a PayPal account (and not incur a fee for it if you send it as a “gift”!), and Google’s commerce wing just added a money attachment feature to Gmail as well. And there’s no shortage of startups — Venmo, Stripe and more — doing similar things in micro-payments.

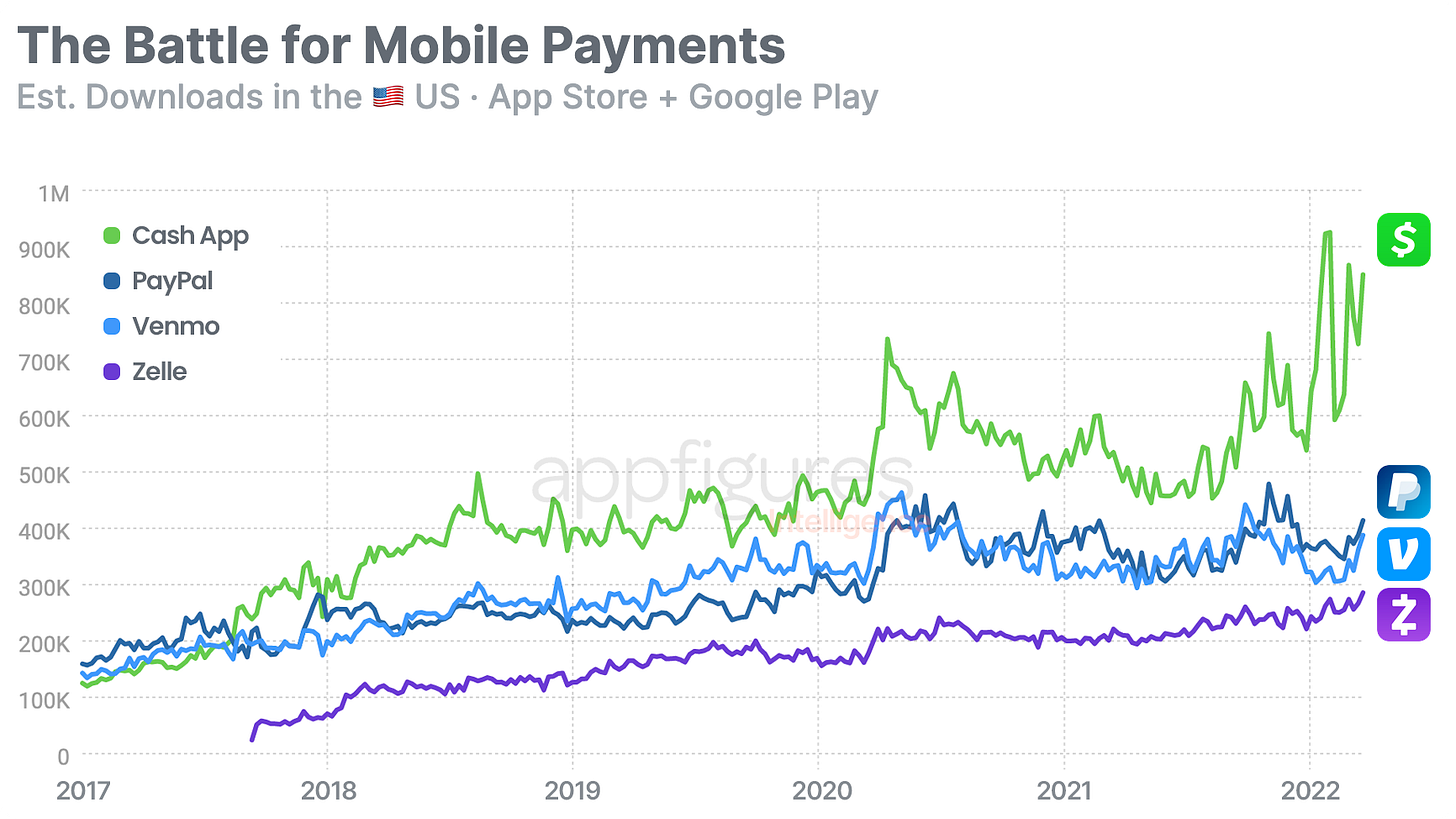

Yet, despite the accuracy of that statement, Cash App has pulled away. In 2017, just 4 years in, they were already essentially on par from a downloads perspective with Venmo and PayPal.

Then by 2018, they really started to tear away. And last year, they dwarfed the downloads of both PayPal, and PayPal owned Venmo, combined.

This growth isn’t slowing down either, with healthy forecasts into 2026 by Insider Intelligence.

And for Block, doubling down on Cash App is increasingly important when you consider where this global P2P payment market is heading.

Okay, so why and how has Cash App won within 10 years?

First, Cash App went where Venmo wasn’t—predominantly Black Millennials and Zoomers from the South who were lower income and considered underbanked (or even unbankable entirely). Cash App saw a large group of people who saw the financial system as intimidating and unrelatable being underserved.

Atlanta became their first market, and Cash App bought these folks a simple and free way to move money quickly with instantly available deposits into bank accounts instead of waiting 3 business days to “cash out” using competitors like Venmo or PayPal. This was all packaged in a rebellious and vibrant brand that embodied the community’s culture. This hook really resonated, and Cash App found a foothold in the crowded market from which to build momentum.

Obviously honing in on a super specific segment of the market and having a novel hook that grabs their attention is just a fractional part of early success.

So let’s shift gears and unpack how Cash App has been driving their impressive growth, and what can you learn from their playbook. 👇

How They Grow: From P2P powerhouse to a full-suite commerce Super App

Jim Mckelvey co-founded Block with Jack Dorsey (Twitter) in 2009.

Block is a FinTech force when viewed from a distance. They’re an embedded system that has changed commerce for small businesses. But when viewed up close, you see that Block isn’t one big innovation, rather, the kernel of their success comes from a series of micro innovations on stuff that already existed. The power of Block is how they’re all stacked together.

So much so in fact, that Jim went and wrote a book about what he dubbed The Innovation Stack. In it, he describes the innovation stack that made Block (then Square) so successful:

We want to allow millions of small businesses to accept credit cards for the first time, so we have to make it easy to sign up. We need easy sign-up, so we have to design simple software and eliminate paper contracts. We have millions of people signing up, so we have to keep our customer service costs down. We need to keep customer service costs down, so we have to have simple pricing, and net settlements, and no hidden fees, and no paper contracts. We need to have a low price, so we have to save money on advertising, so we have to have an amazing product, and hardware so cool that people talk about it, and a product that they can explain without our help.

The key idea Jim drives home is that by creating one “innovation” on top of the other, you’ll make your product a lot more valuable and more defensible.

He suggests to do that, hone in on a vertical and focus your innovations on areas where other companies are marginalising the needs of customers. And by innovation, Jim reminds folks that copying and innovation are often synonymous. It’s not about reinventing the wheel, it’s just as much about piggy-backing on innovations from other markets/products and making them work in your context.

By stacking little wins and copied ideas on top of each other that work in conjunction, they create a dependent and more complex system. That stack becomes the secret sauce and is what competitors will have a hard time trying to replicate. Copying one block and getting it right is easy—but having to stitch 10–20 blocks in the right way becomes a great moat.

And given Cash App was built within Square under Jim and Jack’s leadership, it makes sense they inherited some of that DNA. 👇

Cash App’s innovation stack

Brian Grassadonia, Head of Cash App and Square’s first product manager said Cash App took a lot from Square’s Seller’s growth playbook. Based on his interview with Credit Suisse, we can deduce that Cash App’s high level innovation stack is something like this:

Build a P2P micropayments product so great (utility x simplicity) that people bring their entire networks to it. Cash App’s early traction came from younger and poorer unbanked and underbanked users who flocked to the apps simple (and free) peer-to-peer payments functionality. The more people that joined, the stronger the social network effects became simply because two customers always benefit in every transaction made. That’s the bedrock of both user new acquisition and retention/reengagement of existing customers.

Reinforce the core product-led acquisition channel with other innovative ways of attracting customers at massive scale and for super low costs. Cash App’s success arguably comes from their distribution-centric culture. P2P margins (where companies like Cash App get 0.50% to 1.75% of the transaction) are super tight. Making real money is a function of huge volume, and for hundreds of millions in transactions, you need millions of people. The kicker is given the low margins, CAC needs to be very low. That was against Square’s B2B/enterprise culture where CAC is way higher, and Cash App built their own obsessive culture where their operating model and their business formula revolved around CAC. When making decisions, building roadmaps, structuring teams, or staffing projects…it was all about CAC.

Layer in adjacent financial products, so that each new product enhances existing ones and allows more customers to find added utility in the network. This is their super app play. Once the base network was established and there was distribution channels bringing in users for the cheap, the next move was shift from a payment tool to a financial platform. As always, the platform play keeps users engaged and gives them reasons to bring (and keep) more of their money in the Cash App ecosystem. They did this with crazy product velocity, adding and cross-selling features like a card, the ability to buy Bitcoin, fractional stock trading, direct deposits, rewards/discounts, taxes, and even BNPL. As well get deeper into, this has turned the P2P app into full banking product which was an especially good fit for their un/underbanked customer segments.

Let’s use these blocks as our thread as we go through Cash App’s strategies and tactics.

⚠️ Keep reading…

This post is too long for email and will get cut off. To keep reading, hit the button below or click here.

1. Cash App’s three-prong, product-led, acquisition channels

Product-led acquisition (PLA) means your users naturally invite other users while using your product. They don’t need a financial/artificial incentive.

Multi-player SaaS (Slack), social networks (Facebook), or entertainment products (TikTok) are the easy examples. There’s just organic sharing and inviting, where by doing so, you’re growing those products user base for them—sparing them the need to spend money on ads.

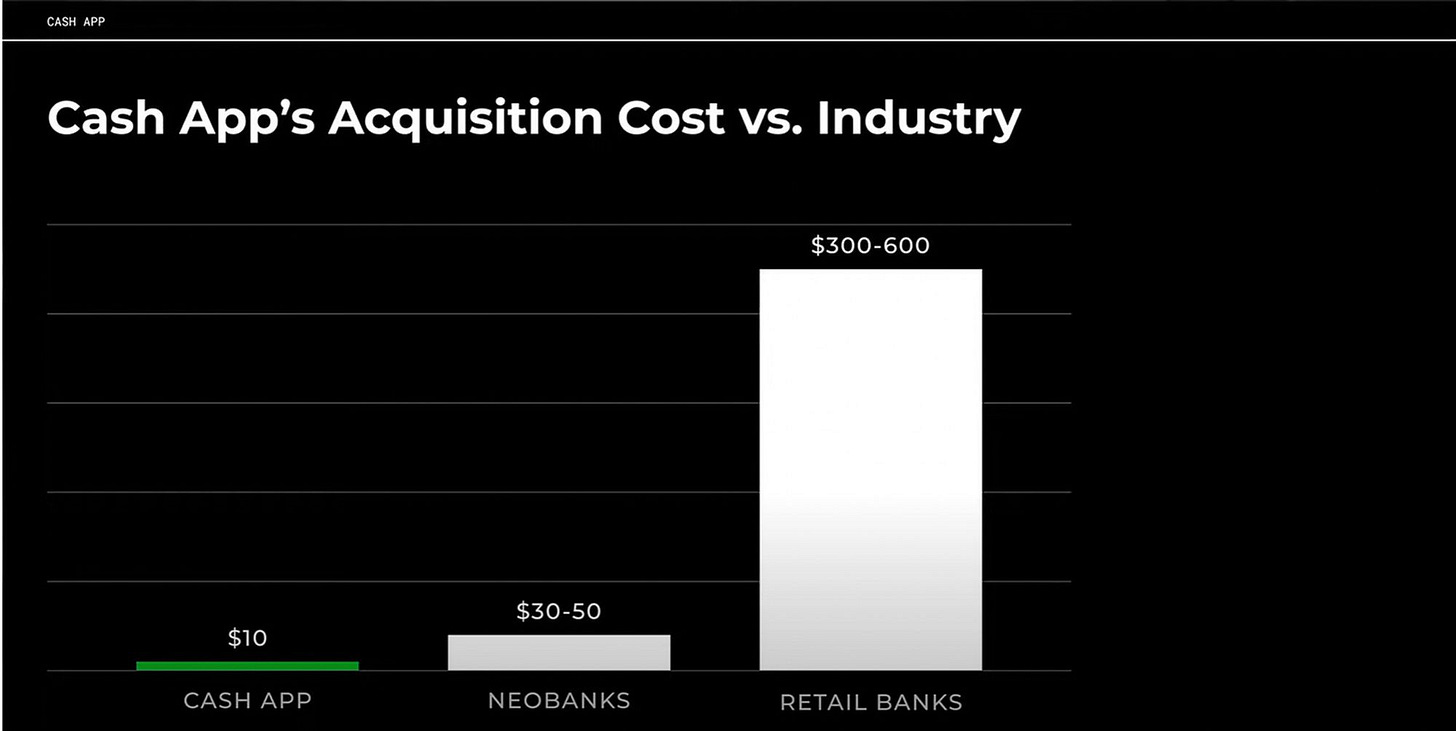

While regular banks don’t grow via PLA and traditionally have high CAC ($300-$600), Cash App does. When I sign up and send a payment to my friend who doesn’t yet have an account, there’s no way they won’t create one to claim the $100 I just sent them.

PLA means Cash App doesn’t primarily rely on ads, content, or sales to grow.

And because the Cash App product (1) created utility that was simple to access, and (2) made the product intrinsically more useful as more people you knew joined, they tapped into 3 major PLA drivers that have helped them scale across the entire US market in a stable and financially sustainable way.

Just look at these numbers—clear evidence of their distribution-centric and CAC-obsessed culture.

In other words, Cash App is acquiring customers at 10%-30% the cost of a neobank (i.e Chime, Revolut), and 1%-3% the cost of a traditional bank (i.e Chase, Bank of America). 👏

And ultimately, PLA scales so well and drives down CAC because of:

Virality: PLA has compounding effects. New users invite more users who invite more users. Ads, SEO, and sales do not produce virality like this and tend to stall.

Fewer dependencies: With PLA, you’re not at the mercy of algorithmic and product updates by third-party ad platforms and search engines. For example, Facebook sometimes removes audiences from their ad targeting settings, killing your ability to run ads just to those people. And Google often updates their search ranking algorithms, annihilating blogs’ hard-earned traffic overnight.

Low marginal costs: PLA scales without your costs increasing because it usually has no marginal cost. Compared to ads, sponsorships, and influencers, which quickly become prohibitively expensive and trend to worse margins as you scale. Plus, advertising costs structurally rise every year as more startups advertise.

Okay, clearly it’s holy grail of long-term growth. And looking at Cash App, we see 3 types of PLA they’ve integrated into the product:

They’re encouraging other users to invite other users

They’ve turned Cash App into a billboard.

They’ve triggered word of mouth.

Encourage users to invite other users (invitation virality)

For starters, Cash App has a straight up “Invite Friends and Get $10” offer. This is baked into onboarding as you’d expect, and is also always accessible from the app. It plugs right into your contacts and is super simple to send out.

This is a classic incentivized invitation, or referral program.

You’ve seen them all over the place, simply, because they’re worth having. It doesn’t hurt, but, by itself it’s not product-led acquisition.

Sure, some people will go through and select all their contacts to make some bucks, but ultimately artificial programs like this have three major limitations:

People get over it. A small cash reward often isn’t enough to get people to spam their friends.

Cash incentives may attract lower quality users who don’t fully active and churn out.

There’s a detachment from the point of referral, and actual product value.

Expanding on that last point, when I joined Cash App, I had no motivation and reason to go and invite a bunch of people. I wasn’t paying anyone, and it doesn’t serve me to have people on there until I need to pay someone, or get paid.

That’s where Cash App’s real PLA comes in—sending payments or sending requests to get paid.

That’s the organic stuff that has super high conversion rates.

And then, once a user has a few contacts inside Cash App and starts to see a friend-based activity feed get populated, this natural invitation mechanisms amplifies thanks to Cash App being a utility-based social network. Rex Woodbury explains it perfectly:

Cash App acts like a social network because it is a social network. Cash App sees a 31 percentage point increase in retention when a user has 4+ friends on the app. The product is designed to integrate social features, which in turn improve unit economics.

We don’t view Cash App as a consumer social company, but we should. Venmo, similarly, has long been a social network in disguise. 🥸 Venmo is where you can see that Aaron paid for Cady’s Uber home from the bar (gasp!), that your ex has been going on lots of coffee dates with some guy named Shane (ugh), and that Gretchen invited Karen to her bachelorette but didn’t invite you (honestly, such a Gretchen move). Pro tip: go set your Venmo default to “Private” 👀

Venmo’s social feed

Revisiting Cash App’s story has made me think about a certain type of social network—the utility-based social network. These are social apps that serve a core purpose (e.g., peer-to-peer payments), but that also layer on social features to improve growth and retention. In some ways, utility-based social networks evoke Chris Dixon’s “Come for the tool, stay for the network.” You download the app to accomplish a job to be done, but you stay for the community.

Instagram started as more of a tool than network—the app was primarily a photo-editing app, where you could overlay cool filters onto your pictures. Rapidly, though, the network overpowered the editing tools.

Cash App serves a real purpose beyond socializing. But it’s also extra sticky and enjoyable because of the social components. We’re social animals, and over time all consumer companies gravitate in some way toward social. Take Amazon, the most utilitarian of consumer companies. They have Inspire, their short-form video feed for UGC, as well as social features like reviews, community forums, affiliate programs.

This is the most classic way to create viral growth and is hard to engineer after the fact. But there are certainly ways to optimize it within your own product 🛠️

Consider the following:

How might you make the user’s life easier if their friends or colleagues were also using it? e.g. easier to share content, a secure communication channel

How might you make the user’s life more enjoyable if their friends or colleagues were also using it? e.g. fun way to share content

How might you remind the user about the benefits of their friends/colleagues being users? e.g. show missing friends/colleagues

How might you make it easier to invite friends? e.g. import contact list, collect to LDAP

How might you make it easier to figure out who to invite? e.g. smart sorting of potential friends

And again, incentivized PLA isn’t something to just discard. There’s juice that could be worth the squeeze. So, if interested, to optimize for this type of artificial virality, consider:

How might you create a selfish incentive for users to bring in new users? e.g. free money, free storage

How might you create an altruistic incentive for users bringing in new users? e.g. save your friend money

How might you create FOMO which motivated users to send invites? e.g. a limited number of invites like Gmail, Clubhouse, Spotify, Superhuman, OnePlus

How might you increase an existing incentive? e.g. double your existing bonus

How might you surface your existing incentives more prominently? e.g. a large banner, more entry points

How might you make it easier for your users to know who to invite? e.g. import contact list, connect to Twitter to find friends

One of my favorite things about Storylane is that they enable personalized demos. Each prospect is unique, and with Storylane’s integrations they make it easy to give your customers/leads personalized demos based on their needs, role, or market segment. Try Storylane for free. (sponsored)

Turn your product into a billboard (experiential virality)

The second built in PLA channel Cash App is using is billboarding—when a user’s use of your product is visible to others around them. For example:

When your product is physically recognizable, like touting the new iPhone or MacBook in a coffee shop, or wearing Adidas sneakers. This is passive experiential virality where you just see it as you go about your day.

When the product is something you repeatedly share with others, like sending a Calendly link or when you spam your friend with TikTok links. Calendly is clearly branded and requires the other person to experience the product, and TikTok videos are watermarked wherever they are shared, and drive viewers into the app.

When the product brands itself in your communications, like when Apple says “Sent from iPhone” at the bottom of your emails, or Loom says “Made with Loom” on every video.

As you can see, billboarding is when your use of a product helps others see it in action. This triggers free, one-to-many exposure and leads to free product-led acquisition.

Cash App experiences a blend of billboarding example #2 and #3, which are both active experiential virality.

First, users share their $cashtag with other people. And they’re not ashamed to do it either—like pasting it on their car windows when it’s their birthday or after getting married:

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

That’s user generated billboarding if I’ve ever seen it.

And then of course there’s the branded communications, the “You’ve just been sent money by Jaryd on Cash App”.

Both of these actions get the Cash App brand in front of others without the need to spend a nickel. 🫰

This method of PLA is less applicable to most products, but it’s worth thinking about. To discover whether you can integrate billboarding into your own product, consider two questions: 🛠️

What are all the places that your product is publicly used? Outdoors? In email conversations? Via SMS? On social media?

For each place your product appears, ask how you can make your product more unmistakably visible in that place. For example, if your app is used for sending email communication, embed a signature that mentions your app. Or if you’re an ad platform—whether it’s rooftop billboards or banner ads—place your company’s name on the ads. Now your ads become ads for your platform.

Trigger word of mouth

Word of mouth (WOM) isn't pure PLA, but its also free, scalable, and driven by your users.

And it works because of one thing, and one thing alone…a remarkable product that gets people remarking to others about.

There are no shortcuts, no cheat codes. If your product isn’t great, people don’t tell others about it. And for that reason, if you’re growing this way, it’s the best signal you’re doing the right thing.

When I add newsletters like Product Growth, Category Pirates, Digital Native, etc, to my recommendation lists, I do so because I feel compelled to tell others about their work. It’s excellent, and I don’t need a kickback to do so. Same story when I preach Notion, Sukha, or when I tell friends to go watch Silo on Apple TV.

And therein reveals the two ways WOM emerges:

A delightful product experience that users want to spread to others. User delight comes from being entertained (e.g. Disney+) and from reducing the friction in an otherwise painful process.

Delight from pain reduction is how Webflow, Zapier, and Squarespace grow. People remark to others: “I was able to make my website in 1 day instead of 2 months with an expensive agency. You have to try this yourself.”

For Cash App, it’s also somewhat of a hybrid. For many folks who were unbanked, Cash App relieved a huge pain. They could get setup in minutes on an app that felt designed for them, and they were getting instantly settled payments. So, they told others in their community. And remember, payments are hyper-localized and trust-based, meaning once WOM was spreading in communities with Atlanta, it spread quickly.

Again, to enjoy the benefits of WOM, start with first-principles: build something great that solves a real problem in a delightful way.

On that point, I have just three pieces of advice:

If you care about WOM, make sure you’re measuring it. Luckily, it’s easy—you just ask people. This could he integrated into your onboarding flow, or you could have some popup when you visit that says, “How'd you hear about us?”.

Then, a leading indicator of WOM is your Net Promotor Score (NPS). A lot has been said in favor and against this metric, but personally, I like it. NPS simply asks on a 1-10 scale, “How likely are you to refer us to a friend/colleague?”. The gold though comes from the short comments section below that rating question—it tells you what you’re doing well, and what you need to do to drive more WOM.

Finally, take that feedback and generalize it among groups. Look at the delta between who loves your product and who doesn’t, and then create a two/three main levers to (1) help move more people into the 8-10 bucket, and thus (2) drive your WOM.

Once you’ve done that, there are some ways to throw logs on the fire. For example, ask yourself these questions:

How might you get non-users with a large following to experience your remarkable product? e.g. free accounts for influencers

How might you make your users feel special or high-status by showing off they have the product? e.g. waitlists, invites

How might you make it easier for your users to spread the word? e.g. share buttons, easy to find links

How might you simply ask people to spread the word? e.g. try adding copy to the product

Onto the next pillar of Cash App’s growth—this one is awesome and super unique.

But first, if you’ve found value in this newsletter over the past year and walk away from these deep dives learning something new, the best way you can support my work (it takes a lot of time researching/writing these) is to upgrade to a paid membership. It’s less than $7/m, and besides support, it also means you’ll get:

Access to member-only posts

Access micro advice from me in Chat, where paid subscribers can ask me anything.

30% off all future information products I release (swipe files, templates, courses)

2. Cultural cachet as a viral and low-cost distribution advantage

Cash App has been able to penetrate US pop culture like few other finance or banking brands have been able to do. That’s in large part because outside of their core PLA, they’ve also been able to cut through the noise in a crowded market with a creative distribution machine that is consistently on point.

It’s rare for a FinTech product to gain such cultural relevance, but when you consider they’ve been able to get over 200 hip-hop artists to name drop their product in a song, it’s clear they’ve achieved the modern brand’s dream: to become part of the mainstream culture. No appropriation. No lame ads. Just genuine momentum.

Easier said than done, of course, but Cash App brings us a model we can all learn from.

Influencer and partner marketing, executed flawlessly

Cash App users were predominantly Black in the beginning, and thus the app’s network effect became especially strong in the Black community.

And when you break into a community, unexpected things can happen, like how so many rappers started featuring (for free) the brand in not just their lyrics, but even the name of the song and album.

Here’s what a search for “cash app” on Spotify returns:

Block is still not entirely sure how this even happened, but here’s what CEO Jack Dorsey said at a 2019 investor conference via Wall Street Journal:

This is also something we weren’t expecting, but I think Cash App has touched in the culture. We’ve just benefited from people loving it and wanting to sing about it, and putting it in their music videos, and it’s amazing how much that spreads.

And for what isn’t the only example here, Cash App noticed how Black culture was embracing the brand and the hip-hop trend, and they leaned in heavily.

In 2018, they teamed up with Travis Scott and Lil’ B. They also tapped the likes of Lil Nas X, Cardi B, and Megan Thee Stallion, to name just a few. Each of these artists used Cash App to give away money to their fans, and through linking itself with celebs, Cash App embedded itself not only in communities of its users and fans, but also in the wider culture. Collaborations also extend to charitable causes, like matching donations and emerging artist promotions.

Simply, this allowed them to acquired customers through the rappers’ social media followings at an extremely low cost. Free money is an easy sell, and it doesn’t take that many customers to justify the cost.

Here’s a great breakdown of the numbers from Ark Invest on the low-cost customer acquisition:

While banks can pay from $350 to $1500 to acquire users, Cash App acquired a new customer through Burger King in five minutes without any direct mail or bank branch visit.

Square has run similar [$100,000] campaigns with rappers like Travis Scott and Lil B and other influencers, triggering a network effect for the Cash App… If only 129 of the 120,000 who commented on [Travis Scott’s] tweet were new to Cash App, then Square’s cost of customer acquisition would have been less than the $925 per user that banks pay on average, according to our research, and 6,000 comments, only 5% of the total, would have dropped it to $20. Moreover, as the converted users appear to spread the word on social media, the Cash App can acquire additional users from just one.

Well worth the money, especially when you considering the influence that hip-hop fans have on their peers. According to REVOLT’s Gen Hip Hop study, hip-hop fans are 2x more likely to be culturally influential. So for Cash App, it’s the right audience to acquire.

What’s interesting about this strategy of leaning into hip-hop artists is how it differs from Cash App’s main competitor, Venmo. In short:

Venmo followed the classic startup GTM play—target early adopters in your friend group, on your college campus, and on the big East and West coast hubs, NY and LA.

Cash App targeted underserved communities in the South and Midwest, and broke into new groups through creators with huge followings.

And this all comes next to their core PLA engine, where these influencers and their fans have grown the user base and brand awareness further, which pulled in other folks who seek higher-end services like Bitcoin and investing.

Cash App’s broader flywheel looks like this:

This flywheel and the viral growth that comes from the hip-hop community is so powerful, that Cash App and Block pulled a super interesting move back in 2021—they acquired the music streaming app, TIDAL.

Why? Well, here’s what rapper Lil B said before this acquisition:

Cash App, Square, Twitter: Anything that Jack gets behind, I’m behind. I’m behind Jack Dorsey 100 percent. … I respect who respects me and who reaches out to me. I got a chance to see all the great stuff that they’re doing, and now they got a lifelong fan.

I respect who respects me. That’s how you get to a place where your product is name-checked in literally dozens of songs, for free.

So, the bigger picture behind spending $297 million on a failed music streaming service is to send crystal clear message to every artist, the same message that Jack Dorsey delivered to Lil B back in 2018—I respect you.

I love how Alex Johnson puts it:

Square understands that, in an environment where digital technology innovations can be copied and improved upon almost overnight, culture is one of the only durable competitive advantages. A business model built around cross-sell will succeed not because it’s convenient for the customer, but because the company doing the cross-selling is cool.

Like I said above, catching how the hip-hop community was talking about Cash App and leaning in heavily wasn’t the only example of how the team has built a hugely successful strategy off existing behavior. 👇

Watch what people are doing and saying, then double down on it

One of Cash App’s biggest social media plays is #CashAppFriday.

Except, they didn’t invent it.

#CashAppFriday already existed among fans, and until 2017, Friday tweets came organically from people heading to Twitter and Instagram to share they $cashtags and ask each other for money for the weekend. 🍻

Cash App’s genius was to get on the trend and eventually make it an official sweepstakes—with larger prize pools, of course.

They figured out that (1) people use financial apps their friends are using, so creating social engagement is critical for growth, and (2) the fastest way to social influence is to piggyback on the already existing social influence and amplify it.

So, once again, Cash App leaned in. First with memes. Easy.

Then, they ramped up with the money. And no chum change either.

Any startup can learn a lesson from Cash App here: no matter how competitive a market, or similar the product is, those with the greatest distribution/availability will win. And one of the best ways to grow availability when your company is young and budgets are small? Listen to your audience and tap into existing conversations.

Go read Reddit forums, read Tweets, and go hang out where your users are spending time. Getting integrated into the community of your customers is so important. And yes, for every product, there is some community somewhere.

If you want to build a cultural brand, put your audience’s culture first

Cash App understands and taps into culture extremely well.

They know that one of the hottest topics in the US is financial inequality, and they also understand that Black Americans are almost 600% more likely to be unbanked compared to White Americans. Not only do they understand these cultural issues but they are actively trying to address them and improve the situation. Their new brand platform ‘That’s Money’ looks to both normalise conversations around money and breakdown a lot of financial jargon that prevents many from becoming ‘banked’. Yet CashApp doesn’t do this in a cringey or purpose washing way. It does it in an incredibly powerful way because the brand has taken the time to really understand and tap into black culture.

Just watch this short video:

And outside of just great videos, their entire brand just feels like some combo of Gen Z-meets-hip hop aesthetics, and it revolves around democratization of investing and improving financial literacy.

All their content creates a massive following and differentiates Cash App from apps like Venmo, where things feel more buttoned up and like traditional banking.

The rapper Amine said, “This isn’t even just rap, this is just Black culture in general. Venmo is people in your business, and we don’t like people in our business. Venmo is made for white culture. ‘Drinks with Sarah.’ The 🔌 for the electricity bill. Venmo’s like the feds.”

And as a closing though on all this:

For the next generation of companies, the biggest network effect is culture, not technology. Long-term brand defensibility has more to do with whether a company can believably connect with culture through the shared things they like than if it has a proprietary product or acquisition channels.

If you find value in my work and are enjoying this post, a $7 subscription is the best way to support this newsletter. The first 500 folks who subscribe will get 30% off the usual $10…for life. ❤️

3. Product velocity as fuel for the growth engine: The Cash Is King Ecosystem Strategy

I’ll start by saying this…speed isn’t everything.

If you’re working super fast but you’re tackling the wrong problem, or just shipping outputs very fast instead of actual *outcomes—*then you’re just running in the wrong direction quicker than the next guy.

Ultimately, impact is what matters most.

There should be no arguments there.

But, especially for startups and earlier stage products, how fast you’re moving (AKA, velocity) is probably the #1 signal correlated with success.

I didn’t say it, the G.O.A.T did:

He’s right.

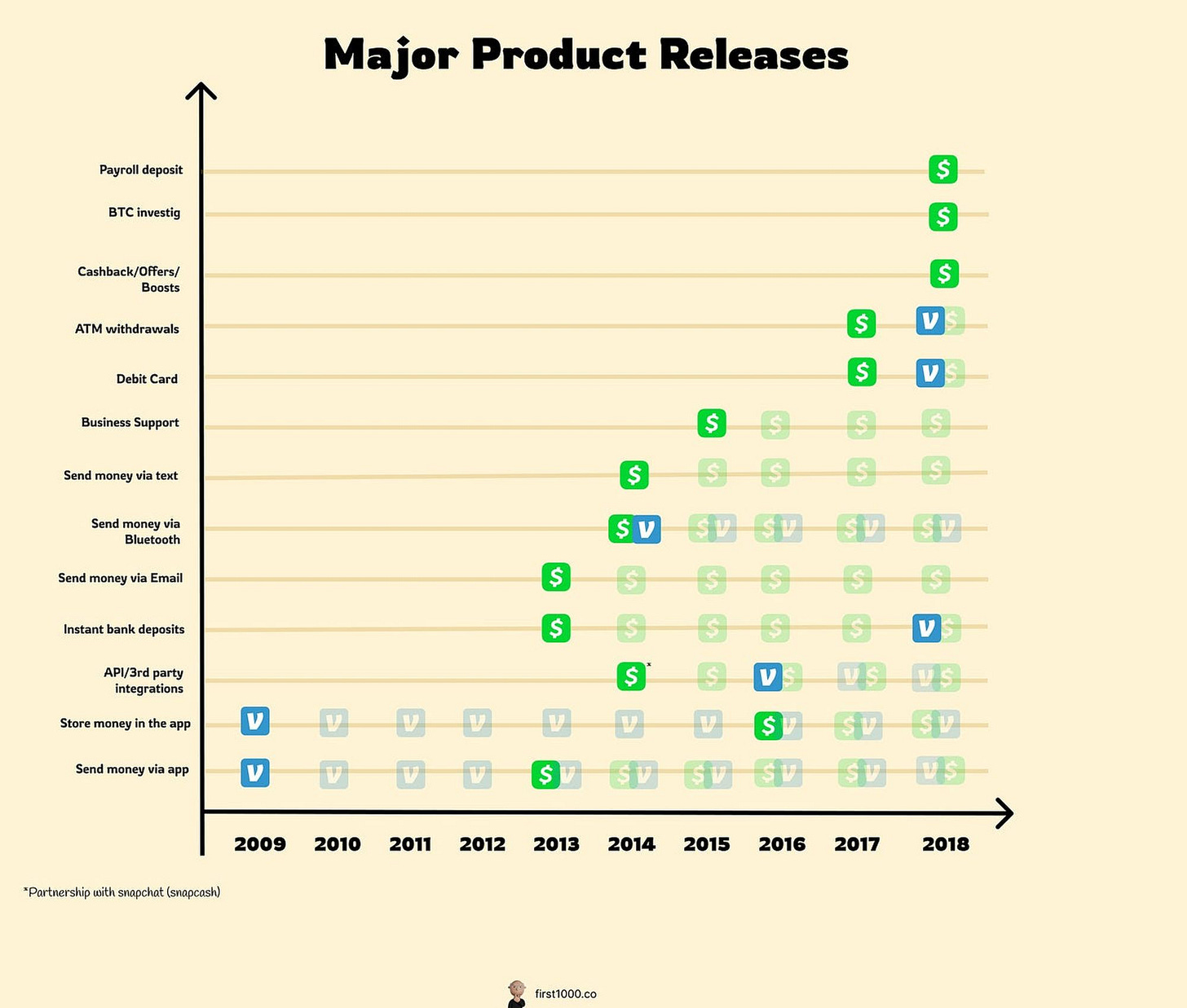

And considering Cash App which started out with a super basic peer-to-peer payment tool, it’s clear that their product velocity has been a huge driver. At a rate far surpassing the Venmo’s in the space, they’ve designed adjacent products where each new release enhances existing ones, allowing customers to find more utility in the network.

Here’s a visual Ali Abouelatta made that overlays Cash App’s vs Venmo’s major shipping velocity. Who do you think became a more handy payments Swiss Army Knife sooner?

This aggressive expansion into things like API integrations (key for becoming a platform), instant deposits, and debit cards set the stage for Cash App's explosive growth…as well as their ability to become a neobank (more on this in a second).

And the thing about building a Swiss Army Knife vs just a pocket knife product is that your shipping velocity becomes a compounder that (1) drives your overall utility, (2) strengthens your network effects, and (3) creates more friction around switching.

Zelle is a tool.

Cash App is a platform. Venmo is also a platform, but they were slower to get there.

In other words, it’s not all about who gets to market first, rather, it’s about who’s first to build the platform that solves the right mix of problems.

Shopify wasn’t the first ecom solution. Stripe wasn’t the first payments gateway. And Cash App wasn’t the first digital wallet and micropayments platform for consumers.

And of course there’s another important angle to compounding product value. Writer, investor, and just overall legend, Rex Woodbury, says it well:

When you think about a company’s unit economics, there are two sides to the equation: customer acquisition cost (how much it costs to acquire a new customer), and customer lifetime value (how much that customer is worth). Cash App has layered in new products over time to increase the customer LTV side of the equation:

So, while smart distribution and creative marketing have lowered CAC, adding in more “blades” to the mix has allowed Cash App to cross-sell and capture a bigger share of their consumers wallet—theoretically, and actually.

AKA, each product launch has increased the gross profit per user, where each incremental $ in ARPU has just been poured back into their pot to drive acquisition. Plus, the surface area for acquisition (the total addressable market) increases when you have more features to attract people. I.e by adding BTC trading, they unlocked the market of folks interested in BTC.

As of a 2022 investor presentation, Cash App has four separate products that are each doing $200M+ in gross profit a year: Instant Deposit, Cash App Card, Bitcoin, and Business Accounts.

And as reported in the same presentation, when someone uses one of these products (i.e adopts more of the Swiss Army Knife), they are far more likely to remain active.

All of these rapid releases are steps towards a larger vision though.

Cash App’s/Blocks ecosystem strategy: The neobank x Super App

First, two definitions:

A neobank is basically a lighter weight bank that operates completely online. e.g Chime, Revolut, Monzo. They need licenses, and mostly focus on consumer.

A Super App is basically an everything app that covers lots of aspects of our personal lives. WeChat is a leading example in China, and Elon has ambitions to make X the same thing. Payments and transactions are a key part of that. These can be broad (WeChat), or narrow (e.g everything shopping = Klarna)

Cash App is arguably already a Super App for Personal Finance. Which is really just another way of saying a (neo)bank.

Things like P2P, crypto, micro-lending, investing, and Block’s acquisitions of Afterpay for exposure to Buy-Now-Pay-Later, and Credit Karma Tax for tax filing, are clear signals that Block’s ambitions are to make Cash App the go-to place for consumer banking and finance.

And I have little doubt that Cash App’s financial offerings will continue to expand rapidly until they have all the offerings you’d expect of a legacy bank like Chase (besides the icky physical branches).

Remember, their mission is to make banking accessible for the underbanked. Thus, “to bank unbankables”, you must become a bank. 🤷♂️

But, if you Google “neobanks”, most lists fail to mention Cash App.

That’s a mistake and gross miscalculation.

From a functionality perspective, Cash App already has the makings of a neobank. And from a scale perspective, they’re doing more in revenue ($10.6B) than most of the big digital banks:

Monzo ($537M)

Revolut ($1B)

Chime ($1.85B)

But again, people are not treating them that way. As Ark points out, venture capital funds and the market in general are valuing most neo/challenger banks at about $2K per active user, whereas Cash App is being valued as a digital wallet at $140 per monthly active user.

That’s a huge discrepancy, and I agree with Maximillian Friedrich’s analysis:

Investors are valuing the prospective cash flow of a Cash App user at less than one tenth that of a Monzo user. Some investors argue that Monzo and other challenger banks offer core banking products like deposits and debit cards while Cash App and Venmo are peer-to-peer payment platforms and should be valued differently. We disagree. First, Cash App does offer direct deposits and debit cards in partnership with an FDIC insured bank, much like the challenger banks do in the US. Moreover, while Cash App does derive a large percent of its revenue from instant-transfer fees to and from user bank accounts, Cash Card interchange revenue already should be its second largest revenue stream. Moreover, while Cash App does derive a large percent of its revenue from instant-transfer fees to and from user bank accounts, the Cash App has seven revenue streams, while some features remain unmonetized to drive user engagement, at least for now. Most challenger banks rely only on interchange revenues and, in Europe, which has capped interchange rates, on membership fees.

And besides Cash App having more diversified revenue than these neobanks, we’ve already seen another key structural advantage they have over them that brings their CAC to crazy competitive levels: network effects.

So, if you view Cash App as an underpriced Super App for finance (a neobank) that is growing faster and cheaper, the bull case for their growth and valuation becomes crystal clear.

Simply, if they continue to ship with velocity and execute on their roadmaps, the value of a digital wallet user could shoot up to that of a bank. Combine that with the macro tailwind of more people using digital wallets, and you get a very valuable Cash App.

Doing the math is not in my wheelhouse, but qualitatively speaking, things are looking good for Block’s Cash App (which is already ~60% of their value).

Nobody has put it better than investor Mark Goldberg:

Cash App’s greatest coup has been to refashion the image of a bank from a branch to a Nike store.

Cash App = a neobank.

Where the big vision get’s super interesting though, is where I think Block is looking: Block = The Super App for Commerce…both B2C and B2B.

Just look at their rebrand…from Square (something defined) to Block (something that can be built upon infinitely).

Block touts 5 broad products in their ecosystem:

Square: Powering all the ways you do business

Cash App: Powering all the ways you do personal money

Spiral: Bitcoin open source projects

Tidal: Music streaming platform

TBD: A decentralized open source financial platform

Something be brewing here folks, and it’s being driven by product velocity around strong strategic alignment across all of Block’s properties.

So, given how vital velocity has been to Cash App’s broader ecosystem play, the big next questions becomes: how do you help your own team move faster?

How to operate with velocity⚡

This is something I’ve been thinking about for a while, and I want to go deeper on it. So, stay tuned, because next week Wednesday I’ll be publishing a dedicated post on how to increase team velocity, and what kills it.

This will be part of the paid corner—From The Garden—so be sure to subscribe below to get access and discuss the post with me and other readers in Chat.

Adios 👋

And that’s a wrap folks on our Cash App analysis…

Thanks for reading! If you learned anything new today, you can sign up here for more issues. Also consider sharing this post, perhaps becoming a paying subscriber to support my work, or if you are a paying subscriber already, giving a gift subscription to a friend, colleague, or family member.

Until next time.

— Jaryd ✌️

For best-in-class product demos, check out Storylane. (sponsored)

Looking forward to reading this!

Also, sorry for this being a day late. I wasn’t feeling great earlier this week.