How Attio Grows: The Playbook For Disrupting a $280B Giant

Lessons on launching a B2B product, pricing, B-17 bombers, The Chef Flywheel, mastering PLG, and lots more

👋 Hey, I’m Jaryd and welcome to another edition of How They Grow—bringing you deep dives on the growth of world-class companies, including their early strategies, current playbooks, and actionable product-building lessons we can learn from them.

Hi, friends 👋

I’ve loved Lego my whole life. As a kid, I’d spend hours following and building against the plans, then later breaking them down to customize and build my own version of some car, ship, or city.

The best was getting to combine and integrate Lego from one set (like Star Wars), with pieces from another (like Lego City), and creating some fictitious storyline that was just mine.

Being guided at first to build something you’d bought and wanted (i.e what you saw on the shelf), and then being given the confidence and flexibility to let your creativity come through and plug-and-play however you wanted in the pursuit of building something uniquely your own is, in my view, what still makes Lego the greatest “toy” ever.

Lego made a generation of builders.

And in recent years, us Lego-lovers have been blessed with a wave of software companies leaning into the same elements of flexibility, creative empowerment, integration potential, and playfulness.

These companies have brought disruptive plays to their market categories by focusing on giving users an unopinionated way of getting their jobs done.

These companies—like Notion, Airtable, and Linear—have won their markets, claimed billion dollar valuations, and created incredibly loyal fan bases for what I see as a simple yet undervalued reason: they let builders build.

Today, we’re talking about a fast-growing company that is playing highly competitive ball by building the Lego version of a CRM— an extremely powerful, flexible CRM for for founders, builders, and go-to-market teams of the next generation of companies.

Today, we’re going deep on Attio.

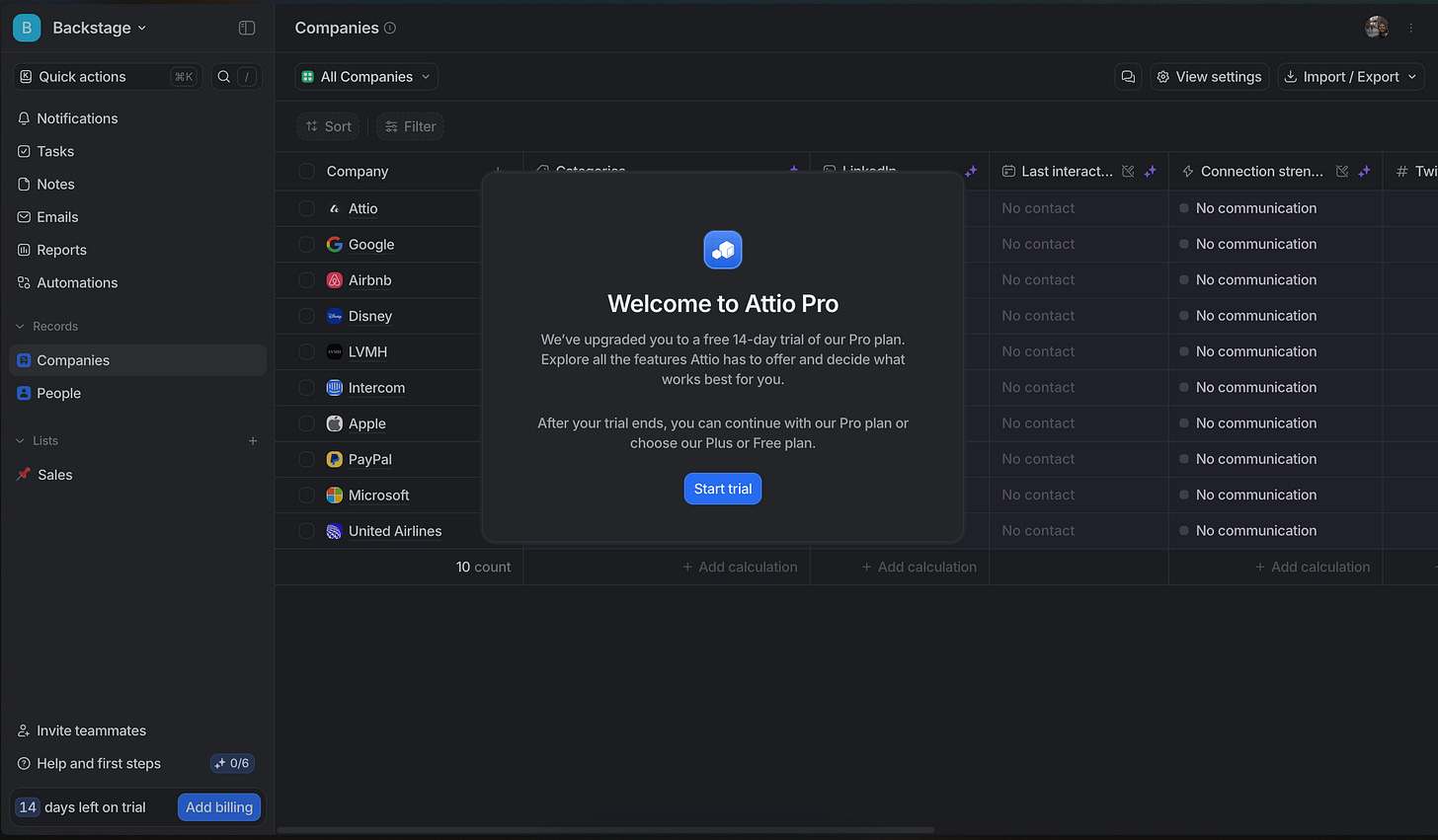

Attio is one of the few products I’ve come to love incredibly fast. Outside of having a remarkably powerful product that’s easy to use with a familiar and beautiful UI/UX, the reason I was so impressed so fast was because Attio has a ludicrously fast Time to Value as part of their onboarding and PLG motion.

We’ll go much deeper on this, but in short, while signing up I synced my work email and calendar. To my surprise and delight, a few seconds later when I landed inside the product, I saw a rich global view of all my relationships with all the people I’ve ever emailed.

I didn’t do a thing. I didn’t have to fill out a single field.

The platform succinctly drew a timeline of all the people and companies I’ve ever engaged with, and created profiles presented alongside intelligent insights based on hundreds of extra data points that were automatically enriched and filled out.

Within just 5 minutes of using Attio, I was playing around with:

Filtering my contacts based on attributes like connection strength, LinkedIn following size, estimated company review, and country (among many others)

Asking for pie chart reports on the job titles, industries, and the seniority of the people within my network

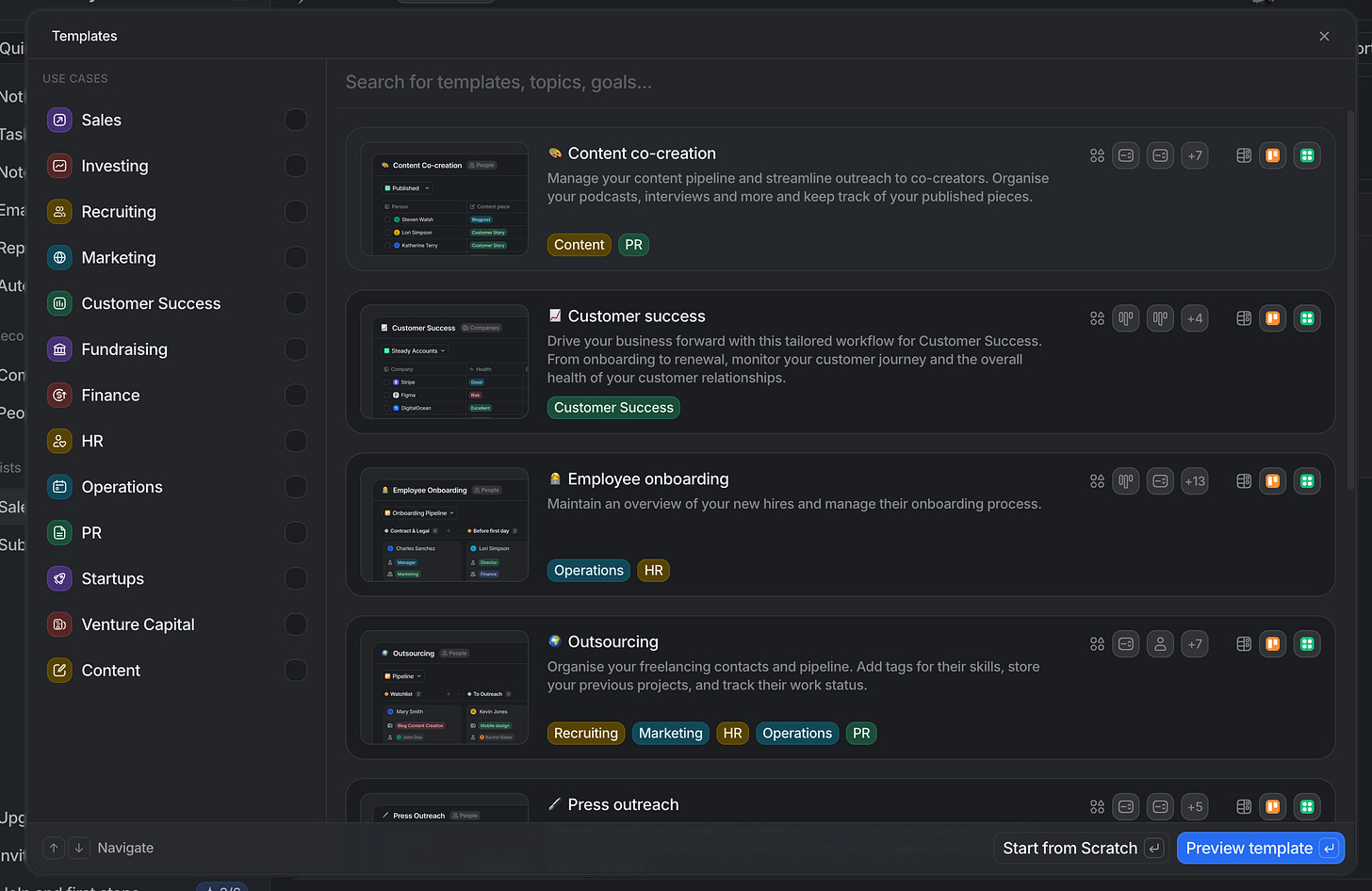

Using a done-for-you template to populate a sales Kanban board for How They Grow’s partnership deals

Creating Collections/Lists of people—like my contacts who are founders, investors, and marketers

This was literally just the tip of the iceberg. Attio had no business being so valuable so fast.

So, of course, I went deeper. And just like I did with my Lego, I pulled and plugged to make Attio my own.

It became super obvious that Attio, despite being a CRM, isn’t limited to sales or marketing. The platform’s modularity makes it a CRM that cuts across many verticals and use cases. Whether you run a high-growth PLG startup, a B2B marketplace, or run a modest little newsletter like mine, if you have a product that you’re bringing to market and your relationships with people and companies matter (when don’t they?)…then Attio will work for you.

The second thing that became apparent is that their secret sauce—which is very hard to pull off— is that Attio is simple when you need it to be, but advanced and powerful when that’s what you or your team need. Simply put, the power/complexity of Attio is fluid, yet the usability and intuitiveness is fixed.

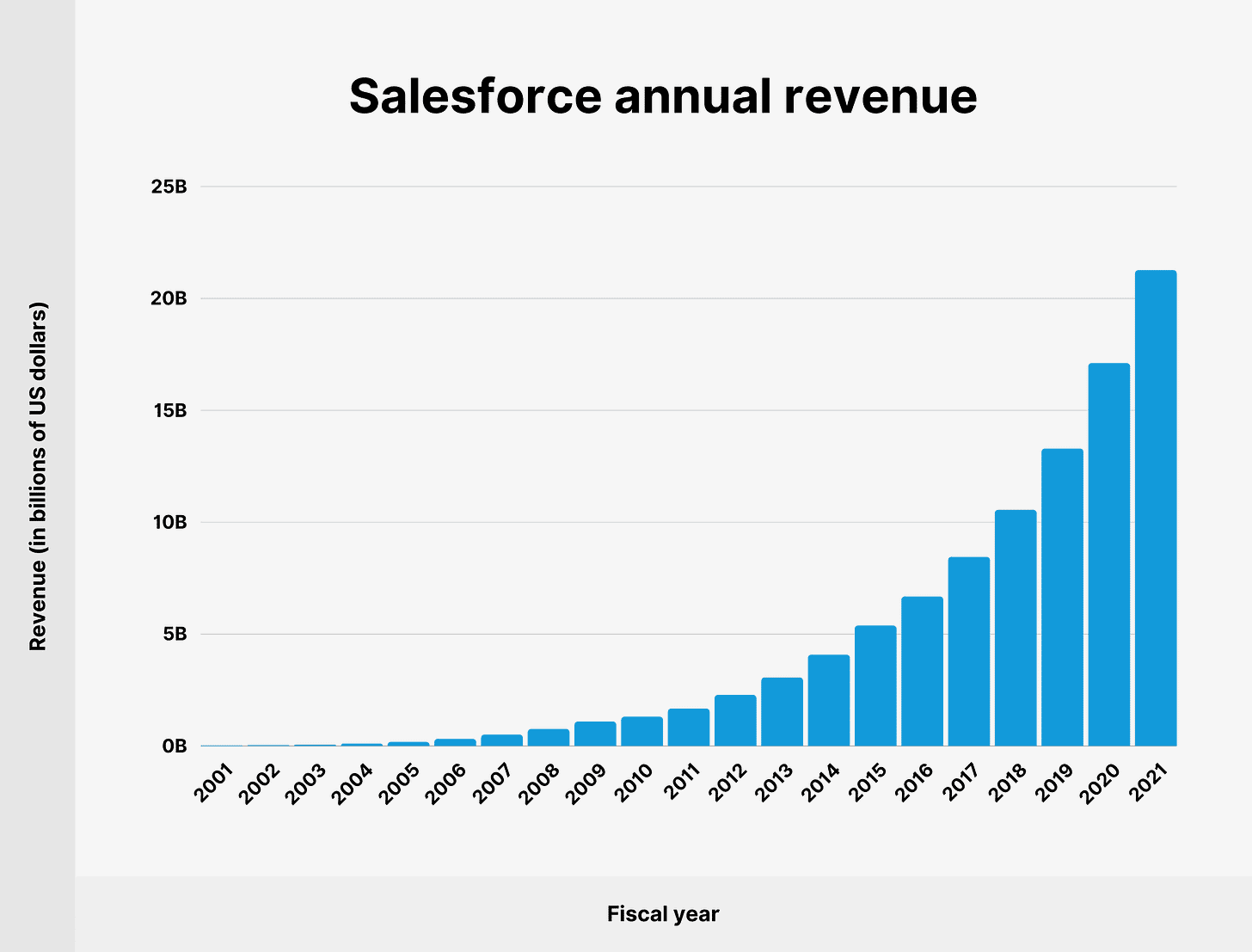

This is all great and well, but let’s not forget the elephant—the humongous elephant—in the market. Salesforce is the CRM authority who reign supreme. Marc Benioff is a force to be reckoned with, with a $285B Death Star that has wiped out many CRM challengers who’ve ventured too near.

This makes for a great story, and at long last, a great Star Wars analogy I’ve had in my back pocket for a year and a half: The Rebel Alliance vs the Empire.

So, in today’s post, I bring you an analysis into Attio’s story, strategy, and PLG breakdown. To make it extra juicy, I was fortunate enough to sit down with Nicolas Sharp, their Rebel Leader CEO, who gave me an inside look at how Attio is building the nimble and ambitious Rebel Alliance and coming for the behemoth and heavily defended Salesforce Empire.

p.s If you’ve never seen Attio before, I’d suggest taking a look for context.

Part 1

The Beginning: A New Hope

I. The rise of an Empire

Why not have some fun with it 🤷 Click play below….

Lol. Here’s the slightly more detailed version :)

A Customer Relationship Management (CRM) is a system for managing all of your company's interactions with current and potential customers.

It’s the lifeblood of driving a sales pipeline and turning connections to cash.

In the late 1990s—while I was (true story) playing with my first Star Wars Lego set— the CRM industry was dominated by on-premises software that was expensive, complex, and time-consuming to implement and maintain.

It was a market ripe for disruption, and in 1999, Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez founded Salesforce with a vision to revolutionize the industry.

They saw an opportunity to create a cloud-based SaaS solution that was more accessible, affordable, and user-friendly, and in doing so, they not only set the stage for a new era in CRM, but they began a larger motion of software eating the world.

Salesforce's novel approach to software delivery eliminated the need for businesses to invest in expensive hardware and IT infrastructure, making it easier and more cost-effective for companies of all sizes to adopt CRM technology.

They did to the CRM category what AWS later did to server infrastructure. And what thousands of other SaaS companies have done in turn.

This leveled the playing field and made it possible for small businesses to compete with larger enterprises. Additionally, Salesforce's focus on customer success helped them build strong relationships with their users and establish a loyal customer base.

But Salesforce didn’t just build an Empire because they took the CRM to the cloud.

Salesforce’s growth and rise to ubiquity in the market was driven by its powerful data model, flexibility, and customization options.

This true Force was driven by harnessing custom objects.

The Custom Objects are strong with this one

Eventually, all companies need to tweak their processes to match the way they do business. Say you’re starting a sales motion, it’s fine to use an out-the-box solution to get going. Or even a simple spreadsheet will get the job done.

It’s a great starting point as it keeps teams out of unnecessary weeds early on when the goal is to just find a few people to buy your product.

But, as you sell more and your relationship graph of companies and people grow, you’ll mature your sales organization. You’ll get to a point where what got you from 0→1 won’t get you from 1→2.

Every team and business context is different, so it’s an eventuality that through finding success, teams will outgrow themselves and start to need more than the basic concepts. Stock-standard attributes like Name, Company, Email, etc—while still relevant—start to become secondary to unique identifiers per company and type of customer.

Salesforce recognized this. They knew that when teams were building their own on-site CRMs, customization was an innate feature because they spec’d out their own CRM needs.

So, in their chess move to build a cloud CRM for everyone, they brought the Custom Object to the CRM galaxy.

The name tells you what it does…it allows users to configure the objects they need alongside a CRM’s predefined concepts. The object can be anything you want.

I’m no mathematician, but: Custom Objects = Flexibility = A powerful data model

With that formula, Salesforce’s secret sauce was that they allowed their customers to bring their unique business process to the platform.

Salesforce remained unopinionated in its workflow.

And up until Attio, given the sheer complexity of it, there were really only two players that even attempted to support the custom object: Salesforce and Hubspot. But since Hubspot only have it in their enterprise plan (and added in many years later), in reality, only Salesforce truly delivers on the underlying promise of a flexible data model.

Many Salesforce instances will have hundreds of these objects ranging from Workspaces to PaymentGateways all in service of representing the full relationship between the business and their customers. This solution cleverly circumvents many of the problems that result from not having context by replacing them with deep configuration.

— Alexander Christie, via Attio blog

Wielding this Force, Benioff has taken Salesforce to incredible heights.

Our story just starts here…

II. A crack in the Empire

But, in the immortalized words of Uncle Ben, “With great power comes great responsibility”.

And Salesforce’s responsibility was to manage complexity as they brought the market more power. As one ex-Salesforce customer said…

I recall that Salesforce.com was fairly easy to use 10 years ago and is now very complete but cumbersome.

And here’s what another said:

Sales is the result of actions and interactions with customers, not entering mountains of data. Programs like Salesforce literally train sales reps to hide in their cubicles all day.

If your customers can’t get to grips with the basic functionality of your system without expensive and extensive training seminars, how can they be expected to maximize the potential of the product?

Despite being a great piece of software—and one of the only ones that can model the unique sales process of a business— this has opened up Salesforce’s big weakness.

The hole in their Death Star is a result of their own success. And what’s more, Salesforce has built an economy around this complexity, meaning they don’t have a clear incentive to fix it.

The CRM complexity tax

In their ascent to $285B market cap, Salesforce has:

Layered in hidden costs, becoming an expensive item on any team’s budget.

Because Salesforce has achieved its flexibility by rejecting product context and replacing it with a highly configurable platform and an ecosystem of tools that connect into that platform, it requires specialized upfront configuration. This has made it increasingly laborious to get started with, and complicated to use.

Due to lots of features and lack of focus on design, it becomes increasingly difficult and less intuitive for people to use even once setup.

Become increasingly more expensive and time consuming to make any changes to the data model once it’s set up. Why? Because consultants often come in to create a Companies Salesforce instance, so once they’re done, regular users a) have no idea how to make changes, and b) are too scared to break things.

Become a time-consuming tool. Salespeople often spend more time feeding their CRM and updating data entries (often in multiple places) than their primary job function—selling.

Just become slow. Salesforce is old and running on a legacy architecture that just can’t keep up with the expectations users have for modern software. And, Salesforce is in a pinch because they have promised backwards compatibility which makes material performance/infrastructure changes difficult.

All in, Salesforce’s size has created rigidity, which makes adjusting the Death Star slow and has exposed a gap for a nippy X-Wing Fighter to get under the trenches.

With that, other challengers began to emerge.

III. Shortcomings of challenger rebellions

We know that the problem with Salesforce is complexity tax.

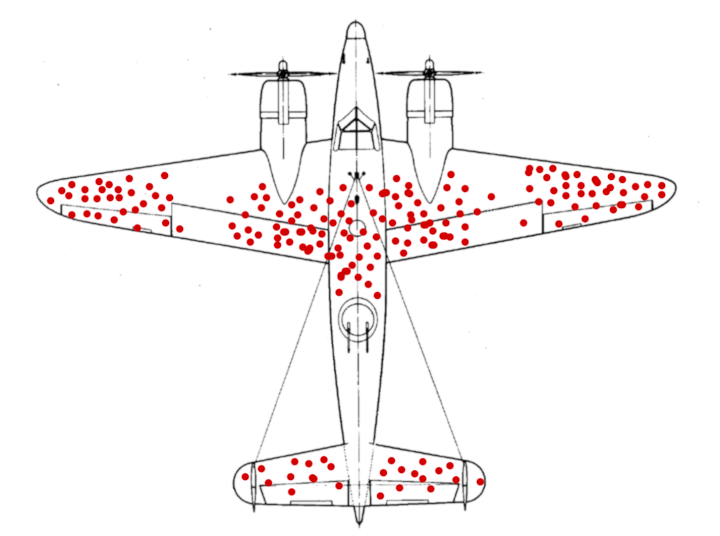

But, to understand where other challenger CRMs fall short, let’s talk for a brief moment about the First Airborne Division during WW2.

If you watched Apple’s Masters of The Air recently, you’d be reminded that the US was losing hundreds of B-17 Bombers and fighter jets to enemy fire and flack over Germany.

On analyzing returning planes, an interesting pattern was observed.

What do you see?

Probably the obvious, and exactly what the Allies did—most planes were being shot on the wingtips, central body, and elevators.

The solution to protect the planes? Just reinforce the wingtips, central body and elevators.

Before reading on, do you agree with that analysis?

Well, then a contrarian statistician named Abraham Wald came along and argued otherwise. He suggested that the engineers should reinforce the armor of the planes’ noses, engines, and mid-body. Essentially, all the parts of the plane where there were no bullet holes, and no reported damage.

Why?

Because in reality, the planes getting shot in those areas were being destroyed from the damage and never had a chance to make it back to be analyzed.

In other words, the original analysis was flawed as an interpretation was made under survivorship bias.

Now, why is that relevant to the competitive landscape of CRM?

Because if you look back at the 6 real user reported problems I listed with Salesforce, you’ll see a commonality: they all orient around a complexity and a usability problem.

That makes sense, because all the companies that have “survived” and did so with Salesforce had to make their data model work. So, their visible problems are a byproduct of all that tinkering.

And any founder interviewing Salesforce customers to understand what their CRM should do differently would gravitate to the obvious feedback—make the CRM easier to use.

The result is that most challenger CRMs aim to solve legacy CRM’ problems this way. They are typically cheaper, far more straightforward, and allow users to get started more quickly without the need for lengthy setups and Salesforce specialists. Some of these startups even target specific verticals to better serve niche markets—like this one for Dentists.

The problem is these startups, just like the Allies at first, are focusing on reenforcing the areas that, while still important to fortify, miss the broader picture.

They aim to resolve complexity issues by way of removing the flexibility, and giving users an opinionated platform with a more rigid data model.

Which is very problematic, because what they do is take away protection from the critical areas like the engine to bolster up the more withstanding wings.

They are an oversimplification of a more nuanced problem.

Thus, the shortcoming of most challengers to the Empire is a simplicity tax that renders a weaker data model. One that users will inevitably outgrow if they survive.

And just like a beautiful car but with horrendous miles per gallon—only a small subset of people will ever use it long term.

The real key to success here lies in the ability to deliver a powerful, scalable data model that meets the needs of businesses of all sizes while providing a seamless, intuitive user experience.

Attio’s founder Nick knew this, because before Attio, he too founded a challenger CRM for VCs and private equity investors to manage deal flow. He took the road of building narrow, saw the shortfalls, and changed course to focus on the forest, not the trees.

Fundstack had lots of happy customers. Revenue was growing fast. By all measures, it was going well, but we felt it wasn’t ambitious enough. No matter what you’re building as a startup, you work damn hard.

We basically had this moment of realization: if we're gonna put all of this work into something knowing that this isn't the best version of what it could be, what’s the point?

So me and Alex sat down in a cafe and thought: hypothetically, if we were to pivot and really build something that we think would ultimately be much better and more ambitious than this, what would it look like?

And then we drew out what then became Attio. We couldn't help but go for it.

— Nicolas Sharp

IV. Bringing balance to the CRM galaxy

As Star Wars taught us in 1977, every force has a weakness. There’s always a shadow side to every advantage and strength.

The formidable Death Star of Salesforce had a vulnerability that once spotted, created a wedge for attack. The same is true for the strengths of other CRM startups that came before Attio.

And that’s the first lesson I learnt from Nick Sharp.

A big incumbent in a market of course is a threat, but it’s also an opportunity. Nick and his team used Salesforce heavily when he was a VC, and when ideating what problem to solve, he spent a lot of time figuring out what:

What made Salesforce great (i.e what people liked)

What tradeoffs they had to make to create that greatness (i.e what people didn’t like)

And which of those tradeoffs would be incredibly difficulty for Salesforce to maneuver and cover up (i.e how they could counter position)

You can do that for any company, and by doing so, will find a startup opportunity.

And by doing that analysis on Salesforce, as well as the existing challenger CRMs, that’s how Attio saw how to bring balance to a massive market.

Attio’s plan of attack: The strategy to bring down The Empire

TLDR: No compromise between flexibility and usability. And the most intuitive CRM with the best data model and the fastest time-to-value will win.

After speaking with Nick, studying the market, and using Attio myself, the following strategic components stood out to me. I’ve added a quick note on how you could more broadly apply their move to your own product.

♟️Their Move:

The data model is the underlying essence of the CRM. Without an incredibly powerful one, no CRM can grow with their customers. So, they are building a best-in-class one.

🎯 Your Move:

Identify the core loop of your product and go deep on it. Invest heavily in making it best-in-class, as it will be the foundation for your product's growth and success. No other feature matters until you have that waxed.

Really make sure you do thorough discovery to understand your customers' current and future needs. That’s how you make sure your product's core can scale with their evolving requirements.

♟️Their Move:

By being the engine behind other teams; PLG and sales-led strategies, and attaching their pricing to the value Attio brings those teams, Attio will always grow so long as their customers grow. The scalable data model means they can capture and retain that value they create indefinitely.

🎯 Your Move:

Develop a deep understanding of your customers' key metrics and objectives, and then use that in your Pricing & Packaging to demonstrate how your product directly contributes to their success.

Continuously monitor and communicate the value your product creates for customers, using data-driven insights to reinforce your product's importance in their growth journey. E.g, If someone wants to downgrade their plan, show them what a premium plan has helped them achieve and what they will lose.

♟️Their Move:

Investing in customization and integrations will widen their serviceable market, as it makes Attio a horizontal CRM that works for any industry, any size and type of business, and most use cases.

🎯 Your Move:

Develop a robust API and documentation that enables customers and third-party developers to build custom integrations and extensions, increasing your product's versatility. That’s how you become an ecosystem and solve a bigger surface area of problems.

♟️Their Move:

Attio is focusing on a bottom-up play with a reverse-trial offering, targeting the real builders and operators, and using them to wedge into a larger org and invite more people. Compared to long sales cycles with decision makers, Attio is leveraging builders to build internal conviction.

🎯Your Move:

Use a reverse trial—no credit card—to get users experiencing the full value of your product for a limited time. Suggest that they stick to a paid plan to keep certain features, but also allow them to downgrade to an unlimited freemium plan at the end. Just make sure to remind them what they’re about to lose.

Delineate between individual vs team onboarding flows. A first time user vs a user joining a company workspace should have a different path. Read more about that here.

Know when to suggest that individuals invite other people without being pushy. First prove your value as a single player tool, then hint at even more value with multiplayer.

♟️Their Move:

They make it easy for power users to dive deep and build advanced things, but just as easy to hang around the surface of the product, get value, and not get overwhelmed by stuff that light users don’t need. When you need depth, it’s obvious. But it doesn’t sit there and confuse you before you’re ready.

🎯 Your Move:

With onboarding—which extends beyond just sign up—context and timing matter so much for how you show users around your B2B SaaS. Don’t tell people what your product does, and don’t show them everything all at once. You want to be simple on the surface, advanced down below, and make it incredibly easy and progressive for users to oscillate between layers of functionality.

♟️The Move:

Automatic enrichment is the default vs cumbersome manual data entry.

🎯 Your Move:

Leverage AI, machine learning, and third-party data sources to automatically populate fields, suggest relevant information, and streamline workflows. This can kill your friction.

Lean into the power of defaulting features to on. Focus on building things that most users will want enabled, and allow for a path to opt out.

♟️Their Move:

Modern teams want multiplayer collaboration, and Attio is doubling down on team value by combining the graph networks of collective company emails. The moment several people from the same company sync their emails and calendars, the relationship graph for a company becomes 10x more interesting. Now all interactions across all company users join the CRM, vs a single person’s touch point history.

🎯 Your Move:

Identify opportunities for collaboration and collective intelligence within your product, using the combined data and interactions of team members.

Aggregate and analyze data across team members to surface valuable insights and recommendations that individual users might not have access to.

♟️Their Move:

Build a brand that teams who use tools like Notion, Figma, Slack, etc can resonate with. Unusually for a startup, Attio did a full rebrand early on to appeal to their ICP of the builder archetype.

🎯 Your Move:

Identify your ideal customer profile (ICP) and the other tools they frequently use, understanding their preferences, values, and aesthetics. This can help you create a brand identity that aligns with their expectations and resonates with the broader ecosystem of products they rely on.

Continuously refine your brand based on customer feedback and market trends, ensuring it remains relevant and appealing to your target audience. This can be reflected in homepage redesigns, messaging audits, and fixing marketing debt.

With this series of strategic moves, I believe Attio’s growth will follow a trajectory similar to these companies (most whom I’ve covered) that have peeled away a segment of the market from their respective incumbents

Gmail → Superhuman

Mailchimp → beehiiv

Chrome → Arc

Wordpress → Webflow

Photoshop → Figma

The Go-To-Market: Launching with Force

Attio followed a tactic that has worked well for companies like Figma, Airtable, OpenAI, and Notion.

They ignored traditional startup wisdom and didn’t publicly launch their product until it was largely fully formed.

Just like if The Rebel Forces had attacked The Empire too early, they’d have been crushed. They needed enough momentum, strategic insight, and firepower before scaling an assault.

So after deciding to focus on the broader CRM market vs a narrow solution, Nick shepherded Attio into a heads down build mode for 3 years. They collected emails via a waitlist, worked tightly and behind closed doors with a few ICP customers to refine their product, and made sure that for launch, they had built against first principles the CRM they knew the market needed.

They made sure to take no shortcuts and inherit no bad patterns developed in other CRMs.

Here’s the lesson: Don’t launch, onboard

Startups usually launch (and maybe re-launch) as soon as possible to quickly start iterating on a half-decent product.

Take Uber as an example. They were creating a new market, where the alternative is usually a terrible experience (getting a cab before Uber sucked). And since ride-sharing was a new space, there was a pressing need to be first.

When that’s the case, get out there, and as fast as you can. People won’t care if the product isn’t perfect. Anything you release is going to be worth it for some people, and that gives you a small advantage. When you have a network effect, like Uber, that small advantage is going to start compounding on itself.

But Attio wasn’t entering a new market where there is a land grab opportunity. CRM is a big space. They are a premium product competing against Salesforce, without an explicit network effect built into it. Therefore, the bar to launch was much higher.

That’s why they chose to take more time building, and do a gradual ramp up of users.

And from a similar point of view, the competitive products that were, and still are, on Nick’s radar are not the ones building CRMs.

He sees them as being too caught up in the past, trying to solve the problem that the legacy CRMs created without any real shot at competing on the data model or performance front.

Rather, he’s keeping an eye on products that may not be considered CRMs at all today but could become them in the near future as the new market paradigm evolves and becomes more widely understood.

These are the products that may be working on CRM-adjacent problems that could eventually see a bigger opportunity in CRM.

A beautiful insight for founders: look in unexpected places for competition. It will keep you watching where the puck is going, vs where it is or has been.

And after 3 years, without getting distracted by the competition, Attio launched in Q1 of 2023.

The approach to the Death Star was on.

Part 2

Attio’s PLG Breakdown: Understanding each layer of the Iceberg

The early innings of Attio’s customer acquisition was classic B2B GTM: founder-led sales.

Nick was tapping his personal network, scoring Reddit, Twitter, and community pages, and just focusing on Attio’s ICPs who were open to trying a new type of CRM.

This is really the only way to start B2B…I’ve never seen a startup find their first 1, 10, 100 customers in really any other reliable way.

This approach puts the founder in the driving seat to meet, build relationships, and learn from probably one of the most influential and direction setting cohorts of customers a company will have. Without directly interfacing with customers, you lose the feedback loop and ability to test if your product’s message is fitting the market, etc.

By doing founder-led sales, Attio got to a point of adding about 5-10 accounts per month—in the early days even winning Coca-Cola.

Aside: Curious how to transition out of founder-led sales? Here’s a great framework

In this early phase of acquisition, onboarding was white-glove. Everyone joining had Nick or an early team member making sure they understood what Attio did, how it was different, and crucially, manually migrating their data into Attio.

Nick told me this took days to get done, but was essential in figuring out how to actually operationalize that flow within the product.

Organic/word-of-mouth has always been a huge input of leads for Attio. In the beginning—while this sales and onboarding processes stuff was getting figured out—this demand was pushed towards a waiting list.

But, once they did figure that out and added a bottom-up, product-powered loop to get people signed up, paying, and expanding their accounts—growth just took off.

The PLG Iceberg recap

Kyle Poyar posed the question: Can PLG beat Salesforce?

Here’s my answer:

“Beat” isn’t the right word. I think Attio can “beat” Salesforce in a similar way to how Figma is beating Adobe. Salesforce will always be bigger, but Attio can carve out an exceptionally valuable slice of the market for themselves.

And that will happen if Attio can perfect all the layers of the PLG Iceberg.

In short, for the newer readers who haven’t read the Canva or Miro deep dive, the Product-led Growth Iceberg is a handy framework I developed to think about the varying layers of self-service growth.

Essentially the Iceberg represents a funnel, starting at the tip with the table-stakes of PLG. If you can’t get this right, nobody will even try your product so all the deeper, less-obvious, but more potent levels of PLG would never even matter.

As a company crushes one layer, their PLG motion progresses along incrementally harder phases toward the bottom of the Iceberg, which gets to the biggest challenge of all: can the product through operationalized acquisition loops naturally get one cohort of customers to bring in another?

All in, if you pull all of this off, you very likely have product-market-fit and a sustainable, low-cost, distribution system.

It’s the holy grail of product growth.

So let’s go through each of Attio’s layers and see what we can learn.

Layer 1: Core problem communication

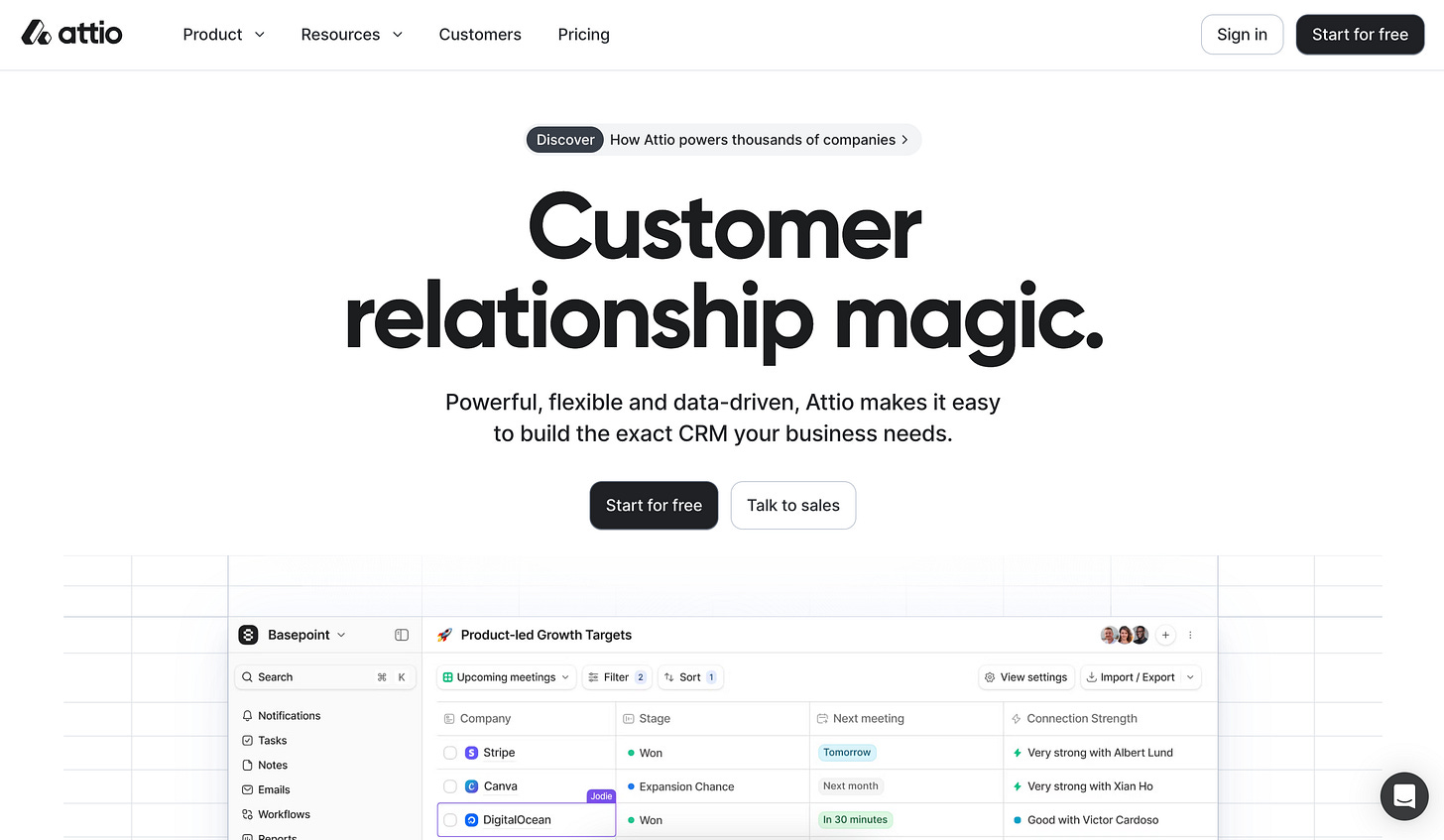

Simply put, do people understand within a few seconds, and above the fold of your homepage, why your product will help them solve their Job-To-Be-Done.

PLG means your product is your #1 salesperson.

So, just like a salesperson reaching out over LinkedIn or email to get a prospect’s attention, it should not start with something dry and generic like “Hope you are well…”

Lead with value, be crystal clear, and the more you can personalize a leading message to someone (think dedicated landing pages for campaigns, personas, use cases, etc), the more of a shot you’ll have to get them to invest more time in discovery.

And that part is essential, because most people in B2B are not signing up without scrolling some more and poking around a few other pages before making a decision.

When I chatted with Nick about this, what really stood out to me was how he described the concept of “Why us” vs “Why one”.

“Why us”, vs “Why one”

When you’re selling to someone, you’re either:

Explaining why someone needs any solution to a problem (why one).

Think about a category-defining product like the Apple Vision Pro. Apple needs to educate the market why they should fork out $3000+ to buy their headsets. What they’re pitching against is apathy to the problem.

Explaining why someone needs your version of the solution (why us).

Think about the famous ScrubDaddy pitch on Shark Tank. Everybody knows they need to clean dishes and that a house needs a kitchen sponge. The pitch isn’t convincing people why people need a sponge, it’s that they need their sponge.

Over to Attio, the game in Layer 1 of the Iceberg is using product-marketing to tell people why they need Attio over another CRM.

Here’s how Nick put it:

CRM is a “why us” market rather than a “why one.” People know what a CRM is and know that they need one.

So our job is to answer the question convincingly as to how we’re different from other CRMs in the market.

A lot of that is done through brand and it's done through crafting a message, a look, and a feel that resonates with your target audience.

We knew early on that we're up against incumbents and we're trying to persuade people that we’re better than them. Brand plays an important role in that.

— Nicolas Sharp

That last point about brand is interesting, because usually investing in brand and comms starts to happen in B2B post Series A. But when you’re playing in a crowded market like CRM and differentiation is exceedingly important, building a challenger brand that holds its own like Attio has done is essential.

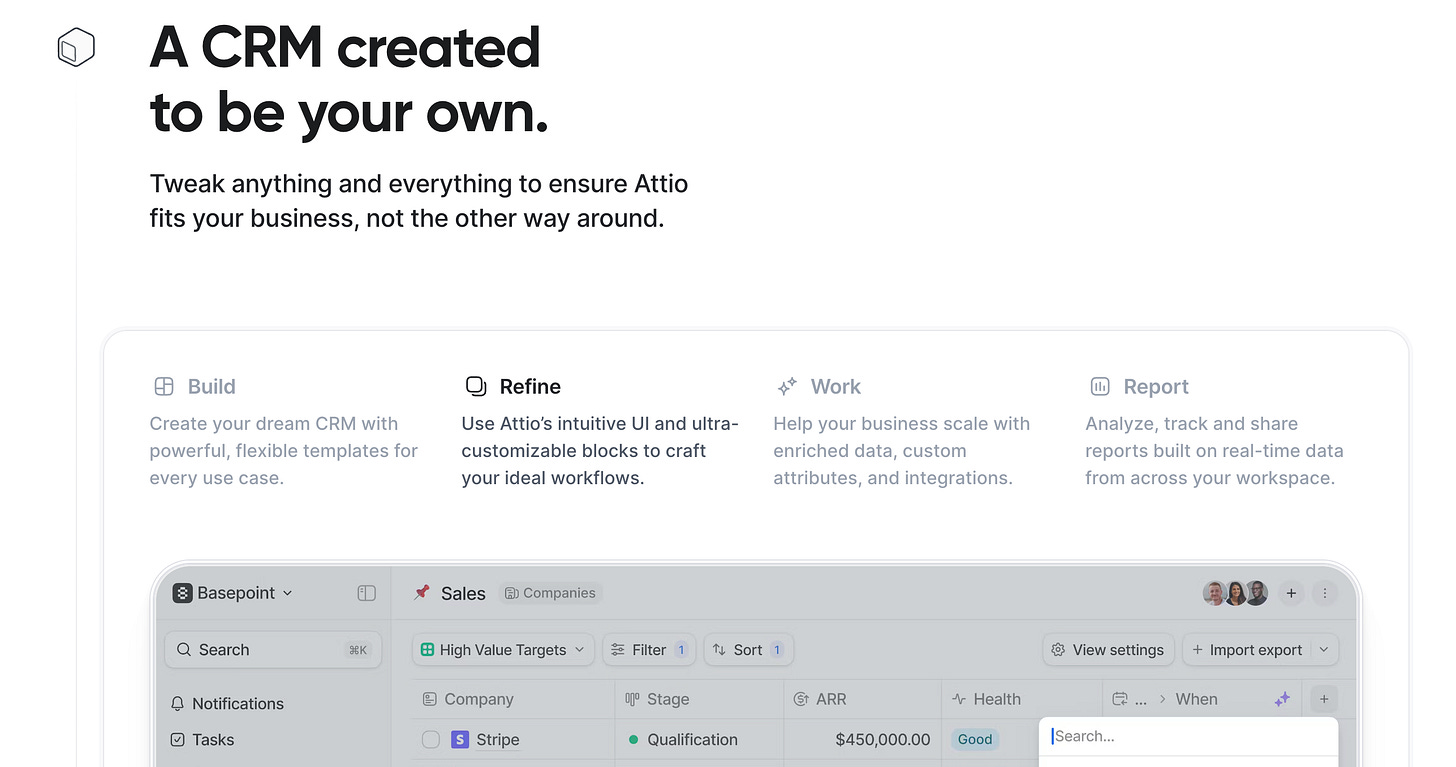

Let’s analyze their homepage for a second.

Some observations on how they’re putting the product’s value first.

The hero copy plays on the word CRM by spelling our Customer relationship magic which is clever, witty, and hints at a subliminal message of what the product is. But while a word like magic is generally eye-rolling, in this case, it’s not misleading at all. During onboarding, you truly do get a magic moment. This is a statement that catches the eye and makes me want to read the text below to understand what is magical about Attio.

The sub copy conveys Attio’s core value—a powerful data model that is flexible and configurable. In this sense, Attio is positioning its differentiation more towards other challenger CRMs vs Salesforce. That makes sense, because founders and early stage companies may be evaluating these folks more vs the enterprise-centric Salesforce.

But, just playing around, one version I’d be testing is to hit a note like this: As powerful and flexible as Salesforce, but infinitely more intuitive and fast for the modern builder. No hidden costs.

This calls out the competition, creating an instant anchor in people’s mind

It leads with why people like Salesforce, and why people don’t like challengers

It communicates how Attio solves the problems people have with Salesforce

It also mentions the “who this is for”, all in one sentence

Attio are using the “show don’t tell principle” here by embedding a catchy but informative product video on the homepage. This is something I see tools like Slack and Atlassian are using too. It gives people a tease of the promised land behind the signup wall.

Once people are a little hooked with this leading attention-grabber, they may scroll to get some more information.

Here’s what they see:

The copy emphasizes:

Notion-like value, emphasizing why builders may want to pick Attio

Ease of getting started with templates

Intuitive UI, a big differentiator to Salesforce

Custom Objects, a big differentiator to challenger CRMs

Workspace reporting and visualization

The thread in all their messages is feature<>value. This tells you what outcome you get, and practically, how Attio will help you get it.

This makes sure the copy isn’t vague, yet still value driven.

Never forget social proof

In the world of B2B, an essential point to understand when selling software—whether via bottoms-up or top-down—is that people want to look smart in front of their bosses.

Your goal is to help them de-risk their decision and internal pitch.

If you’re an influencer in a buying decision, you’ll have a lot more juice convincing a CIO or CTO to put down the company credit card if you tell them other similar companies to you are using that same vendor.

That’s where social proof comes in.

Right at the top of the homepage, even above the hero copy, Attio links to a page dedicated to informing prospects about all the other companies getting value from Attio. That’s a great tactic you should steal.

There’s logos, there’s customer quotes, and there’s thoughtfully-crafted case studies, like this one: How Marker.io uses Attio to drive product-led growth.

That’s a great page that users of Attio can share internally to build conviction in company-wide adoption. It’s basically trying to replicate the modern day equivalent of “Nobody gets fired for buying IBM”.

Layer 2: Friction & Value discovery

Once people have been convinced “why Attio”, the next key to making PLG work is to make it as easy as possible for users to get started with the product. You want the product to deliver value ASAP.

It must be flexible, with a low learning curve. If it’s too complicated, users will look elsewhere.

But at the same time, the rope to balance is:

Fast and easy to get setup. AKA, as little friction as possible

Healthy and necessary friction

The healthy and necessary friction is often overlooked by folks as they just try to open the floodgates as much as they can to get those acquisition numbers up.

But you need it. It weeds out poor quality users (e.g people who don’t really need your product, or will never pay you) and it also makes sure that the high-quality users coming in get to value.

Because on that last point, friction up front could well make it 10X faster to get to value post-signup.

Let’s take a look at Attio’s onboarding path from homepage to product dashboard, and we’ll see that in practice.

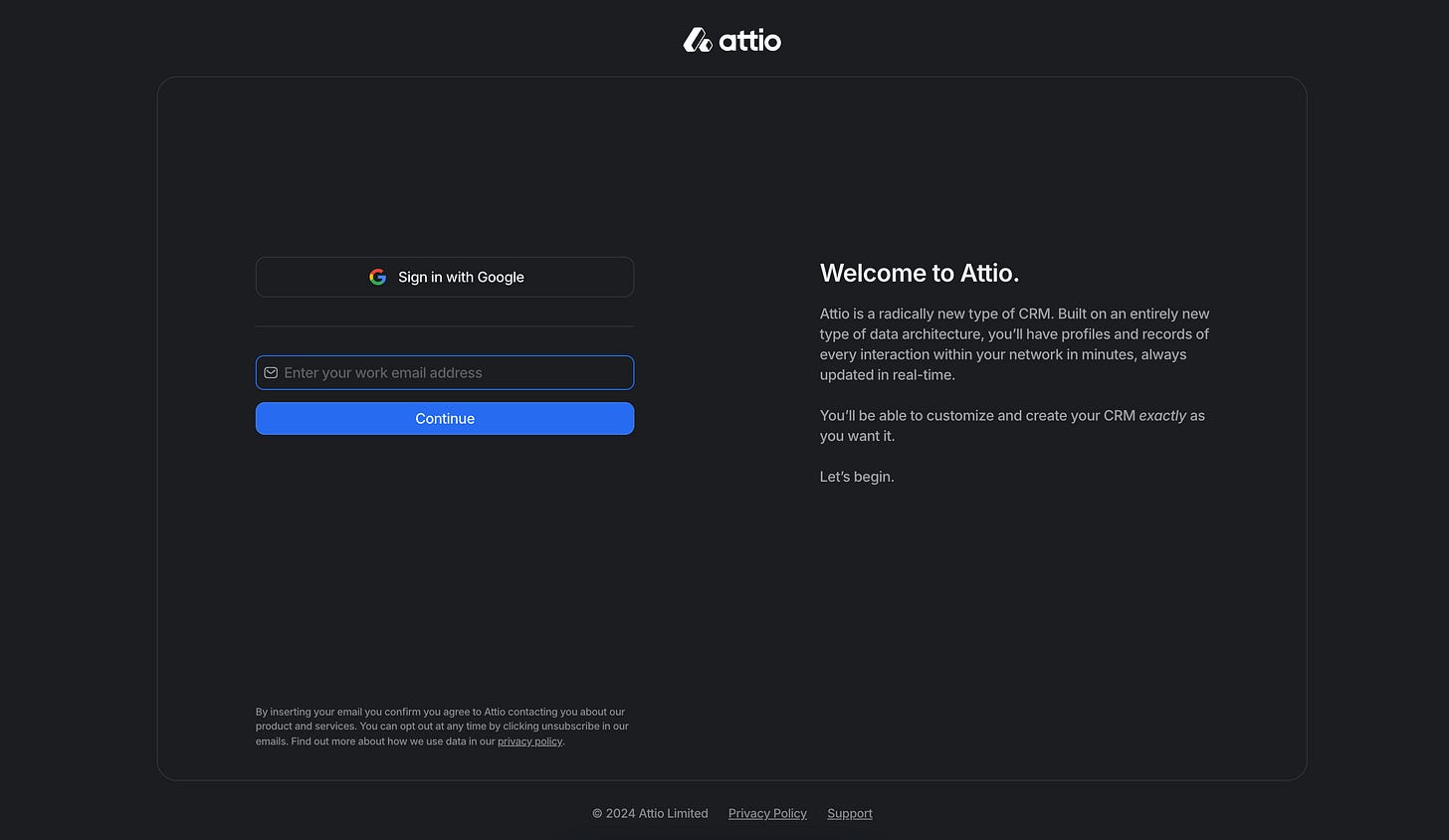

Screen 1: Picking the right hard requirement to act as a filter

What works well:

Single-sign on makes one-click email and password entry super easy. If you don’t have this, definitely consider adding it in. It’s a UX pattern people expect.

The page reminds people why Attio is different, nudging them to finish step 1.

Attio requires you to sign up with a work email, including via Google Auth. This positions Attio as a business-grade product. And while it may seem like risky friction for anyone who just wants to see what Attio is about, this is an incredibly strategic requirement that benefits the user.

Using a work email, which they inform you about if trying to input a personal email, brings you a relationship graph of all the people you’ve interacted with professionally. That’s the value of Attio, so it’s a friction point that will a) weed out non-serious people, and b) make sure serious people have a short Time To Value.

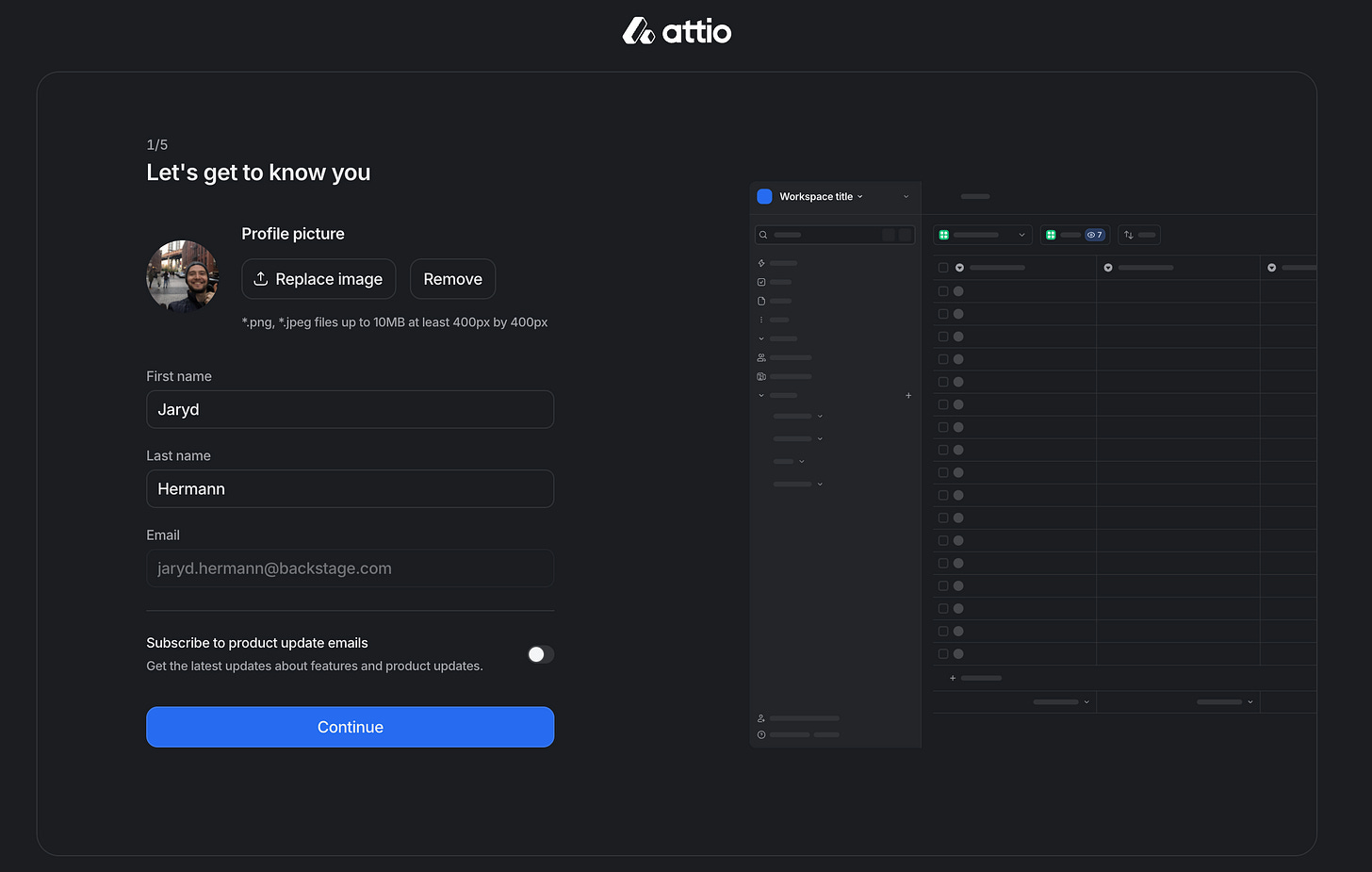

Screen 2: Information for collaboration

I get why this step is here for a team-based workspace tool, but I’m not sure how necessary this step is. I’d probably do away with it for two reasons:

It doesn’t contribute to the user getting onboarded and finding value

It doesn’t capture any key information to filter qualified/unqualified people

If a user is using Attio in single player, this doesn’t matter much. One suggestion here would be to lose this step for individual user sign up, and push it into the team member onboarding and invitation flow.

i.e If you are working with others, add some profile info to make collaboration effective.

Every additional screen in onboarding brings drop off, so really always focus on the absolute essentials.

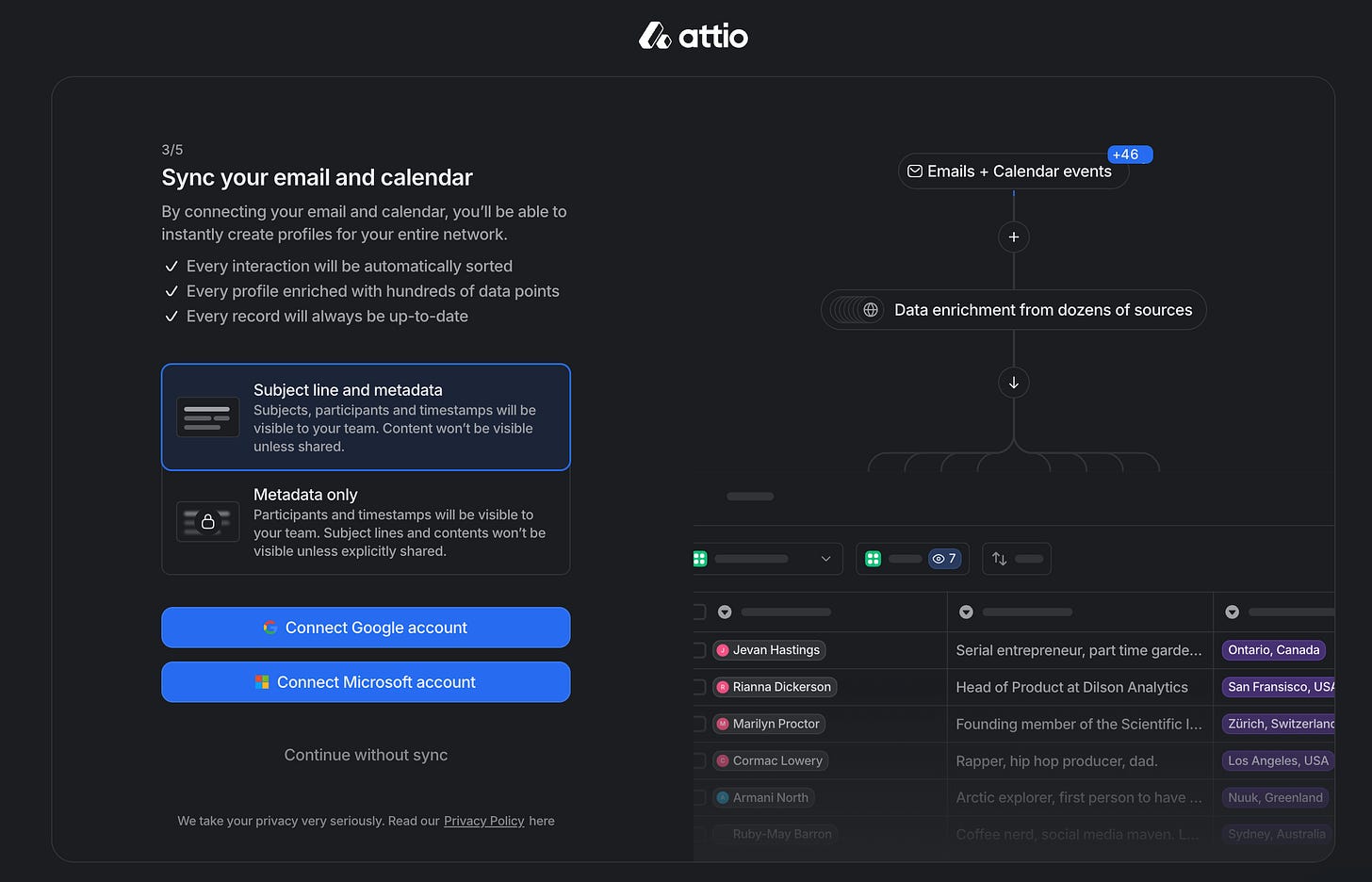

Screen 3: Where the magic starts to happen

This is arguably the most important action a user will take during onboarding. Nick told me there is a huge correlation here between users that sync their emails/calendars and retention.

What works well:

It’s clear why you should connect your accounts.

They use a smart default by choosing the option that is most valuable. This eliminates the guesswork and any thinking.

They have simple 1-click buttons to make this connection happen.

They use visuals to show you the power of syncing—like automatic enrichment from dozens of sources.

They still give users the option to continue without a sync, giving an offramp to folks. The reason for this is they still allow you to sync within the product.

They get ahead of peoples’ concern when it comes to sharing account data, and remind people how important privacy is and what Attio’s stance on data/privacy is.

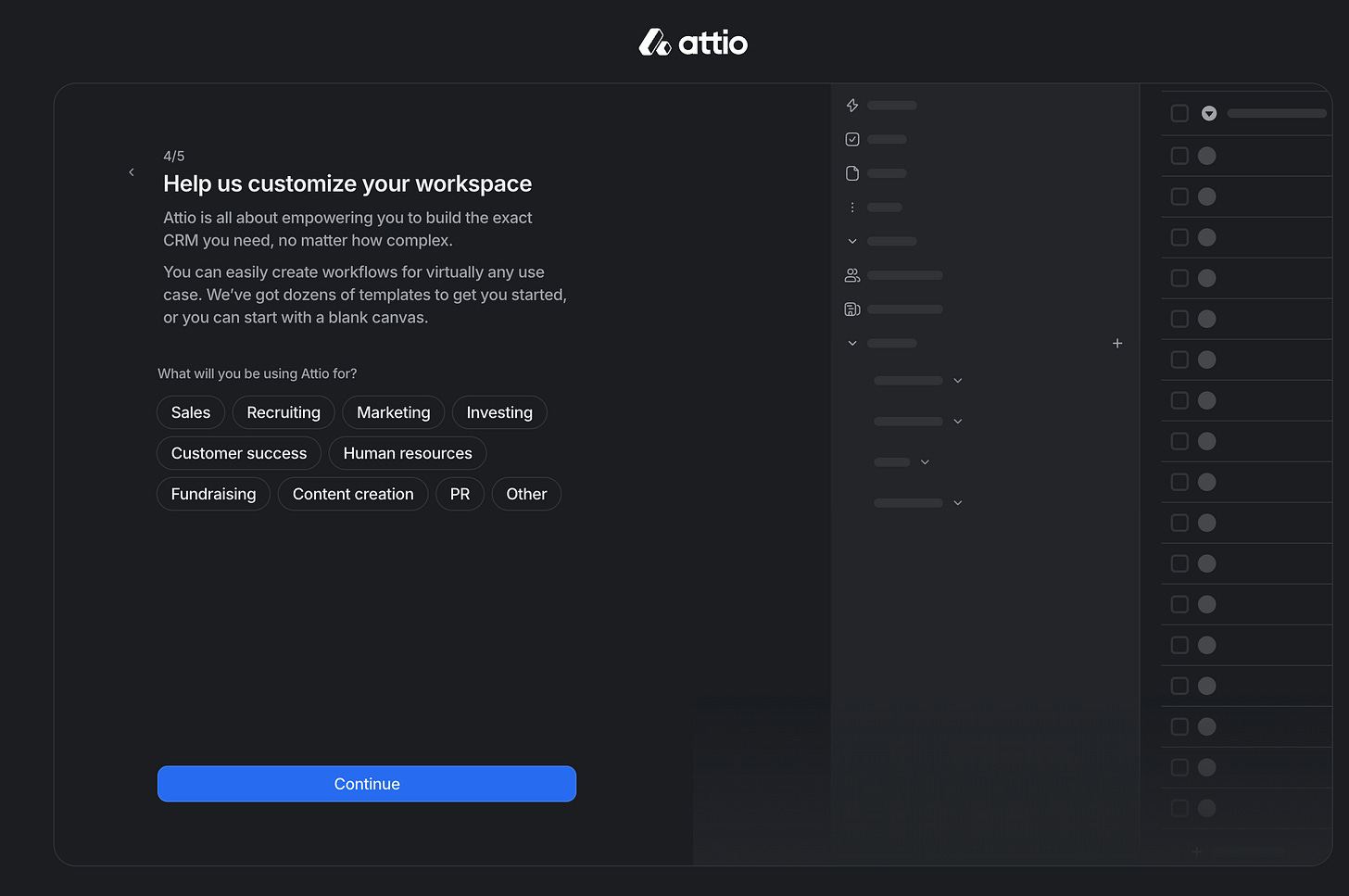

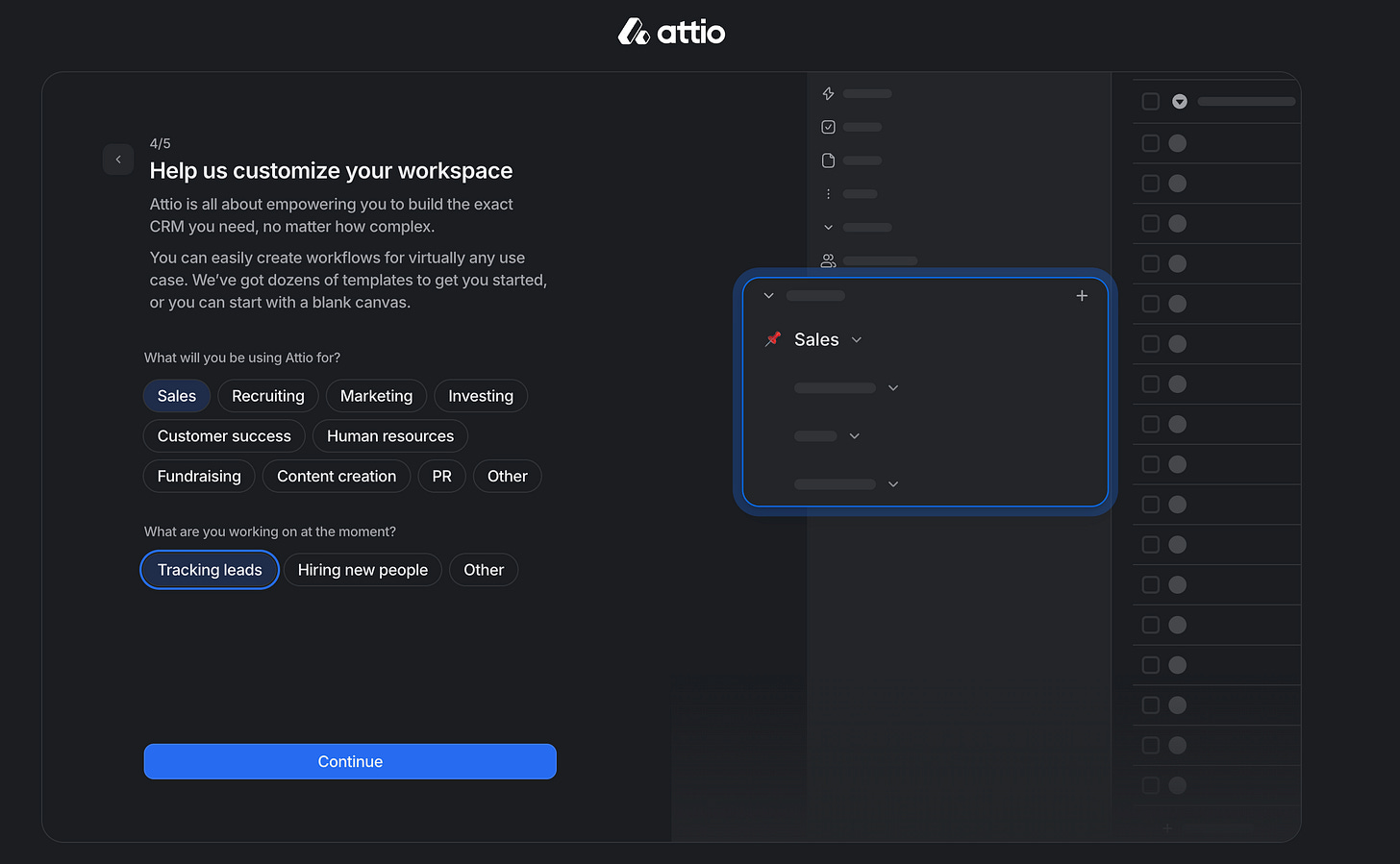

Screen 4: Segmentation, forking, and workspace setup

This screen captures a users core use case. It’s a critical part of onboarding for anyone product that works for different personas and has variance in Jobs-To-Be-Done.

What works well:

Only popular use cases are suggested, not all of them. This minimizes information overload for most people in the funnel.

Related, as the second screenshot below shows, they use progressive information reveals to show sub-categories. Again, making sure to not overwhelm people with choice.

It’s a nice touch that the visual on the right panel is adaptive to the choices a user makes. Small details like that compound to a user’s perspective of a product’s finesse.

This segmentation is valuable for two big reasons:

It helps the user by generating them popular templates to get started with

It helps the user because onboarding email sequences will be focused on their reason for using Attio

It’s data that helps Attio drive a better sales pipeline

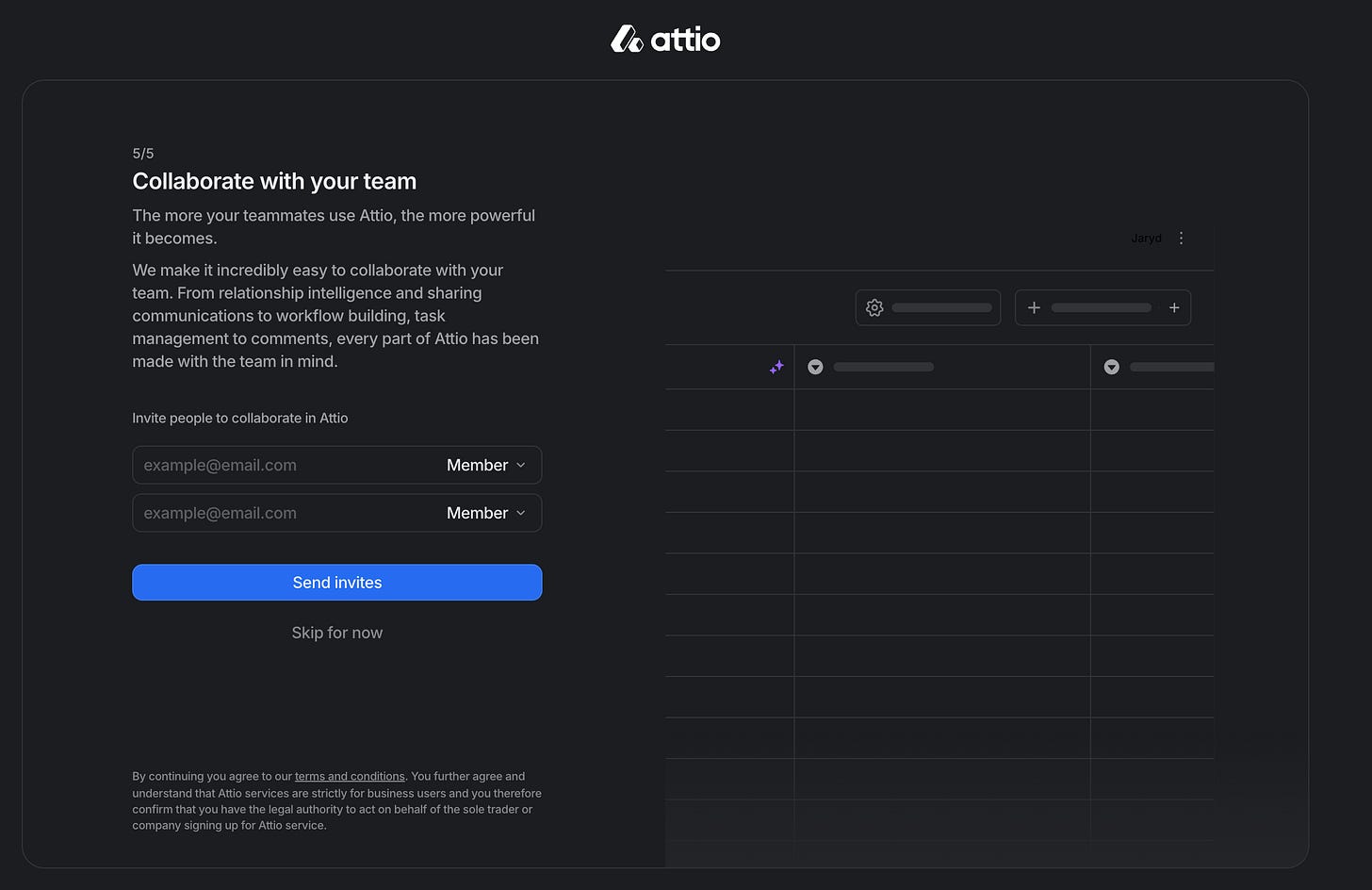

Screen 5: Kickstarting the product-led acquisition flow

The last part of onboarding is nudging users to start the bottoms-up flywheel and invite their team.

While you can use Attio in single player, it works best as a multiplayer tool. AKA, the more people on a team integrate, the sooner they experience the core value and the more “sticky” it becomes within a team, thus getting them hooked which increases their chances of upgrading.

What works well:

They remind you why adding your team is important—it makes Attio more powerful for you

It makes it easy to drop in emails and select permissions (with useful permission defaults)

What I’d suggest here is that they test adding a magic link. A simple copy and paste link that someone could drop in a Slack channel for example. The link would bake the invite parameters into the URL, and ideally take anyone clicking it to a page that is personalized, mentioning things like

Who invited you, and from what company

What use case that person is using Attio for

Clear step to join the workspace and contribute to making the graph network even more powerful

Thinking of people’s email addresses is a hack.

Welcome (and goodbye): The reverse-trial and the downgrade path

Once inside the product, a user is greeted with a reverse trial.

The standout takeaway here is that they opt people into a reverse trial for Attio Pro with no credit card friction. AKA, unthrottled value. The bet they’re making is that by giving away everything for 2 weeks, people will build workflows, invite folks, and enjoy all the bells and whistles.

I love this lesson: provide value first, receive money later.

Then, after 14 days, they most likely (assuming they’ve used Attio) don’t want to lose that at the end of the trial. That’s tactic plays on two psychological principles:

Loss aversion: a cognitive bias that describes why, for individuals, the pain of losing is psychologically twice as powerful as the pleasure of gaining.

The endowment effect: a cognitive bias that causes people to value something they own more than something they don't own.

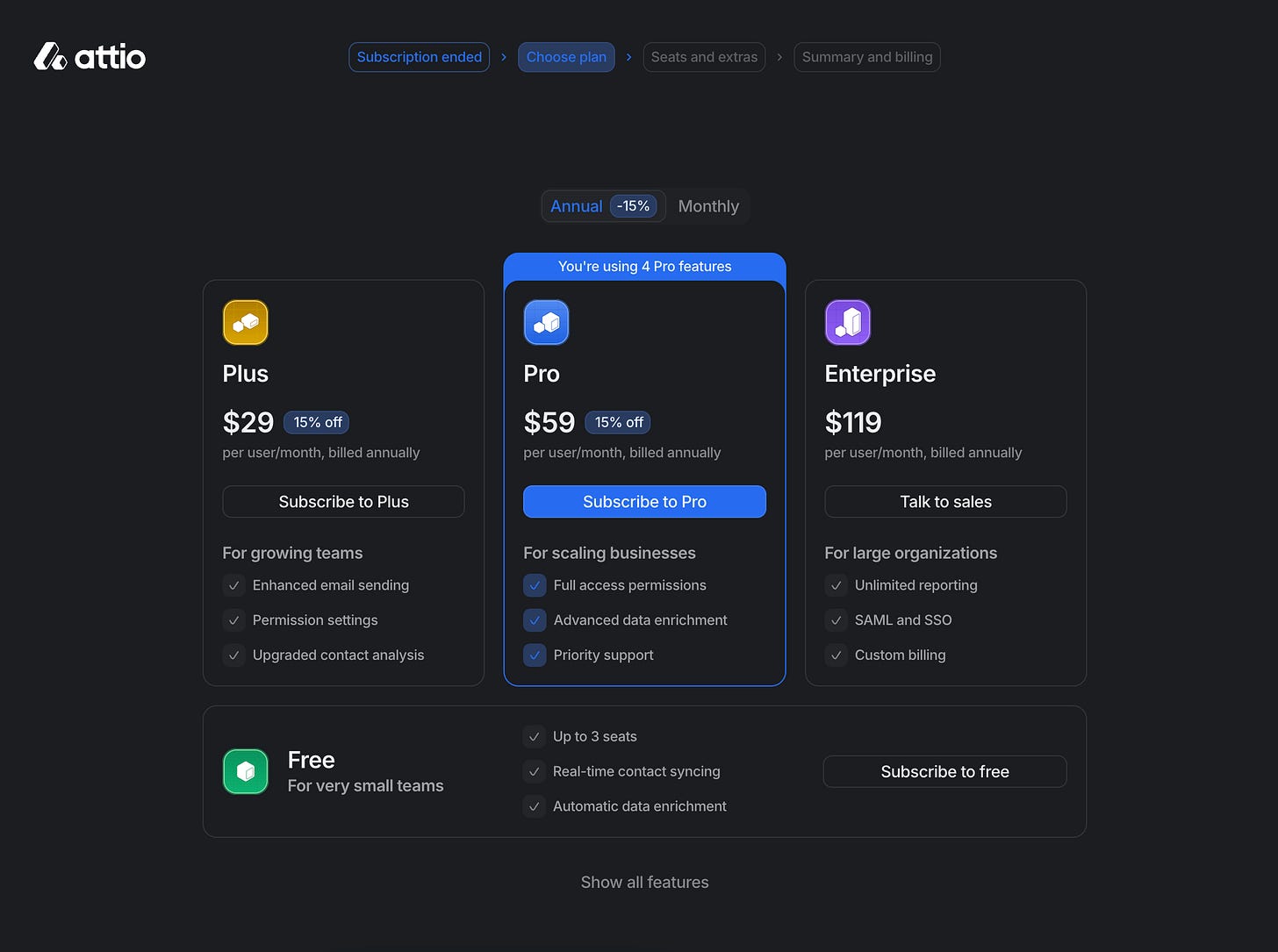

To see those effects in action, let’s jump ahead for a minute and look at these two brilliant screens a user sees at the 14 day mark when their trial ends.

Here’s what makes them so smart:

It reminds people how many Pro features they’re using, and how many they will lose access to.

It positions what they have as the middle ground of paid plans. If they want to downgrade, they can always go left and pay for a Plus plan.

If a user selects to downgrade all the way to Free—which still has a lot of value for very small teams—then they highlight the very specifics of all the things that might break due to losing tool access. They also make users confirm they understand what they’re losing and how their workflows may change.

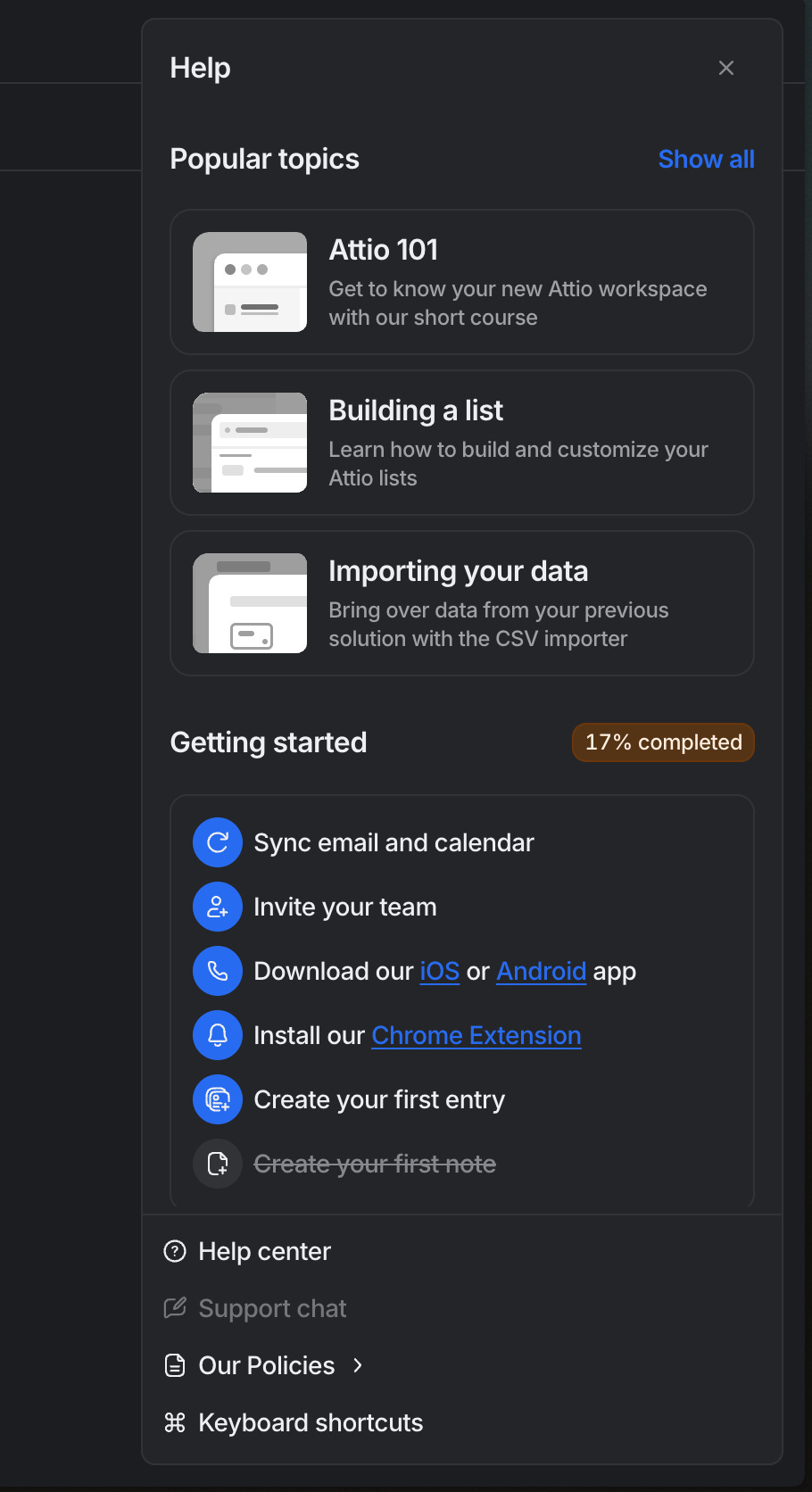

Tours and persistent onboarding

Once inside the product, Attio first points you around the UI with a demo.

Then, and this is always available, they have a sidebar that can be pulled up to guide you through onboarding.

Each step listed under “Getting started” makes Attio more valuable and becomes a strong indicator for retention and plan expansion.

This is almost always a good idea to have inside your software.

Templates: Eliminating the learning curve

After being shown around, one of the first things a user will do is create a List. This could be a list of all the VCs you know in San Fransisco, or literally any other collection of relationships you want to manage.

But knowing where to start could be tricky, and people want value fast. So, Attio has a wide selection of templates to get you going ASAP. From Kanban boards to spreadsheet-like list views, picking a boilerplate place to start means they de-risk people from getting lost in the sauce and not hitting that Aha moment.

This has worked wonders for platforms like Notion, Figma, Airtable, and the other no-code company Attio keeps.

Migration Assistance: Making switching easy

One of Attio’s biggest moats also happens to be the moat of their competitors.

If you’re setup in a CRM with existing workflows and tons of data, there’s big friction around switching CRMs.

Like being deeply embedded in the Apple ecosystem with your apps, phone, computer, watch, etc. Once you’re in, leaving is hard.

And because Attio is late to the CRM party, many of their target market customers are already using a CRM.

So, to combat that and eliminate switching friction, they make migrating from one CRM into Attio relatively simple.

To see and experience this stellar onboarding yourself, try go through their flow.

Layer 3: Repeatable Value

The real driver of sustainable PLG success is where users form a pattern of use around your core value action. This is what drives long term engagement and retention—without any habitual usage you (1) risk a leaky bucket and (2) minimize the product’s ability to qualify leads for the sales team.

Looking at Attio, there are a few main sources of repeatable value outside of their core loop that keeps people locked into Attio:

Great feel and experience.

The UI/UX is state of the art. It’s slick, relatable, and for anyone who’s ever used Salesforce—just the ease of use is an ongoing point of value.

How a software feels—whether that’s tactileness, sound, animation, humor, flow— is key to any PLG adoption.

One of my personal favorites, and a growing UI pattern of the slicker products out there, is their expanding library of keyboard shortcuts. It just makes getting around so easy and skips the slowness of needing to move your hands between mouse and keyboard.

Growing library of integrations.

By being able to connect Attio with your favorite apps, you can build more embedded workflows. Speaking of which…

Advanced automations

Automations are workflows that get supercharged inside Attio. You don’t need them, but the more of them that you set up, the more effectively you can work and save time repeating rudimentary data entry and tasks.

Infinite real-time reporting

Being able to slice up and segment all the data inside your CRM is super valuable. You can start simple with just a basic chart, or get more advanced and build out custom dashboards.

The more reports you generate (which are always kept up to date for you), the less likely you are to abandon Attio.

Multiplayer mode

How much value you get from Attio is a function of how many connected company emails and calendars are synced. This is a big loop for ongoing, and new, value. Every interaction over email or scheduled event by a team member brings in new data and makes Attio a more important tool in a company’s stack.

Growing template library

As Attio grows, they launch more and more templates that can streamline how easy it is to get your data visualized in different ways—often ways you wouldn’t have thought about without a template.

Here’s the takeaway: The best products have low floors and high ceilings

They move people along the product value curve really well. They do this by offering a super simple and quick path to value, while enabling users to discover and push the product further if they wanted to.

Layer 4: Monetization and Expansion

Typically, when you hear the word growth, it’s referring to user acquisition.

And while acquisition is a critical part of the growth flywheel, what many companies don’t realize is that monetization is the one of the most underutilized levers for growth in SaaS.

It’s the equivalent of personal income vs wealth.

Without income (acquisition), you can’t grow financially. But once you have it, your wealth is totally dependent on things like:

where you invest your money (savings account vs the market)

the fees you incur while investing (0.25% vs 1% will have a huge difference)

how long you leave your investments alone for

The same is true for any PLG motion.

A study from Price Intelligently, a software engine for pricing, looked at more than 500 SaaS companies and analyzed what a one percent improvement in acquisition, retention, and monetization did to their bottom line. Their results were wild—the impact of improving monetization was 4x that of acquisition in building business value.

Layer 1 and 2 = acquisition

Layer 2 and 3 = engagement and retention

Layer 4 = $$$

It’s worth really thinking about how to get this piece of the Iceberg right.

So, here’s the overarching question you need to nail: How do you create value and maintain trust with your customer while driving revenue?

In short:

Know a) who you’re building for and segment users by b) what they value and c) what they are willing to pay. Those three elements create your positioning, and that’s the foundation of a monetization and pricing strategy. Once you have it — you can figure out your price point.

From here you can segment your pricing and do all sorts of interesting things, like upsell them in different ways and price based on different value points.

Crucially, what you charge needs to be based on perceived value. That’s the value the buyer sees based on their needs, not what you come up with at your desk. The better you match your price to perceived value, the less likely you are to leave money on the table.

If buyers don’t understand or don’t need the features you’re offering, then nothing else matters. For example, do your customers care about all of your 20 features, or do they really just care about 3 of them? The argument (which has been proven in pricing master Madhaven’s book) is that you can be a lot more successful if you focus your pricing on emphasizing just the 3. Perceived value > value.

On Pricing & Packaging, you need to balance your Burgers and Shakes. Burgers represent the main reason people use your product. It’s your fundamental value metric, like storage for Dropbox, or seats for Attio. Shakes are premium features that boost the core value, but are not the value in-and-of themself. In Attio’s case, that could be unlimited reporting or deeper data enrichment—they are the things users need to upgrade to get.

Burgers and Shakes must work together to make one Happy Meal, and drive both conversion and expansion. In Attio’s case, users will get contextual upsells, like “Upgrade for more seats”, that push them to upgrade beyond the core value limit. These are huge monetization drivers because they are time-based, and catch a user when they have high intent, like inviting more teammates into their Attio workspace. Shakes typically require additional work around awareness and are dangled in front of users as a way to drive upgrades.

Attio strikes this balance perfectly, and it’s a key part of their land & expand strategy:

No credit card upfront builds trust, as people see value before being charged

They have 4 price plans, covering each ICP across the market spectrum (from solo entrepreneurs like me, to startups, to enterprise). What’s in each plan is based on what each of these buyer profiles need.

They price their product against network-based value (more members connected = more workspace value = higher price).

Attio has mapped the lifecycle of a target customer and looked at how to align value and usage over that lifecycle. This value pricing is attached to the size and growth of a company. If a sales org gets larger, they will expand their seats in Attio.

There are zero banners or in-your-face modals to upgrade. Instead of being aggressive in pushing the upgrade, they rely purely on Burgers and Shakes.

The Shakes are nested all through the product. Like this gentle paywall that appears when I hover over “Create Report” after using my 3 free ones. Great contextual timing.

This next point about pricing I found super interesting.

Attio is both more expensive, and more affordable

Through a combination of market research and speaking to users, Attio, as Nick said, “very unscientifically” chose an initial price.

For a product entering a crowded market, that approach to finding your price point makes sense because you have so many reference points.

Usually, in this case though, founders aim to be the bargain for money. In a commodity game, surely the lowest price wins? The idea is that by being the cheapest, you can land grab as many users as fast as possible. This makes sense if you’re building in a new market and there’s a clear first-mover advantage, or some kind of network or greenfield effect.

But, that’s definitely not the case with CRM, where the market is very established. And if you’re building a premium product like Attio, that’s where orienting around “When does it feel expensive but you'd still buy it anyway?” makes the most sense.

And this “unscientific” approach to “premium” has left Attio’s Pricing & Packaging in an interesting space:

Their plans are more expensive than challenger CRMs like Folk or Pipedrive, but;

Unlike these startups, Attio has a very generous freemium plan.

And of course, to no surprise, their plans are substantially a) more affordable and b) easier to understand than Salesforce’s are

Do the math

The last point I want to bring up around startup pricing is back-of-the-napkin forecasting.

I said this to a colleague earlier today…forecasting is a fool’s errand.

And I really do think that any forecast that takes you more than an hour is a waste of time. You will be wrong.

But, quick and directional forecasts that are not shooting for precision can be worthwhile. One case is with your price.

For example, once you’ve picked a price, you can do a quick gut check on market size. This helps with:

If you want to be venture-backed, as it gives you a high-level trajectory of how you grow into a $1B valuation (~$100M ARR). That’s $price x #customers.

Figuring out what your enough is as a founder. Maybe your goal is to build a lifestyle business and do a couple hundred thousand a year in revenue. A quick forecast can help you figure out how long it will take to get there, and how feasible it is.

To point it out, those are both selfish reasons that don’t benefit your customer. Your price should not be rooted in what will make you rich or help you raise your next round. Your price must be value based for the user. Don’t tweak the price in favor of your needs/goals.

But, if using a true value-based price doesn’t get you a decent forecast, then you may well be working on the wrong idea.

Okay, into the deepest and final layer we go. 👇

Layer 6: Flywheels

If you can pull off a product-led acquisition (PLA) loop, thus getting one cohort of users to send more users to the top of your PLG funnel, you’ll be well on your way. 🌱

Why? Well, to answer a question with a question, what’s the best channel for acquiring customers?

Whichever helps you scale as cost-effectively as possible. And PLA means your users naturally invite other users while using your product—for free.

Now, the notion of PLA often gets people tripped up. Having a refer a friend button by itself is not PLA, because it’s not a natural loop—it’s an artificially incentivized channel that just happens to be accessible from your product. It’s less effective because:

Most users don’t care about receiving a small cash reward—especially business users.

Cash incentives attract users who are more likely to churn

People get uncomfortable spamming their friends about products

True/natural PLA means you have a network effect, and that allows you to scale to your entire market without breaking the bank.

It’s the gold standard for growth for many reasons, but here’s a succinct one from Paul Graham:

Don't start a startup where you need to go through someone else to get users.

Generally, there are 4 ways you can integrate natural PLA into a product.

Encourage users to invite other users. Not for any reward, but because it makes their experience more valuable.

Turn your product into a billboard. When you send an email from your iPhone, or share a TikTok video, your email signature says “Sent from my iPhone” and your video is watermarked with the TikTok logo. Brilliant billboarding.

Encourage users to make shareable content. When folks like me create content on platforms like Substack, we’re self-motivated to share it with others in order to build our audience.

Trigger word of mouth. Either you create an incredible product experience and you delight users from entertainment (i.e shows on Netflix), or you delight them by eradicating a pain that they’re excited to spread the word.

Attio is doing all 4 of them. 👀

We’ll double click on each, but first, a different type of self-reinforcing loop.

The Chef Flywheel

Dogfooding is an overused term. Also, none of us eat dogfood.

I much prefer my term, The Chef Flywheel, because just like a chef testing his food, companies that rely on their own products to succeed will always build far superior products.

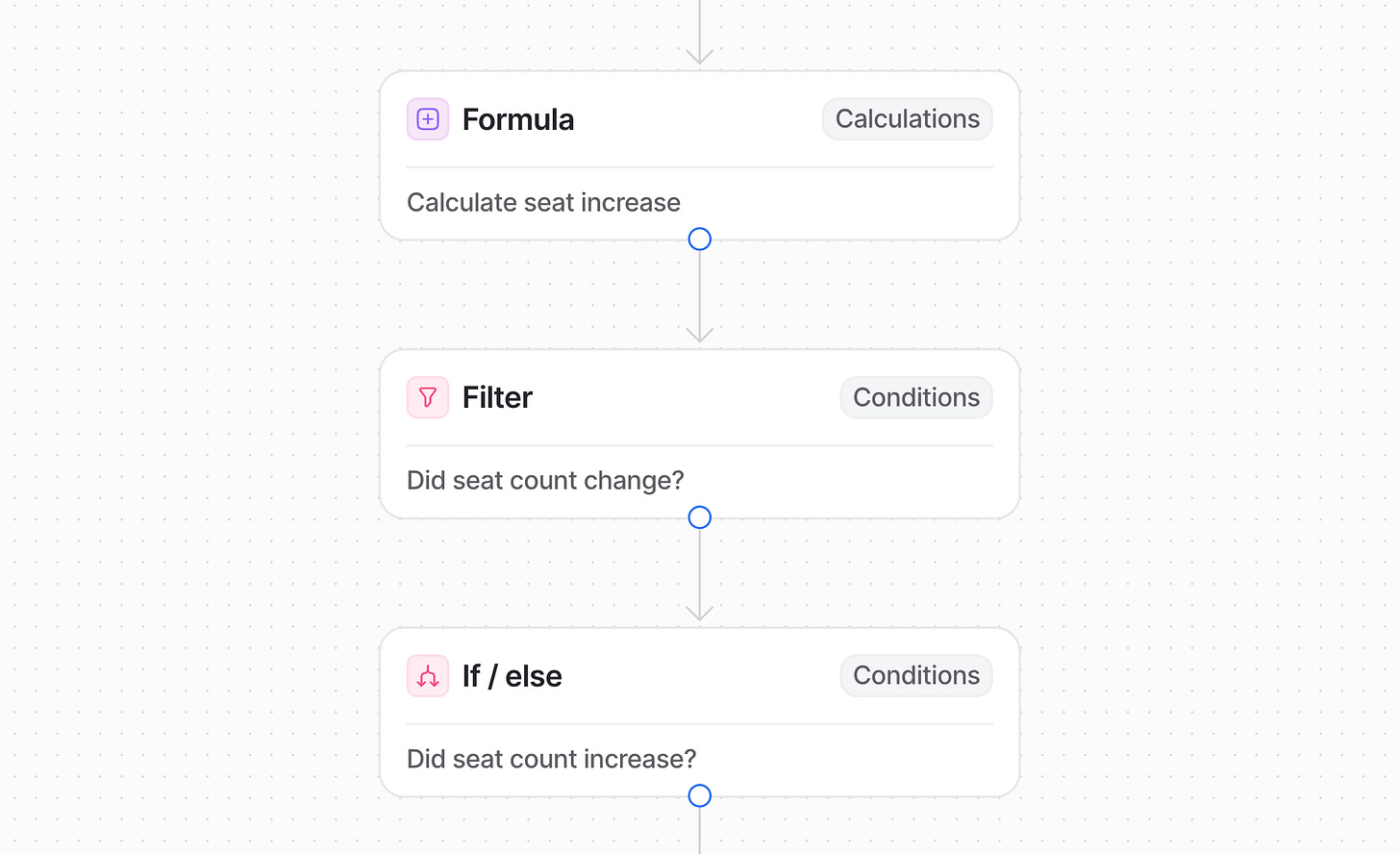

To explain…part of Attio’s land and expand play is identifying when customers are in a likely position to need sales intervention. For example:

Seat count hitting a limit

MRR climbing fast

Downgrading from a plan

This is the essence of product-qualified leads. Attio uses all of these signals to figure out when to use a human to help get folks across the line and upgrade. But here’s the cool part…Attio uses their own product to do all of this.

With Attio’s Automations templates and Custom Objects—just like their own customers—Attio no longer has to manually monitor these PLG metrics. Like this one for monitoring if your customers increase their seat count.

Attio uses their own product to grow, even further marrying their own success to that of their customers. By tasting their product all the time, they build a better product.

You always want to be your own ideal customer. Your biggest food critic.

The multiplayer flywheel

Attio is intrinsically a team tool that gets better when more people you work with are inside. Nick made it very clear in our chat that the biggest signal for long-term retention is when someone invites someone else into their workspace.

It’s a core loop that drives their growth.

Billboarding

I think this picture covers it…

Each email sent using Attio, at least by users on lower price plans, markets Attio across all their customers’ unique networks.

Free advertising. Love it.

Shareable community-made content

This is a flywheel that Attio are not actually tapping into yet as far as I can tell, but they are in a prime position to leverage it, especially given their investment in community.

In short, Attio have two template libraries:

Templates for Lists (i.e fundraising boards)

Templates for workflow automations (i.e a churn monitor)

Right now these are all internally generated, which is of course limiting.

Attio’s audience is builders, so, why not let the builders share what they’ve built?

I’d certainly want to try out some workflow that someone like Lenny created.

I’m sure this is coming, and much like how community-generated templates have powered Notion and Figma, I think they can do the same thing for Attio.

Productizing and fueling word of mouth growth

Word of mouth can’t be stimulated. It will just happen when you make something great and get it in front of the people who need it.

But once you see it happening, you can lean in to support and facilitate it.

Here are 2 ways Attio are nurturing organic growth:

Gamification. This is rare to see in B2B, but I’m all for it. To support their customers who are already spreading the word, Attio recently launched a referral program that rewards folks with points. One billed seat = one point, which can be redeemed for actually cool stuff.

Help me get a monitor please…Try Attio for Free :)

Posting updates to Twitter and building in public. Another thing that helps accelerate WoM is posting about feature updates on Twitter frequently, as well as through email with customers. As Alex says, “We post even the smallest stuff because every update counts. The more you inform, the more ‘compound interest’ you create.”

And that, friends, is Attio’s PLG Iceberg. But where will it take them from here?

Part 3 […in video]

Future: Where Attio is going

The Rebel alliance is just getting started, here’s how I see the above growth motions propelling them forward, what I see them focusing on next, and my take on the bull and bear case.

Instead of writing it out, because there’s over 10,000 words you’ve already read, here’s a quick video.

Cheers! 🥂

Alrighty, that just about covers it for today!

Huge thank you to Nicolas, Alex, Alice, and Ilan for helping make this piece possible.

To show our appreciation, if you’re a founder, your relationships impact your revenue, and you think Attio is pretty neat, why not take Attio for a spin. I’ve been thoroughly enjoying it…if the above didn’t make it obvious :)

Otherwise, as always, thank you so much for reading! If you learned anything new today, you can sign up here for more issues. Also, consider sharing this post, or perhaps becoming a paying subscriber to support my work.

Until next time.

— Jaryd ✌️

Awesome writeup as always! And thanks for sharing the billboard ;)

Fantastic write up, Jaryd. Super educational and very insightful. Attio looks awesome!