How Atlassian Grows

Lessons on kickstarting and scaling a B2B/enterprise business from one of the greatest go-to-market machines of all time.

Hi, I’m Jaryd. 👋 I write in-depth analyses on the growth of popular companies, including their early strategies, current tactics, and actionable business-building lessons we can learn from them.

Plus, every Friday I bring you summarized insights, frameworks, and ideas from best-in-class experts to help us become better builders.

Hi friends, 👋

Today we’re going to be looking at an absolutely legendary company in the tech world. One ubiquitous with the agile development movement. The company behind the products powering likely every startup we’ve looked at so far. The unconventional unicorn, born and raised far away from the gravitational pull and influence of Northern California.

Back in 2002, while Ben Affleck was being named People's Sexiest Man Alive and Gollum was beginning his infamous rant about “my precious”, two college dropouts, Mike Cannon-Brooks and Scott Farquhar, said fuck it to wearing suits and ties and working for the man.

Entrepreneurship equated to unemployment, and a joke, in Australia back then. When they launched Atlassian with many judging eyes watching — they had a simple goal: Sell one piece of software a week, no matter what, and we’ll live.

To achieve that, and by virtue of situation and necessity, they ended up trailblazing a little something you know today as product-led growth.

With that, $10K in credit card debt, and a few other contrarian strategies — they built their enterprise software business to $2B ARR and a $42B valuation, all while bootstrapped and with no sales team for a large part of their lifetime. Oh, and legally settling split decisions between shareholders for a multi-billion dollar company over rock-paper-scissors. That’s rock-n-roll. 🤘

Today, Atlassian is playing an important game — the game to win and own the DevOps pipeline. They’re a key player in this $7B market, and their suite of products is used for all sorts of endeavors, like building software, pizza delivery, exploring Mars, and designing cars. Jira, their iconic issue tracking and project management tool, is used by +250K businesses (including 83% of Fortune 500s), and through brilliantly executed M&A integrations and an app marketplace — they’ve got the entire product development lifecycle covered.

And when you’re valued at over 6X your market size and growing your annual revenue at ~30% as a 21 year old company — you’re doing something right. 👏

So, it’s no surprise Atlassian has gone down in history as one of the most efficient go-to-market machines of all time. And in an overheating economy where venture capital is dry, unicorns are dead, and it’s the camels and zebra who survive — GTM efficiency and sustainable growth have never be more important.

On that note…let’s break down their strategy.

There’s a ton of concrete advice for builders to be learnt from their journey. My one ask: If there’s even just one takeaway that sticks with you today, please consider subscribing and sharing this post with a friend or two. And speaking of…big shoutout to @kasperkamperman for winning our competition from How LEGO Grows — your support is how this newsletter grows.

Ok, shameless self-promotion over. 🫠

Let’s get right to it.

[NB: If you’re in your email, hit this button to read the full thing]How They Started

In 2002, Sydney was not a place for tech entrepreneurs.

There was no startup ecosystem.

No venture capital.

No hungry talent willing to bet it all. The big cushy jobs at three letter companies were far too appealing, especially without startup success stories to tease anyone in.

In other words, it was the complete opposite of all the hype and momentum happening across the ocean in California.

But, two young upstarts didn’t care. With a healthy combination of blind optimism and no fucks given — Mike Cannon-Brookes and Scott Farquhar decided to go ahead and plant their seeds in a barren, rainless dessert.

They enter early 2000s startup-land in Australia.

And the best part of this story — they succeeded not in spite of of the overwhelming odds against them, but because of them.

If a tree is planted in tough soil, without rain, poor light, and rough winds — and it figures out how to survive — that’s a strong and durable MF.

On that note…meet Atlassian. 🌳

And rolling with this plant analogy, let’s look at where the seed came from. 🌱

Breaking away 🐟 🐠 🐟 🐟

In the late 90s, Mike and Scott were at the University of New South Wales in a work/study program. They’d do some studying, then be assigned out into the real world to get some work experience.

Sounds good, except on Mike’s very first placement just 6 months into the scholarship, he realized he hated the whole idea of working a corporate desk for somebody else. Staring at the looming ladder to climb above, and running the same old rat race, like everyone before him.

So, as many a story goes, he dropped out and starting building an idea of his own.

It was called BookmarkBox, and it synced peoples bookmarks across their browsers. Mike wrote the code and operated the business for a year, raising some friends and family money to keep at it. But, like I said…Australia was a tough place to grow. And at the same time, another US company, Blink, raised $35M to do the exact same thing.

As much as he appreciated his dad’s $10K, it didn’t quite size up, and he knew they’d get crushed.

But Mike had built something with a couple hundred thousand users, so he reached out, flew to NYC, and sold to Blink to at least get something out of it.

He paid people back, including his dad. Which, funny story, because he thought 0% ROI was a bad investment, he skipped the opportunity to be first to invest in Atlassian.

Oopsie.

Meanwhile…Scott was still in the program chipping away at different company tours, including IBM and PWC. He had a similar bitter taste forming, getting very turned off by the culture and way that corporations in Australia worked.

So…we have two ambitious people frustrated with the standard career path and some cash in the bank from an exit. The stage was set.

Now, for a lesson on not ghosting people.

2-words to mint a billionaire 📬

Sometimes you look back on a moment and realize you screwed up.

Like the guy who paid for pizza with 10K Bitcoin back in 2010. That ended up being a $650M order. 🥲

Or the guy who turned down the opportunity to invest $50K for a third of Apple. Today, that stakes worth the GDP of Belgium (the 24th highest in the world). Big tears 🥲.

Or, all the students who ignored Mike’s email to help start his next venture. His pitch: “Before you all take grad jobs, do you want to do something crazy and try our own thing?”.

Mike's only taker was Scott, who replied with a simple “I’m in”.

He turned down the safe path for the wildly uncharted and more risky one. He saw what Mike had done already, was disillusioned by corporate, and decided to back him.

As he recalls:

There was no technology industry in Australia at the time, nor a startup industry. Our university professors disowned us. Our parents looked the other way. Our original goal was to earn more than AUS$48,500 [a grad salary] and not to have to wear a suit to work.

— Scott

When the two joined forces, they had no idea what their startup was going to be, they just new it was going to be something digital and in the tech space.

Bad business 📉

Mike and Scott’s first stab at a tech startup, in their own words…was a terrible idea.

There was this enterprise software company out of Sweden that they thought had an excellent product, but terrible support and documentation. The idea: provide customers with great (missing) documentation and support for it.

AKA — they’d run tech support for someone else’s software. And they did this totally rouge. No involvement or buy-in from the company, just two dudes from Australia writing docs and running a two-man support shop from their bedrooms at all hours of the night (even taking customer calls at parties).

To make the operation official, they founded Atlassian. They registered the LLC for $100, and split the 100 shares 50:50.

Speaking of shares. I found this part of their story hilarious. When they formalized Atlassian more and got some legal help — one of the things they needed to address was how they’d officially resolve issues and disagreements given the equal split.

Of course, what other way would there be besides Rock-Paper-Scissors.

And seriously, no BS — that was the clause in their formal shareholders agreement all the way up until they IPO’d, where I guess they knew Wall Street would’t have been too happy with multi-billion dollar decisions resting on rock beating scissors.

So, we’re at Atlassian circa 1999-2000. Their business model was simple — a customer pays $360 if Mike or Scott successfully resolved their issue. The problem was, they ended up writing such great documentation that the only calls they got were the hardest issues, and at the worst hours. This quickly made the $360 bad business. As Mike recalls, “we kept getting phone calls at 4 am in the morning, and my girlfriend at the time was very unhappy with this business.”

With their computers running all hours of the day, phones on full volume, and alternating what nights they were on call, it’s no surprise they stayed in the service game for less than a year.

But it certainly wasn’t a year wasted. In fact, what they were busy working on to make their lives just a little bit easier was actually soiling the ground for what came next.

From bad, to ASS 📈

What they’d been doing, was actually writing their own software to make the support business run better. Like wikis for docs, an email archiving tool, and they even wrote a support tool called the Atlassian Support System — which initially went by its acronym. 🙃

Well, ASS was an app that allowed them to write tickets, manage issues, and was built to make their own life providing online support and managing tasks more efficient. Sounding familiar?

Combined with the operational nightmares of being a support shop on different time zones, writing software showed them where their passion actually lied, and where the real opportunity was. They saw how the Swedish company got to write the software once and just continuously monetize it. Whereas each dollar they made was directly correlated to the time they put in.

In other words, software was far more scalable. And again, this was 2001 — “software eating the world” wasn’t a thing yet, so that wasn’t such an obvious insight.

So they pivoted, and went from supporting software to building software.

Mike and Scott had created 3 different apps that year which they used themselves, and decided to put them out into the world to see if anyone else needed them. They did some promotion, and ASS was the clear winner.

As developers themselves, this interest in ASS from the developer community really felt like a great fit. They had first-hand experienced the need for developer-specific tools around tracking issues and working on shared tasks, and nobody had built project management or collaboration tools yet for devs.

So they got to work, borrowed Mike’s credit card, and in 6 months — with ASS as the nuts and bolts — they released the first version of Jira. With it, Mike had $10K in credit card debt, but more importantly, they introduced the novel idea of a single place to manage multiple software projects. 💡

And a good 21 years laters, it’s still Atlassian’s biggest product.

Let’s see how they did it. 🕵️♂️

Atlassian’s $42B growth machine

We’ll start with how Mike and Scott broke Atlassian into the market, getting into the details of how they started getting those critical first few users, through to their the first 1K.

Atlassian’s go-to-market playbook

Let’s pull in a framework here to help us investigate and map it out.

And, what better model than leaning on Caroline Clark’s, who worked at Atlassian as one of the first go-to-market hires for Jira. Basically her framework, dubbed “Go-To-Market Nirvana for B2B”, consolidates her learnings and views on figuring out the best GTM motions at B2B companies.

The three key pillars of her playbook are:

Who is your ideal customer?

How are you going to reach them?

How are you going to scale?

With this as our tool, let’s dig into what Atlassian did.

1. Finding their specific WHO

When starting a company and mapping out all the cool things you want to be when you grow up, it’s natural to think of all the different types of people that will use your product.

You want to have lots of ICPs — because the broader your appeal, the bigger your market. And it’s exciting to think about how these people will one day get value from what you’ve built.

They keyword there is one day.

Trying to start out by being everything for everyone before you’re even anything for someone is a terrible idea. I know, because I’ve made that mistake before.

The more niche you can start, the more successfully you can find your way into the market, and expand from there. That’s how you move towards various ICP’s.

This is the concept of a beachhead which we unpacked in How Canva Grows.

Atlassian’s beachhead was developers.

Since Mike and Scott were devs themselves, they were already dog-fooding their own product and seeing the pain points — giving them a lot of customer insight and empathy to others like them. And what’s more:

Software developers are a great audience because they go out there and find tools to solve their problems, and they work with a lot of other groups in a company. That makes them a great entry point into the larger company.

— Scott Farquhar via Acquired podcast

To Scott’s last point, that’s a very valuable strategy for B2B and enterprise growth. It’s a land-and-expand play, which looks like this.

Devs would set off a domino effect, which is how Atlassian won more and more seats inside a company.

So, bringing this to your own work — how do you go out and find who your ICP is?

Our look at Superhuman was the best example I’ve seen on honing in on a very specific specific audience.

They reverse-engineered product market fit from the very beginning and used this approach to nail their High-Expectation Customers (HXC) and craft a beautifully concise positioning statement, by:

Setting up a survey to ask their users "How would you feel if you could no longer use your Superhuman?”

Segmented their audience to paint a detailed picture of who their HXC

Analyzing feedback to flip on-the-fence users into fanatics

Using that feedback in their roadmap to drive improvements by doubling down on what users love and addressing what holds others back

Continuing tracking product/market fit over time as their most important metric

Once you’ve done the research, you end up with something like this. 👇

2. How they reached them, and the OG’s of PLG

Knowing who you’re targeting is the first step. Acquiring them is another beast.

Especially when it’s 2002, a recession, and you’re a 2-man software startup with $10K in credit card debt while in Australia. 🏝️

But, launching Jira in Australia raises some very interesting factors to consider in their success:

They were far away from tech hubs in Northern California

There was less competition, less noise, fewer distractions

There was less access to startup capital (in their early days…there was none). This meant no investors breathing down their neck and more room to experiment, build a sustainable model, and figure things out without being pushed to grow at all costs.

And to (1) try make Mike’s credit card whole again, and (2) just survive and avoid those suits — they had one goal: Sell a single copy of Jira per week, initially priced at $800.

This would allow them to eat and pay rent. As Scott recalls, “if we didn’t sell 1 copy a week, we were screwed. The fear of death was clear.”

But back then, all the examples Mike and Scott had to look at around how to actually sell that one copy a week were sales-led. But they didn’t have money to hire sales people. 🤔

So, this situational circumstance and necessity all led to their novel go-to-market model: Atlassian needs to be bought, not sold.

We knew that in order to reach that goal whilst remaining in Australia, we’d have to sell online, at low prices, and in massive volume. So our business model was heavily influenced by geography – and it worked.

Our experience with computers was downloading and using computer games, and that was a different world to the way that enterprise software was sold back then.

But not today, these days you download enterprise software in the same way as computer game, and we were at the forefront of how that happened, and the thing we built in that model is actually less important than the fact that we changed the business model of how people adopted software to be much more consumer like.

— Scott Farquhar, via NPR

In other words…they created what we know today as product-led-growth (PLG). 🙇

And for this way of acquiring and converting customers to work, they’d knew they need:

An audience which actually prefer trying and buying their own products, and;

A product which can be adopted self-serve

Well, as Scott said earlier, their ICP of software developers checked #1.

And for #2, they came to a great insight. This way of selling Jira would create a tight feedback loop between product, marketing, and their end-users — setting up a highly-efficient distribution flywheel to propel the business forward.

As Jay Simmons, former Atlassian President, explains:

The flywheel begins with creating a great product. Back in the early days of Atlassian, we talked about building a remarkable product. We chose the word ‘remarkable’ with intention. We wanted to build a product that people felt compelled to remark upon. That would then build word of mouth which would help us acquire more customers. But the flywheel begins with a great product that meaningfully solves problems for customers. And then we tried to remove as much friction in front of the customer’s path as possible.

Their GTM distribution loop looked (and still looks) like this. 👇

This was a huge advantage sales-led companies didn’t (and still don’t) have.

Mike and Scott were strong believers that their customers wanted to help themselves. So they architected everything around that self-service model. As Jay notes, “First you have to build a great product that people can discover on their own, begin to use on their own, onboard effectively on their own. If you can’t do those things, it’s not going to work.”

So they ditched the “Contact Sales” form everybody else was running with, prioritized an intuitive onboarding process that did all the explaining/selling itself, and built their homepage up to look mighty impressive so that people would be more trusting of trying out their enterprise software without the typical sales pandering.

In the early days, our website would always make it seem like we were bigger than we were. It would say “Atlassian has a number of international offices” — but that number just happened to be one.

We’d have sales, account, support (at) Atlassian, but that would all go to Mike and myself. If people called up and wanted to speak to accounts, we’d be like “sure, I’ll get accounts on the line” and hand the phone over to Mike from accounts. We did every job there was to do. Put different hats on when we needed to. And different voices.

— Scott Farquhar

🛠️ And a quick note for builders: Once you have your ICP and you’re wondering if PLG a viable GTM strategy for you, ask yourself these questions:

Who buys your product, and is it the same as the person using the product? Can you make it the same person, at least for the evaluation period?

Do your users enjoy trying out new products, like software people do? How can you make it easy for them to do so?

Who are going to be the internal champions for your product in an organization? What job titles do they have, and how do they discover new products?

Finding their first 10 customers and getting that flywheel in motion

Let’s bring in our GTM Nirvana framework again to look at different acquisition channels:

Looking at that first channel — Atlassian had a distribution advantage. Mike and Scott were popular with the open-source community, and focused on selling to this receptive group when they first launched.

Open source helped. Communities (mailing lists! newsgroups! IRC!) helped. Constant marketing (Jira Jira Jira Mike was my name for a while). Free beer. Uneconomic prices. Great customer service.

— Mike Cannon-Brooks, CEO via Lenny’s Newsletter

This approach of tapping your personal network for early B2B customer acquisition is very popular. But a personal network will only take you so far. So, here are some of the other things they did that worked well to get the word out…

Stunt marketing to the right communities. Mike and Scott quickly started heading to were their potential customers were spending time, picking IRL water-cooler communities like conferences/events in the US and Europe. Given they couldn’t afford booths, they’d pull a bunch of creative Guerilla tactics, like: (1) sneaking in Atlassian flyers and leaving them at bars and on other booths, (2) cornering people to run demos, and (3) sponsoring live attendees at a Belgian podcast with beer. Except, before they handed the beer out at the door, they slapped Atlassian stickers over the label.

Digital ads. This was the early internet, and paid ads were much cheaper and had better click-throughs. So, even with a tiny budget (sometimes $100/m) they saw solid results running Google Ads.

Referrals. In a similar way to how devs go and find solutions to their own problems, they also share those solutions once found. Dev forums are often a pot of gold for finding new tools and ways of doing things — and because Jira was a remarkable and novel product — word was spread.

With these four early channels, they were able to get to about $100K in sales at the end of Jira’s first year. And at this stage, as Mike recalls, they were still very much “hands to hands” with each new customer.

He also remembers a game-changing moment that came shortly after. One day, American Airlines, out of the blue, faxed them some money (yes, we’re a long way from Stripe). "That was the fax that changed our lives. We went from selling one copy a week to selling ten copies a week, and then it just kept going."

Which leads us to the third and final part of Caroline Clark’s framework…how do you go about reaching the N-th rung in your customer base?

3. Scaling to reach their first 1K customers

It took Atlassian ~3 years to hit the proverbial 1,000th customer.

While they continued to use the channels above, here’s some of the other things they started doing that propelled them forward.

Growing with a different kind of sales force

Simple and transparent pricing (KISS)

Improving the product with user groups

Launching their second product — Confluence — and the beginning of cross-selling

Let’s zoom in.

Growing with a different kind of sales force 🧑🤝🧑

In the early days, rather than building an army of salespeople, Atlassian invested in what they called product advocates. Instead of selling the software, the advocates would focus just on moving people along the product value curve, hopping in when people hit friction points and getting them to max product value.

We would say to every customer, ‘Let us know how we can help.’ Our product advocates were absolutely focused on the success of the customer and they were there to remove whatever potholes the customer might step into. They’d answer a question on product capability, or competitive alternatives, or pricing, but with a great answer, they would then send the customer back into the self-service path.

— Jay Simmons

By having one advocate to roll through many customers, and building everything around self-service — Atlassian was far more capital efficient than other companies. Dollars coming in went heavily into product development to make that scalable flywheel spin faster. And they stayed away from artificial boosts, growth at all costs, and unfavorable upfront investments in sales and marketing.

In other words, they were building a camel business:

They were resilient: Preparing for the future through thoughtful, strategic growth.

They were cautious: Maintaining reserves to help get through tough times and replenish during the good. Their value was in being financially conservative, hiring the right team, and focusing on building the technology and biz model that was revolutionizing the industry.

They were committed: They were dedicated to business-building fundamentals and stressed positive unit economics early on, and every day, to ensure impact on long-term success.

The were customer focused: Their products and business model were all driven by customers’ needs.

As Jay says:

Once you go down the track of scaling with manpower, it’s very difficult to say, “Woah, we could actually fix all these things in the product, and then we wouldn’t need as many people.”

Once your train is set in motion, it’s difficult to jump to a different set of tracks.

And Atlassian viewed this bottoms-up, self-service, funnel as a core part of the product in an of itself. They obsessively watched people going through it, figuring out where there was friction, and experimented with different ways to optimize it. Jay notes, “If somebody went through an evaluation of the product and said, ‘No, I’m not going to buy it,’ we would spend a bunch of time understanding what the headaches were that convinced you to go somewhere else, and look for patterns that we could smooth out.”

We are not anti-sales; we are pro-automation. We take an engineer’s philosophy to everything that we do. We are really about scaling the business.

— Scott Farquhar via SmartCompany

Simple and transparent pricing (KISS) 💵

Pricing is an essential thing to nail as a PLG company. There’s no salespeople to hash out terms and explain your value, so your pricing page has to do all the talking.

This means your pricing model needs to be clear and straightforward to reduce friction during the purchasing process. It should be easy to understand and predict what it’s going to cost without needing to conduct more research or having to “Contact Sales”.

Just be clear and and upfront with people from the get-go.

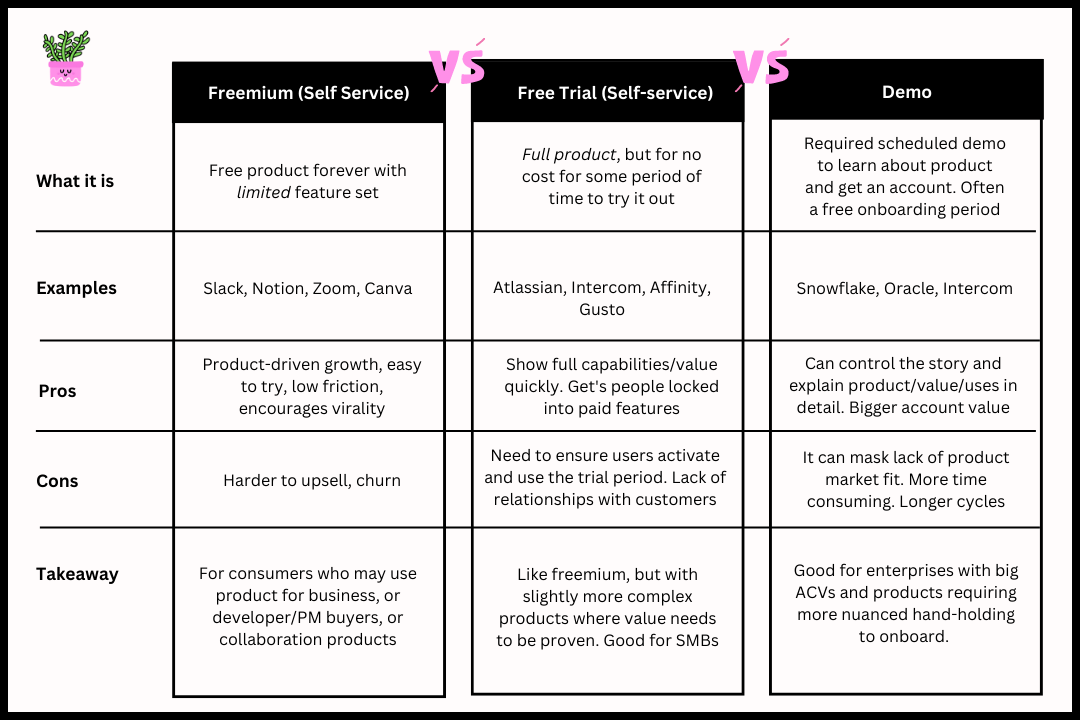

Now, as a B2B company, you typically have 3 hooks on the pricing front to get people to try your product:

Eventually, most companies end up with a blend of these strategies. Like Atlassian today, who has a tiered pricing structure with trials (free, standard, premium, and enterprise). But, on their path to their first 1K customers where they were on a quest to get into as many companies as possible, not just the companies with the most seats — they kept it much simpler.

They went with just a single price point for Jira, based on seats, at just above free.

[In the early days], we were so focused on reducing the cognitive load on the customer that was coming to us. And if you have four different versions at four different price points, that’s very difficult to help the customer wade through.

It helped us when we were unknown and young and small because it was just so simple — the KISS principle actually worked in our favor, where you just came to the web and it was like, ‘Oh, Jira’s one price’. I just need to think about the number of users, I don’t need to think about, ‘Does it include this? Does it get SSO and the security stuff or no, that’s in the enterprise package. Is it worth twice as much for that stuff?

There are all these questions that the customer gets bogged down into thinking about and that’s friction. [Which] can be okay in the right context with the right approach, but in our particular case, we chose not to introduce it. We were just going to make it simple. We're going to go for high velocity volume customer acquisition, and we're going to reserve future opportunity to have those expansion conversations with those customers.

— Jay Simmons, via First Round

Pressing on that last comment of Jay’s there a bit more. To to do that effectively, they used a free trial to bring users in, and then focused on getting them hooked so they’d then set off a domino approach and get others join. And with a low price point, people could easily try and buy Atlassian with a credit card rather than going through the headaches of financing.

As mentioned, they eventually expanded their pricing structure. But by then, as Jay says, “They’re already hooked. They’re already deeply committed. They love the product, and it’s used by thousands of users. Now they just want some extra security features and if we want to charge them for it, it’s probably easier.”

Improving the product with user groups 👀👂

Before it was cool and easy to coordinate online — Atlassian was organizing regular in-person user sessions.

Mike and Scott quickly saw user groups as an excellent opportunity to interact with their customers (and potential customers), build relationships and brand advocacy, as well as build a tight feedback loop with their end-users and product teams.

And they got all of this value for the price of a just few pizzas.

Going back to that core distribution wheel - following community-led product development is what helped them build great products.

And as a takeaway, remember from “Why Community-Led Product Development Wins” that regardless of your company stage:

The customer is one of most important people on the team.

You can’t build empathy for the customer by only relying on secondary sources, you have to immerse yourself in their problems by talking to them directly.

You should build a community to have daily interactions with customers about the product and their lives — it helps you build better products.

And the last thing they did in their path to 1K customers was launch a second product just a year after launching Jira.

That’s a pretty unconventional move, but it set in motion the next evolution of Atlassian as a business — moving us from Act 1 to Act 2 in their GTM strategy.

Confluence and cross-selling

So Jira was just a year old, growing nicely, and bringing in revenue. Conventional wisdom would be to keep going deep on that specific problem (issue tracking).

But from the get-go Mike and Scott where on the lookout for other revenue streams.

At the time wiki technology was gaining traction in the developer market. They saw it as an overlapping problem for their same ICP (one they themself were also experiencing), so they leant into the opportunity and built Confluence — a standalone wiki-based workspace for teams, designed for enterprise.

They positioned it as a dev team collaboration platform that made knowledge management easy.

Investing attention and money into a brand new product so soon was a risky move, because lack of focus on one could have led to failure of both. Like Jay Simmons says, “Every time you create something new, it’s going to take away from something that’s already here that also needs more coal in the furnace.” But Mike and Scott’s thesis of there being other directly-connected problems that they could solve paid off.

And I think a key reason it did was that they took a multi-product strategy approach, vs bundling it all together under Jira. Because, by having two stand-alone apps, they didn’t risk muddling use-cases up and making it a harder to explain product.

Jira did issues. Confluence did wikis.

Except, they happened to play very nicely with one another, which they noticed dev teams were starting to love. This led to a very neat idea. 💡

Cross-selling

Simply, this is a strategy to move customers from one complimentary product to another, layering in value of product X while using Y. If done with very targeted customer journeys, it’s a powerful sideways distribution tool.

To compare it to up-selling, which Atlassian started doing with tiered pricing of the same product: 👇

We began to build this muscle around how you think about cross-merchandising, cross-selling, and upselling. How do you think about pricing and packaging around multiple things?

Every product in Atlassian’s portfolio is effectively a product that a customer could begin with or a product that they could expand to. I can start with Jira and expand to Confluence. I can start with Confluence and expand to Bitbucket. I can start with Bitbucket and expand to Trello.

— Jay Simmons

And the strategy was wildly successful. Confluence customers became Jira customers, and visa-versa. Today, over 90% of their customers paying $50K+ a year have purchased more than 3 Atlassian products.

This is a great showcase of embedded value. As companies become more entrenched in Atlassian, they build up a great moat for themselves due to things like:

🌐 Network effects: Like being an Apple user….once you’re in, the ecosystem is amazing.

😣 Switching cost: Again, like Apple, once you’ve got the iPhone/Mac/Watch — habits are harder to break and the effort/cost to change goes up.

🫰 Scale economies: Their CAC is really focused on getting a company to use one Atlassian product. From here, it’s much cheaper to cross-sell to another. Meaning, once you have a customer, the cost of gaining incremental revenue goes down.

Now, Atlassian tried many things to cross-sell, but according Matt Ryall, ex Head of Product at Atlassian, these are the three strategies they found to consistently work:

Build useful integration features to ensure that the products work well together. Confluence and Jira both had features that connected the two products starting from 1.0, which made them a natural set to buy together.

Bundle related products together as a default evaluation setup, e.g. Jira and Confluence. This is like how Microsoft used to sell Office as the bundle of Word + Excel + Powerpoint. We didn’t even discount (and still don’t, I believe), but people still bought them together because they worked well together.

Suggest other products only when appropriate based on customer behaviour or data thresholds. For example, a Trello customer might see a “try Jira” popup once they hit >100 cards on a board or >10 boards. A Jira Software customer with a “support” ticket type might get a suggestion to try Jira Service Desk.

We tried a number of cross-sell marketing campaigns (e.g. emails to customers of our other products) but they had only limited success. For cross-sell emails to be successful, they need to arrive just when a customer is getting started with a product, or coincidentally when they happen to really need something. Just emailing them at random times was ineffective at best and annoying at worst.It’s important to note that you shouldn’t focus on up-sell or cross-sell at all until you have a very successful product that customers are willing to buy. Especially in the case of cross-sell, each product needs to succeed or fail on its own terms as a product, and then cross-sell is a slight accelerator. You definitely don’t want to send your best customers to try out something that isn’t ready for prime time yet.

That’s a goldmine of insight for anyone working on multiple products. 🙏

So, with their peanut butter and jelly duo of Jira | Confluence — and the subsequent beginning of their DevOps ecosystem — Atlassian’s growth trajectory changed. By 2007, they had over 10K customers in ~100 countries. And they also found their way into big wig companies like Oracle, Citi, Boeing, AT&T, and even the US Supreme Court.

As Mike says, “We had two rocket engines driving us along, not just one.”

And with these two PLG machines working at full-throttle, Atlassian started using content to keep it all moving smoothly.

Fueling PLG with product-led content

Content can drive growth in lots of ways. The obvious one is SEO, but there’s also things like viral articles, user-generated-content (UGC), editorially produced assets, data-generated pages, etc.

All of these play an important role in building brand awareness, bring in people to the top of the funnel, and helping them understand how to get the most out of the product. Which, for a company leaning on PLG to drive customer acquisition, retention, and expansion, is an especially powerful fuel. ⛽

With this in mind…Atlassian has done three big things on the content side that have worked super well for them:

They’ve built an organic traffic engine, also giving them a big SEO moat

They’ve very cleverly created an association between them the Agile Software Development movement

They’ve used training to lock people in with Atlassian University

Let’s investigate.

1. Building an organic traffic engine 🔎

Content is a little bit like WD-40 for your marketing funnel, but you don't just spray it carelessly. You need to apply it to the areas that squeak.

If you're not investing in content, you're missing out on PLG's full potential as a growth lever. Even the term PLG itself is content marketing. It's also not only about PLG, content has a big role to play in sales-led motions as well.

More specifically, it's not just content for the sake of making content, but it's content that is on the one hand aligned with your product's goals. On the other hand, it brings something new to the table like your company's character or unique point of view on the market.

— Alex Zhitnitsky, Atlassian Senior Lead Product Marketer, via Heavybit

Ahead of the curve as usual…Atlassian began blogging in the mid-2000s. This was the early days of content marketing, long before large businesses fully understood the advantages of it.

So, while big companies were busy spending the bucks on traditional advertising, Atlassian was out there capitalizing on content marketing geared specifically towards developers, covering things like product features, technical docs, and how-to guides.

This built them an excellent reputation in the community, rallied them up a lot of attention, and got them into the race of building SEO authority earlier than anyone else.

And with content in the context of SEO, some companies use listicles to drive traffic and leads (Zapier), others targets long-tail keywords to build their SEO moat (Airtable).

Atlassian uses resource hubs.

These content pages speak directly, and deeply, about specific topics that their core audiences care about. This makes is easy to consume what you’re looking for without having to bounce around a general blog. Just take a look at their hub on Agile.

Similar to how we saw with Canva, this is great example of education being some of the best forms of marketing.

Learning-focused hubs like this bring them a consistent pipeline of leads and millions of dollars in traffic value. Plus, they are among the most valuable and heavily trafficked pages on their site. Just as an example, the agile resource hub ranks for over 85K organic keywords, attracting over 600K visitors. All with no ads.

Not bad as a sustainable way to feed the top of the funnel.

Along with these hubs, they also have their Work Life blog which features podcast episodes, guides, and research reports covering a wide range of topics. All together with their resource hubs — Atlassian have built a huge channel to bring in potential customers.

Leading to…

2. Building association with the Agile movement 💑

No shortages of these…but another brilliant move by Atlassian was to associate their brand (and products) with the Agile software development movement.

Agile development has become hugely popular, with Scrum and Kanban being common terms associated to it. And if I said what companies come to mind when you hear the word “Agile” — I’d bet a pretty penny you think of Atlassian/Jira.

I certainly did…and their product-focused content deserves some major credit for creating this very powerful piggybacking mechanism.

The benefit of this association being: As more and more companies heard of Agile and started becoming Agile shops — Atlassian was right there to capture their interest, teach them about it, and help them on that journey.

As Agile grew — so did Atlassian. 👏

3. Locking people in with Atlassian University 🤓

Every product has a value curve (especially B2B SaaS tools), which looks something like this:

Atlassian costs the same amount, whether you’re a noob with it or a expert.

But, the more you learn, the further you move along the the value curve. This maximizes what you get out of your subscription, makes you feel smart (because who doesn’t like knowing all the tricks), and drives your word of mouth potential and likelihood of sticking around.

Atlassian knows that.

So, how do they get people more invested in their product?

Well, in 2011 they launched Atlassian University — their free training and certification program. This has become a very useful marketing tool as it keeps their customers loyal and engaged.

Because, once you’re clued up on all the neat workflows, integrations, and hacks — you’re much less likely to abandon that expertise and switch to a competitor.

…

Now we’re at the part of the story where Atlassian was starting to grow up and reach some meaningful scale. It’s here where companies usually started exploring some mid-stage growth accelerants.

This is what Atlassian started doing:

Adding channel partners

Category/Business Line expansion (Playing the ecosystem game)

Strategic M&A

Let’s start with how they built a channel partnership ecosystem, getting them some “feet on the street” where Atlassian has little market presence.

Building a global network of channel partners

First, what’s a channel partnership?

Simply, these are business agreements where you tap into another company’s channel to distribute your product. Like how Google made early deals with Netscape, Yahoo, and AOL to get in front of people searching online, or how Netflix partnered with DVD manufacturers to get Netflix coupon’s dropped in their DVD player boxes.

If pulled off, this lever can be a game-changer.

So, when it came to building up their enterprise customer base, Atlassian prioritized building an ecosystem of partners to represent them in resale instead of scaling an internal sales force:

When Atlassian was really young, we would come across customers in the enterprise and they’d say, ‘I’m comparing you to IBM Rational and IBM is sending in a whole demo team and doing a dog and pony show, I want Atlassian to do the same thing.’ We chose not to invest in that directly.

Instead, we thought it was the perfect opportunity to build a channel partnership ecosystem, because if we wanted to make a push for the enterprise, those big companies were going to need some hand holding.

— Jay Simmons

If they wanted to get bigger in South Korea, for example, they’d establish a resale partner who operate in local time, sell in a localized way, and meet clients on-site.

This was far more efficient for them than tackling the challenges of building up their own sales force in each new country they wanted to push into. Which Jay notes as immensely complicated:

If you think about building an international business, a lot of companies will say, ‘I need my first boots on the ground in Europe.’ But it’s not just boots on the ground, because you don’t just need a salesperson, you have to think about how that person is supported with marketing. Eventually, there’s going to be tax implications for paying the salaries and how they’re transacting with customers locally. There’s a bunch of other stuff that comes with planting a flag in a particular country, and it can get immensely complicated.

This unconventional move for enterprise software bought Atlassian a nice wave of benefits:

Today, channel partners are a core part of their marketing flywheel. It’s also created a totally new ecosystem, with over 500 Atlassian channel partners around the world, each armed with their own sales force. And the value of this strategy is perfectly captured by these few words from Jay: “If it was just us, with a team of 100 people in Germany, that approach I believe is dwarfed by the thousands of partners in Germany that get up every day, without a business card from Atlassian, but are in essence working for Atlassian.”

So, we’ve looked at Jira and Confluence — both being propelled by self-serve engines, fueled by content, accelerated further by channel partners.

Which brings us to the last thing we’ll be looking at today. Act three of Atlassian’s GTM play:

This is, as us product people love to say…

The Big Picture: Winning and owning the DevOps pipeline

First, WTF is that?

Simply put, it’s how the software sausage gets made.

A slightly more detailed explanation — it represents the processes and tools that let developers and operators work together from 0 to 1 as they build and release software into the world.

Think of it like a cyclical conveyer belt with a bunch of stages, like: planning, coding, building, testing, releasing, and monitoring for feedback. It looks like this 👇

And just like how all cars come off the factory belt — all apps come via the DevOps pipeline.

Except in the software world, this critical convey belt is fragmented. There are lots of different tools/services teams use during the development process.

And if every tech product (and therefore company) touches DevOps, and the belt is fragmented — that’s a big opportunity.

This is the important game Atlassian is playing. The game to be the standard industry backbone from 0 to 1 — helping everybody make better sausages. 🌭

And here’s how they’re playing it: ♟️

Building their own products across the pipeline

Supercharging them with over 5K+ community-made apps from their marketplace

Filling the gaps by integrating with other products (their M&A playbook)

If you say so, Leo.

1. Building their own products across the pipeline

The first strategy here is fairly straightforward — they build their own native products to plug into different stages of the development process.

These products sometimes have overlapping audiences. Other times they’re built for separate operational teams. But they always integrate with each other and play very well together.

This makes a very compelling value proposition for teams already running on an Atlassian product to just lean in and become an Atlassian-first shop.

Which, you guessed it, means there’s a lot of focus on cross-selling.

Now, I’m not going to get into the weeds of each product they’ve made, I don’t think it’s necessary. The takeaway though is that Atlassian has paid extremely close attention to who their audience is and what problems exist in their lives. They obsessed with the overall customer journey, and true to their first vision of Jira (one place to manage software products) — have just expanded that offering 100-fold.

This is just like how Stripe expanded from their core Payments product into an entire payments infrastructure ecosystem, benefiting them by:

Higher margin products ⇒ more money ⇒ growth

New products ⇒ new personas + solving new problems ⇒ growth

An ecosystem ⇒ moats ⇒ customer lock-in ⇒ retention + growth

Atlassian benefits here in much the same way. And here’s a quick map I threw together of where all Atlassian’s core products fit into this larger pipeline.

That’s a neat, tight-knit, Atlassian environment. But, to truly make it an ecosystem, they opened the doors to third-party apps.

This move supercharged their own products —making them pound-for-pound more valuable— and brought their customers a whole bunch of new functionality that the Atlassian team could never feasibly build themselves. 🤌

2. Maximizing coverage with their DevOps Marketplace

Atlassian, yet again, was ahead of the crowd on a very important front.

They figured out the value of the now-ubiquitous open API. This was an important insight.

Why?

Because often enterprise software ends up getting overly complicated as teams build and layer in new features for specific use cases. This grows it into a monumental application, which is why demos, sales, and hefty on-boarding are often needed.

But that just wouldn’t fly with Atlassian’s PLG engine. So, APIs were the answer because it allowed smaller software companies and indie developers to extend Atlassian products with pluggable components to solve different use cases.

This kept the core Atlassian products clean and focused, while still unlocking Pandora’s box to infinite possibilities.

At first, it was just a matter of giving access to their APIs. But this was quickly adopted and lead to a steady stream of new apps getting built, which initially were just being listed and discovered on a public Confluence page. So, leaning into organic user behavior and this demand for modifications, in 2009 the Atlassian Plugin Exchange was born, which evolved into the more fleshed out Atlassian Marketplace by 2012.

It wasn't just a storefront and direct access to Atlassian's customers. We built a legal and finance framework and offered a native licensing system, payment, invoicing, taxes, subscription renewals, etc. so developers could focus on the things they love, like building great plugins.

Today, big, successful, globally operating software and consulting businesses have evolved in the Atlassian ecosystem, often in part because of the Atlassian Marketplace.

— Scott

Just like how Apple did with the App Store in 2008, making the iPhone infinitely more valuable — Atlassian made it possible for users to customize their products to meet the unique needs of their teams.

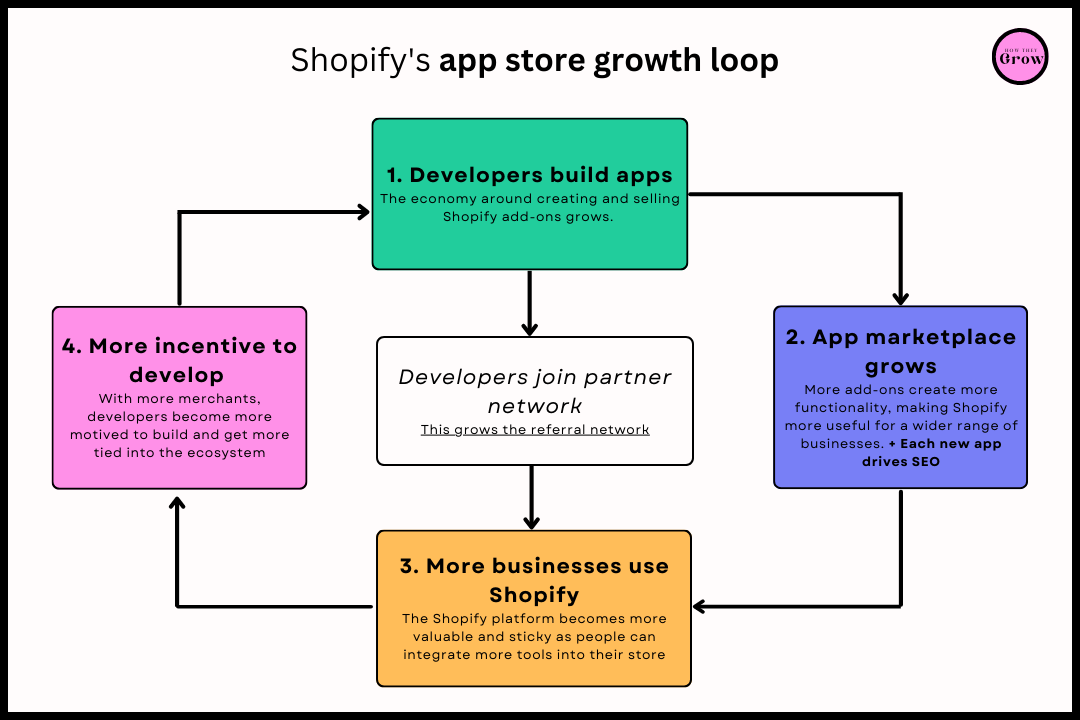

Today this model brings Atlassian a solid $300M in annual sales, with many multi-million dollar products having been launched by third-parties. Which, as marketplaces do, creates a nice growth loop similar very similar to the one we saw in How Shopify Grows.

Here’s an excerpt:

This massively widens their addressable customer base, because now more types of people can use Shopify for anything, or add functionality, do subscription sales, or do whatever without Shopify cluttering and muddying the messaging of the core product.

Referrals and their app marketplace were the first two things they did that really gave them strong engines to scale — but their app marketplace is what started building them defensibility through stickiness (their moat):

What [the app store] really starts to do is build the moat, where Shopify becomes the absolutely dominant platform because they’ve got all the apps. They are very much like WordPress in blogging, it’s really hard to shake that inertia because they have all the plug-ins. Shopify has exactly that in the e-commerce world.

— Ben Gilbert, via Acquired Podcast

You might be seeing a growth loop emerge here 👀

That exact same flywheel is in play here with Atlassian…bar the middle piece.

3. Filling the gaps by integrating with other products

In 2010, they raised $60M in secondary funding from Accel Partners. This was to start building up their acquisition capital war chest, which Mike/Scott specifically noted was to buy other enterprise tools to help the get into other verticals.

And with the DevOps pipeline clearly visualized in front of them and a constant eye on the evolving landscape — they essentially had an acquisition target map. 🗺️📍

All they had to do was zoom into where they had a gap, find companies building in that space, and make a deal happen to close it — with each acquisition→integration growing their ecosystem of products and strengthening their network effects, bringing in new customers to the Atlassian universe, as well as opening up more opportunity for developers in the app marketplace.

Today, they’ve executed on 20 very strategic M&A’s, which broadly seem to have followed two tracks:

Buy to complement existing product offerings

For example, acquiring Bitbucket (a hosted code repo for collaboration) helped fill an important product gap in the “Code” stage — getting them new talent and IP, and a piece on the board in this vertical much faster than building their own (speed to market)

Buy to enter new ends of the market

For example, acquiring Trello (a much simpler project management tool) helped bring a product to the lower, more consumer-focused, end of the market while Jira focused upstream. This unlocked a huge pool of non-customers who didn’t need Jira’s team/enterprise-focused features. And one day, when they grow up and need more power, they can expect a timely cross-sell nudge.

And what’s incredible, to pull a quote from Ruchin Kulkarni, is how these acquired properties have grown once falling under the Atlassian umbrella:

Atlassian’s core non-acquired businesses (Jira and Confluence) grew 4x since IPO (24% CAGR) as vs. their acquisition heavy business lines which grew at roughly 8x (38% CAGR) during the same time period!

— How Atlassian built a $50B+ acquisition-led growth engine, via Toplyne

The point here is that they clearly nailed the “what do we do now that we bought them 🤷” question. Lots of companies make acquisitions, but most don’t execute well on integration. People leave, culture tanks, and the odds are in favor of integration being a little bit of a shit show.

That’s because combining two separate companies the right way can be an absolute nightmare, with clashing brands and personalities, mismatched code bases, and a world of unknowns.

But this growth across the board shows how they’ve managed to create long-term value for Atlassian and the acquired companies. And they’ve done it by developing a field-tested M&A playbook we can all learn from.

Atlassian’s lesson on post-merger integration 🤝

Below is what Atlassian have called out as their most important lessons on integrating well. I’ve pulled a quote for each to give you some more color, but If M&A isn’t applicable to you, feel free to just scan the headings in bold. 👇

Start integration before the deal is announced.

“When we were acquiring AgileCraft, we brought their leadership team together with their peers at Atlassian for a joint leadership kickoff and strategy session prior to Summit. We used that week to learn about each other, gain a common understanding of each other’s businesses, how we run our teams, and what we do and why we do it. It was a great catalyst for moving forward.” — Christina Amiry, Head of M&A Strategic Operations at Atlassian.Be as transparent as possible.

“When we announced Trello we did an Ask Me Anything (AMA) with a bunch of Atlassian leaders so we could have a really open conversation from the start. It set the tone for Trello that they could ask anything they wanted and we would answer candidly even if the answer is we don’t know yet.” — Jessica Hyman, Head of Strategy and Operations for Atlassian’s People TeamAnswer employees’ most pressing questions.

“Every employee has just three questions that you need to address as quickly as possible: 1) Do I have a job? 2) Who do I report to? and 3) How will I get paid? Until they get answers, nothing else matters.” — Betty Jane Hess, former head of the acquisition integration team at Arrow Electronics (62 deals)Get to know the pain points. “As People Partner, when I would start working with a new group, I prioritized going on a listening tour. I spoke to every manager and several employees focused on learning what they do, how they do it, what makes them tick, and where they may need support.” — Jessica DeGrado (Atlassian who helped integrate Trello, Opsgenie, and Jira Align)

Find the hidden leaders. Hess suggests finding the go-to people on the team you’re acquiring and putting them on an integration task force. This establishes trust and can help you identify landmines in the integration process, because these trusted individuals are the ones others turn to when they see problems creeping up.

Introduce culture over time. “[Introduce a buddy system]. It gets people working at a team level so they have someone to ask the ‘dumb questions’ and can start building personal relationships” — Christina Amiry

Provide support on the ground. “There’s a benefit when people come to the office. Trellocation [an initiative to bring Atlassians on-site for the Trello deal] brought in so much information and knowledge about how tools work and bridge the gap between the two worlds.” — Jessica DeGrado

Sweat the small stuff. “We thought through every single benefit that would change and made decisions on if they were worth keeping because of importance to the team.” — Jessica Hyman.

Over communicate.

“So many of the things that we found valuable in integrating companies were just life lessons about graciousness and honesty and candor. Tell them what you can, tell them as soon as you know it. And if you can’t tell them, say, ‘I can’t tell you that, but as soon as I know it I will.’” — Betty Jane Hess

Curious what a deal with Atlassian looks like? Checkout their public term sheet, or their philosophy behind it. 🕵️♂️

And that’s it folks… 🙏

That’s how Mike Cannon-Brookes and Scott Farquhar planted a little seed in the rough Australian terrain, tried some contrarian approaches that paid off, minted PLG without knowing it, and grew it into the $42B titan we know today.

Legends. Keep rock (paper, scissoring)ing on. 🤘

I hope you learned something new from them and their growth machine [recapped takeaways below]. If you did, or just enjoyed this post, feel free to pass it along to a friend or two. I’d really appreciate it. ❤️

Until next time.

— Jaryd ✌️

Takeaways: The business-building recap

Solving problems you experience is a great way to find a startup idea. It’s great when you can dog-food your own products, and it gives you real empathy with your users.

Pivot, and do it soon. If you’re business model isn’t working, you’re not inspired, or you’re idea just isn’t sticking — iterate/pivot sooner rather than later. That’s the value in startup-nimbleness.

Narrow down on who your ideal customer is. Research, find your beachhead audience, and don’t try to be everything for everyone before you’re anything for someone. The more niche you can start, the more successfully you can find your way into the market, and expand from there.

Software should (ideally) be bought, not sold. But for PLG to work, you need (1) an audience which actually prefer trying and buying their own products, and (2) a product which can be adopted self-serve.

The most important part of the PLG distribution flywheel is building a remarkable product. If people don’t love what you’ve built, the wheel won’t turn.

For early B2B sales, tapping your personal/founder network works very well initially, but it tapers out. Your network can only go so far, but it’s super effective for getting your first users.

Experiment with Guerrilla tactics to reach early customers. To go beyond the network — find online and offline water-cooler communities and do what you need to to get attention.

There are other ways to have sales assistance without a typical sales force. Try using product advocates to remove friction during onboarding and around activation. It’s an education play vs a sell play.

Keep your pricing simple and transparent. Don’t make people go digging — just be straightforward. This is key for PLG success.

Take the time to connect with customers — the feedback loop is invaluable. Things like user groups also build relationships and brand advocacy.

Community-led product development wins. Listening to your community and making the customer part of the development planning is an excellent way to bring the customers voice into the product.

Become a camel. Forget the unicorn — growth at all costs isn’t cool. Running a sustainable business is mission-critical, and try to avoid artificial boosts and unfavorable upfront investments in sales and marketing before a strong foundation is in place.

Be cautious expanding into a multi-product company too early. Overextending and lack of focus could lead both to fail, but, if you can pull off a new complimentary product for your same audience (AKA overlapping problems)— you could win big.

It’s much easier to sell to an existing customer than a new one. Cross-selling and up-selling are powerful strategies with lower CACs.

Content is an excellent fuel to the product-led machine. It drives brand awareness, brings in people to the top of the funnel (traffic), and helps them understand how to get the most out of the product (education).

Education is the best form of marketing. Hard sells are off putting — it’s helping people that gives you mileage.

As you start to reach meaningful scale — look for mid-stage growth accelerants. Like channel partners, category/business line expansion, or geographic expansion.

Channel partnerships, if pulled off, can be a game-changer. It’s a quick way to scale a sales force without the overheads, and benefit from tapping into another company’s distribute network and advantages.

Be keenly observant about your customers entire workflow/lifecycle — even outside your core product. It’s great to go deep and focus on one problem, but the more stages of a user’s life you’re in and the more you become an ecosystem, you’ll benefit by: moats ⇒ customer lock-in ⇒ retention + growth

Third-party plugins (made possible by an open API) can unlock Pandora’s box of product potential for your customers. Instead of bogging down your team by building specific use cases and cluttering your product — let your community create add ons for custom functionality.

M&A can be a great way to close product gaps, or get you into other lucrative markets. But, when acquiring a company, post-deal process is everything. Put mission/goals, culture, and people first.