How Superhuman Grows

What a $2bn email startup can teach us about not launching, pricing, viral growth loops, and reverse-engineering product-market-fit.

Hi, I’m Jaryd. 👋 I write in-depth analyses on the growth of popular companies, including their early strategies, current tactics, and actionable business-building lessons we can learn from them.

Plus, every Friday I bring you summarized insights, frameworks, and ideas from the best entrepreneurs, writers, investors, product/growth experts, and operators.

Hi friends 👋

Good to see you all again!

So, I love geeking out on new productivity tools— which makes it’s pretty alarming that it’s taken me so long to give Superhuman a go.

I’ve been hearing about this hot startup that’s built a new email client (nobody told me Gmail was broken?) for some time, and thought what better way to join the party than to just throw myself right into the deep end learn about their product and growth strategies.

Seems like a scalable way to trying new things out. 🙃

Well, I went all in. I subscribed, nitpicked around the product, and scourged all the weird and wonderful corners of the internet for valuable insights (about 20 hours)— so you don’t have to.

I’m a fanboy.

This week, I bring you several great takeaways on how to grow. From how to not launch in an existing market with incumbents, finding the right price, viral growth loops, to an extremely valuable system for measuring the illusive product-market-fit (PMF).

I have already applied that system at work and it made me feel very smart.

I excitedly bring you…🥁

How Superhuman Grows

(Click that link ☝️ to read the full thing in your browser)

Here’s what to expect:

Intro

What they do, where the idea came from

How they grow

Validating the idea and getting the first 5K customers

Positioning, and figuring out the perfect price

Don’t launch — onboard.

Building a systemized PMF-engine for growth

Viral Growth Loops: The right way to get people talk about your product.

Waitlists

Key Takeaways

For a second, I’m going to be like a shameless, self-promoting, YouTuber. If you learn at least one thing, please consider subscribing (if you’re new here), sharing with someone, and/or just giving it a like!

Thank you, and a huge thanks to everyone who helped spread the word last week — I’m extremely grateful and appreciate it 🙏

With that out the way — let’s get to it.

Superhuman — Gmail for the cool kids.

I’m not sure if that’s cool or cringe to say anymore — I’m going to go with somewhere in the middle… 👀

Last time, I wrote about Notion — a pioneer in the productivity stack.

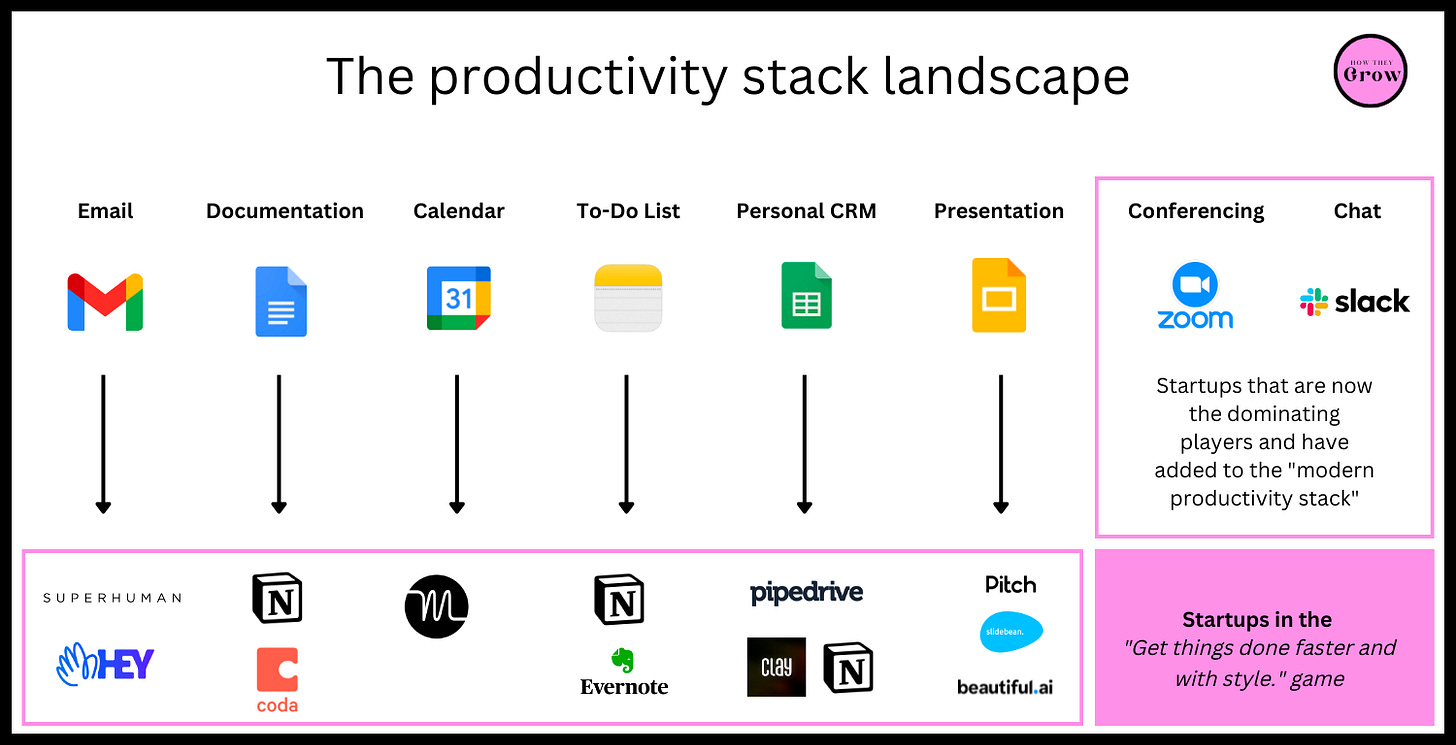

The productivity stack?

This is all the tools that people who work on computers use to get things done everyday — and there are several main categories inside of it.

Email

Documentation

Calendar

To-do list

Personal CRM

Presentation

Conferencing

Chat

Since the birth of the personal computer (70s) and World Wide Web (80s) — we’ve had productivity apps shipped to us promising to make our lives easier.

In ‘88, Microsoft gave us their famous Office suite. In 2006 - Google came sniffing for some of that honey with their competing G Suite.

And Microsoft and Google dominate the productivity landscape with some of the most functional tools out there.

But, some people now want more than just functionality. There is so much noise around us, that people want to find ways to optimize their productivity and get the most out of their limited time.

So, we’re seeing a wave of new productivity tools that focus on creating user experiences that give time back to their users. These Microsoft and Google challengers aim to help people complete their tasks faster while having a delightful experience.

We’re seeing an evolution from Get things done, to Get things done faster and with style.

Here’s a look at the productivity stack with the status-quo, and the startups coming for their lunch.

Email is a productivity vertical full of opportunity for a few reasons:

It’s used all the time (we use it about 3 hours a day)

It’s hardly changed since it started

It’s inherently viral (people send “invites” to each other all the time)

There’s hardly any startup blood in the game (just complacent incumbents)

That’s why Rahul Vohra started Superhuman in 2014.

What is Superhuman?

Superhuman is an email client like Gmail — except faster, more powerful, better designed — and made like a game.

In the words Rahul: “Superhuman is the fastest email experience ever made. It’s what Gmail could be if it were made today instead of 12 years ago. And unlike Gmail, Superhuman is meticulously crafted. So that everything happens in a hundred milliseconds or less.”

You also don’t stop using the exchange behind Gmail or outlook. Those accounts still exist and your email address doesn’t change. What Superhuman gives you is an interface with a bunch of shortcuts and automations that gets you through your email twice as fast. You also get valuable info about contacts (like socials, bio, etc), and you can do everything without a mouse.

Here’s David Ulevitch from Andreesen Horowitz explaining why people love it:

“Once I started using Superhuman, the idea of using anything else melted away. You don’t realize how slow Gmail is until you use an experience focused on speed. Since the product is meticulously crafted so everything happens in 100ms or less, everything from search to triage and response is blazingly fast. Every element of Superhuman helps you move faster, stay in flow, and experience joy.”

Superhuman wants to get you to inbox-zero. For $30 a month.

And the best part — you have to be invited to go through a 30 minute onboarding call to be given the privilege to pay it.

They’ve made waitlists cool again. And I’m not referring to just grabbing people’s emails pre-launch. Superhuman still has a growing waitlist 6 years after being made available. In startup-land — putting the breaks on your growth and holding off on customers waving cash at you is heresy.

But while everyone else is focused on growth-at-all-costs and building a 100% tech-driven, human-free experience to support that — Superhuman uses scarcity to choose their growth rate, pre-qualify their leads with high-touch onboarding , and build even more organic interest.

Superhuman has brought a premium product to an existing market where the norm is free email - building a ~$2bn business. And they’ve done that by making a specialized tool for a very specific group of people — founders, managers, and executives — and knowing how to market to them.

Before getting into how they do it — let’s see where the idea came from and why Rahul felt the need to take on Gmail.

Where the idea came from

To throw you right into the middle of the story — Rahul became obsessed with a dead simple formula that he could not get out of his head.

And there are ~1 billion knowledge workers

That’s 3 billion hours a day on email

I’m not sure if Rahul did this part, but here’s a cool analogy to show the scale of that: that’s about 350,000 years in email a day, or the same amount of time since the beginning of homo sapiens.

That’s everyday.

That’s nuts.

That’s a BF opportunity.

This was 2013-ish, while he was taking a break after selling his previous email startup to LinkedIn, Rapportive — a product that added social profiles to Gmail. It became the first Gmail plugin to scale to millions of users, and kickstarted a whole ecosystem of email plugins.

“[At Rapportive], I developed a very intimate view of the email. I could see Gmail getting worse every single year, becoming more cluttered, using more memory, consuming more CPU, slowing down your machine and still not working properly offline. And on top of that, people were installing plugins like ours, Rapportive, but also Boomerang, Mixmax, Clearbit, you name it, they had it. And each plugin took those problems of clutter, memory, CPU, performance offline, and made all of them dramatically worse.”

— Rahul in an interview with Salesflare

He was looking for the next big thing to work on — and his mind kept going to email — to that 3 billion hours a day opportunity.

“If you can’t stay away from an idea, it’s a good sign you should work on it”, he said in an Acquired episode.

Besides not getting an idea much bigger than that — Rahul had a deep understanding of the market. Rapportive was a Chrome extension, and having built that himself, he had a front-row seat into how Gmail was working — and how it was getting worse and slower each year.

So while the opportunity was sitting right there, and the need for disruption was growing — nobody was taking on Google and Microsoft.

Shaking up email was a perfect founder-market-fit for him. He’d spent a good amount of time in the idea-maze of email and Superhuman was a natural progression from Rapportive.

So, like all good founders — he first bought the domain, and then started sketching out the concept and model for Superhuman in Feb 2014. In may 2015, he wrote the first line of code, and started building a team with $750k in seed cash.

And that’s how Superhuman was born.

Todd Jackson from First Round Capital packages that story really nicely into a framework we can use to come up with our own startup ideas.

Market first: Start with a market or space that interests you, ideally one you’re familiar with. Then look for a specific problem. If you want to raise money — make sure it’s a big market, or a small one that’s growing fast.

Find an experience ripe for improvement: Look for areas where you think there should be a better experience than the status quo, and iterate from there.

Problem first: Start with a problem you’ve experienced firsthand or have a unique insight into, and then go find out if enough other people have the same problem.

The growth story of Superhuman starts with finding out if enough other people had a problem with email.

How they grow

Validation and the first 5,000 users

When you have an idea — you have a hypothesis.

It doesn’t matter how big or small the idea is, or whether you even consciously think about hypotheses — there’s always a reason you believe it will work.

Before you go outside in shorts — check the weather.

Before you eat old leftovers — sniff it.

Before you start a company — find out if it’s a good idea. And just like you don’t want to wait too long to figure out if that 3-days-old Chinese food was bad — you don’t want to end up building something nobody wants and wasting potentially years of your life. No pressure.

You can’t (successfully) grow a bad idea.

Figuring out if you’re onto something starts by knowing what your hypothesis is, and then asking what’s the quickest way you can validate it.

Let’s look at how Superhuman did it.

In the first year of Superhuman, as we were primarily building, we threw up a landing page. It was a terrible landing page, a basic Squarespace thing, that took us all of 2 hours to put together. All you could do on this page was throw in your email address. And when you threw in your email address, you got an automatic email from me, with two questions:

1. What do you use for email today?2. What were your pet peeves about it?

I had two hypotheses going in.

Hypothesis number one was that for Gmail, people were upset about how slow it had gotten, how it wasn’t working properly offline and how they had to use Gmail plugins to make it do the things that they wanted to do.

Then for third-party email clients, people were upset about how buggy they were, how unstable they were, and how they don’t sync properly. All of which are still true today.

Part of the validation came from people responding to their page’s value statement (enough for many founders). But, if they saw themes in the answers — they’d know they were right, and they’d know what the biggest problems to focus on were.

I personally would have added one more question in there, something like “What do you do professionally?”. This would have been a useful way to start learning about their audience — i.e CEO’s who use Gmail are annoyed about how slow it is.

Anyway, throwing up a landing page only works if people actually go there. So here’s what Superhuman did to get traffic.

They focused on getting press and creating FOMO

The best way to do it is to pick one or two events a year where you can insert yourself into the cultural zeitgeist. For us, one such event was when Mailbox was being shut down. It was the perfect narrative, “I’m over here, come look at my company.” […] I currently have one of the most widely read articles on how to survive an acquisition. It was written in response to the Mailbox shutdown. […] That post ended up on Medium, and was syndicated to qz.com. We were able to insert it into the Zeitgeist. That article probably took me three days of doing nothing else, and another day of shopping it around. So four days all in. But those four days bought north of 5,000 signups.

Inserting yourself into the Zeitgeist means taking advantage of something that’s relevant and timely — something people are talking about — and getting involved in the conversation.

Mailbox was a popular email client that promised a more efficient email experience, and when people were talking about its shutdown, it created a nice gap for Rahul and his team to make Superhuman relevant.

This is a creative marketing strategy that’s good for press and growth spurts, but not a growth engine you can rely on. But it worked great as a turbo-boost for Superhuman and it got them their first 5,000 users.

So, if there is a trend or existing cultural momentum you can build on, lean into it. But what if there isn’t? What other ways can you reach people to validate your idea?

First, know who your target audience is. Then, try one of the 7 other strategies that Lenny Rachitsky found account for every consumer apps early growth:

Go to your users, offline. Find out where your users are hanging out in real life and meet them there. Snapchat went to malls, Tinder went around college campuses.

Go to your users, online. Find the groups and forums where people are talking and meet them there. Dropbox went to Hackernews, TikTok went to the App Store.

Invite your friends. Ask your friends if they’re from your target audience to join. Examples of founders who went the friend route are Slack, LinkedIn, and me and this newsletter. Thanks for joining first Joe!

Create FOMO. This requires having a strong value proposition or an inherently social product. Superhuman, Robinhood, and Clubhouse are the best examples here of companies that created FOMO with their waitlists.

Use influencers. Find out who the influencers are in your target market, and then get them to talk about your product. Good examples here are ProductHunt and Twitter.

Get press. Is there a unique, compelling, fresh story you could pitch to the press? This overlaps with entering the zeitgeist, but also stands alone. We know Superhuman did this, but Slack and Instagram used press well.

Build a community. This takes more time, but building a community early gives you a great platform to leverage later. Producthunt started building community with a mailing list, and Stackoverflow used their founders communities.

Okay, so Superhuman got press and created FOMO to get early users and validate their hypothesis that people had an issue with email.

The next step in their growth story was figuring out the right price. And the way they approached this is gives us a great framework.

Figuring out the perfect price

To some, $30 bucks a month for a product that’s usually free is crazy. To others, it’s totally fair.

And this leads perfectly into two key elements of pricing: (1) know who you’re selling to, and (2) know your value to them.

Those two elements create your positioning — and that’s the foundation of a monetization and pricing strategy. Once you have it — you can figure out your price point.

Positioning

First, you need to know what the competitive landscape looks like, who your ideal customer is, and how you’re going to position yourself to them.

Before we tried to address pricing, we first addressed our positioning.

Are we the Ford of email? (Nope.) Are we the Mercedes of email? (Not quite.) Are we the Tesla of email? (Getting there!)

We started with this article by Arielle Jackson: Positioning Your Startup is Vital — Here’s How to Nail It. Arielle advises using a formula like the following:

For (target customer)

Who (statement of need or opportunity)

(Product name) is a (product category

That (statement of key benefit)

Unlike (competing alternative)

(Product name)(statement of primary differentiation).

We thought about this hard for Superhuman, and did further reading. In particular, Positioning: The Battle for Your Mind, was very helpful

In 2015, we came up with this positioning:

For founders, CEOs, and managers of high-growth technology companies

Who feel like their work is mostly email

Superhuman is the fastest email experience ever made;

It’s what Gmail could be if it were made today instead of 12 years ago

Unlike Gmail -Superhuman is meticulously crafted so that everything happens in 100ms or less.

As nice as it sounds — you can’t be everything to everyone and you need to understand who you’re targeting in order to make better decisions. Superhuman’s go-to-market (G2M) positioning statement is very narrow, and that allowed them to get very specific not just about targeting in a saturated market, but knowing how to monetize and retain the right people.

Finding the right price point

From that G2M positioning statement — it’s clear Superhuman is a premium tool for a premium market. To get to their pricing, they followed an extremely tactical and research-based approach — and got out there and spoke to their target audience.

In Monetizing Innovation, Madhavan advocates for developing pricing alongside product, in a way that supports the positioning

Madhavan covers lots of ways to develop pricing. We used one of the easiest methods, which is the the Van Westendorp Price Sensitivity Meter. In late 2015, we asked ~100 of our earliest users these questions:

At what price would you consider Superhuman to be so expensive that you would not consider buying it? (Too expensive)

At what price would you consider Superhuman to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

At what price would you consider Superhuman to be starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (Expensive/High Side)

At what price would you consider Superhuman to be a bargain—a great buy for the money? (Cheap/Good Value)

The price point that supports our premium position is the third one: "when does it feel expensive, but you'd still buy it anyway?" (One can imagine that Tesla did this with the Model S.)

The median answer for the third question was around $30 per month. And that's how we picked our price.

Most startups usually focus on the fourth question, the bargain for money. The idea there is that by being the cheapest — you can land grab as many users as fast as possible. This makes sense if you’re building in a new market and there’s a clear first-mover advantage, or some kind of network or greenfield effect.

But, that’s definitely not the case with email, where the market is very established and the competitive products are great. If you’re building a premium product like Superhuman, that’s where orienting around the third question, “When does it feel expensive but you'd still buy it anyway?” makes sense.

One of the things I love about this method besides how simple it is, is that it’s question-based. That means you have to go out there and actually ask people — and not just thumb-suck pricing in a vacuum around your desk. And Rahul individually spoke to 100 people about pricing.

The last point I want to bring up around startup pricing is back-of-the-napkin valuation forecasting. If you’re going to the venture-backed route — how does your price get you to a billion dollar valuation (or for a subscription business, ~$100M in annual revenue)

This point is said perfectly by Rahul.

Once we picked our price, we had to do a quick gut check on market size. For example: how can we grow into a $1bn valuation? Let's assume that at that point, our valuation is 10x our run rate, so our ARR is $100M. That would be ~300k subscribers at $30 per month — and that is conservatively assuming no other ways to increase ARPU (e.g. new products, or going upmarket). We asked ourselves: do we think we can get to hundreds of thousands of subscribers? We answered yes, and went ahead with the price!

So from a go-to-market standpoint, Superhuman had (1) their initial audience, (2) their positioning, and (3) their price point locked down. Most founders would be itching to get an MVP into their hands as soon as possible.

But Superhuman is 2½ years in — and they still haven’t shipped. This is heresy for startups that are supposed to be embarrassed by the first version of the product. As Reid Hoffman has said, “If you’re not embarrassed by the first version of your product, you’ve launched too late”.

This brings us to a less common go-to-market motion that has been an essential part of Superhuman’s success.

Don’t launch — onboard.

Superhuman never launched.

By the summer of 2017, we had reached 14 people — and we were still coding. I felt intense pressure to launch, from the team and also from within myself. My previous startup had launched, scaled and been acquired in less time. Yet here we were, two years in, and we had not passed go.

But no matter how intense the pressure, I wasn’t ready to launch. Common practice would be to "throw it out there and see what sticks,” which may be fine after a few months of effort when the sunk cost is low. But the “launch and see what happens” method seemed irresponsible and reckless to me — especially given the years that that we had invested.

— Rahul

Startups usually launch (and maybe re-launch) as soon as possible to quickly start iterating on a half-decent product.

Take Uber as an example. They were creating a new market, where the alternative is usually a terrible experience (getting a cab before Uber sucked). And since ride-sharing was a new space — there was a pressing need to be first.

So, when that’s the case — get out there, and yesterday. People won’t care if the product isn’t perfect. Anything you release is going to be worth it for some people, and that gives you a small advantage. When you have a network effect, like Uber, that small advantage is going to start compounding on itself.

But Superhuman isn’t entering a new market where there is a land grab opportunity. They are a premium product competing against Google, without an explicit network effect built into it. The bar becomes much higher.

That’s why they chose to take more time building, and do a gradual ramp up of users. This might seem like anti-growth — but it’s been an essential part of their growth and virality.

Let’s take a closer look. Their onboarding is what made me (and countless others) really love their product.

Onboarding makes for a better product experience

Last time we spoke about how Notion onboarded users with a simple quiz, then personalized their product experience, and how that moved them along their value curve. That was a great example of self-service onboarding, powered 100% by the product itself.

Superhuman’s onboarding is different. There’s a quiz — but the answers are used by a human to make sure you’re a good fit, and to have a personal, 30 minute conversation with you.

Their onboarding has 5 goals:

Gradually build a user-base of highly qualified people. This is simply quality of quantity. They want people who need Superhuman — people who will love it and stick around.

Learn about their customers. Each onboarding call doubles-up as a user interview, this keeps them constantly in the loop with what people think and need, and how they work with existing alternatives.

Ensure people get the full value ASAP and become power users. If someone from the team is showing you around the product and getting you to do stuff in front of them — you’re going to get how things work. This cuts down the learning curve, and leads to better activation and higher retention.

Build brand loyalty and increase retention. They spent 30 minutes talking to me 1:1 — I felt taken care of and valued. That made me more connected to Superhuman. I have no doubt others feel the same.

Drive virality. I heard about Superhuman after my CMO told me about their onboarding because it’s a unique product experience worth talking about. And here I am…

Fortunately for Rahul — he didn’t onboard me. But he did personally onboard the first 200 people himself, and this is how he defined their early onboarding process:

Give the new user a detailed demo of Superhuman, and share what makes it magical and delightful.

Reminder them that Superhuman is a paid, premium product and test price sensitivity with the Van Westendorp Test.

Ask how they currently do their email and take notes on all the Superhuman features they would benefit from.

Show them how to get through email in Superhuman twice as fast as they were doing before.

Insist that they do email with you, live, for 30 minutes. Doing it with them is crucial because every time, I would find 5 to 10 bugs that I would send back to my team. We would make sure to fix them within a week. If we didn’t, we wouldn’t be able to surface the next set of bugs that we should address.

Send them a personalized gift (I would send a bottle of wine or whiskey) to show them how much you valued their time. This obviously slows down as you get out to scale with many thousands of users.

I didn’t get a bottle of whiskey — but I learnt a lot about onboarding.

Onboarding can be a great marketing instrument

Onboarding is a great asset in the marketing toolbox. The closer marketing and growth are to the product, the better they can leverage the product experience.

Yes, personalized onboarding adds friction to growing your customer base — but it brings much higher activation and retention rates. And if done right, like Superhuman, has other growth benefits:

It creates delight. Imagine joining a product and having the CEO take an hour to talk to you. We’re so used to automated onboarding checklists and generic emails, that having a real person take time to connect and help you (not sell to you) is a surprise. And when you’re pleasantly surprised — you tell people.

Product differentiator. Obviously Gmail and Outlook aren’t doing this, but also, no other B2C startups onboard the way Superhuman does. Doing something different in your space helps with your unique positioning.

Drives word-or-mouth. The onboarding story and the personal involvement of Rahul were the basis for viral growth. In the first weeks and months, the surprise effect got people talking on social media. This quickly turned into a viral loop, driven by positive user posts and accelerated by engagement from the media and from thought leaders. Whether you think this adds too much friction or not — the result has been a huge waiting list because they only give access to the tool after onboarding, adding another limitation that created even more demand.

Gets press talking. Superhuman got early attention because of a unique experience, not because of a pitch email sent to TechCrunch. And getting press and thought leaders in your space talking is a great way to throw fuel on a viral growth loop.

Check out this onboarding survey template that mirrors Superhuman’s. 😎

So, onboarding brings users into your product and can be a great way to get people to love it.

But how do you know how much they love it? And how can you get more people to love it?

The next aspect of Superhuman’s growth looks at exactly that. And the way they do this was absolutely fascinating to learn about. I have already tried this framework at work for our roadmap planning — and I’m thrilled with the results.

Building a systemized PMF-engine for growth

At this point in the game — we probably all know how important product-market-fit (PMF) is.

If you have PMF — your product is working and people need it — and you’re in a great place to successfully grow. If you don’t have PMF, getting there should be your only goal before pushing for growth ahead of it.

Marc Andreesen from a16z, sums up PMF in a lovely quote:

You can always feel when product/market fit is not happening. The customers aren't quite getting value out of the product, word of mouth isn't spreading, usage isn't growing that fast, press reviews are kind of ‘blah,’ the sales cycle takes too long, and lots of deals never close.

And you can always feel product/market fit when it is happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You're hiring sales and customer support staff as fast as you can. Reporters are calling because they've heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house.

FYI — Rahul had investors staking out his house. It happens.

Of these three milestones, the most likely to kill your business is the first: not building something people want.

So — how do you know when you’ve built something people want? Once again — let’s look at how Superhuman did. Because they reverse engineered PMF and it’s flipping genius.

In 2017, I was intensely trying to find product/market fit. I searched high and low; I spoke with all the experts; I read everything I could find. This included classics such as thought pieces from Paul Graham ("make something people want"), Sam Altman ("users spontaneously tell others to use your product"), and of course Marc Andreessen ("you can almost always feel it when it is happening"). As vivid and as compelling as these definitions were, they were all still lagging indicators.

My core insight came when I found Sean Ellis, who ran early growth at Dropbox, LogMeIn, and Eventbrite — and who coined the term "growth hacker". Sean had found a leading indicator:

Just ask a user “how would you feel if you could no longer use the product?” and measure the percent who answer “very disappointed.”

[As a leading indicator, you can find out how far away from it you are]

Ellis turned this into a robust customer development survey. [He] established a magic number and a clear benchmark: 40%. Companies that struggled to find growth almost always had less than 40% of users respond "very disappointed" — whereas companies that grew most easily almost always exceeded that threshold. And therein was the hint that would become core to our method:

I eventually started to wonder: what if you could measure product/market fit? Because if you could measure product/market fit, then maybe you could optimize it. And then maybe you could systematically increase product/market fit until you achieved it.

— Rahul

Main takeaway from that long quote: Ask your users how they’d feel if they could no longer use your product. The group that answers ‘very disappointed’ is key to unlocking product/market fit. This method gives you a tool to quantifiably know how close (or far) you are to PMF, vs the lagging definitions which are more a feeling you get when you have it.

So, they built a 5-step system around it to measure and optimize PMF

Setup a survey to ask your users "How would you feel if you could no longer use your X?”

Segment your audience to paint a picture of your high-expectation customers (HXC)

Analyze feedback to flip on-the-fence users into fanatics

Use that feedback in your roadmap to drive improvements by doubling down on what users love and addressing what holds others back

Continue tracking product/market fit over time as your most important metric

Let’s unpack each of those in more detail.

1. Setup your survey

In 2017, Superhuman did just that. They went out and asked users how they’d feel if they could no longer use the product.

They asked 5 simple questions:

How could you feel if you could no longer use Superhuman?

a) Very disappointed, b) Somewhat disappointed, c) Not disappointed

What type of people do you think would most benefit from Superhuman?

What is the main benefit you receive from Superhuman?

How can we improve Superhuman for you?

What is your job title?

We sent the survey only to users who had been using Superhuman for at least a few weeks, and who had sent a minimum number of emails. At the time, we had just 100-200 users to poll, but the survey also works at smaller scale. You start to get directionally correct results around 40 respondents — much fewer than most people think!

This is what they got (creating their first baseline).

[Source: First Round Capital]

Not quite there — but as Rahul says, “With only 22% opting for the very disappointed answer, it was clear that Superhuman had not reached product-market-fit yet. And while this result may seem disheartening, I was instead energized. I had a tool to explain our situation to the team and — most excitingly — a plan to boost our product/market fit”.

With baseline in hand — they next four steps are really what creates an engine around improving PMF and using that to grow.

2. Segment your audience to find your High-Expectation Customer

Not all users are equal.

With your early marketing, you may have attracted all kinds of users — especially if you've had press and your product is free in some way. But many of those people won't be well-qualified; they don't have a real need for your product and its main benefit or use case might not be a great fit. You wouldn't have wanted these folks as users anyway.

As an early-stage team, you could just narrow the market with preconceived notions of who you think the product is for, but that won’t teach you anything new. If you instead use the "very disappointed" group of survey respondents as a lens to narrow the market, the data can speak for itself — and you may even uncover different markets where your product resonates very strongly.

This leads to the value in being hyper-focused on the right people — your perfect customers — which are not necessarily your early adopters.

The term high-expectation customer, or HXC, was coined by Julie Supan — a G2M and positioning expert who’s worked with Airbnb, Dropbox, and Thumbtack. “The high-expectation customer, or HXC, is the most discerning person within your target demographic. It’s someone who will acknowledge—and enjoy—your product or service for its greatest benefit. They look things up. They research things. And they have ideas for new types of products or services that can help them save money, gain time, get healthier or make their team more productive,” says Supan. “If your product exceeds their expectations, it can meet everyone else’s.”

For example, Airbnb’s HXC doesn’t simply want to visit new places, but wants to belong. For Dropbox, the HXC wants to stay organized, simplify their life, and keep their life’s work safe.

She has written about this at length, and it’s a fantastic read: [What I Learned From Developing Branding for Airbnb, Dropbox and Thumbtack](https://review.firstround.com/what-i-learned-from-developing-branding-for-airbnb-dropbox-and-thumbtack').

As Rahul said — they narrowed in on the 22% of people who loved Superhuman. This was their group of HXC’s. “For me, the goal of segmenting was to find pockets in which Superhuman might have better product/market fit, those areas I may have overlooked or didn't think to scope down to.”

To segment down, this is what they did:

They grouped the survey responses by the first question

They then assigned a persona (using peoples job title)

Then they focused on the personas that appeared in the 22% group — and used those to narrow the market

But Superhuman didn’t stop at using job titles for their HXC — they dug a lot deeper. They took only users who would be very disappointed without the product and analyzed their responses to the second question in the survey: “What type of people do you think would most benefit from Superhuman?”

This is a great question, as people that are happy with your product will almost always describe themselves, not other people. And they will use their own words. This lets you know who the product is working for and the language that resonates with them — which can give you nice kernels of insight for your marketing copy as well.

Their HXC definition got very specific and they used it as a tool to focus the entire company on serving that narrow segment better than anybody else.

Here’s Paul Graham explaining why starting very specific is so important:

When a startup launches, there have to be at least some users who really need what they're making — not just people who could see themselves using it one day, but who want it urgently. Usually this initial group of users is small, for the simple reason that if there were something that large numbers of people urgently needed and that could be built with the amount of effort a startup usually puts into a version one, it would probably already exist. Which means you have to compromise on one dimension: you can either build something a large number of people want a small amount, or something a small number of people want a large amount. Choose the latter. Not all ideas of that type are good startup ideas, but nearly all good startup ideas are of that type.

When you know who that small group of people is — it allows you to build against their feedback and avoid distractions from other groups of less interested customers. This makes the PMF engine we’re walking through so effective, because you optimize for what a small number of people want a large amount.

3. Analyze survey feedback

Now that the segments and personas were defined, they could analyze the responses to discover two super important things: (1) why people loved the product, and (2) how they could help more people love the product.

Continuing to segment only on their HXF group — they looked at the third question on the survey: “What is the main benefit you receive from Superhuman?”

This allowed them to find clear themes around what people valued most — which they could then use to help answer the question, how do we convert more people into this HXC group?

I love this next part — they first just ignored everyone who said they wouldn’t be phased about not using the product. At first this surprised me, I would have thought that if you can convert your haters, you can convert anybody. But the way Rahul describes why they just brushed over this group of people is brilliant.

Politely disregard those who would not be disappointed without your product. They are so far from loving you that they are essentially a lost cause. They’ll request distracting features, present ill-fitting use cases and probably be very vocal, all before they churn out and leave you with a mangled, muddled roadmap. As surprising or painful as it may seem, don’t act on their feedback — it will lead you astray on your quest for product/market fit.

This left them with the people who said they would be somewhat disappointed. As Rahul explains, “the seed of attraction is there; maybe with some tweaks you can convince them to fall in love with your product.” They then filtered this group into two further segments — people who resonated with the same main value they had identified (Speed), and those who did not.

The sweet spot for them — Somewhat disappointed users for whom speed was the main benefit.

They focused heavily on this group, because the main benefit of Superhuman resonated with them, meaning something — probably something small — was holding them back from becoming very disappointed and joining the other HXC’s. So they looked more closely at their answers to the fourth question on the survey: “How can we improve Superhuman for you?”

In the same way they found themes for why their HXC’s loved Superhuman, they found themes for what this group needed to love the product.

Along with some tong-tail insights, they found that the main thing holding back those users was simple: the lack of a mobile app.

“With a clear understanding of our main benefit and the missing features, all we had to do was funnel these insights back into how we were building Superhuman”.

4. Use that feedback in your roadmap

To increase your product/market fit score, spend half your time doubling down on what users already love and the other half on addressing what’s holding others back.

If you only double down on what users love, your product/market fit score will not increase. If you only address what holds users back, your competition will likely overtake you.

5. Continue tracking

Doing this exercise even just once is super valuable. But repeating it as a system? That’s were the real goodies are at. 🌈

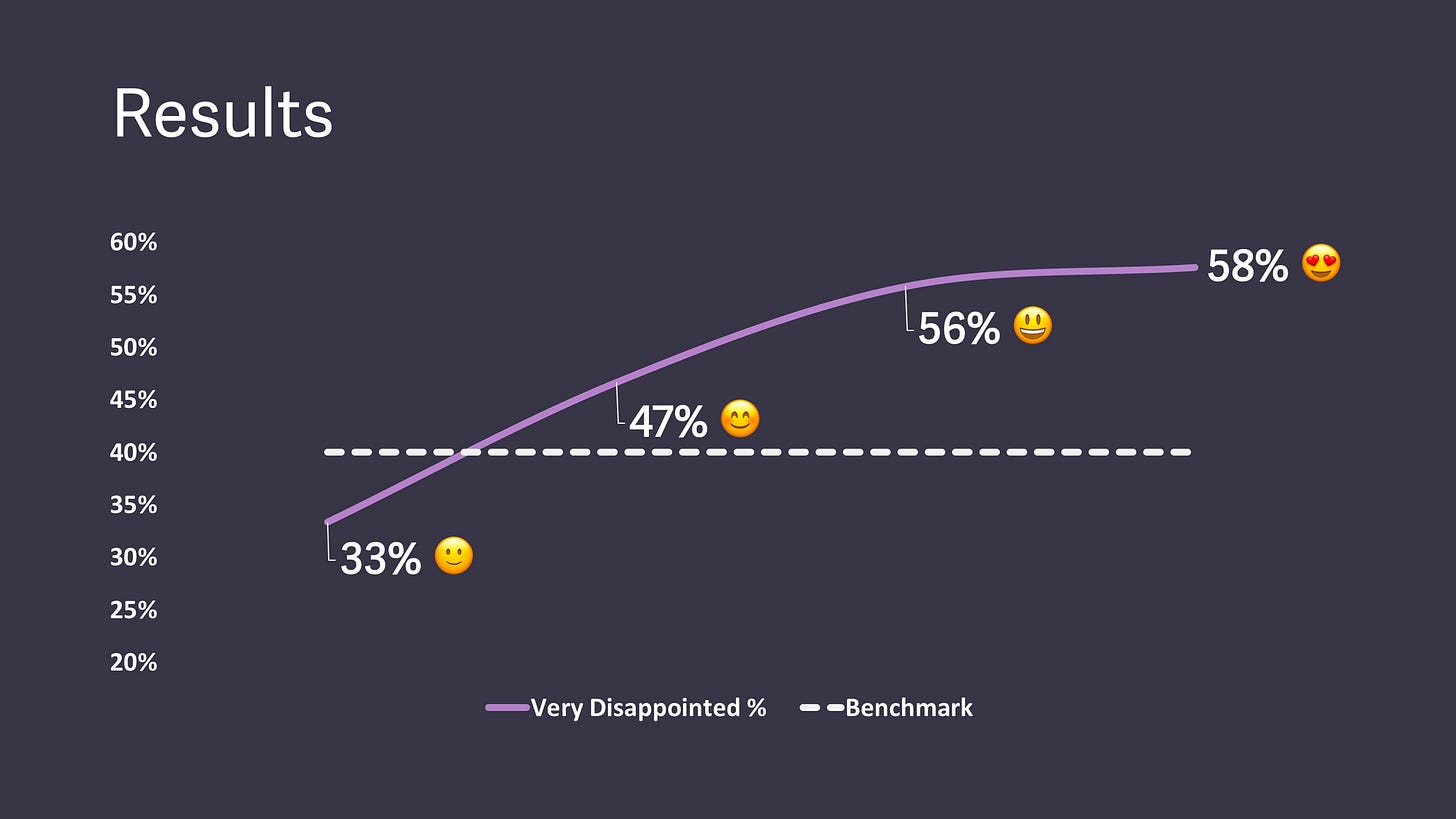

Superhuman repeated the process and made the product/market fit score their most important metric.

As time went on, we constantly surveyed new users to track how our product/market fit score was changing. (We were careful to ensure that we didn’t survey users more than once, so as to not throw off the 40% benchmark.)

The percent of users who answered "very disappointed" quickly became our most important number. It was our most highly visible metric, and we tracked it on a weekly, monthly and quarterly basis.

To make this easier to measure over time, we built some custom tooling to constantly survey new users and update our aggregate numbers for each timeframe. We also refocused the product team, creating an OKR where the only key result was the very disappointed percentage so we could ensure that we continually increased our product/market fit.

Reorienting Superhuman around this single metric paid off. Within just three quarters of their work to improve the product, the score nearly doubled to 58%.

When people love your product — you grow. And sustainably.

[Source: First Round Capital]

💡 You can play around with this interactive tool to see a sample of actual Superhuman results. You can see the word clouds change as you click around — and you can also put in your own data and use it to build your own product.Now, if you read my last piece on Notion — you know that talking about loops gets me all giddy. 👀

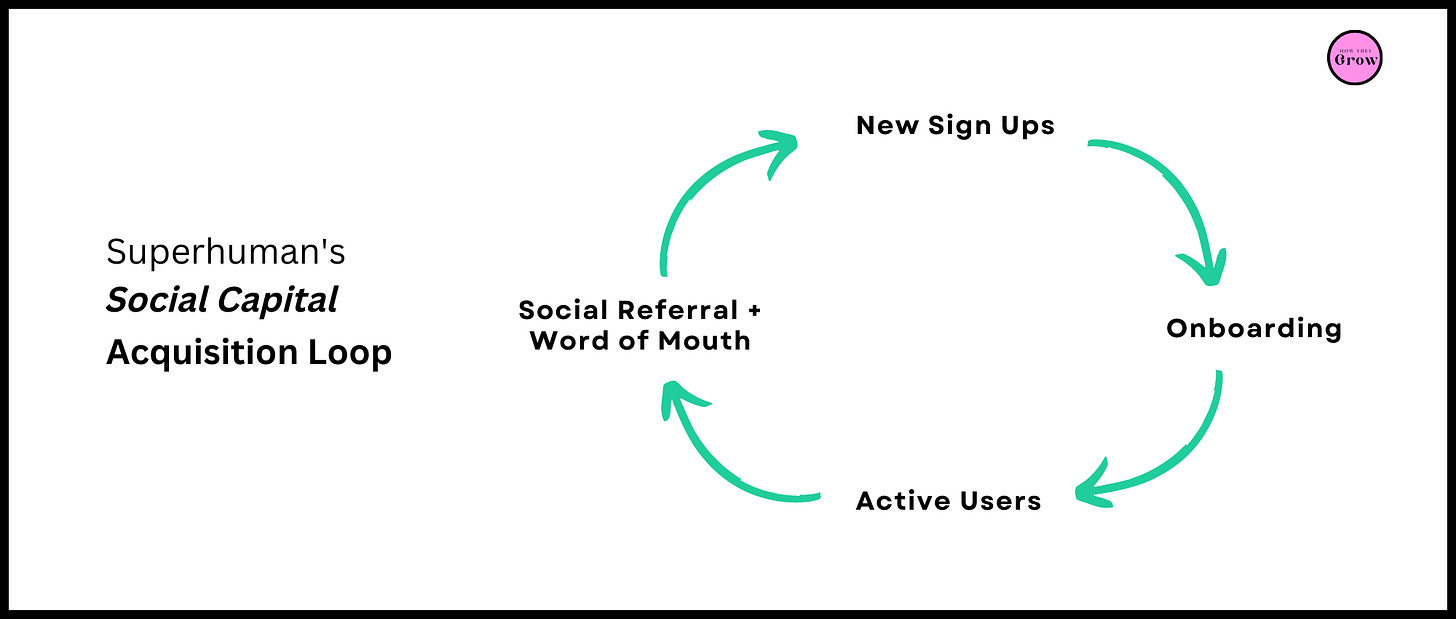

Superhuman’s Viral Growth Loop

Superhuman has a growth loop — where most of the new users come directly from existing users.

More specifically, they have a virality loop — where demand drives more demand.

Normally — you grow your business. Take Google Search — you coming in and searching for something that doesn’t directly lead to more people coming in and searching.

But at Superhuman, a nice flywheel emerges:

You hear about Superhuman and join the waitlist

Superhuman onboards you

You send an email to friends with Superhuman signature (and talk about it)

Your friend sees the signature and signs up for Superhuman

And the true viralness of Superhuman’s product here isn’t a measurable viral factor like direct invites — it’s people talking about it.

Superhuman doesn’t have the traditional sales process of an enterprise company, but neither do many other productivity startups with bottoms-up approach. What’s more unique here, is that Superhuman’s acquisition loop is more like a consumer social product.

With a channel like this, it brings its costs to acquire a new user way down and instead of building a sales team, can hire people focused on making a killer onboarding and customer experience.

This is much better for the bank because demand drives demand, vs your dollars brining in customers. Each new person who joins becomes far more valuable as they are now part of your distribution channel — and you get to invest your money in the product and a nice holiday party.

This makes loops a great growth engine because they are self-sustaining. This loop is how they grow!

Now, you might be looking at that 4-step loop and be thinking — but that Onboarding creates so much friction. They can grow more!

And you’d be right — but it’s good friction.

The friction around onboarding looks like it hurts that step of the loop, but it net improves the entire loop. Sure, sign ups are dinged a bit — but it makes sure that the people who join are highly active and committed, which we said earlier, makes the referral rate much better.

And now that we’re talking about loops and onboarding — there’s another important loop inside of this loop. This is the stuff that get’s Christopher Nolan excited.

This is the feedback loop.

Their onboarding process shortens the customer feedback loop tremendously — and they keep improving their product and positioning. It’s like lubricant to their engine.

Two of the top shortcuts inside the Superhuman product are 1. Giving feedback and 2. Referring new users. And looking at that loopy-loop, it’s no surprise why.

These are their core loops: strengthening the product and increasing its reach.

Okay, I need to stop saying loops. 😵💫

Let’s talk about waitlists — because they do, in fact, fuel the whole l**p.

Using waitlists to hype up demand

In 2019, Superhuman had about 15,000 paying users and a solid 220,000+ on the waitlist! In August 2021 — it was at 450,000.

That’s the most recent figure I could dig up — but at $30 bucks a month — that’s $13.5M in additional MRR or ~$162M annualized in cash up for grabs.

That’s huge — almost another $2bn just waiting to be added to their valuation.

Investors like Andreesen Horowitz, Ashton Kutcher, Mila Kunis, Will Smith, and The Chainsmoker must be sitting at the table, knives and forks at the ready.

Fun table though.

With that much growth in front of them, it begs the question, why keep using a waitlist?

Because by creating scarcity, they get to choose their growth rate, pre-qualify their sales leads, and drum up even more organic interest. People want nothing more than what they can’t have, and Superhuman plays on this effect by making people jump through hoops to gain access — a stark contrast to the typical, needy, kick-the-door-down-with-marketing-emails sales funnel.

So why would you take your waitlist away, when your marketing strategy relies on creating a cycle that selects for people who like you, who are kept happy with great support, and who get even more excited because they can refer their friends. Their friends then gravitate to the product, are primed to like it and become excited by their “golden ticket” — and the cycle starts again.

Don’t mess with a good thing.

Looking at Robinhood and Superhuman (the two best examples of companies who used waitlists)— there are several takeaways on how to create a successful one:

Start with a clean home page and a clear message. Have the main value of your product the focus with no distractions.

Have solid messaging and a clear call to action to encourage joining and sharing. And thank people for signing up, ideally with a message from the founder.

Use a list to show how many people are ahead of them in the queue — it encourages people to get friends to sign up so they can get ahead.

Make the sharing easy. Put in links to share on socials or with email, and make sharing easier by auto-populating a message.

Immediately follow up with more valuable content. Show a promotional video (if you have) or other content to get users excited about the product. They will be more likely to tell other people.

Keep playing on scarcity. Encourage people to check back to see where they are on the waiting list, and remind them how to get ahead.

Don’t go radio silent. You need to keep your waitlist engaged while they wait, otherwise they can lose interest.

Have a fun, delightful, transition from the waitlist into the product. Make people feel like it was worth it.

And that’s it friends. Before getting to a recap of the key takeaways...

Thanks for staying with me to this point — if you got here — you find me and my use of gifs at least tolerable. And for that, I appreciate you. 🙏

I know these pieces are on the longer side, and that’s by design. I spend a lot of time researching the companies I pick, as well as going on research tangents to clarify themes, frameworks, and other insights that come up. All in, it takes me about 20 hours.

My goal is to bring you (and me) the most comprehensive deep dives into how companies grow — so we can all build and grow better products.

If you know anyone else who you think will find value in these pieces — please consider sharing it with them below.

And to sign out, here are the high-level takeaways.

🍕 Key Takeaways

🙀 Don’t be scared of Google. In fact, a space with huge incumbents and no startups is a great market to explore. There’s clearly opportunity, and if you look into trends and customer pain points close enough, you can find your wedge into a competitive space — often taking a position that established players can’t.

💡 To find an idea, start with either Market, Experience, or Problem. There are three main ways to find a startup idea to work on: (1) Start with a market that interests you. (2) Look for areas where you think there should be a better experience than the status quo, (3) Start with a problem you’ve experienced firsthand or have a unique insight into.

🚩 Start with a clear, specific articulation of the problem. "Email sucks now" may have been accurate, but it wouldn't have helped anyone land on a solution. When you deeply understand the problem, you are more likely to create the right solution. Rahul's original pitch was literally a screenshot of Gmail's interface where he pointed out all of the little things that added up to make the product experience worse. From that strong foundation, Rahul then spent time applying his singular viewpoint to designing an email experience that he would want to use — the classic founding story of solving your own problem.

🥧 Quantify the size of the opportunity (in a creative way). 3 billion hours a day in email is such a powerful way to inspire people to get behind your idea. Figure out how big your market is in, pitch it in a creative way, and try find an analogy to stick it in peoples mind.

😍 Find an idea you can’t stop thinking about. “If you can’t stay away from an idea, it’s a good sign you should work on it”.

🤌 To get early customers, lean into the cultural zeitgeist. There are several different ways to get your first 100, 1K, or even 5K customers. One way is inserting yourself into a current conversation or trend, and leaning into that to peak interest and get press.

💸 Your G2M monetization strategy starts with (narrow) positioning. To get to your price point, you first need to know who your target audience is and how you are positioning your product. The more specific you can be, the more relevant your price and messaging will be when you go-to-market.

💲 Round up your pricing if you’re a premium product. “Our initial pricing was $29 per user per month. Then I had a few conversations with some pricing experts who pointed out that if we're truly owning the premium experience category, then ending your price with a nine probably isn't the best thing to do. So, we pretty quickly rounded up to $30 per month.”, Rahul Vohra.

🐌 Launching isn’t for everyone. If you’re entering a new market and there’s a first-mover advantage (land grab users, branding, network effect, greenfield effect) — get a version out ASAP, even if you’re embarrassed. But if you’re going into a space like Superhuman did, a gradual ramp up of users via onboarding might be a better move. As Shishir Mehrotra, founder and CEO of Coda said, “A startup should only launch for one of three reasons: number one, either you need more users or customers to sell to. Number two, you need more capital to spend. Or number three, you need more candidates to hire.”

👫 Onboarding is essential, and it creates good friction. Superhuman’s approach isn’t the most scalable and won’t work for everyone — but the benefits of onboarding are clear. So find a way to bring it to your product.

🔥 Waitlists are a great way to build hype and drive organic interest. Scarcity is a powerful tool that can help you enter a market, or even launch a feature. It gives you control over your growth rate (allowing you to fix issues and make a product great) before opening up to to many people before you’re ready.

❤️ Be obsessed with finding product-market-fit, and making that a core metric. Making something people want and love is probably the most important signal that you will be able to grow sustainably. You have to find PMF as a top priority — so use the 5-step framework to keep iterating and measuring until you get there.

🎯 Segment to find your high-expectation-customers (HXC), and don’t fret about the rest. Not all customers are equal, and trying to be everything for everyone is a huge distraction. Find the people who need your product’s value the most, narrow in on them, and leverage their feedback to build your base of qualified customers.

➰ Find your growth loop — it’s your most sustainable engine for growth. There are various different types of growth loops — Superhuman uses a viral loop. Find your engine, and bring all teams together around it as your framework to drive growth.

See you next time! ✌️

— Jaryd

What a thorough breakdown! Loved it absolutely :)

Rahul indeed is a superhuman. His second startup is blowing successfully. My team and I are developing a marketplace for people to start creating experience and sell those experience to generate income. We're 6 weeks before launch and really looking forward to use these methods by Rahul that you've described. This is my first time reading your article and it blew my mind how detailed you write about the growth of superhuman. Keep it up Jaryd!