How Etsy Grows

Lessons on kickstarting and growing a marketplace from Etsy’s $14b handmade empire.

Every other week, I pick one company/startup you probably know, and go deep on their go-to-market strategy, how they acquired early customers, and what their current growth engine looks like.

If you haven’t subscribed yet, join the other folks interested in growing a company by subscribing here:

Hi friends 👋

I’ve said it before — the internet is a weird and wonderful place.

And this week, we’re going to be looking at how one of the strangest corners of the internet started, and grows.

Etsy. She looks like your normal consumer marketplace, but there’s some pretty weird shit you can find on there. From lovely arts and crafts — to totally bizarre taxidermies, an octopus in a jar, and custom made dinosaur dildos. 🤷

Yeah, if you’re a public company worth $12.7 billion and you’re selling squirrel feet and have a whole section for dinosaur dildos (NSFW) — I’m going to do a deep dive on what’s going on!

Starting a marketplace is appealing for several reasons (which we’ll get into), but they are also notoriously hard to get going. So, today we’ll be getting into the mechanics and the growth drivers behind a consumer marketplace business. I’ll also bring you several great takeaways here along with actionable frameworks and strategies for us to learn from.

I hope this piece gives you insight into what it takes to build a successful two-sides business like this.

Speaking of growing something, before we get stuck into Etsy, I do have one ask. If you learn at least one thing in this piece, please consider subscribing and sharing How They Grow with anyone you know who’s interest in startups and growth. Right now I can’t offer you anything for referrals since the newsletter is free — but I will be immensely grateful.

Cool — let’s get to it!

How Etsy Grows

(Click that link ☝️ to read the full thing in your browser)

Intro

Marketplaces businesses

Etsy’s founding story + the landscape

How they grow

Kickstarting the marketplace

Scaling the marketplace

Growth through M&A

Takeaways

Before putting on our shoes without socks — we first need to talk about marketplaces.

What is a marketplace business?

At first glance, marketplaces seem pretty straightforward — you match supply (people who have something) with demand (people who want something) and facilitate a transaction to make the marketplace work. But, in reality, marketplaces are far from simple.

They are actually probably one of the hardest business models to get right because they are built upon multiple complex systems that are connected and intertwined. This makes them, compared to any other type of business, most similar to a dynamic living thing.

A great marketplace product should seem easy to a user — tap a button and a car shows up — but behind the scenes there’s a constant moving puzzle being solved to keep the balance and this living organism alive.

If you think about running a marketplace, you're basically like a gardener. You have to have a very light touch. If you're building a SaaS business, you're a construction worker, you're building the product and the features and selling it, and it's this very linear thing.

For a marketplace, you're like messing with this ecosystem that you don't actually really understand how it works. And sometimes you might do something over here which drives this long-term effect two months later, and then you're going to be pulling your hair out later trying to figure out what you did over here that made that thing happen.

— Dan Hockenmaier, Developing a growth model + marketplace growth strategy | Dan Hockenmaier (Faire, Thumbtack, Reforge)

Most types of businesses control the supply of their product (e.g D2C ⇒ Glossier, B2C ⇒ Superhuman, B2B ⇒ Notion) and to grow, really just need to create more demand.

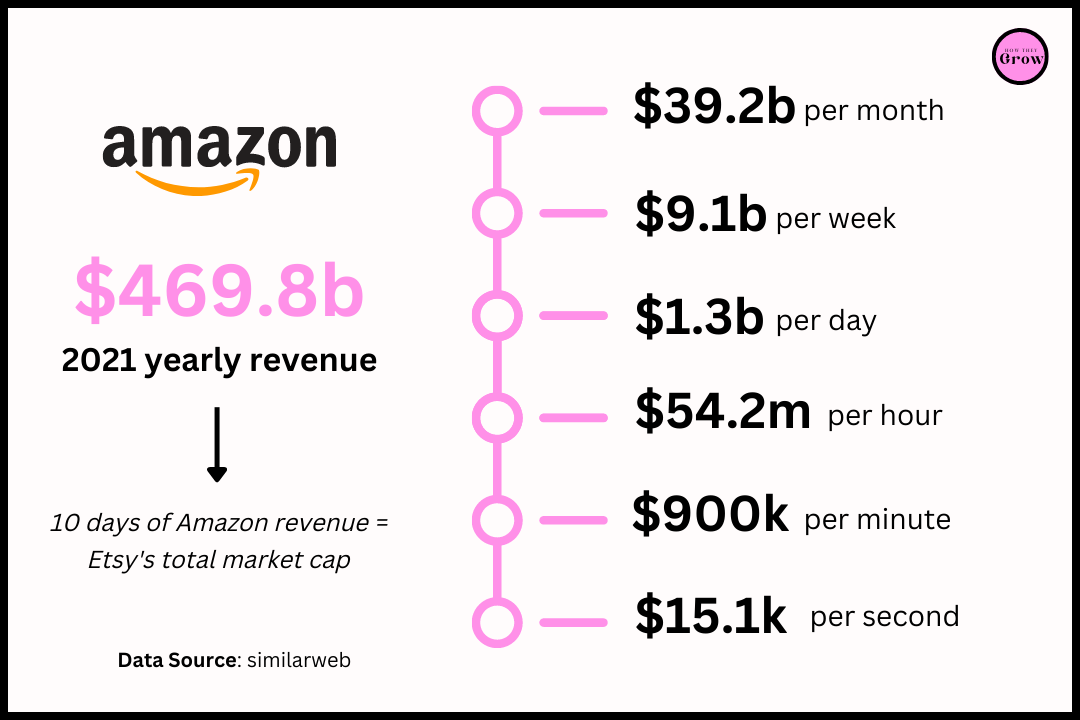

But companies like Airbnb, Uber, Lyft, Alibaba, eBay, Etsy, Hipcamp, DoorDash, Caviar, Rover, Postmates, Thumbtack, TaskRabbit, and Craigslist have another big problem to worry about when growing.

They don’t own any supply — so growing requires acquiring more supply and generating more demand. But do that in the wrong order, or too much or little of one, and you end up with a whole bunch of dinosaur d*cks nobody buys. 😱

So, if they’re so hard (no..marketplaces) — why are they so appealing?

Why start a marketplace business?

According to Lenny Rachitsky, who was the lead PM on the supply side of Airbnb’s marketplace for over 7 years, there are 5 key benefits:

Network effects: The more users you get, the more useful/cheap your product becomes, and therefore the more users you get (e.g. Lyft/Uber vs. taxis)

Barrier to entry: Once they have a strong network effect, it becomes increasingly difficult to enter or replicate the marketplace (e.g. Airbnb vs. hotels)

Efficiency: No inventory means cheaper to operate (e.g. Airbnb vs. hotels)

Scalability: No inventory means easier to scale (e.g. Rover vs. dog hotels)

Flexibility: No inventory means easier to pivot (e.g. Uber Black -> Uber X)

Okay, we have a decent understanding about what a marketplace business is, some of the complexities, as well as what makes them good businesses.

With our socks afoot — let’s talk about Etsy.

Etsy — the mega-niche marketplace

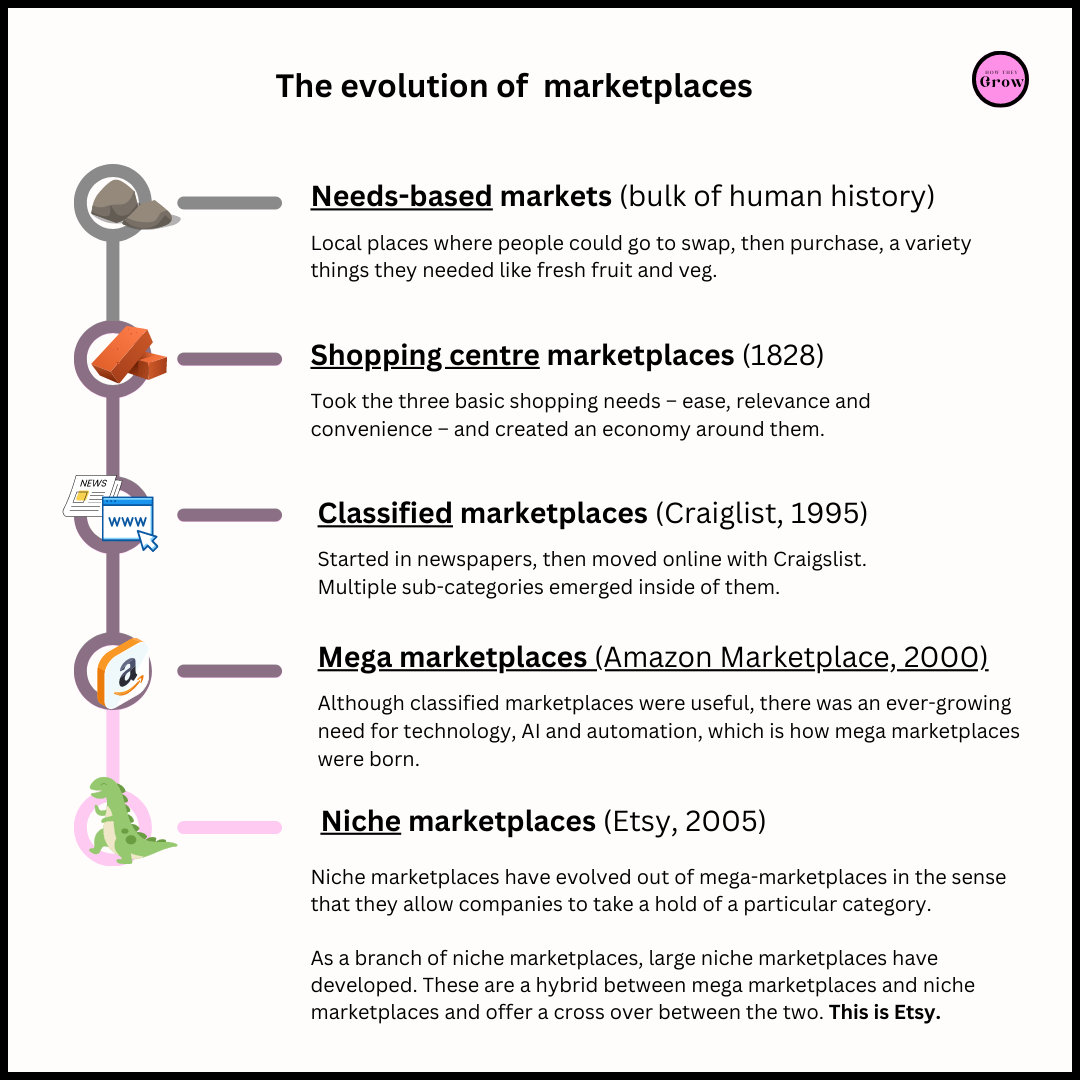

Marketplaces have been around ever since there was somebody who had something that somebody else wanted. They are primordial, and are a manifestation of human need and desire and the behavioral dynamics around getting what we want.

To set the stage, I’ve briefly summed up the evolution of marketplaces for you below.

In 2005, bookseller and construction worker Rob Kalin found himself searching for a way to sell his handcrafted furniture online. As luck would have it, two of Kalin's close friends — Chris Maguire and Haim Schoppik — were also interested in selling handmade goods online.

I started my own company with woodworking and I was making these couture computer cases, and I looked for the best way to sell those. I looked in the offline world, where there’s consignment and there’s wholesaling, and neither of those were really my cup of tea. I also looked at the online world and neither of those really worked out.

And then the magical moment happened when I started working with Jean Railla, who was the creator of Get Crafty.... She asked me to help her rebuild Get Crafty. That was my introduction to designing websites.... I was looking to sell my own furniture, and so that idea percolated and I talked with Jean about adding a marketplace to Get Crafty. She said, and I probably agreed with her, that it would probably be better to start the marketplace separate instead of doing it inside of Get Crafty, because Get Crafty was really a community of people talking, so one thing led to another and the idea of creating the marketplace as a marketplace took birth.

And when I initially started Etsy, my thinking was I’ll build the marketplace where I’d like to sell what I’m making, and then I’ll get right back to making these things.

—Rob Kalin, co-founder, via From Scratch

He quickly became inspired to create an online shop in which he and his friends could sell their handmade creations, helping them become "the protagonists of their own lives."

They started Etsy in a Brooklyn apartment, and the initial version took them just two and a half months to build. The first online niche marketplace was born! They sold their first item (a handmade Flamingo print zip pouch for $8), and ended their first year with ~9K sellers, 22K buyers, and reported over $1 million in sales.

Two years later in 2007, Etsy had nearly 450,000 registered sellers and were generating $26 million in annual sales. That same year, they raised their first venture capital of over $3 million.

Etsy’s growth has been staggering since. In 2022, their GMV was $13.4 billion, and they have 96 million active buyers, with 7.5 million sellers. But, Etsy estimates that the Total Addressable Market for them is $1.7 trillion —which, gives them plenty of room to get excited about and grow into.

Today, the marketplace has become mega-niche and deals in a broad range of items, including stuff in the art, clothing, photography, jewelry, sex, beauty, homeware, knick-knacks categories, as well as antique or vintage handmade toys. They’ve built a beautifully branded platform with great seller features, and provide an ecosystem that allows creators to display their personal-made items with "the feel of a farmer's market instead of a supermarket."

This has enabled many people to quit their 9-5 jobs — which is one of my favorite things that marketplace businesses do — creating economic empowerment.

They pride themselves on being a place where independent creators are free to experiment with products and form real connections with buyers. Trends often start on Etsy — be it dinosaur dildos, sloths, or unicorn merch — and sellers usually offer lots of customization opportunities.

And an interesting finding, despite being founded by men, a Fortune report revealed that the overwhelming majority (86%) of Etsy's sellers are women. Same situation on the demand side, with 81% of buyers being female. And, according to CNBC Markets, Etsy is also one of the few tech companies with gender parity — where half of Etsy's workforce, board, and leadership team is made up of women.

Put simply — Etsy is a company largely run by women, used mostly by female entrepreneurs, to sell to a mostly female consumer base.

So we know where the idea came from, what Etsy does today, and we have a sense of how they’ve grown (by the numbers) into the biggest niche marketplace out there.

But how does Etsy fit into the landscape? What else is out there for sellers? And how has Etsy position themselves in the market to be so successful?

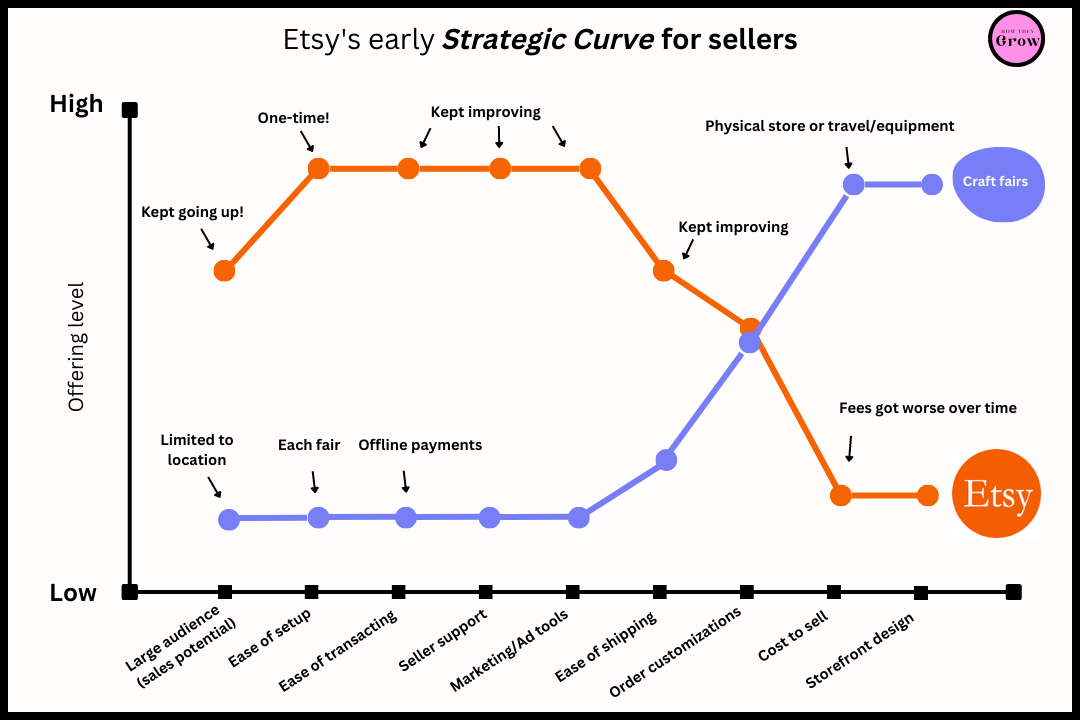

The early landscape + Etsy’s strategic positioning

To answer those questions, I’m going to use a framework I’ve been very much looking forward to putting to use in this newsletter.

It’s called the Strategy Canvas. It’s is one of the core concepts that came out of the wildly popular book, Blue Ocean Strategy (by Renée Mauborgne and W. Chan Kim).

In short, in one visualization, it captures the current strategic landscape and the opportunities for a business.

The strategy canvas allows your organization to see in one simple picture all the factors an industry competes on and invests in, what buyers receive, and what the strategic profiles of the major players are. It exposes just how similar the players’ strategies look to buyers and reveals how they drive the industry toward the red ocean. Importantly, it creates a commonly owned baseline for change.

Blue Ocean Strategy, Strategy Canvas

This is what that looks like, and how it works at a high-level:

You map out the things that customers care about (i.e price, quality, speed, etc)

You plot how much or little of those things your competitors do (think direct, indirect, substitues)

You hypothesize which factors are most important, and what people want more or less of

You then plot your own value curve according to that — creating your strategic differentiation

This, according to the authors, is how you find your unique space in the market and bring value to people that they can’t get elsewhere. For further reading on this framework, I’d start with this video, and then take a look at these other related tools here.

So, bringing that together, this is what the landscape looked like when Etsy started in ‘05, and what their unique value was. Craft fairs and trade shows were the industry-standard — so I’ve mapped the status-quo vs Etsy’s unique offering.

The landscape has obviously changed as more competition has come into play.

But Etsy has stayed true to their well-defined mission: To keep commerce human. They’re the #1 online marketplace people go to when in search of unique and differentiated products, which is very different from Amazon's approach.

If you are looking for a commoditized product — Amazon is unbeatable in terms of selection, prices, and logistics.

How do you beat Roger Federer?

You challenge him to a game of chess, or maybe cards. But you never, under any circumstance, enter a tennis court against him.

Here’s why… 👀

As a niche marketplace — Etsy is playing Federer using 5 key advantages

They are not competing on price and convenience, they are competing on providing special things. And that novelty is what brought them such quick adoption and growth, taking Etsy public and towards their current $12b+ valuation.

How They Grow

Let’s start by looking at the complex problem of kickstarting a marketplace.

Kickstarting the marketplace: Acquiring their first 1K users 🐣

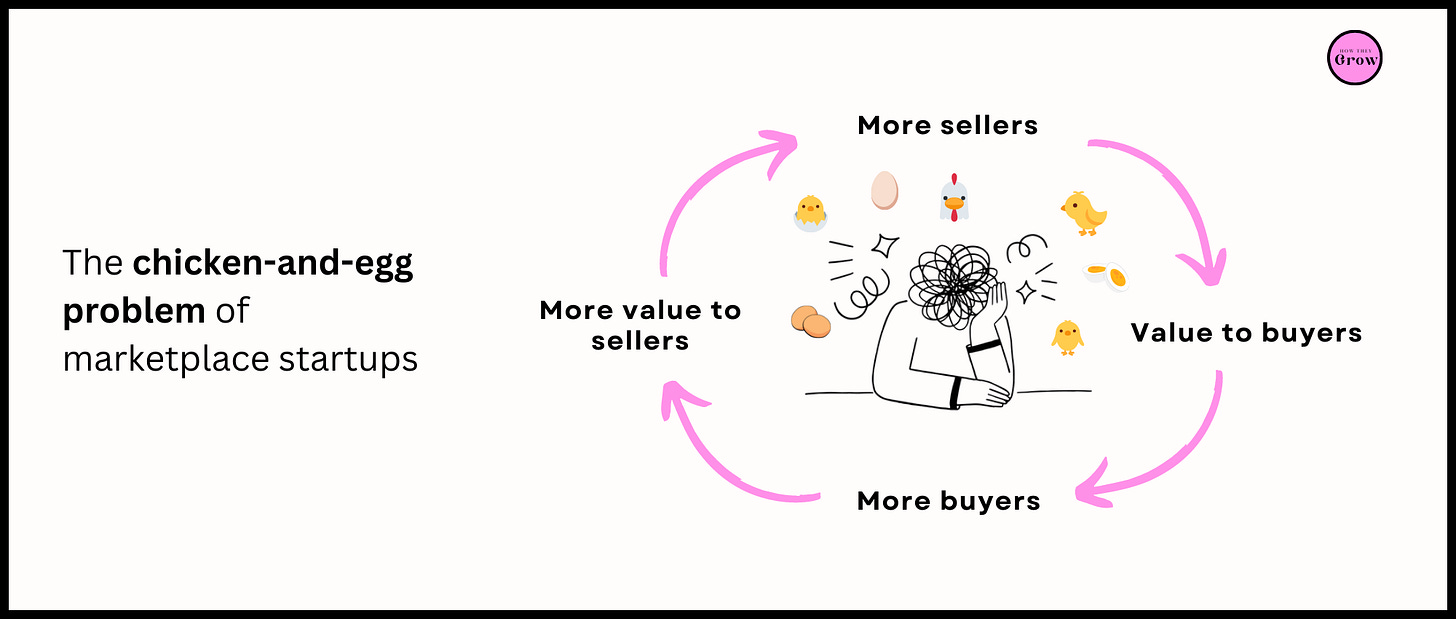

That’s the flywheel of a marketplace, the usual question is, where do you start?

Once a marketplace business is operating, supply (i.e. restaurants, homes, drivers) happily serve demand (i.e. eaters, travelers, passengers). However, when your marketplace is just getting started, and you have neither supply nor demand, it’s challenging to get the flywheel going. You must convince one side of the marketplace to commit before the other side.

For example, without restaurants onboard, a customer looking for food has no reason to check your app. And without customers using your app, restaurants have very little reason to spend time onboarding onto your platform.

This is the chicken-and-egg problem, and solving it is one of the biggest barriers to launching a marketplace business.

So, how did Etsy do it?

They constrained their marketplace

They focused on the seller-side first (the chicken?)

They drove early supply with direct sales

They drove demand with various mechanisms, mainly powered by their sellers

Let’s unpack each of those.

Constraining their marketplace by category

Almost every marketplace starts by constraining their market to help them get to a critical mass more quickly. This is vital for two-sided businesses because every market you enter — whether that’s geography or a category — has its own independent dynamics. Simply, don’t take on more than you can properly monitor and control. You’ll more than likely end up with a mess.

Uber or Airbnb (i.e location-based businesses) need buyers and sellers in the same place. So, having a vibrant marketplace in LA has no impact on your liquidity in say, NYC. If supply and demand don’t need to be in same physical location — then limiting yourself by category is the move.

Constraining helps you start small, build good network effects, and grow with healthy marketplace metrics — like how quickly it takes to find what you want, and whether you can even find what you want at all.

From the beginning, we had only three categories of things you could sell: vintage items, craft supplies, and handmade items.

Having decided how to constrain the marketplace, they then need to pick which side of the marketplace to put most of their resources behind (supply or demand).

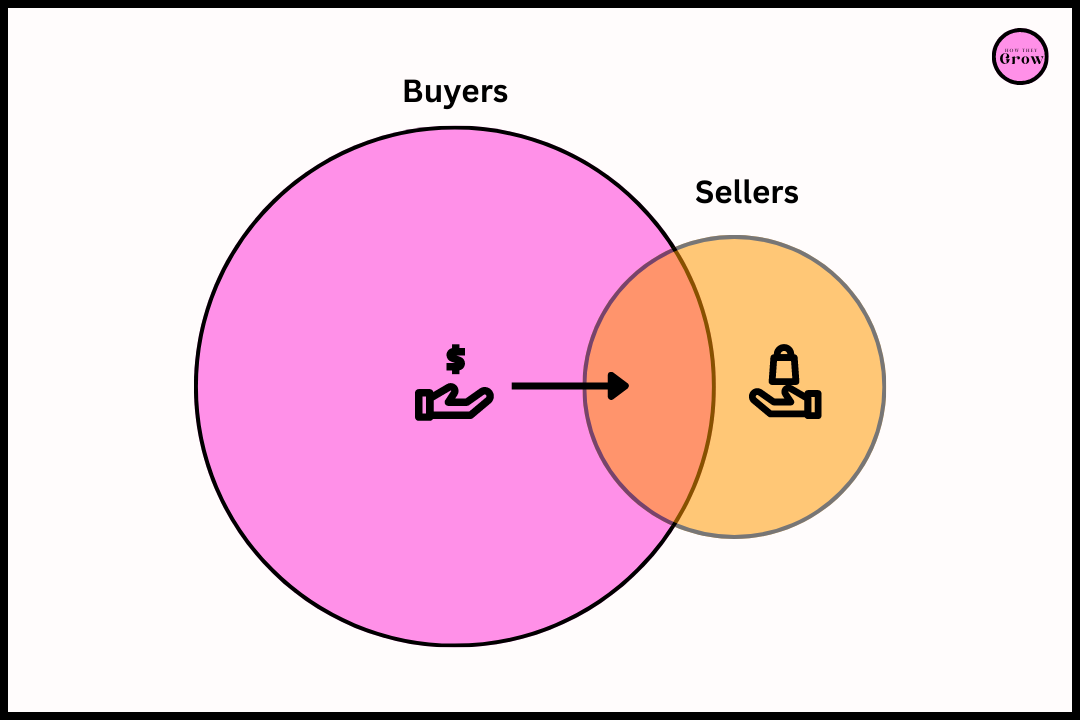

Focusing on the seller-side of the marketplace first

Most marketplaces focus on generating supply as their priority. This is because supply is usually the hard side of the market, and often supply drives its own demand.

In my opinion, starting with demand would be like inviting customers into your shop, but it’s empty. The only time that makes sense would be if there is a huge amount of immediate interest from supply, and there are not enough buyers to keep them happy.

In the early days there was a huge focus on sellers. The marketplace needed sellers and their listings to build enough supply to attract buyers. Also, the sellers were also the buyers early on. Supply directly created demand. They were literally all the same people.

— Nickey Skarstad, ex-Director of Product at Etsy.

Driving initial supply [bringing in chickens 🐥]

Etsy started by focusing on supply, and, has continued to stay supply constrained throughout most of their history. That’s the reality for most successful marketplaces — and if you’re starting one, should probably be yours.

Why?

The best answer I could find comes from an an awesome thread by Li Jin, a partner at a16z, driven by her conversations on marketplaces with Andrew Chen and Andrew Chapin.

The best consumer marketplaces end up supply-constrained because they tap into an incredible amount of demand. The product/market fit is so strong that this demand puts pressure on supply.

Everyone talks about chicken-and-egg as if demand and supply were equivalent problems. But identifying a widespread user need and driving tremendous value for the demand side is what underpins successful consumer marketplaces.

I often see early-stage marketplace founders, during the idea picking stage, focusing too much on the needs of the supply side. “Suppliers in [industry] need better monetization, more data, lower fees, etc, which is why we’re creating a marketplace that helps them with this!”

But the most successful marketplaces didn’t start by solving supply problems. Homeowners likely weren’t thinking pre-Airbnb, “I have a spare room and need to monetize it.”

Instead, these marketplaces started with acute, widespread demand problems. They honed in on user needs that already existed--for affordable places to stay and convenient transportation--that were poorly or insufficiently met, and leveraged underutilized supply to fulfill the latent, excess demand.

“Chicken-and-egg” becomes 🐥 supply ⇒ 🥚 demand ⇒ 🐥 supply, 🐥 supply, 🐥 supply!

That means (1) identify a user problem, (2) then bootstrap enough supply to make the marketplace valuable to initial users, and (3) once there's product-market-fit (PMF), focus on scaling the supply side to meet all the demand.

So, looking at (2) — how did they get those proverbial first 1,000 users?

One of the most common ways to acquire the first 1,000 users as a consumer startup, is to go recruit your ideal customers directly where they hang out.

Etsy went out and met their sellers offline and online, and used direct sales as their main acquisition method. Unsurprisingly, this follows the now cliche do things that don’t scale. But especially for a marketplace where 1 unit of supply (i.e one store) can serve a lot of demand — the ROI for this hands-on effort makes sense.

Offline:

We did something that works and is often overlooked. We got off the internet and there was a team out there across the U.S. and Canada attending art/craft shows nearly every weekend. Supporting potential sellers (we would buy them lunch, drop off ‘craft show kits,’ pass out handmade promos)—these were artists/crafters that were influential in the handmade world. We knew if they set up shop on Etsy, and were successful, others would follow.

The community team went to a different show every single weekend all across the U.S. and Canada. Most sellers I knew did not have any other kind of online presence or activity on other sites.

ーDanielle Maveal, via Quora

Online:

We ventured to build a marketplace for this apparently underserved niche, and while doing so we became familiar with Craftster.org (which at the time was another message board consisting of around 100,000 people). We reached out to Craftster’s founder [Leah Kramer] and suddenly we had an audience with an even larger group of interested sellers.

By the time we launched the site (roughly two months after conception), we had thousands of sellers excited to register and try it out. The ball started rolling almost immediately (especially since we offered fee-free listing for the first few months while we built a billing system).”

tl;dr: We extended an accommodating bridge to a preexisting online community, and they jumped aboard happily.

ーChris Maguire, co-founder, via Quora

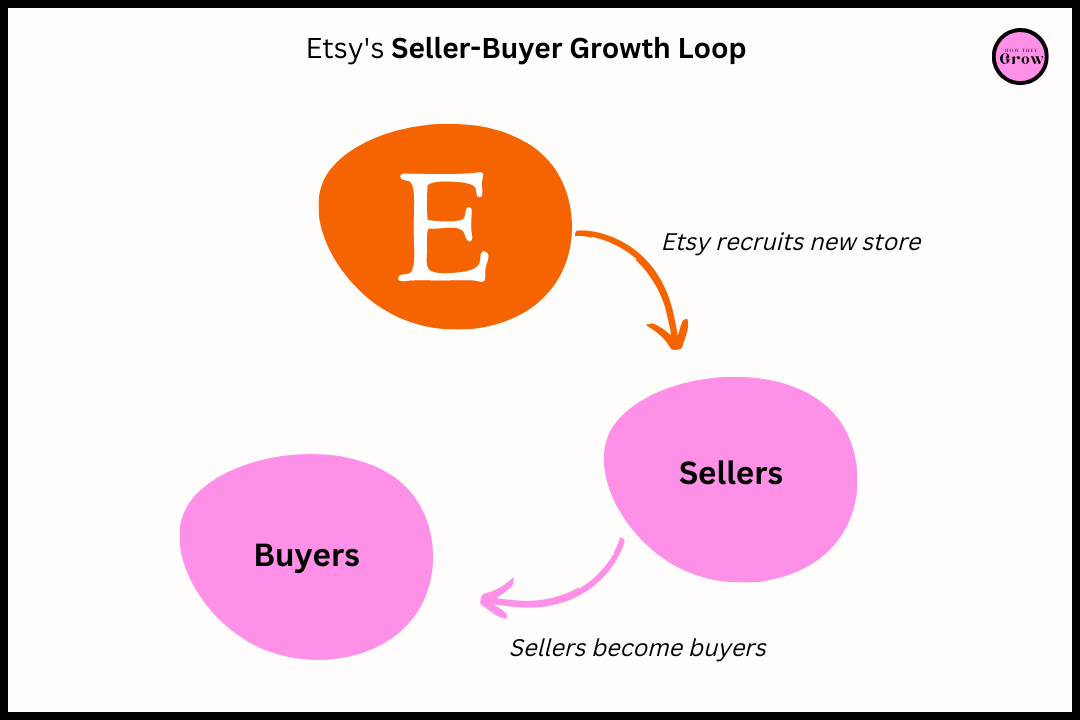

And, according to Thales Teixeira in an HBR podcast, one of the major benefits Etsy found recruiting sellers was that they would eventually recruit their own buyers to the site instead of just using digital marketing. Did somebody say, loops? 👀

Driving initial demand [selling their eggs 🥚]

So, Etsy started by constraining the early marketplace to just three categories, focusing on supply growth, and building their initial supply by going to find crafty-folks at craft fairs, both offline and online.

At some point with a marketplace, you will need to invest in driving demand. How soon you need to do that depends on whether you have PMF, where growth is coming from, and how easily you are bringing in new supply.

When Etsy saw that they were acquiring supply relatively easily, and, that the sellers were being underutilized — they started investing in creating more demand.

They did this in four ways — significantly…all free channels, and all growth loops!

Supply driving demand

Word of mouth

SEO

Seller-buyer-seller loop

Again, let’s look at those in a bit more detail. 🔬

Supply driving demand 🔁

Etsy enabled their supply to drive demand — something many platforms and marketplaces, including DoorDash, Cameo, Behance, Product Hunt and Substack have done.

Sellers were doing their own grassroots marketing, and that became a big growth driver. Etsy pushed sellers to promote their shops to their communities in order to drive growth of their shops, which in turn drove growth of the marketplace overall.

Note — regardless of the type of product or business, if you create a growth loop, you’ve got a sustainable engine to drive growth.

Word of mouth 🔁

Etsy had a unique value proposition that was so different to anything else out there. People, especially woman, had a huge desire to buy unique handmade items.

Sellers chatted at craft-fairs, told their friends and customers, and were often buyers on Etsy themselves. And people would show off all the things they were buying — for gifts, or for themselves — and pointed people back towards Etsy.

SEO 🔁

This channel is effective on the demand side — supply side, not so much.

Think about user behavior. If you’re looking to buy a camera or gift, you’re going to search for exactly what you want, or inspiration, on Google and there are going to be loads of results trying to get your attention.

If you’re selling a camera, you’re far less likely to Google “where to sell cameras”.

So, generally speaking, marketplaces invest in SEO to bring in more demand for their sellers.

With millions of product listings getting indexed by Google, search traffic was very real even early on.

— Nickey Skarstad

And, according to GrowthHackers.

The company was spending ‘next to nothing’ on customer acquisition. This trend remained fairly consistent as the company continued to grow. Since 2011, organic channels have represented 87% to 91% of Etsy’s traffic, while paid ads have been responsible for between just 2% to 7% of traffic.

And that again, highlights the value Etsy got from focusing on sellers.

More sellers ⇒ more listing ⇒ more SEO value ⇒ more demand ⇒ more sellers!

The seller-buyer loop 🔁

An early growth driver was a loop that was created by sellers who were making handmade items buying the supplies to make those handmade items from other sellers.

This self-sustaining ecosystem created nice network effects and powered buyer growth early on, before more organic buyer growth happened over time.

— Nickey Skarstad

Okay, these sellers were clearly doing a lot for Etsy! Basically they were driving 4 individual, free, growth loops to help Etsy bootstrap demand — growth loops that all still drive growth for Etsy today!

This is why picking the supply side of their marketplace was such an effective strategy.

Okay, so we know how Etsy kickstarted their early marketplace. Now, how did they scale it?

Taking a note from Hulu, Peacock, and soon, Netflix… If you’re finding this content valuable, consider clicking the little gray heart below the headline at the top of this post, subscribing, and/or sharing this newsletter with friends.

Onwards we go!

Scaling the marketplace: More supply and demand 🐓

In the early days — most marketplaces focus on supply. But, things start to change as PMF is found and the marketplace grows up.

You might stay supply-constrained, but you could also become demand-constrained.

What does that mean?

It simply means that your biggest constraint to driving additional transactions is a lack of supply (e.g. Airbnb Homes, Uber drivers) or a lack of demand (e.g. Rover dog owners, TaskRabbit customers).

In theory, you always want more of both, but in many cases adding more of one side doesn’t actually lead to growth. Your resources are better spent elsewhere.

— Lenny Rachitsky

And according to Lenny, as marketplace, one of the first things you need to do as you start to scale is figure out if you’re supply or demand constrained.

And how do you know which one you are?

Cue expert answer. 👇

Supply-constrained = too much demand to fulfill all potential transactions

You’ll typically see:

Very high sell through rates (% of listings that get sold)

Quick “turnover” (amount of time a listing sits before sale)

Low or no buyer CAC

Demand-constrained = more than enough supply to fulfill all the inbound potential transactions

Transactions will still happen, but on average it will take a lot longer - and many listings may never sell!

For Etsy — being supply or demand constrained varies per category. They might have more people selling those dinosaur dildos than there are buyers…and they might have more people wanting to buy vintage posters than they have sellers.

One strategy doesn’t fit all here. So, to handle this fluidity on constraints and know where to focus their efforts to grow, Etsy (like most marketplaces) uses a model and set of metrics to help them understand which side needs their focus in a specific category — i.e liquidity.

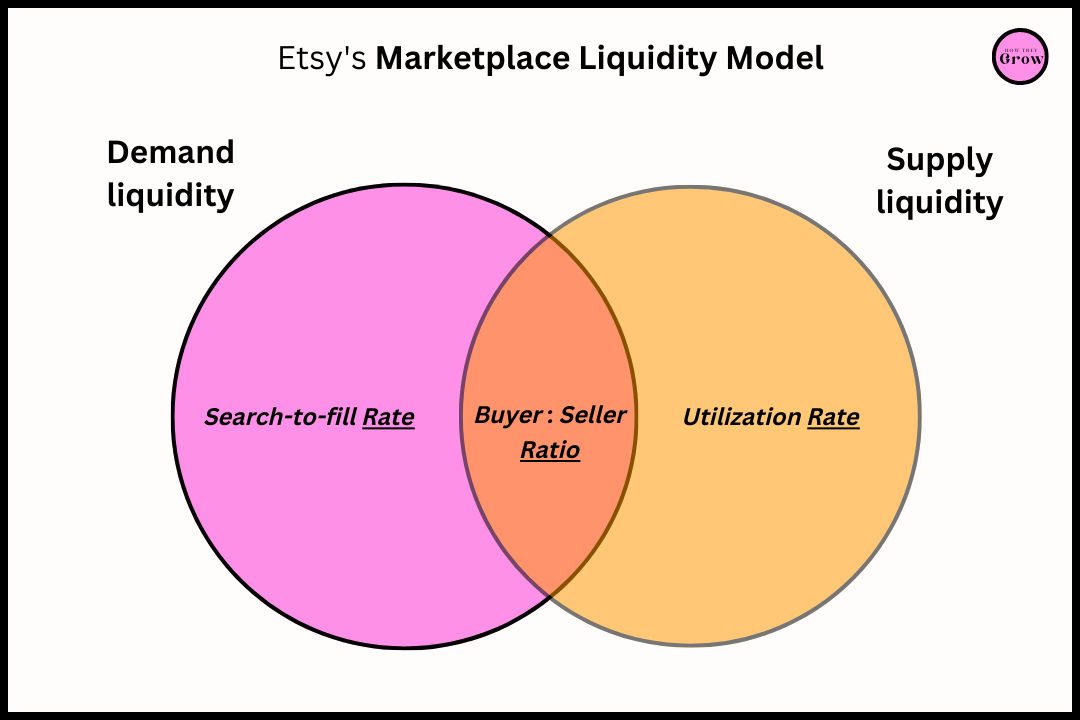

Measuring marketplace liquidity across categories

Liquidity is the lifeblood of marketplaces. It is the efficiency with which a marketplace matches buyers and sellers on its platform. One could say that a marketplace without liquidity has no real product because the ability to transact on the platform IS the product.

— Julia Morrongiello, WTF is Marketplace Liquidity?

For Etsy, liquidity on their seller side is best captured by measuring the Utilization Rate, i.e — are people who sell stuff getting orders. And on the buyer side, it’s best measured as Search-to-Fill Rate — which represents the likelihood that what someone searches for leads to a transaction.

That middle part, simply, is how many sellers there are per buyer. This is usually always tracked for a marketplace, but in the case of Etsy, it’s less important. That’s because supply (defining that as sellers here, not inventory) isn’t really matched with demand in the same way that it is with Airbnb or Uber Eats — where if there are too few drivers, people get hangry!

With this model for liquidity Etsy constantly evaluates what’s going in inside their categories, and appropriately grows the side that needs the most attention.

Now, all that being said…

For marketplaces, “owning demand” is the surest path to sustainable growth. In practice, that means users come directly to you, rather than going through intermediaries like Google or Facebook, and that they exclusively (or almost exclusively) rely on your marketplace instead of comparison shopping with competitors.

It’s one of the key challenges of any marketplace. “Demand efforts” like SEO, SEM, CRO, and amazing UX are necessary, but not sufficient; ultimately, the key to owning demand is through supply strategy.

The right supply strategy varies based on the product being offered and those customers’ needs. If users value consistency and predictability—like, say, UberX—the path to long-term success generally lies in being both better and cheaper than the competition.

However, in most marketplaces, users value having a high variety of supply. For these marketplaces, there are three main strategies for supply differentiation: comprehensiveness, exclusivity, and curation.

For Etsy, their supply strategy has largely been exclusivity. But as they’ve evolved into that mega-niche marketplace we keep talking about, have added a comprehensiveness strategy to the mix too.

Supply Strategies: Exclusiveness ⇒ + Comprehensiveness

Simply, this is being the only source for something that’s in-demand. That’s a unique value proposition that gets people excited and brings in more customers.

Want to watch Stranger Things? You need Netflix. GOT? — you better be on HBO.

That’s the power of having exclusive inventory.

By and large, you find the types of handmade stuff that’s on Etsy, only on Etsy. And the way they have maintain that un-contracted exclusivity with their sellers is by providing them with best features (like onsite and offsite ad solutions), solving seller pain points like inventory management and shipping, and bringing them the largest qualified group of buyers.

As Etsy has scaled, their exclusiveness strategy has become stronger (branding + network effects), but they’ve also become far more comprehensive.

A comprehensiveness strategy prioritizes building an extensive and diverse supply base, giving customers many different options for any single transaction. For many winning marketplaces, comprehensiveness is the core value proposition that allows them to own demand and provide a sticky product.

As an example, if you want to buy handmade decorative pillows — you’re now going to have over 850K results across countless different stores.

That’s a ton of choice (comprehensive) , and Etsy’s probably the only place you can reliably get that stuff with all the right buyer protections, etc etc. (exclusive).

Comprehensiveness comes in two shapes and sizes though — vertical and horizontal.

Vertical ⇒ does Etsy have a lot of choice in a specific category?

Horizontal ⇒ does Etsy have coverage across different categories?

Decorative pillows tells us yes, they do have great depth in the categories they offer.

How about across categories?

Category expansion: Niche to mega-niche!

In the early days, Etsy constrained their market to just 3 categories — allowing them to build liquidity and create network effects with their target audience.

Today, they have 3,240 sub categories across 15 top level ones.

This has made them mega-niche. They’re niche in the fact that it’s all handmade, but they’re mega because you can now find basically anything handmade there!

Each new category they expand to creates more listings, more SEO value, and brings new buyers into the Etsy ecosystem.

And, what’s more…

Etsy's sellers are typically small entrepreneurs, meaning they can adapt quickly to changing demand. This makes Etsy's inventory dynamic as it can rapidly evolve to reflect the latest pop culture trends and social norms. For instance, mask sales skyrocketed during the pandemic -- over 53 million face masks were sold on Etsy in 2020 -- as thousands of sellers responded to overwhelming consumer demand.

Ultimately, this diverse and dynamic inventory is a big advantage. If you're a buyer looking for something personal or unique, there's a good chance you'll find it on Etsy. And if you're a seller looking to monetize your creativity, this marketplace is a perfect fit.

This wide range of exclusive, dynamic, supply is how Etsy “own demand”. And owning demand, according to a16z (leading VC’s in marketplace investment), is the “the surest path to sustainable growth”.

But Etsy has another loop at play.

Demand driving supply 🥚⇒ 🐥

I’m sure you’ve been on Airbnb before to find a place to stay, and wondered what hosting would be like. Well, many people do in fact come to Airbnb as travelers, and end up becoming hosts. That’s exactly what happened to me.

And that’s the buyers-becoming-sellers loop, and it’s been a self-sustaining engine of growth for Etsy.

Here’s how it works:

I come to Etsy to find a handmade gift

I learn about this growing craft community

I know I’m creative, and daydream of selling things I make on Etsy

I hit the “Sell of Etsy” button

My life-long dream of selling handmade desks comes to life

There’s a great piece by Brian Rothenburg on this type of growth loop. Essentially, he says this is one of those things that you just can’t force — it either happens organically, or it doesn’t.

If it is happening, you should lean into it and optimize conversions with better discovery and product flows from buyer-side to seller-side.

And because Etsy cuts across various categories, they have a huge advantage in terms of the demand side understanding the breadth of offerings. This makes the platform seem more accessible to people who might have an idea for something to sell.

With Uber (specific), you can be motivated to become an Uber driver or Uber Eats driver after taking a trip. But with Etsy (broad), you can be inspired to sell anything handmade.

Lastly, as Etsy’s bank balance has increased — they’ve also expanded supply & demand another way.

Growth through M&A: Building a House of Brands

When a business has capital — it has choices.

Essentially, there are four things they can do with it. They can reinvest (hire more people and build new things), return capital to shareholders (dividends), buy other companies (M&A), or build up their balance sheet.

Generally, reinvesting is the best move for startups. You get to grow your team, create more customer value, and grow by building your own house.

But, as you get bigger and bigger, and your profits and cashflow get better — buying other companies becomes a viable strategic move.

And as a marketplace, according to Kevin LaBuz (ex-Strategic Finance at Etsy), there are three options for M&A:

Consolidation: Increasing market share in existing verticals or geographies.

Expansion: Entering new verticals or geographies.

Technological: Adding tech capabilities or acqui-hiring engineers.

In 2018, Etsy made their first acquisition of DaWanda, a German marketplace for gifts and homemade goods. This was the first time they went after an external opportunity and grew their geographical presence. “It consolidated Etsy’s market share in Germany and improved its marketplace liquidity, while also expanding its footprint into Austria, Poland, and Switzerland”, according to Kevin.

DeWanda has since been fully merged into Etsy, meaning all the stores and inventory that were on DeWanda now live on Etsy.com — the buyers followed.

Since then, they’ve acquired 3 other major brands, with the M&A focus being vertical and geographic expansion.

Etsy’s M&A strategy is to build a House of Brands by acquiring a portfolio of unique marketplaces. Acquired companies operate independently as standalone businesses, but share best practices and resources. Etsy owns four differentiated brands:

Etsy: A global marketplace for vintage and handmade goods;

Depop: Secondhand fashion with a strong Gen Z customer base;

Reverb: A marketplace for new, used, and vintage musical instruments; and

Elo7: Brazil’s leading online market for unique and made-to-order goods

— Kevin LaBuz, How Etsy Has Sustained Growth With a Clever M&A Strategy

Here’s a visual summary of their acquisitions, and how each helped them grow.

[Source: Etsy 10Ks and regulatory filings]

Josh Silverman, Etsy’s current CEO, refers to their M&A playbook as “Picky & Patient”.

In my experience, companies can be in a mode where they kind of feel like they need to go and buy something and I’ll buy whatever I can in the next three to four months to fill some kind of need, in my experience, that usually doesn’t end well. A better place to be is to have a clear set of criteria for what you’re looking for and be patient and picky and then opportunistic. When the right deal comes around, you buy it. If it’s at the right price, if you’ve got the bandwidth to do it and if it’s a great fit.

— Josh Silverman

Essentially, they wait for opportunities to come up that meet their M&A criteria, which according to their Investor Relations documentation, are: strong and authentic brands, vertical or geographic leadership, expanding Etsy’s TAM, asset-light marketplace business models, unique supply, similar growth drivers, and aligned missions.

By and large (as long as quality and trust are maintained), two-sided marketplaces get better as they get bigger. More sellers brings in more buyers and more buyers attract more sellers. While these acquisitions have put a dent in Etsy’s balance sheet — Etsy has delivered on their promise to help these brands grow, which brings in more portfolio value for the Etsy overall.

…and that’s a wrap! [Takeaways 🍕 coming up right below]

This was loads of fun, thank you so much for reading!

If you learned something or just enjoyed this deep dive — feel free to hit the like button, subscribe if you’re new here, or share How They Grow with a friend. ❤️

See you in 2 weeks for the next deep dive — and now, also on Friday’s for our new weekly column, 5-Bit Friday’s!

— Jaryd ✌️

Takeaways 🍕

Note, the hyperlinks just bring you to the relevant section above.

Finding a way to solve your own problems is a great way to find a startup idea. There are various ways to come up with a startup idea, most of them revolve around observation. Sometimes the best ones come from scratching a personal itch and building something for yourself — like finding a place to sell the furniture you love to make.

Marketplaces are hard businesses to start — they’re like living organisms. Most businesses just need to create demand, but marketplaces need to create supply (which they don’t own). And the ways these two sides interact is dynamic and unpredictable. But, once they’re going — have great advantages like network effects, defensibility, economics of scale, and other efficiencies that come as they scale.

A great way to understand the competitive landscape and opportunity for a business or idea, is to create a Strategy Canvas. Strategy is hard to get right, and finding a useful strategic framework that works for your business can be tricky (because there are lots). But, one great diagnostic tool and way to visually show the unique value and competitive differentiation, is with a strategy canvas.

Don’t take on Federer — find your game of chess. You won’t win on a tennis court, so in order to be successful, play a different game. This is true for marketplaces or any startup idea, and using the tool above can help you find your advantage against the likes of Amazon.

To start a marketplace, follow these four high-level steps. Constrain the market (geo or category), focus on the hard side (usually supply), bootstrap that side, drive demand. There’s nuance in there of course, but that’s seemingly the playbook according to Lenny Rachitsky.

The chicken-and-egg problem, seemingly, isn’t really a problem — start with chickens. “Everyone talks about chicken-and-egg as if demand and supply were equivalent problems. But identifying a widespread user need and driving tremendous value for the demand side is what underpins successful consumer marketplaces.” Chicken-and-egg becomes: 🐥 supply ⇒ 🥚 demand ⇒ 🐥 supply, 🐥 supply, 🐥 supply!

To get those first users — get out there like Etsy and meet your target audience where they are, whether offline or online. How to get your first customers varies based on business model, audience, and a bunch of other things. But, getting out there to meet the people you want on your platform where they currently hangout can be a huge ROI.

When you’re acquiring supply relatively easily and the sellers you have are being underutilized — that’s when to started investing time in creating more demand. Having supply is usually a great carrot to bring in demand, but sometimes you need to specifically invest in getting more buyers.

Marketplaces can have several interesting growth loops at play. Supply drives demand, SEO, word-of-mouth, and if you’re lucky — demand drives supply.

As a marketplace scales — the way it gets constrained can change. You need to have a mechanism in place to watch liquidity metrics to make sure you have healthy dynamics. Liquidity if the lifeblood of marketplaces

For marketplaces, “owning demand” is the surest path to sustainable growth. And the key to owning demand is through supply strategies, like exclusiveness, comprehensiveness, or curation.

Category expansion can make a niche-marketplace mega-niche. Scaling into new verticals or horizontals makes your marketplace more comprehensive. Etsy’s niche has stayed handmade, but they have grown to have anything and everything handmade.

M&A can be a viable strategic move to help a marketplace grow. When you have cash, you have options — one being to buy other companies. For marketplaces, the strategic value in acquisitions is consolidation, technology, expansion.

Any of your own takeaways? Would love to hear in the comments below!

Really very informative post.

Your growth stories are packed with actionable insights.

Thank you for the deep dives. It's like a force multiplier.