8 lessons from my first startup investment

Breakdowns on negative CAC, strategies of constants, creator squads, a brilliant cold email tactic, and more

Jaryd here! 👋 You’re reading How They Grow—my newsletter’s main series where we unpack how the greatest companies are winning, and what you can learn from them.

Friends, I just made my first startup investment. Today’s deep dive is a tad different, where I’ll share what stood out most to me about the company’s approach. My hope is that sharing this will add to your mental model and inspire some ideas to help you with your own product.

For example, have you ever heard of negative CAC, a strategy of constants, or using a suite of brands to sell your product? Yup, neither had I.

I learned this from Athyna.

Athyna helps companies grow their full-time teams by unlocking great talent in non-obvious emerging tech markets like LATAM. They get rid of the headaches that come with building a distributed workforce, they use AI to match talent and companies ridiculously fast, and they add tons of value to both ends of an important equation: They help companies save money, while simultaneously helping the people working there make more of it.

But that’s impossible, Jimmy!

When industries mature, growth slows. And when growth becomes more expensive, efficiency becomes the name of the game. Efficiency means sustainability, and that means founders need to obsess over healthier profit margins.

This is just how the world works. As my favorite economist, Noah Smith explained it; this is where we’re at with the tech industry since most things on the internet have now been built.

The result of this maturity and cost of growth is real…startup failures in the US have jumped 60% over the past year. Also, according to Carta, the bankruptcy rate of startups is 700% more than in 2019.

Ultimately, startups fail when they run out of cash. And in tech, headcount is by far the biggest line item—often accounting for ~70% of a company’s budget.

Athyna is in the business of bringing that number way down without compromising on talent quality. In a time of expensive growth, Athyna helps make it affordable again, giving startups essential extra runway.

That’s a bet I can (and did) get behind.

What to expect 🤝

The rest of this piece will unpack 8 new ideas on product, growth, strategy, and startup building I’ve learned studying how Athyna grows. Here’s a peek:

The power of embedded media companies

Creator-squad growth

A strategy of constants

Mind the shiny object

The cold email growth hack

The sidecar product trick

A simple, but hard, superpower.

Build what you can consume

20-minute read.

If you want to learn more about how Athyna can help your company grow and save on your biggest cost, you can learn more here or just book a call.

1. The power of embedded media companies

💡 Big idea: Modern media companies (e.g. NYT) have a software company embedded inside. But, next-gen software companies will have media companies embedded inside.

🫰 Why it matters: Embedded media companies can create negative CAC and turn lead gen into a profit center. And with growth becoming more expensive, founders who don’t build a media/creator strategy may struggle with it in the coming years.

🥇 Applying it: An easy first step is investing in your personal brand. Social media or starting a newsletter is a tool to grow your audience and therefore your business. Or, you could consider buying a small newsletter/podcast.

Let’s go deeper…

People were confused when HubSpot acquired The Hustle newsletter and the My First Million podcast. What business does a SaaS company have buying two media companies?

Well…

HubSpot wants to grow in the SMB and mid-market.

CAC through traditional marketing and sales here is very crowded/expensive

That CAC is only going to increase as those channels get more saturated

Newsletters & podcasts are good at building large and engaged audiences for very little cost.

Those SMB & mid-market decision-makers read/listen to The Hustle & MFM

By owning them, HubSpot drives brand value and can reach them for free

Bonus: These companies will keep making money to pay back the investment

Unpacked like that, it’s hard not to see the brilliance of the strategy.

And it’s clearly worked. Since then Hubspot has built the Hubspot Podcast Network which now has 34 unique podcasts all focusing on at least one of HubSpot's ICPs. They’ve doubled down on this “Own your own media” play and are hoping to find the next MFM early.

They’re not alone.

Pendo acquired Mind the Product—a PM community and newsletter.

RobinHood acquired MarketSnacks—a financial newsletter for consumers.

Mailchimp acquired Courier—a business magazine

Zapier acquired Makerpad—a no-code newsletter.

SemRush acquired Backlino—a marketing newsletter.

By owning these embedded media companies, these software companies are all enjoying what Bill calls negative CAC through this channel and organically integrating their brand in extremely valuable, non-salesy, content.

It’s such a winning move.

And Athyna is doing exactly that with the Open Source CEO newsletter that boasts a wild 40,000+ subscribers and sold-out sponsors.

The only difference is Athyna didn’t have to buy it because it’s written by Bill! With every email that Bill is paid to send, his media co. drives leads to Athyna.

To build or to buy…

If you’re a bigger company wanting to break away from expensive channels, you’re probably best off buying one because you’re getting the right audience instantly, vs being distracted and having to build one yourself.

As Kyle Poyar says,"Big SaaS companies with billion-dollar valuations can afford to treat media acquisitions as experiments and as an insurance policy against uncertain future outcomes. They don’t necessarily need to build a comprehensive business case with board-approved targets in order to get the green light on an acquisition. These types of acquisitions haven’t been proven out yet among earlier stage (Seed-Series C) or more cash-constrained companies.”

But as Athyna and Bill show us, startups can also invest in their own, independently branded and run, newsletters or podcasts to feed their core business. For instance:

PostHog has Product For Engineers co-authored by the team.

beehiiv has Big Desk Energy by founder/CEO Tyler Denk.

It’s not easy doing this while running a company, but Bill has great advice on how to do it.

We now know software companies owning an embedded media company get free growth. Bill saw how well it worked, and asked a simple question, “How we can 10X this?”

Instead of buying more media companies, Bill’s genius strategy was to get many media companies to buy a part of Athyna. Let’s pull the thread on this below.

🔑 Bottom line: Owning your own brand-independent media company is like having another business that gets paid to organically drive excellent leads to your main business.

2. Creator-squad growth

💡 Big idea: Go beyond paid creator/influencer marketing. Create a group of creator investors that will keep shouting your name.

🫰 Why it matters: People want to buy from other people, not brands. But an ongoing creator program can be expensive. One way to indefinitely tap this growth channel and grow while your creators grow for $0 in cash, is by raising a mini round that is creator-led.

🥇 Applying it: Think about a few “influencers” in your space that likely reach your ICP. Then test a lead-gen campaign with one or two of them. Get some data, and then model out what ~10-20 creators could do for your growth.

Let’s go deeper…

Athyna’s latest funding round of $2.5M was mostly led by 15 creators. Myself included.

The combined reach of this group is well into the hundreds of thousands of unique people, with many millions of monthly impressions. As investors in Athyna, we talk about Athyna.

The data? 40% of Athyna’s leads are now coming through this channel.

And importantly:

They aren’t paying any cash for this growth, allowing them to invest in other channels and R&D.

As these 15 media companies grow (which conservatively is probably a combined 50-100% a year), this channel becomes more effective vs how others become more competitive.

This growth all compounds in SEO over time given all the content is evergreen, with mounting backlinks and increased domain authorities of these growing creators

The word-of-mouth flywheel will spin faster.

I’ve seen more and more companies have a creator strategy, but they’re all based on paying the creators via direct sponsorships or affiliates.

I haven’t seen one besides Athyna leveraging creators by getting them to pay the company to talk about them.

It’s negative CAC on steroids.

Somebody Give Bill a Bells! 🥃

But while this idea was Bill’s baby, I must give so much credit to the team who do an extraordinary job creating a community around this group of creators. I won’t give away all the behind-the-scenes secrets to this brand-new program because Bill might slap my wrists, but here’s one thing that stands out to me.

What they do: Athyna offers to help us with content, research, sponsorship outreach, and facilitating collabs. Plus, we all share lots of insights with each other in Slack on how to grow and monetize.

Why they do it: Athyna wants their creator investors to be as successful as possible.

The outcome: Growth in their creators means growth to Athyna.

Everybody wins.

The universal idea is this: Don’t be shy about giving away parts of your company to people who can have a direct hand in helping you grow it efficiently and sustainably. That’s employees. It’s key customers or partners. It could be creators…

💡 Bottom line: Every growth channel is going to become more expensive to play in over time. Investor creators could accelerate your negative CAC strategy and drive steady leads.

3. A strategy of constants

💡 Big idea: There’s a Bezos philosophy around strategy: Always focus on the constants. This means invest in the customer needs and wants that will never change.

🫰 Why it matters: It’s very easy to get caught up adjusting a strategy based on hype cycles. And, while you don’t want to stop lifting your head to see what’s changing and spot possible inflections, you mainly should focus on defining and building upon the things that endure over time.

🥇 Applying it: Find time to map out what your market’s fundamental needs are—the timeless principles that are unlikely to change in the future. Then check if your strategy clearly improves those things for your customer.

Let’s go deeper…

You can probably think of at least 5 products that have added some AI feature that feels unnecessary.

These are trend chases looking to add the Sparkle emoji to their homepage. ✨

But Athyna has based their AI strategy on the idea of constants; an idea first introduced by Bezos.

We know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, 'Jeff I love Amazon; I just wish the prices were a little higher.

And you can always go deeper on solving your users’ constant needs.

For instance, the constants for:

My newsletter’s are

Quality, novelty, and relevance of insights

OpenAI’s are

Accuracy, speed, and cost of model

Tesla’s are:

Battery life and price

Boeing’s are:

Planes that don’t have doors flying off…

If those companies improve their constants, people will love them for it and they’ll grow.

This is all quite neat for anyone who does “strategy” work. It’s almost a cheat code for what to say Yes and No to.

Athyna had a pretty good idea of what their constants were, but to be sure, they started with a needs analysis. They mapped out the functional, social, and emotional needs of their customers and ranked them against how important and often they occurred, as well as from a solution POV how big and crowded the market was.

“Once we had our needs analysis mapped we started building. All product and features pitches needed to map back to a user need from one of our three ICPs” - Bill

It looked like this.👇

In the end, Athyna had 4 timeless needs:

Quality talent - who doesn’t want amazing people?

Accurate role fit - who doesn’t want the most qualified candidates?

Fast time-to-hire - who doesn’t want to find a fit sooner?

Low cost - who doesn’t want to save the bank?

Bill sent me this table showing how Athyna amplifies these constants—where all the constants, but most obviously those of Talent, Process, and Speed are improved with AI.

The typical recruitment process lasts 3 to 8 weeks. By using AI to search tens of thousands of profiles (quality) from markets like LATAM (cost), rate and rank them against job descriptions and various recruiter-enabled assessments (process), and push the best suggestions to recruiters (speed), Athyna gets recruiters and best-match talent speaking within 2 days.

The end result of using AI to improve the constants is their epic new product, Athyna AI.

So, what are your product’s constants? And are you investing in them?

Because the more I think about the companies we’ve covered, the more obvious it is: The companies that (1) are super clear on what their constants are, and (2) always do R&D around going deeper on them, will beat the ones who have loose understandings of them and easily chase shiny objects.

More on shiny objects coming right up…

🔑 Bottom line: The constants in your business should always be reflected in at least one of the pillars of your strategy.

Learning something? Consider upgrading to paid to support my work, invest in yourself, and unlock premium essays like these ones.

4. Mind the shiny object

💡 Big idea: Shiny Object Syndrom is a very common trap. It’s that irresistible pull toward new ideas, strategies, or projects that promise instant gratification and untold riches.

🫰 Why it matters: SOS is anti-strategy because it’s a reflection of indecisivness. If you keep chasing after something new, copying because a competitor is doing it, or just saying yes to all things that come to mind, you won’t ever make progress.

🥇 Applying it: No should be the default answer to new things. Until the evidence is clear that saying Yes clearly intergates with your strategic choice set—Where To Play, How To Win—shut that shit (politelly) down.

Let’s go deeper…

I was recently watching Dragons’ Den (the UK, and original, Shark Tank) and I saw a sad case of an entrepreneur having no idea he had Shiny Objected Syndrome (SOS). You can watch the clip here, but in short, this dude had invented over 40 things in his life—of which not one had ever made any money. He was pitching a product to the Dragons for a biodegradable cable tie, but he was also (1) writing a novel, (2) inventing a parachute for NASA, and (3) designing a new type of surfboard.

Poor Simon.

No need to tell you he didn’t get a nickel that day, and Simon’s trajectory has been eerily similar to this chart…

Focus x Execution = up and to the right.

Distraction x Execution = sideways (or often down) and to the right

Simply because no company can be all things to everyone. Narrowing down the strategic playing field is an absolute must. One quick pulse check you can do right now is to ask yourself (and answer honestly), “What choices have we made that have narrowed our competitive field across markets, segments, channels, categories, and ICPs?”

The tighter and more obvious the answer, the more strategically focused you are.

When you haven’t made a decision about where you want to play in the market, then hopping around to “the next best thing” like Simon is an easy slope to slip down. But, even when you have made choices, chasing the odd distraction that pulls you away from that focus (like a Sirens Song) is still possible.

This happened to me at my own startup, and this happened to Bill and Athyna. They were ramping up and seeing good growth, and got caught in the SOS whirlpool for a bit. It’s much easier than you think to fall into.

Their shiny object was to become an Employer of Record (like Deel).

They shopped this around in 2022 with top VCs when they were raising a $5M round at a $25M valuation. And they got very close to making this happen. Right in the end, the deal fell through due to a conflict of interest.

I think that was lucky. If they’d raised the $5M then, they probably would have gone down the EOR path. A hard and competitive route up against an incredible startup—Deel—that wouldn’t have charted a clear path to winning.

They ended up doing a bridge round of $500k, focused on their matchmaking marketplace which grew at 22% MoM last year, and now do $6M+ ARR.

Focus pays quick and big dividends.

The best way to avoid SOS is to know what choices you’ve made and say no like a mad man to the things that don’t align with where you want to play, and progress how you will win in that market.

Three quick notes from me and Bill’s experience…

Be careful of cool new tech that may provide no real value to your customer

Be careful of entering new markets just because they are there

Be careful of chasing ideas from investor feedback or one big customer

💡 Bottom line: You won’t grow by simply doing more things and playing in more spaces. You need to know when to go deeper on what you have, vs going wider.

5. The cold outbound email growth hack

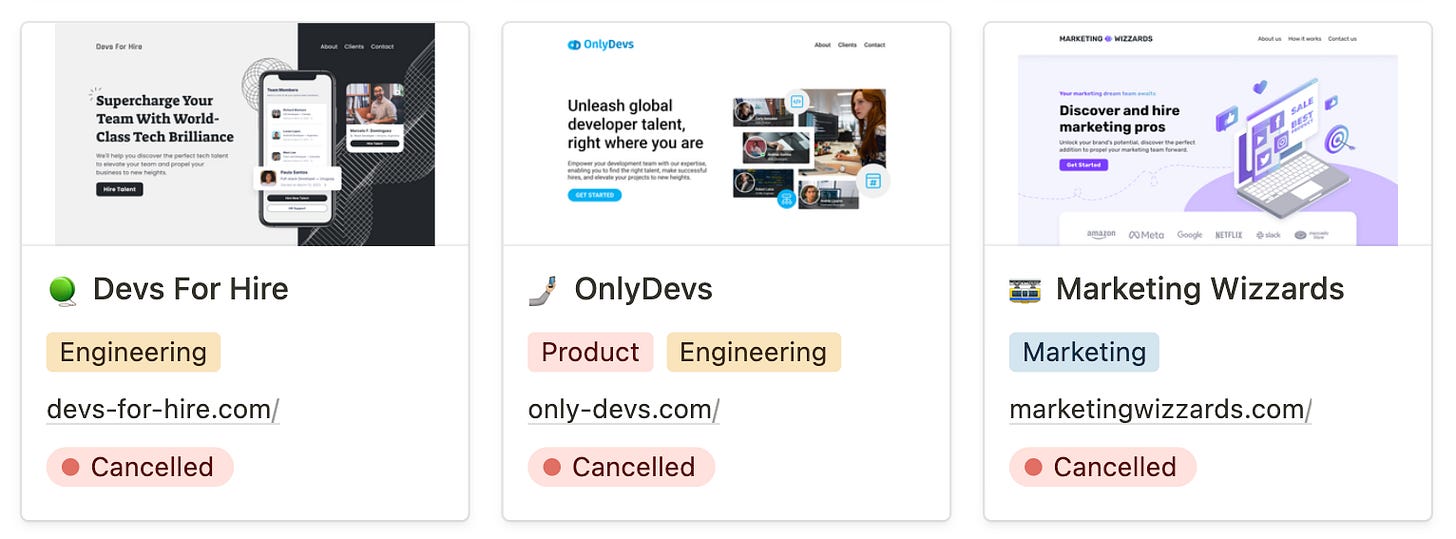

💡 Big idea: Athyna went from sending 50 emails per week to a scaled outbound machine sending 1.2M emails per week. They did this using a suite of different sub-brands.

🫰 Why it matters: Outbound is a volume game, but, it’s hard to send a lot of emails every week because cold outreach is always going to be slowed and limited by how “warm” your email domain is. The more unique domains you use, the faster you’ll reach scale (and the higher your ceiling will be).

🥇 Applying it: If cold email is part of your GTM, consider buying a related domain, feeding it into your email machine, and ramping up its daily sends.

Let’s go deeper…

Outbound email is still one of the best ways to reach B2B buyers. It’s a simple equation—send more emails to more of the right people with the right message, and you’ll land more customers.

But getting to volume takes time because it takes about 3 months to warm up a domain to send any decent number of emails. Which is fair—that’s how we get spared from spam. Send too many too fast, and you’re digging yourself a hole.

But Bill isn’t one to dilly-dally. He had little patience to wait and slowly scale the power of the single Athyna.com domain. So, he took a play from Dr. Strange and launched a full suite of sub-brands that can each send 100K emails a day—like the little email workhorses of Athyna!

It’s quickly become their biggest growth channel, with 60 million emails being sent a year. And doing some napkin math, at $6M+ ARR, that’s an ROI of $0.1 per email.

As Bill said: “I don’t think you need that many channels to really be working to get to a big business. For several years, outbound alone accounted for 80% of our revenue. We’re still a small company, so being able to do this at our current scale leads me to believe we’re probably the best in the world at it.”

FYI, Brett Adcock sold Vettery (a talent marketplace with Athyna’s model) for $110M with the same strategy. For 4-5 years outbound was the only channel he used.

To replicate a strategy like this, simply:

Buy more (cheap) domains

Connect them to your outbound GTM machine (i.e Attio, Apollo, Clay)

Start warming them up and ramping your sequences that all point to your core product

💡 Bottom line: If you’re playing the outbound email game, increase your surface area of success by using multiple domains via sub-brands to run sequences.

If you’re looking to grow your team now or in the near future, consider chatting with Bill and the Athyna team. You can book some time here—just tell them Jaryd sent you and you’ll get first-class treatment.

6. Tactical sidecar products

💡 Big idea: You can build free mini-products (AKA sidecar products) that solve a general, high-frequency problem for your ICP, some of who will then convert to the core product thanks to well placed CTAs.

🫰 Why it matters: These products are like honeypots; attracting new users to the core product with a free (and valuable) hook. They are great for PLG motions!

🥇 Applying it: Find an adjacent, wider use case that's relevant to your core product and customer, and then build a free tool to attract them.

Let’s go deeper…

I first learned of the term “Sidecar Product” when reading up on Snyk, which uses multiple mini products like The Snyk Vulnerability Database and Snyk Advisor to contribute to noticeable platform growth.

These products are not core to Snyk’s product, but they are:

Free to use

Useful to devs

Related to Snyks primary use case of dev security

These micro tools help build brand awareness and funnel the right people to the main lead gen motion since they always place CTAs that send people to the core.

Athyna is using a similar strategy with Ava—their AI-powered Chrome extension for job seekers.

Ava does two things:

For the market, it helps anyone looking for a job (1) build a great LinkedIn profile, (2) tailor their job applications, and (3) get job suggestions.

For Athyna—by creating massive, free, and related value for job-seekers—Ava connects Athyna with the perfect supply side of the marketplace: motivated tech workers who are comfortable with AI. This helps them (1) grow the depth of their talent pool, and (2) is a brilliant data play, giving them first-party insight into real-world job market data.

The second sidecar product Athyna is working on is a third-party job board. Like Ava, this opens another big door to grow the talent side of the market. Also like Ava, it doubles down on their data play. By aggregating tons of usage-based data points, they can build a really solid model that shows the state of labor and can inform where Athyna should invest.

Bill likes to compare this strategy of adding 3rd party employers to how Amazon opened its marketplace to 3rd party sellers. He even scribbled over Bezo’s 2018 letter about it.

This will drive Athyna’s core flywheel, just like it did for Amazon. That’s the power of sidecar products.

So, it’s worth thinking about what you could offer the market as a complementary onramp to your main product.

A word of caution though: When a sidecar product caters to an adjacent, wider use case than your core product serves, you create a gap between the value promise of the acquisition channel and the value realized by the core product. In effect, you’ll get some signups with much lower intent who you should expect will not activate or retain as well as others.

💡 Bottom line: If you build a sidecar product, make sure it aligns closely with your market’s main problem/needs map.

7. A simple, but hard, superpower

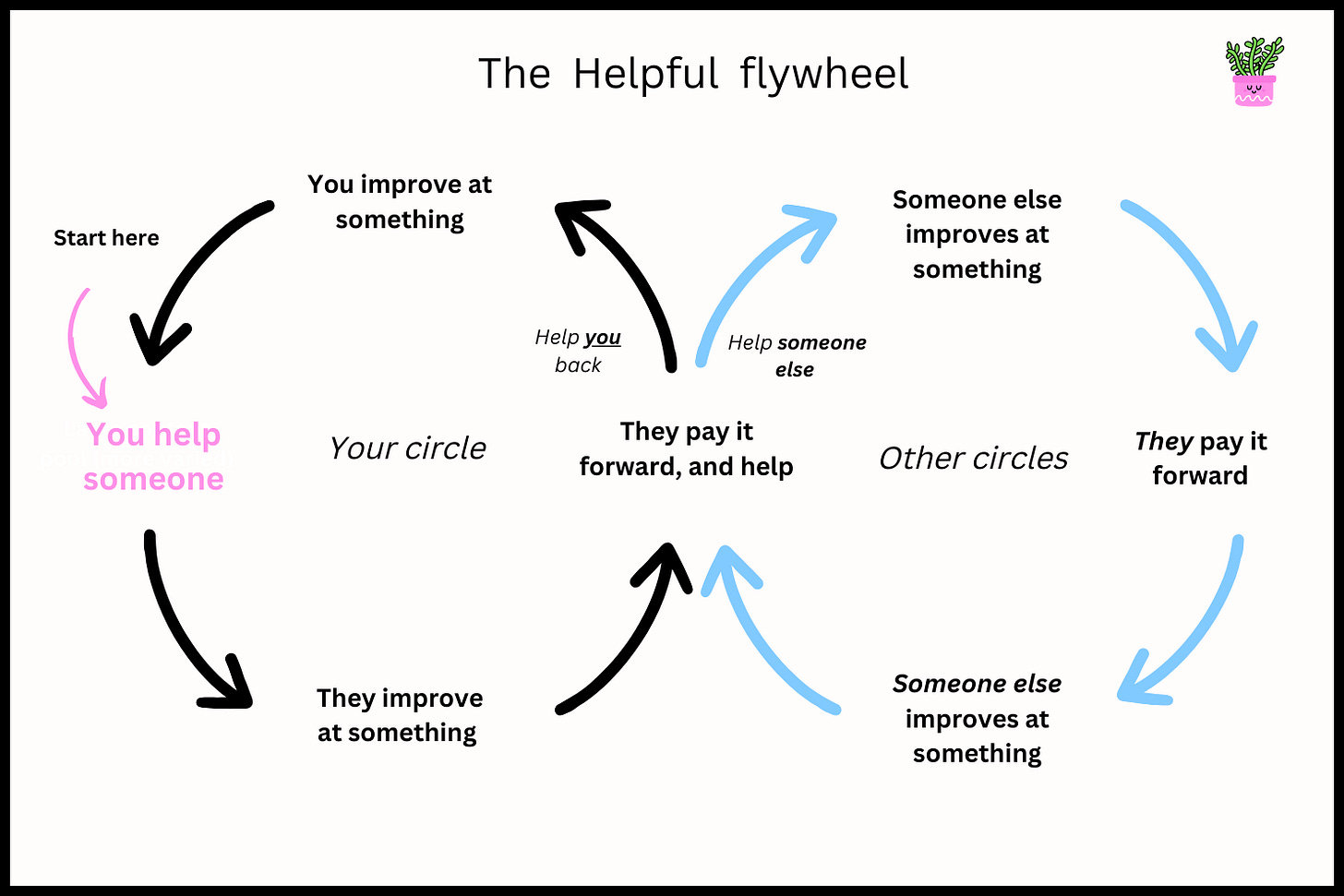

💡 Big idea: Being incredibly helpful to others eventually helps you.

🫰 Why it matters: Actually being helpful is hard. It means saying Yes to things that don’t directly progress your goals and following through. But if you can do a hard thing that other people won’t—the rewards are very high. People reciprocate, and you’ll expand your surface area of opportunity.

🥇 Applying it: The next time you’re catching up with a buddy, coworker, customer, or investor, expliclty ask them, “How can I help you most right now?”. If the answer is doable—do it.

Let’s go deeper…

What I remember most about meeting Bill, besides how flipping cool he is (he’s run with the bulls, patted lions, and swum with sharks!) was seeing a founder building and growing his business in a way that I wish I had.

A trait I quickly came to see in Bill—one that I think is a true superpower that infinitely expands one’s surface area for success—is that Bill does not stop being incredibly helpful. I’m not exaggerating. And not surface-level help, like actually really caring about how he can add value to everyone in his circles. He also asks for nothing in return.

Aside: Selfishly though, plenty of evidence shows that helping others benefit our own mental health and wellbeing. For instance, it reduces stress as well as improves mood, self-esteem, and happiness.

In a world where we want to say No more often to protect our focus, offering to help and delivering on that help is hard to do. But like we saw with Stripe, if you can do a hard thing that other people won’t—the rewards are very high.

I asked Bill about how he manages to be so helpful to so many people while running a $6M+ ARR startup and building a rapidly growing media company, and if he had any advice. Of course, he was happy to help.

I just try to be helpful as a rising ship floats all boats.

I have never really believed in competition, but more so in collaboration. And I guess it’s the same with the program, my socials, and my newsletter. I’m trying to build a big base of allies. Not strategically really, just by trying to be a good person and do fun, helpful, interesting stuff.

I think that’s how we all are really wanting to operate at our core but sometimes people forget. So the ‘work’ if you will hopefully will pay off in some way over time because allies want to see you do well. And I do have a great lot of allies now.

The tricky thing is taking on too much stuff. Which I am incredibly guilty of. I won’t lie and say I have a balanced lifestyle really right now. But having said that, I am doing things I enjoy and making friends along the way, so it’s all good in that regard. A key for me though is to have a solid team around me to help me do more. Delegating and getting support is key. I’d be nowhere near as productive without my team.

💡 Bottom line: Help yourself by helping others.

8. Build what you can consume

💡 Big idea: The most successful companies use their own product to grow. “Never trust a skinny chef!”

🫰 Why it matters: When you rely on your own product as a tool to be successful, it aligns the incentives with your customers, drives crafstmanship and attention to detail, and gives you ongoing feedback from being your own power user.

🥇 Applying it: Dogfood. Dogfood. More dogfood.

Let’s go deeper…

The US job market is crazy competitive, and comp packages reflect that. What’s more, predictions suggest by 2030 there will be a talent shortage in the US, particularly in the tech sector. And when things become more scarce, they become more expensive.

Athyna’s entire shtick is that companies should be growing with remote talent from underutilized and growing tech hub markets. I believe about 80% of Athyna’s supply side is the LATAM market—that’s Argentina, Brazil, Mexico, and Colombia.

People often think offshore talent just means India or the Philippines. That’s because most don’t really understand that the tech ecosystem in South America is as strong as any other ecosystem in the world, outside of the US.

Consider this:

The cost of living in LATAM is significantly lower than in the U.S. This allows companies to offer competitive salaries (up to 40-50% better than local rates) that are more affordable (up to 80% less than onshore) without compromising the quality of life. Simply, offshore is an opportunity to pay a premium to talent at a discount to you.

Emerging tech hubs in São Paulo, Buenos Aires, and Mexico City are producing highly skilled professionals, coming from very mature tech ecosystems.

LATAM professionals operate within similar time zones to the U.S., meaning significant overlap (6 hours or more) for collaboration.

Establishing a presence in LATAM can open doors to new markets and customer bases, driving business growth.

And while Athyna helps US tech companies access LATAM talent and hedge against the 2030 shortage, they themselves are also their own customer and favorite case study—using Athyna to build their competitive edge. As Bill says:

Internally, we have team members that are ex-Amazon, Uber, Oracle, Meta and more. We’d not be able to afford that type of talent had we hired them in the US, Australia etc. All of our team gets paid much more than they would locally and we give RSUs (stock) from executives to interns. So everyone is super happy.

It still makes me shake my head that people want to hire their entire team onshore, whether that be the US, Canada, Aus, or the UK. Salaries are 3-5x higher in most cases, and as Founder & CEO I need to make the best decisions for our shareholders.

So I need to ask, "Will this marketing, sales, creative, product hire add 400% more value because they are boots on the ground in the US?”. And the answer is almost always a “Hell no”. So it would be irresponsible for me to hire in the US.

Of course there are some exceptions, boots on the ground enterprise sales and CS, events, some high level comms that we will hire local to our target markets in the future but that’s it really. We are creating a huge, valuable company, that we are all owners of today and the best way to maximise that is to avoid hiring in the US.

This was definitely a factor in my decision to invest. I believe companies that spend time using their own products and building for themselves just as much as they build for their customers are low-key awesome drivers of growth, as well as craftsmanship inside the product.

How could you not care more when you’re also a power user?

🔑 Bottom line: The more that you and your team use your own product, the higher the quality bar (and customer empathy level) will be.

And that’s the end of our Athyna analysis. I hope you found this post helpful and enjoyable, and appreciated the Smart Brevity I’ve been practicing! 🙏 s/o to for putting that book on my radar.

Once again, if you want to learn more about how Athyna can help your company grow, you can learn more here or just book a call. 🤝

If you have any questions for me or Bill…drop them in the comments!

As always, thanks for spending time with me here today.

Until next time.

— Jaryd ✌️

Forgot to also say congratulations on the investment.

Weird question from me. Is there a recording of Athyna demo. Ideally 10+ minutes showing & discussing the platform.

I'd like to run it through DemoTime and share the resulting summary -- just curious to see how well the message survives being edited down for a marketplace with a compelling pitch like this!

Also just FYI you massively buried the most compelling aspects of Athyna in this write up. The stuff about leveraging different markets to get better, cheaper staff. It really wasn't obvious until right at the end.