🌱 5-Bit Fridays: Avoiding "death by LLM", the most contrarian bet in venture capital, how to cope when you meet someone who is younger and more successful than you, and more.

#47

👋 Welcome to this week’s edition of 5-Bit Fridays. Your weekly roundup of 5 snackable—and actionable—insights from the best-in-tech, bringing you concrete advice on how to build and grow a product.

To get better at product, growth, strategy, and startups… join 11,924 PMs and founders.

Happy Friday, friends 🍻

In case you missed it this week:

Houston, do we have a problem? The Hubble Space Telescope has spotted an intergalactic mystery, something called a Luminous Fast Blue Optical Transient (LFBOT). LFBOTs were first discovered in 2018, are quite rare, and of unknown origin. They're a little like a very powerful supernova, except they brighten and dim far faster, in days instead of weeks or months. This latest find complicates things further because it's in the void between galaxies, the last place one would expect an energetic event like this to occur. 🌚

It looks like Zuck’s promised metaverse is here. Lex Fridman ‘filmed’ an entire podcast episode with Zuck in the metaverse. You can watch the video here, it’s pretty amazing to see their photorealistic avatars in conversation. As someone who lives 7,807 miles from my family and friends, this is pretty exciting.

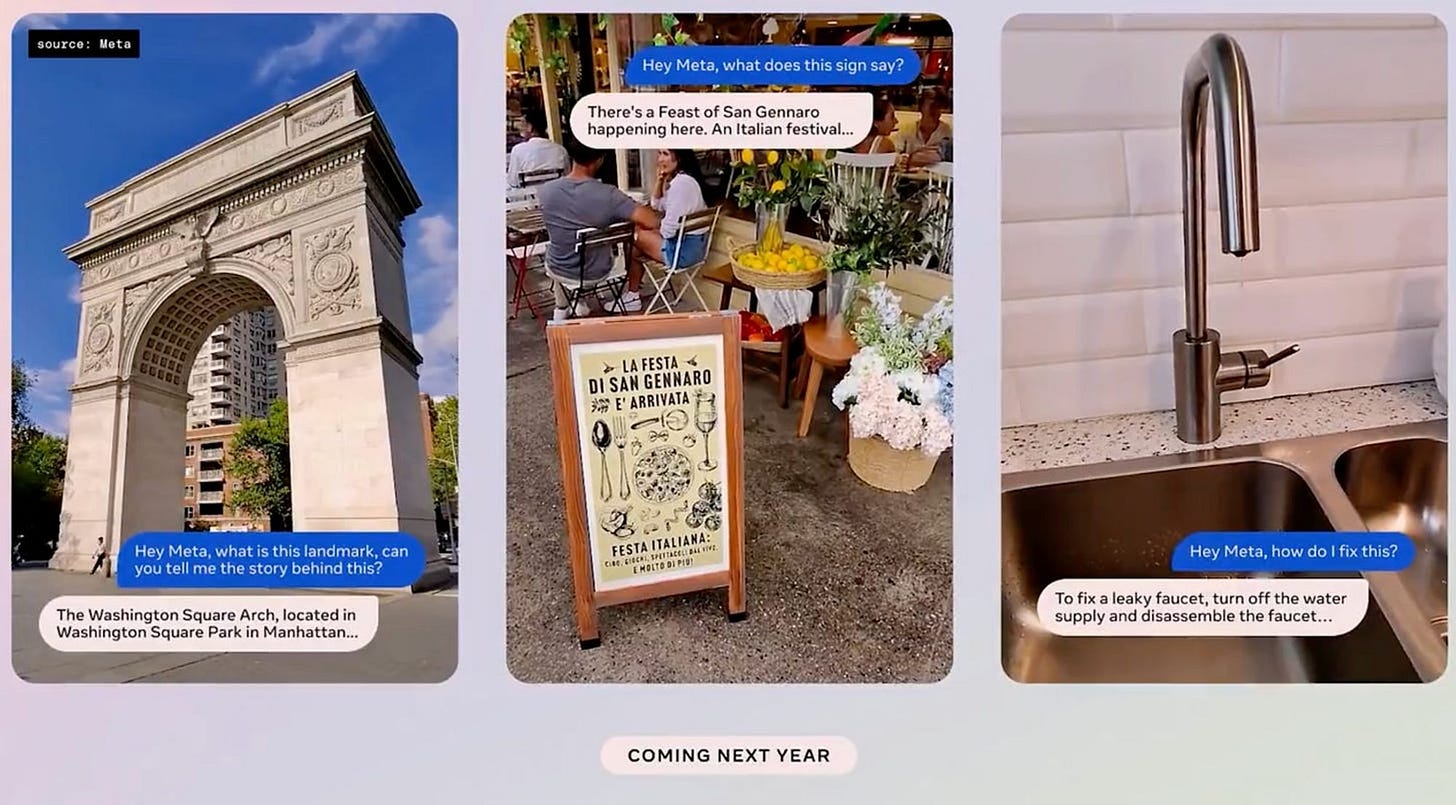

And so is multimodal AI? Perhaps you saw Zuck’s video showing how he learnt to braid hair thanks to the Meta x Rayban’s collaboration on smart sunglasses. No, they don’t actually look stupid. And not only can you take photos, livestream, and make calls, but you can to give them voice commands, use them as headphones with spatial audio, and they are AR and AI integrated. I wouldn’t buy them for that—but for this part—I think I actually would. Just watch this video of Zuck explaining how they will send a software update to the glasses that will enable its AI to be multimodal. “If you want to know what the building is that you’re looking at, or for [the smart glasses] to translate a sign that’s in front of you, or if you need help fixing this sad leaky faucet, you can basically just talk to Meta AI and it’ll walk you through it.” Want a pair? They’re for sale.

Looking for a job? Keep an eye out for LinkedIn’s new ‘Top Choice’ option, allowing you to stand out in job applications. “Top Choice Jobs uniquely connects both sides of the job market: job seekers get to stand out, while hirers see deeper intent signals from applicants who are most passionate about the role. But that’s not all. Applicants can take that extra step to bolster their application and get that extra edge by adding an elevator pitch.”

Wall Street’s heavy hitters are worried about the global economy. Ray Dalio, Jamie Dimon, David Solomon, Larry Fink, and Steve Schwarzman offered some bleak outlooks during a recent conference. From inflation to a recession to commercial real estate, here’s a rundown of their thoughts

Oh, and I launched a community Chat. I’ll be using it to pose questions, drive discussions around deep dives, and also as a place for paid subscribers to ask my anything. My goal is to use Chat as a micro-advice column. To use Chat to AMA, consider upgrading for $7. 👇

Anyhoo, lot’s of wisdom from folks this week. So let’s jump in. 🫡

Here’s what we’ve got this week:

How to cope when you meet someone who is younger and more successful than you

The most contrarian bet in Venture Capital

How to avoid “death by LLM”

Familiarize, don’t memorize

Simplifying Product Management (4 visuals)

(#1) How to cope when you meet someone who is younger and more successful than you

I stumbled upon this post the other day by

from —the heading immediately caught my attention.Unless, as Nick says, you’re Jeff Bezos or a newborn baby, you’ve come across folks who are younger and more successful than you.

Just scroll on LinkedIn on Instagram for 5 minutes and you’ll see some teenager driving a Lambo, running an agency, getting paid to live in a Bali mansion, or making serious bank on Twitch.

And therein lies the issue right? Social media puts us under a constant stream of everyone trying to put themselves in the best light. Whether you’re listening to a podcast or scrolling social media, you’re bound to come across one of these younger, more successful people flaunting their latest professional milestone or passive income stream. Unlike our digitally-disconnected grandparents, we don't have the option to just move away. So, we must learn to cope.

In his satirical post, which brought me a few chuckles and confessionary tears, Nick shares 8 strategies to overcome the existential dread the next time you see that kid making thousands a day on Amazon Affiliates or drop shipping. Like all good comedy, there are some kernels of truth here. And to maintain his comedic delivery, these are Nick’s direct words below.

Assume they aren’t actually successful. Sure, this guy says he “sold his company,” but how much money did he really make? Is he even twenty-seven, or is he making that up too? Sad that he needs to lie about his success to get strangers to like him…

Picture their misery. Even if he did make some money from selling his company– at what cost? Does he have any friends? His girlfriend looks pretty miserable– maybe it's because of their debt burden from his gambling addiction.

Question the value of success What good is "success" anyway? It's not like earning more money makes you any happier. Didn't you once read that $70k per year was all you needed for a happy life? Was that adjusted for inflation? Who cares.

Rewrite your own narrative. It's not like you haven't been successful– you're just playing a different game. This guy did exactly what his parents expected while you pursued your own path. One that isn't measured by society's standards. When you think hard enough about it, you actually feel kinda bad for this guy.

Despair. Jesus, are you really that insecure? Has one encounter with a stranger really turned you into such a petty person? Maybe if you were more secure you would have achieved more of what you wanted to in life. Maybe if you were less obsessed with status, you would be a happier person.

Pursue self-improvement. Okay, you can't change the past, but you can certainly improve the future. Start eating more salads. Get back to lifting three times each week. How much does testosterone replacement therapy cost?

Compare yourself to older, less successful people. When you really think about it, things could be much worse. You could be that investor who was a couple of years ahead of you in college that got ousted from his firm after his deleted Tweets got leaked. Or what about your old boss who's still stuck in the same job after five years? Bet if you went back to that company you'd end up being his manager…

Be Grateful. Or maybe, you don't need to compare yourself to others to appreciate what you have. Maybe it's enough that you get the opportunity to spend another year, another month, another day, another minute above ground. Sure it's an emotional roller coaster of triumphs and setbacks– but that’s just what it means to be human. What else could you ask for?

But, jokes aside folks, that last point really is the truthful one. Be grateful for what you have, and don’t forget the German principle of Freudenfreude: deriving joy from others’ success and happiness.

If you find value in my writing, consider upgrading to paid to not only get subscriber-only benefits, but to also support this newsletter. It’s the price of a single NYC coffee a month ($7), and would mean a ton to me. Why subscribe?

(#2) The most contrarian bet in Venture Capital

You can be contrarian in two ways:

Having a different POV than the consensus mainstream

Having 100% conviction in the mainstream POV and doubling down on it in a way that seems overly aggressive or delusional to them.

The path of least resistance is consensus. The journey is easy when we agree and others nod at our decisions. There’s little pain when we all see the world with the same pair of glasses. If we end up wrong…well…we were all wrong together. 🤷

The hard part is getting things right. But when we do, and when we think, and act, based on a contrarian point of view, that’s where magic can happen.

Our goal is more modest: We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

― Warren Buffett

Now, last week we heard that Thrive was working on a deal to invest in OpenAI—valuing them at $80B. That computes a 3X increase in their valuation in less than 180 days.

Given OpenAI is generating $1.3B in annual revenue, that’s a 61X multiple. 👀

The reaction from many was skepticism that the lofty numbers could be justified or that there was meaningful room for upside from here, barring selling to a greater fool.

Going back to those two ways you can be contrarian, Thrive’s investment fits both. The first—going against the consensus—to most investors, and the latter—doubling down on the consensus like crazy—to the general public.

Let’s focus on the VC angle here. Investing at this price in OpenAI goes against to mainstream investor perspective for 4 reasons that

(Susa Ventures) wrote about earlier this week:While every VC is aware of the threat from OpenAI and will rigorously prosecute every startup under an “incumbent vs startup” framework, most have developed their AI investing thesis agreeing with most, if not all, of the following ideas:

Oligopoly, not monopoly: Base case, there will be an oligopoly of highly-valued foundation model providers. Bull case: there will also be a healthy open-source model ecosystem that is competitive with the best foundation models.

An open-source, flexible ecosystem wins over a closed-source system: Many AI infrastructure investments are predicated on a thriving open-source ecosystem, or at the very least, the foundation model providers not providing great infrastructure and tooling to interact with them seamlessly.

OpenAI wrappers are not interesting companies: Building your own models or having access to proprietary datasets is a key part of differentiation and value delivery.

“Domain expert” models will emerge that are better than the foundation models: Companies will build specialized, fine-tuned models that can deliver higher-quality performance and efficiency across specific domains than the foundation models.

When I wrote about OpenAI (read analysis) and Jasper (read analysis) earlier this year—I made a similar case when we looked at the layers of the AI stack, and when we spoke about at what defensibility in the age of AI means.

Now, to best understand how Thrive likely is looking at this investment, just take a look at what Josh Kushner (the founder and managing partner at Thrive) said in a recent Invest Like The Best episode:

“At the later stages, I always say to her [my mom] that we invest in Fifth Avenue, and my view is you always pay a fair price for Fifth Avenue.

Markets go up, markets go down, but at the end of the day, if you invest in quality, that quality will ultimately compound on itself. There's a scarcity value to quality. Those that invested in Fifth Avenue a decade ago are happy that they have it today.

The biggest mistakes that we've made as a firm are when we've way overpaid for Fifth Avenue or we've bought Third Avenue thinking that it would become Fifth Avenue, and that's just never the case. Our view is if you are concentrated in the most exceptional businesses and you hold those businesses over a very long time, a lot of the value in those sectors that you're investing in will ultimately accrue to the #1 player.

In 2020, OpenAI’s first large language model (LLM), GPT-3, came out. Over the next 2 years, you’d think the best and brightest VCs would be getting into the AI space. Except, the hype was around overpriced monkey jpegs and remote work.

It wasn’t until ChatGPT sparked mass conversation and interest in AI in just a matter of days that hundreds of millions started flowing into AI plays.

Everyone founder and VC pivoted to AI suddenly there were infinite opportunities for new infrastructure investments and new foundation model providers that would “easily” catch up to OpenAI. Open-source models were released that showed little performance tradeoff. Many startups raised money for gimmicks, tools, or apps that would compete directly with ChatGPT. There was a wrapped GPT for almost every little thing, and the folks behind it were getting checks.

But Pratyush posed an interesting question—What if Kushner is right and OpenAI is Fifth Avenue, while everything else is Third Avenue?

He persuasively argues through those 4 mainstream investor views and makes the case that the other VCs are wrong, and Thrive is right.

Monopoly, not oligopoly: Unlike cloud computing (AWS, Azure, etc), foundation LLM models are not commodities. Quality will instead compound on itself and accrue around a winner-take-most dynamic. Simply, most usage will go to OpenAI.

A well-designed, closed-source system will capture more value than an open-source flexible system: Companies will always choose to use and pay a premium for the highest-quality, most ethical, safest, best-integrated, and best-designed system. OpenAI are building the necessary platform and infrastructure tooling around itself to eliminate the need to partner with anybody but them.

OpenAI “wrappers” will be the most successful companies in their space: Building efficient and performant LLMs is flipping expensive. There’s a huge barrier to entry. So, instead of going up against the OpenAI’s and incumbents, OpenAI wrapper startups can focus on winning distribution, building the right product around the models, and developing classic product moats like switching costs, network effects, brand, etc. The model is not the only moat.

New OpenAI models will always be the highest performant and efficient across the majority of domains: Even if there’s a period where a new “expert” model shortly surpasses OpenAI in some domain, it’ll fall behind once again upon the latest OpenAI release. Again, for most customers, the simplicity and reputation of working on top of OpenAI given its quality and ecosystem will be the obvious choice.

Simply put, Thrive believes quality will compound on itself and the startup that created the category will define it.

Contrary to many other VCs, they’re not going to invest in Third Avenue or the infrastructure around it thinking that it’s going to become Fifth Avenue. They’re just going to invest in Fifth Avenue.

If you missed my deep dive on OpenAI—now might be a good time to catch up.

And speaking of AI…

(#3) How to avoid “death by LLM”

Generative AI—driven by the large language models from folks like OpenAI—has the potential to destroy or supercharge most businesses.

We’ve been at an inflection point for a while where builders need to consider what that means for existing products, regardless of how established they are. Do you lean into it, or do nothing and risk having your value eroded by it?

Stack Overflow is a good example:

When Stack Overflow’s traffic apparently went into rapid decline this year, Elon Musk reacted on X with an epitaph: “Death by LLM.” His message initially sent a shockwave across the business world as it underlined the imminent threat that generative AI poses across a wide swathe of sectors — from accountancy and legal to media and software — but are all these companies really hurtling toward oblivion?

If you’re not familiar, Stack Overflow is the best-in-class forum for developers looking for help with coding problems. It’s the go-to place because it’s been built on years of user-generated contributions. Musk’s tweet couldn’t be clearer: he thinks ChatGPT is making the site rapidly obsolete given it’s giving people the same answers, just quicker.

The question then becomes, have companies like Stack Overflow done enough to survive, or will these information-scraping LLMs piggyback on their moats (tons of content) to deliver a 10x experience?

If they do nothing…probably not. But, Stack Overflow is working on two initiatives:

They have a high-priority roadmap to integrate AI

They are charging large AI companies who want to train their models on their data

This paints a clear picture of their current strategy to keep Stack Overflow relevant and more useful than a ChatGPT.

So, while Musk’s provocative warning is of course an exaggeration, the message is still a clear signal to founders and PMs: If you’re not already, create an AI roadmap now. Not tomorrow. Today.

That doesn’t come without caveats though—if you’re going to work on some GenAI feature, ask whether it hits three benchmarks: (1) it meets a clear user need; (2) it improves your unit economics; and (3) it is “defensible,” for instance, by using models and datasets that are unique and hard to copy.

And if you have an idea in mind that checks those three boxes, the best advice?

Get started, try things, experiment. The most successful will take risks, find what works, and learn from what doesn’t.

— Andy Pitre, EVP of Product at HubSpot

Go deeper:

(#4) Familiarize, don’t memorize

Most of us are not running along to do a Ted Talk anytime soon. However, we all speak and tell stories in some professional capacity.

Whether we’re presenting a strategy to leadership, meeting a big prospect client, or pitching to VCs—we’re in the business of communicating.

And our success, whether we like it or not, is measured in part by how well we communicate.

That’s why I love this post from

by .His home-hitting message is clear: it’s crucial to always prepare well, but equally important to never commit the talk to word-for-word memorization.

You might think that would be the dream…preparing your words perfectly and never missing a mark. No risk of missing a point.

However, JD (who’s a communication expert) warns that the risk of sounding robotic runs higher for those who memorize fully. Further, if you forget the precise word you meant to use, you can easily look frozen, which adds pressure to an already stressful situation.

For those concerned that they may come off as unprepared without memorizing, I suggest this: memorize just the opening and closing as well as the outline. Know precisely how you wish to begin and where you want—as my friend Raymond Nasr says—the plane to land. Commit to memory the 3 to 5 (at most) points that will move you from opening to closing. Then, familiarize yourself with the content, but don’t try to memorize it.

This will enable you to be conversational, not canned, and give you the freedom to spend time where you need for a particular audience’s interests or requirements.

To that end, JD outlines 6 specific actions to take towards familiarization >> memorization.

Move from manuscript to outline and eventually just to key terms. The key is to know your destination, have a loose map, and just know the landmarks you want to see along the way. That’s how you remain flexible and come off as conversational.

Envision a huge time shift and practice accordingly. I.e, imagine your speaking time has been cut in half. Now don’t just speak faster, but know what is essential to say and what can be cut.

Create a pocket quote to help with both memory and conviction. The trick is to put a single compelling quote related to your topic on an index card that goes in your pocket. You then create a second note card that contains your outline and main message. If at any point you feel lost, simply say “One quote I appreciate on this topic is from ‘insert name here’” and pull out the card and read the quote.

Record yourself. It’s just good to know what you sound like so you can hear where you might lose folks, and what can be cut.

Test mixing up the order and see what you learn. Try to tell a specific user story first, or talk about the opportunity at the end. Different sections may hook listeners better.

Practice from the middle out. Often speakers practice a presentation always starting from the opening. If they get interrupted or distracted, they go from the top. This makes their beginning strong, but may consequentially weaken the ending. So, flex all the muscles by starting a few times from the middle to the end, or even just the end.

Obviously, this advice applies mainly to folks who do public speaking and need to be excellent verbal communicators. I don’t exactly prepare in this way when I talk through a deck. Still, there’s wisdom in there for the everyday PM: the more senior you are and the more senior your audience becomes, the more your delivery needs to be polished. And to polish your delivery—know your numbers, know the points the CEO must hear and understand, know how to drive a compelling recommendation, and you must be able to do that in the face of a blown-up agenda, tangents, and unexpected questions.

Familiarization over memorization.

This post is about to be cut off, to finish read, click here.

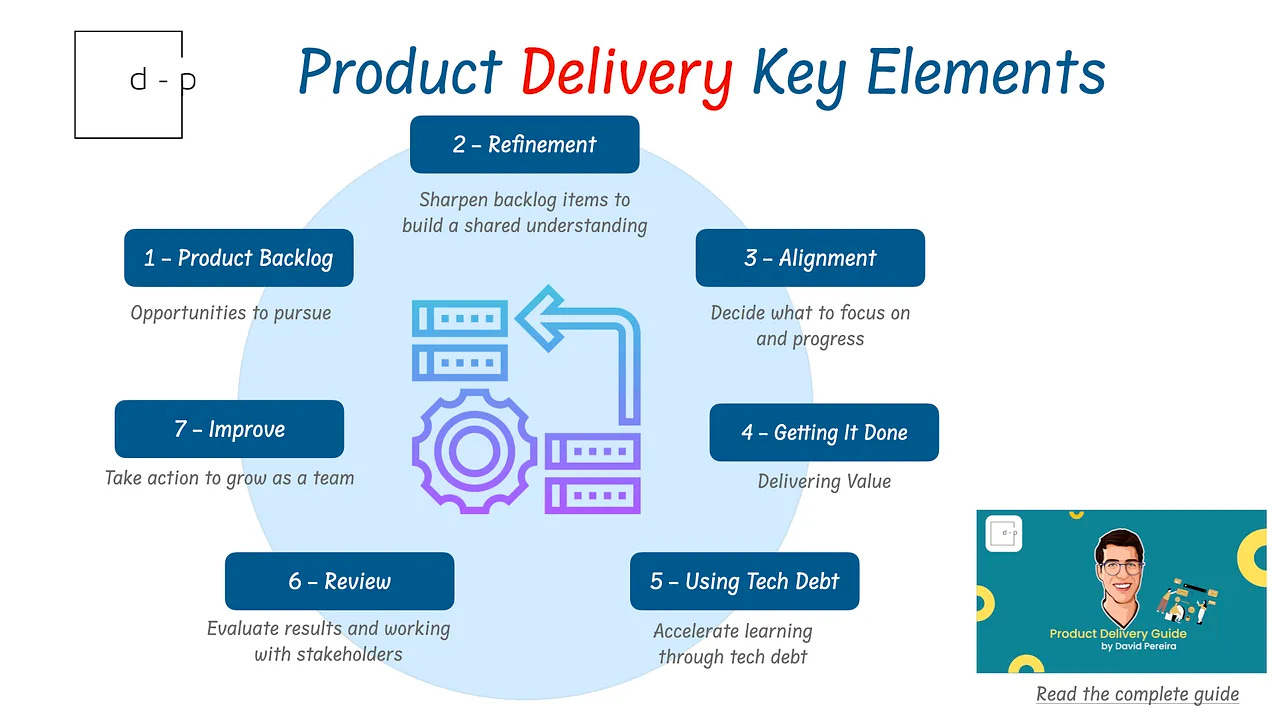

(#5) Simplifying product management (4 visuals)

To send us into the weekend, here are 4 quick images that

from put together that do an excellent job and summing up product management.Simply, the crux of product management can be simplified into three jobs.

Product Strategy → Set the direction to enable focus

Product Discovery → Research to uncover what creates value

Product Delivery → Execution to build and ship what creates value

Together, these functions work like this:

But let’s drill into the key elements of each (visually). This final bit is particularly relevant for aspiring PMs, or folks wondering what product managers actually do. 😅

Product Strategy

Product Discovery/Research

Product Delivery/Execution

Do those things well, and you’re doing capital P product management.

🌱 And now, byte on this 🧠

Rumor has it—regular Americans are getting richer.

A week ago, the Fed and Treasury released its 2022 data from the Survey of Consumer Finances (SCF), which is a big survey they do every three years in which they ask households about their finances.

Basically, as my favorite econ blogger,

, wrote, the numbers tell a really encouraging story:Americans’ wealth is way up since before the pandemic.

The increase is very even across the board, with people at the bottom of the distribution gaining proportionally more than people at the top.

Inequality is down, including racial inequality, educational inequality, urban-rural inequality, overall wealth inequality.

Debt is much less of a problem.

There’s even some surprising good news about income as well as wealth.

The biggest piece of good news (while it certainly doesn’t feel it) is that the typical American family got about 37% richer between 2019 and 2022

Piqued your interest? 👇

Read: Great news about American wealth

And that’s everything for this week, folks.

If you learned anything new, the best way to support me and this newsletter is to give this post a like or share. Or, if you really want to go the extra mile, I’d be incredibly grateful if you considered upgrading. The first 500 folks who become founding subscribers get 30% off this newsletter ($7/m, or $70/year), as well as any other products I sell, for life.

Thanks so much for reading. I hope you have an awesome weekend.

Until next time.

— Jaryd✌️

...this episode killed if for nothing else the freudenfreude...what a radical term...now if i can only figure out a bit where schadenfreude and freudenfreude walk into a bar...