🌱 5-Bit Fridays: The refactoring of creativity, daily rituals of great PMs, company red flags, principles to master growth, and collecting ideas vs creating outcomes

#30

👋 Welcome to this week’s edition of 5-Bit Fridays. Your weekly roundup of 5 snackable—and actionable—insights from the best-in-tech, bringing you concrete advice on how to build and grow a product.

Happy Friday, friends 🍻

Earlier this week, I dropped a new series: The How They Grow Show. I’m very excited about it. And a huge thanks to all of you who have given it a watch, listen, and read.

In case you missed it, The HTG Show is a series of conversations with founders of promising new startups — bringing you insights into early-stage markets as well as tactical advice on building, launching, and growing your product.

To watch (or listen to) the first episode, follow the link below. Also, if you prefer posts over videos, you can always read the snackable highlights from the interview. 👇

Building Ocho: Welcome To The How They Grow Show

Watch now (40 min) | A conversation on selling companies, building wealth, early-stage product development, why startup teams should work together IRL, validating startup ideas, the value of building in public, raising money, customer acquisition, tax-saving tips, and other lessons from a second-time founder.

Awesome, let’s get to today’s post.

Here’s what we’ve got this week:

The great refactor of creativity, and the sustainable advantage of story, process, and ingenuity

The specifics in a daily routine that separate a good PM from a great PM

Venture capital red flag checklist

Principles to master growth: Generalist or Specialist?

Collecting ideas vs creating outcomes, visualized.

Small ask: If you learn something new today, consider ❤️’ing this post or giving it a share. I’d be incredibly grateful, as it helps more people like you discover my writing.

(#1) The great refactor of creativity, and the sustainable advantage of story, process, and ingenuity

To kick things off today, let’s start with a few observations Scott Belsky (Chief Product Officer at Adobe) shared on Tuesday. As Scott describes:

As someone who has studied the creative industry and workflows for many years, it’s inspiring and always somewhat surprising to see how new technology unlocks new possibilities and conjures up new questions. I believe Generative AI will make humans more creatively confident and simultaneously raise the bar for what creative professionals are able to accomplish.

On that note, here are a few specific implications of this new technology he’s thinking about:

Less work, more flow. Through extensive customer research, Adobe has found that their creative professional customer base spends upwards of “50% of their time on self-reported mundane, repetitive work (think meticulously resizing assets for different marketing and social formats, carefully selecting strands of hair when retouching, etc).” Scott posits that with powerful new generative AI capabilities baked into, say, Photoshop, so much more time is unlocked for these creatives. As he says, “The question is how (and if) creative professionals will use all this newfound time and energy in ways that may surprise us”

Process shifts. “One potential consequence of AI significantly refactoring the creative process is losing the seemingly mindless “process” time doing the mundane stuff that ultimately triggers new ideas and thought patterns consciously or subconsciously. I firmly believe that time spent on process remains important, but should be spent on higher-order processes. The key here is to not just reduce process but shift it.”

More surface area of discovery, more possibilities, better outcomes. “Any great designer will tell you that “time” is among the greatest constraints in finding the best solution to a problem. Why? Because time is the factor that determines just how much surface area of possibility can be explored to find the best solution. Time is what allows us (or prohibits us) from more cycles of iteration to discover something truly great. Ultimately, the bar and possibility for creativity will go up across segments as a result of this new technology.”

More accessibility for all. “And for everyone who has ever come into a tool like Photoshop for the first time intimidated by the cockpit of controls and never returned, this era of AI-assisted creativity is for you. With our amplified sense of creative confidence, paired with more accessible tools, we will all be able to do more of what humans can only do - share our human stories. Ultimately, effective creativity is creativity that moves us. We are moved by emotion, by craft and consideration, and by human stories. Refactored creativity should allow all of us to use these tools to do more of what only humans can do - and what humans will crave more than ever before in the years to come: craft, story, and meaning.”

For more essays on the latest advances in tech, shifts in culture, and evolution in the art and science of product design and building teams, check out his Substack, Implications, by Scott Belsky.

(#2) The specifics in a daily routine that separate a good PM from a great PM

If you work in product, you know Gibson Biddle . Gibs is somewhat of a legend amongst PMs, specifically in the arena of product strategy. He was the VP of Product at Netflix, the CPO at Chegg (helping take it public), and today, Gibs hosts talks, workshops, executive events, and guest lectures at places like Stanford.

I first discovered Gibs on Medium, where I read his collection of essays “How to Define Your Product Strategy”. More recently, Gibs started writing an advice column on Substack, and today, I’m sharing a few of his thoughts from a post about the daily habits he’s observed which separate the great PMs from just good ones.

TL;DR: To avoid getting sucked into too many meetings and the necessary evils of the job, begin days with intent, clear away unnecessary meetings, spend more time with customers, block time for managing your own career, balance time between doing/thinking, and commit to learning.

Let’s go a bit deeper so that’s more actionable. In Gibs’ own words:👇

Be proactive

Begin each day with intent. Outline 2-3 tasks you hope to accomplish and stay focused on the most important things. Don’t let the easy/fun projects bubble to the top too quickly.

Minimize meetings. Be clear about the objectives of each session, and wherever possible, handle issues one-on-one or asynchronously (Google Docs, Slack, etc.). Excuse yourself if it’s clear you don’t need to be in a meeting.

Spend time with customers

Engage in focus groups and usability sessions. Spending time with customers helps you put the customer at the center of everything you do to serve as the customer’s voice more effectively within your organization.

Focus on the data. Data is an extension of getting to know your customers, and includes metrics for your product, survey data, and AB test results. Data helps you spot patterns and form hypotheses for product improvement.

Spend time with products. Yours, competitors’, and other products that fascinate you. This lets you approach products with fresh eyes and reminds you how confusing products are, including your own. It also helps you to develop product sense and identify new trends.

Spend time both thinking & doing

Find a balance. “Doing” dominates most folks’ calendars. Carve out time to focus on the long-term by outlining your product strategy. Later in your career, find opportunities to get closer to the details of building products. (Seasoned leaders sometimes get too far from the day-to-day challenges of the product leader’s job.)

Manage your and other’s careers

Make time for folks who work for you. Get to know them as people. If you’re a few rungs up the career ladder, make time for occasional skip-level meetings to see how well your reports manage their teams.

Make time for your boss. Meet your boss regularly, even if you crave independence. These meetings ensure you have shared context to understand each others’ decisions. Occasionally ask your boss, “What am I doing well? What can I do better?” If you’re courageous, ask, “If I told you I was leaving tomorrow, would you fight to keep me?” (This last question — the “Keeper Test” — helps you understand your value within the organization.)

Make time to build relationships with cross-functional peers. Again, get to know them as people to build a foundation of trust. This activity makes future debates more productive. Reaching out to peers in other functions also helps you build cross-functional alignment, an increasingly important part of your job as your career progresses.

Interview candidates. Even if you are early in your career and there’s no pretense that you’ll hire or manage other product leaders, ask to be part of an interview team. This helps you build critical recruiting and interviewing skills. I spend up to one-third of my time recruiting in high-growth startups, and interviews are the one thing on my calendar that can’t be rescheduled.

Build your personal board of directors. Find time to build your community of peers, advisors, and mentors. Learn from them, and from time to time, ask, “How do you think I’m doing?”

That can be a lot to remember and think about on a daily basis. Luckily, Gibs goes on to map those things into a monthly view (link).

(#3) Venture capital red flag checklist

We all know about the spectacular collapse of FTX. However, there have been plenty of other demises of companies that soared high, yet turned out to be outright scams and/or riddled with fraud.

No doubt, there will be more. More customers burnt, and more sophisticated investors hoodwinked.

Bill Gurley— the legendary Silicon Valley VC, and GP at Benchmark—has seen his fair share of investments, to say the least. And toward the end of last year, in response to what John Ray III (the CEO and Chief Restructuring Officer at FTX) said in the November 2022 FTX bankruptcy proceeding filing…

I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity.

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

…Bill wrote an essay positing a straightforward, yet very significant, question: “Could this have been avoided?” As he wrote:

There were many sophisticated investors around the table who arguably should or could have seen “red flags.” What are some of these “red flags?” Before we dive into a detailed list, there are three important qualifications:

The presence of one or two of these things are in no way a guaranteed sign of fraud or malfeasance. However, the more of these you see present in a young private company, the more concern you should have.

There is always a small probability that a situation could have 100% of these characteristics, and still be legitimate. The odds are quite low, but it is possible.

Most importantly, there is a reasonable probability that the absence of standard governance guardrails and constraints actually enables reckless behavior. With such guardrails in place, the company may have evolved in an entirely different direction, which would have been better for both founder and investor alike (especially vs. absolute failure).

With Bill’s caveats, here are the 10 things he urges investors to watch out for to avoid touching any corporate malfeasance, with my favorite excerpts. While the advice below is geared towards institutional investors, I think these are important things to be mindful of when looking at companies, period.

1. “Letting the good times roll”

It’s no coincidence that Enron happened in the late 2000 and that FTX occurred in 2022. Extended, frothy bull markets are a breeding ground for unwarranted corporate behavior. When markets are soaring, speculation increases and as a direct result so does risk. Also, when everything appears to work, investors are more willing to suspend belief. As it was with crypto, sometimes this leads to the development of “new investment rules” that crowd out traditional norms. Lastly, in a heated market, investor competition increases which leads to more investors being willing to “take what they can get” when it comes to governance. As an investor, when the environment is “frothy” you are much more likely to run into these problems. But ironically this is also the precise time when raising concerns will make you look like a washed up veteran who is unable to adjust to the new “realities.”

2. The lack of a legitimate board

FTX is an extreme case where there was no traditional board. But there are many cases where the role of the board of directors is heavily compromised or virtually nonexistent. Filling a board with friends is one way to do this. Filling a board with people who lack experience in private company development (i.e., Theranos) is another. The real question is, “do the founders or operators understand the role of governance and embrace it, or are they trying to intentionally undermine the very notion of governance?” If it is the latter, you have a problem.

3. Super-voting (dual-class) stock

When this technique is used from the earliest stages as a company, you can create a situation where the entire board can be replaced at the whim of a single shareholder. It would be unreasonable to expect board members in such a situation to provide appropriate oversight.

4. Aversion to audits

As the bull market raged on from 2015 to 2022, it became quite trendy for venture capitalists to waive the requirement for an annual audit which is embedded in almost every standard Series A term sheet. This relaxation of governance norms is consistent with the “bull market” argument in point #1. No investor wants to lose a deal over an audit requirement. At least for companies generating meaningful revenue, investors should look to have an annual audit with one of the Big Four accounting firms, or one of the more reputable smaller firms like Grant Thornton.

5. Unique financial data presentations

Related to the point on audits, some companies will insist on presenting corporate data in a way that is (a) inconsistent with traditional corporate accounting, and (b) impossible to square with traditional accounting. Many times, this involves creating a whole new language around unit economics specific to that company. There are also frequent claims of being “profitable” on some definition of “margin” that is specific to the company. Building a unique set of financials can be a reasonable way to use cost accounting to help drive key OKRs. That said, taking this too far can result in an illusionary business narrative that allows one to claim business success where there is not any.

6. “Who is corporate counsel?”

Silicon Valley (and most large US cities) are full of lawyers who have ample startup experience. Having one of these individuals and their firms help guide your company can be crucial to the company’s success. The more “atypical” a company’s corporate counsel, the more concerned one should be.

7. Odd corporate location

The more atypical a corporate location, the more one should be concerned. Island nations are known for serving as tax havens, but they also can have more lackadaisical business regulations. All things being equal, this should clearly be viewed as non-optimal from a governance perspective.

8. Large secondary transactions

Secondary transactions have become commonplace in venture-backed startups, especially as the company moves to Series C or beyond, and in situations where the time to liquidity may be further out than previously expected. There are many good arguments why allowing the founder to take “some of their risk” off the table is good for the company, and as a result it is common to see $1-5mm early liquiduty for founders. However, when $5mm becomes $50mm or many hundreds of millions you are dealing with a different beast

9. Overlapping corporate interests

Overlapping interest, competing interests, or even potentially competing interests. The standard should be the appearance of impropriety. The potential for bad behavior is simply too great.

10. Everyone falls for it

The most dangerous scenarios are the ones where the company is claiming a significant paradigm shift. Founders, employees, and investors intent on disrupting the status quo start believing in a new reality even in the absence of empirical evidence or actual results. It’s one thing to be a successful startup, but it’s quite another to claim to be rewriting the rule book for a whole category of business, with seeming immunity to the fundamental laws of business reality. The investors believe, the press believe, and the politicians believe. In such a world, an incremental investor has zero reason to doubt the legitimacy of the organization because 100% of their data suggests the exact opposite of fraud or incompetence — it is held up as a shining beacon of success. Be wary of the situation that is “too good to be true.” It often will be.

Now that we know how to avoid the scams. Let’s turn back to advice on building and growing legit businesses. 👇

(#4) Principles to master growth: Generalist or Specialist?

You’ve no doubt heard the term “growth hacking”. The tips, tricks, hacks, tools, and coveted secrets that promise to solve all growth problems.

However, as Brian Balfour (Founder/CEO at Reforge, Ex-VP Growth at HubSpot) says: at minimum, “hacking” is misleading, and at most, it’s nonsense.

As addictive as they are, prescription-based tactics and tools won’t solve your problem, and most importantly, help you become an elite marketer. Most real-world work involves a problem that doesn’t have an answer yet, and the biggest growth opportunities are in uncharted territories. More specifically, you don’t figure out the answer by just plugging in the answers that have worked for others in the past. Instead, the biggest upside lies in solving problems that likely didn’t exist before. Becoming an elite growth marketer has nothing to do with the specific hammer in your toolkit and everything to do with mastering the emerging skills, frameworks, and thought processes that enable you to solve new problems, repeatedly.

In an excellent post from back in 2016, Brian unpacks 7 principles he’s found to actually master growth. I’ll cover one in more detail, and give the tidbit for the rest. 👇

Generalist or Specialist?

As Brian argues, it’s not really as simple as being one or the other. Rather, being a great marketer (and this advice really applies to any role), is about:

a) First, mastering the fundamentals

Fundamentals are the bedrock of being good at your job. Once you have them nailed, you can be adaptive, and you can solve a variety of growth problems across different types of situations.

These are things like knowing first principles (e.g. speaking to customers) and knowing how to use a range of frameworks. The better you have your fundamentals waxed, the more you’ll be able to tackle hard and ambiguous problems.

Brian notes that for growth, the fundamentals are not Search, Facebook Ads, Content, Email marketing, etc. It also has nothing to do with a set of tools. Instead, they are:

Data analysis: Understanding the meaning of data to identify, understand, and pinpoint new ideas and solutions.

Quantitative modeling: Turning historical data into a forward-looking model so you can simulate potential scenarios, helping make better decisions today (a great example of this we’ve covered is Duolingo’s growth model)

User psychology: Understanding the psychology of who you’re selling to is essential. You need to know why they care about the problem, what is all the friction that could stop them from buying, and what they respond well to.

Storytelling: “You can be the best at quant modeling, analyzing data, and understanding [customer] psychology, but to be the best growth professional you need to know how to bring those things to life in a way that is compelling and interesting to your target audience. This is storytelling.”

I 100% agree with Brian that the rest—like Copywriting, CRO, TikTok Ads, Social Media, etc— are all built off the foundation of those things.

b) Going Deep

Remember the saying: “Jack of all trades, master of none”.

AKA, it’s much more valuable to be really great at one thing.

Why is that, though?

Here’s Brian’s reason:

Anyone can learn the surface layer of a subject. But going deep requires you to solve problems where the answer isn’t in some hacktics blog post. You never experience this as a generalist. The best way to get better at solving problems, is by solving more problems so in the process you actually build the skills that will enable you to go deep on something else.

When I hire, I will take someone who has become amazing at one thing over a generalist any day of the week because if they got great at one thing, the probability of them becoming great at another is a lot higher.

In the rest of his essay, Brian lays out a few other principles for mastering growth. At a very high-level glance, they are:

Choosing what you work on. In order to optimize for learning, you want to pick projects that orient around problems that have a high organizational impact and are unpopular to everyone else.

Keep one foot in the known. If you want to maximize learning you need a foot in the known and a foot in the unknown. Whatever you are working on, a certain percentage of the work should be things you already know, and a certain percentage should be around completely new skills and terrain.

Prioritize accomplishments over credentials. It is no longer about credentials. It is about creating great work and then finding a way to show it off.

Build a platform/audience: A platform could be a blog or newsletter. It gives you an opportunity to show off your hard work, creations, and thoughts. Having a platform opens up opportunities for you, gives you leverage, and helps build your personal brand.

Get a coach. A business or career coach doesn’t make decisions for you or provide the answers. Instead, you want to find a coach that helps facilitate a better answer than one you would get to on your own.

Takeaway: The best “rules” aren’t shortcuts. They are long-term investments in integrating foundational principles of mastery into your career.

(#5) Collecting ideas vs creating outcomes, visualized.

A few weeks ago I shared a collection of 9 images by Pejman (PJ) Milani. Every day, PJ simplifies complex ideas into stunning visuals. His analogies stick with you, and as a visual learner, I’m a massive fan of his work.

When I shared a few of my favorite ones with you, my link to his work was the second most clicked link in the post. Seemingly, you guys enjoyed them — so here are a few more, with what PJ has to say about each.🫡

I've been thinking about age a lot recently so I was intrigued to come across the above concept from Catell's Intelligence Theory. Apparently, many physicists, scientists, and even entrepreneurs hit their innovation peak early in their careers. And they waste the latter end of their lives miserable because they continue to chase success to rival that of their youth. Turns out, there's a scientific reason for this inability.

There're two types of intelligence (and they're affected by age).

Fluid Intelligence: Ability to solve problems by coming up with new innovative ways to attack the problem. Peaks somewhere between ages 20-25 and then slowly declines afterward.

Crystalized Intelligence: Ability to solve problems from accumulated knowledge (make connections). This grows stronger with age.

The problem comes when people neglect making the jump from fluid intelligence to leverage crystallized intelligence during midlife. Important to note, these intelligences are not related to IQ.

This one reminds me of what Brian said about generalists vs specialists. 👆

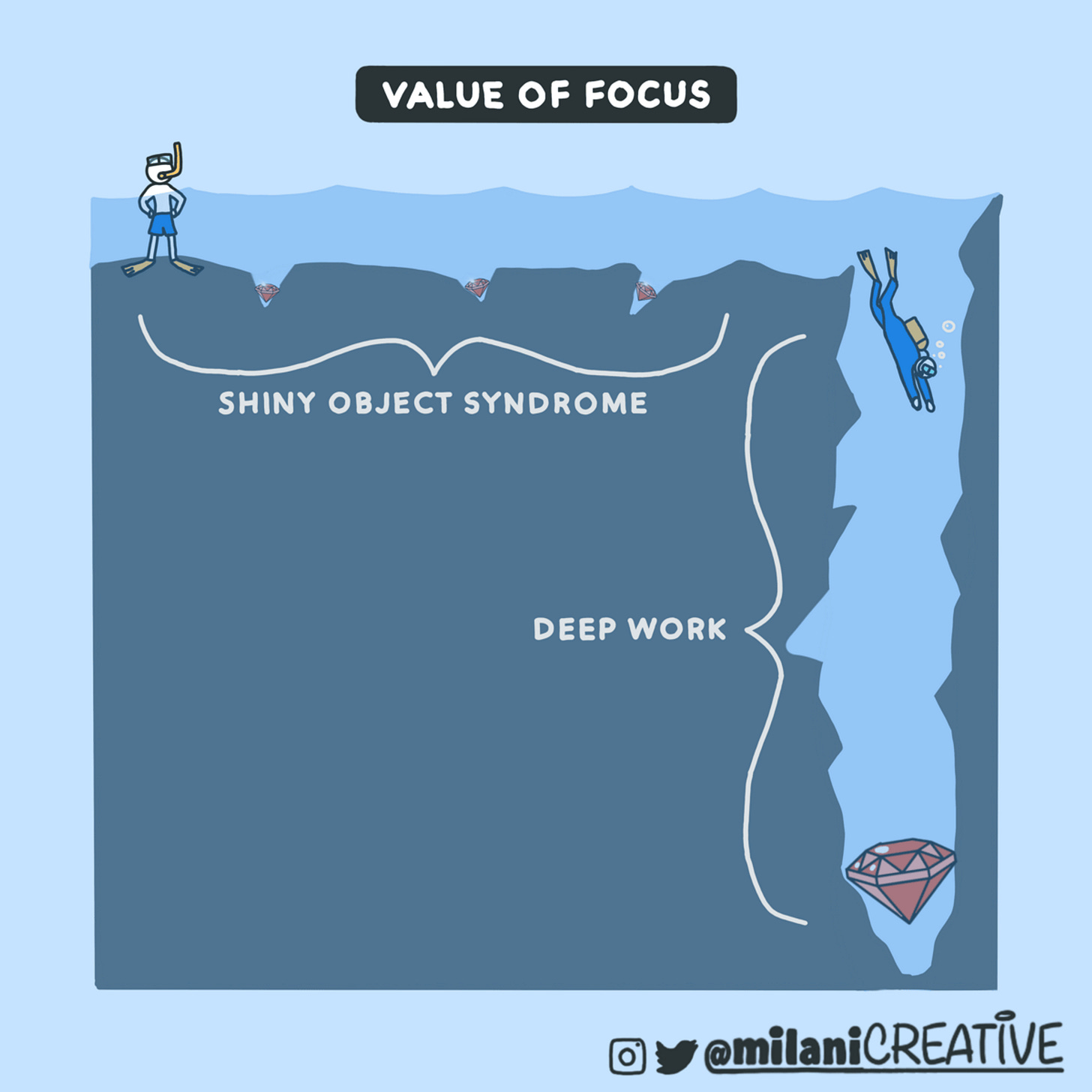

Shiny object syndrome is when you're constantly jumping from project to project because you think the next new thing is going to bring more value than the current thing.

It's essentially thinking "the grass is greener on the other side" and then hopping from one lawn to the next in search of the greenest grass. The irony is that the reason the grass is greener somewhere else is because you never stay long enough where you are to take care of it.

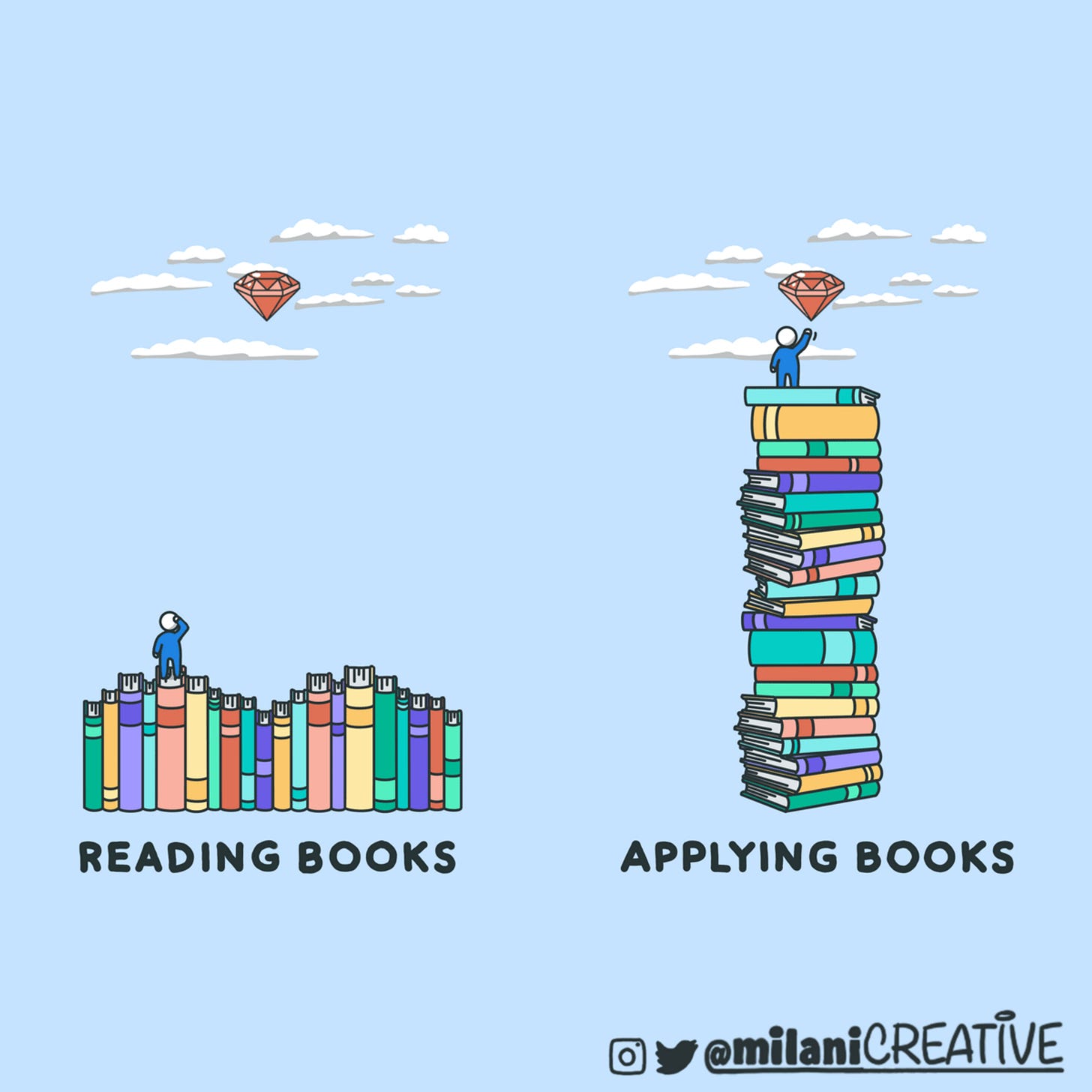

There's a concept called the collector's fallacy:

Believing that by collecting information, we somehow absorb it.

It gives us a false sense of progress.

There's nothing wrong with reading for pleasure. But if you're reading to learn how to do something, there's no substitute for action.

AKA: there’s collecting ideas, and there’s creating outcomes.

For more of PJ’s work, subscribe to his free newsletter.

🌱 And now, byte on this if you have time 🧠

I can’t say I ever thought about this, so when I came across a post, “Why Japanese Websites Look So Different”, I certainly was intrigued to find out.

As an example, this is a modern site in Japan.

Very different from the Western websites which are all about minimalism.

If you’re curious as to why…

READ: Why Japanese Websites Look So Different

And that’s a wrap.

As always, thank you so much for reading. I absolutely appreciate and value you giving me some of your time today. 🙏

If you learned something new, or just enjoyed the read, the best way to support this newsletter is to give this post a like, share, or a restack — it helps other folks on Substack discover my writing. Thank you!

Enjoy your weekend, and I’ll see you next time.

— Jaryd✌️